Listing on public markets is a milestone all companies chase, as IPOs mark a crescendo in their journey. A handful of Indian tech unicorns such as Mamaearth, Zomato, Paytm, Delhivery, Nykaa, Digit and Policybazaar had been there and done that after years of hard work and patient strategising. But how would one position a financial business that started its journey from this pinnacle to service the perpetually cash-strapped Indian MSMEs?

Shachindra Nath’s non-banking financial company (NBFC) U GRO Capital has defied all typical growth norms. So has the founder, navigating an oft-contentious niche loan segment. However, NBFCs account for 30% of the total bank credit in India and play a critical role in credit intermediation and outreach.

Set up in 2018 through the acquisition, recapitalisation and rebranding of the listed entity Chokhani Securities, U GRO took an unconventional route.

“Traditional FIs have a long-term business model and those in alternative investments like private equity and venture capital [PE/VC] look for quick returns. For instance, VCs put their money in a company for three to five years. So, we decided to structure the NBFC as a listed company for investors [banks and PE/VCs] to come and go via the public market, while the entity is there in perpetuity,” explained Nath.

lockquote>

That he emerged as a successful finance entrepreneur was not a lucky coincidence. A thorough understanding of SME lending and capital markets was part of his professional expertise, spanning nearly a quarter of a century. He worked for Landmark Partners, a $27 Bn asset management business, and Northgate Capital, which manages approximately $4.3 Bn in PE/VC assets, before joining Religare for a 15-year span, where he climbed from COO in 2006 to group CEO in 2010.

But by 2011, Religare was bleeding INR 7K Cr, and Nath proposed a bold buyout at INR 8.4K Cr with PE backing. He aimed to rebuild it as a finance company for small businesses and bridge the huge MSME credit gap. For context, the credit deficit stood at $530 Bn, per a 2023 Avendus Capital report, with only 14% of the companies having access to formal credit compared to 30% in developed nations.

This is despite the fact that MSME gross value added (GVA) was 29.1% of all-India GDP in FY22. And the sector’s manufacturing output stood at 36.2% of the country’s total in that year.

Nath was in for a shock. His out-of-the-box approach was considered too audacious and ruffled many feathers. “How could an employee, who started at a meagre salary of INR 16K, dare to take over the entire business? So, in December 2015, I was thrown out,” he still smarted. (Inc42 could not independently ascertain the details of the infighting that rocked Religare then.)

The years that followed were an acid test for Nath. Penniless and jobless, he pitched his vision to as many as 121 investors until four of them – TPG NewQuest, PAG, ADV Capital and Samena Capital – agreed to come on board. Chokhani Securities was acquired and re-emerged as U GRO Capital in April 2018, while Nath managed to raise INR 950 Cr within four months of its inception, drawing upon his outstanding work experience.

Today, U GRO is one of India’s most profitable, data-driven and impactful NBFCs. With a customer base of 80K+ and nearly INR 17K Cr deployed in loans, it boasts an average loan book of INR 8K Cr. Profitable from Day 1, it has designed and implemented a proprietary tech stack for loan underwriting (more on that later) and held its ground against formidable competitors like Lendingkart, Kinara Capital, Finova Capital, Kissht and Navi Finserv.

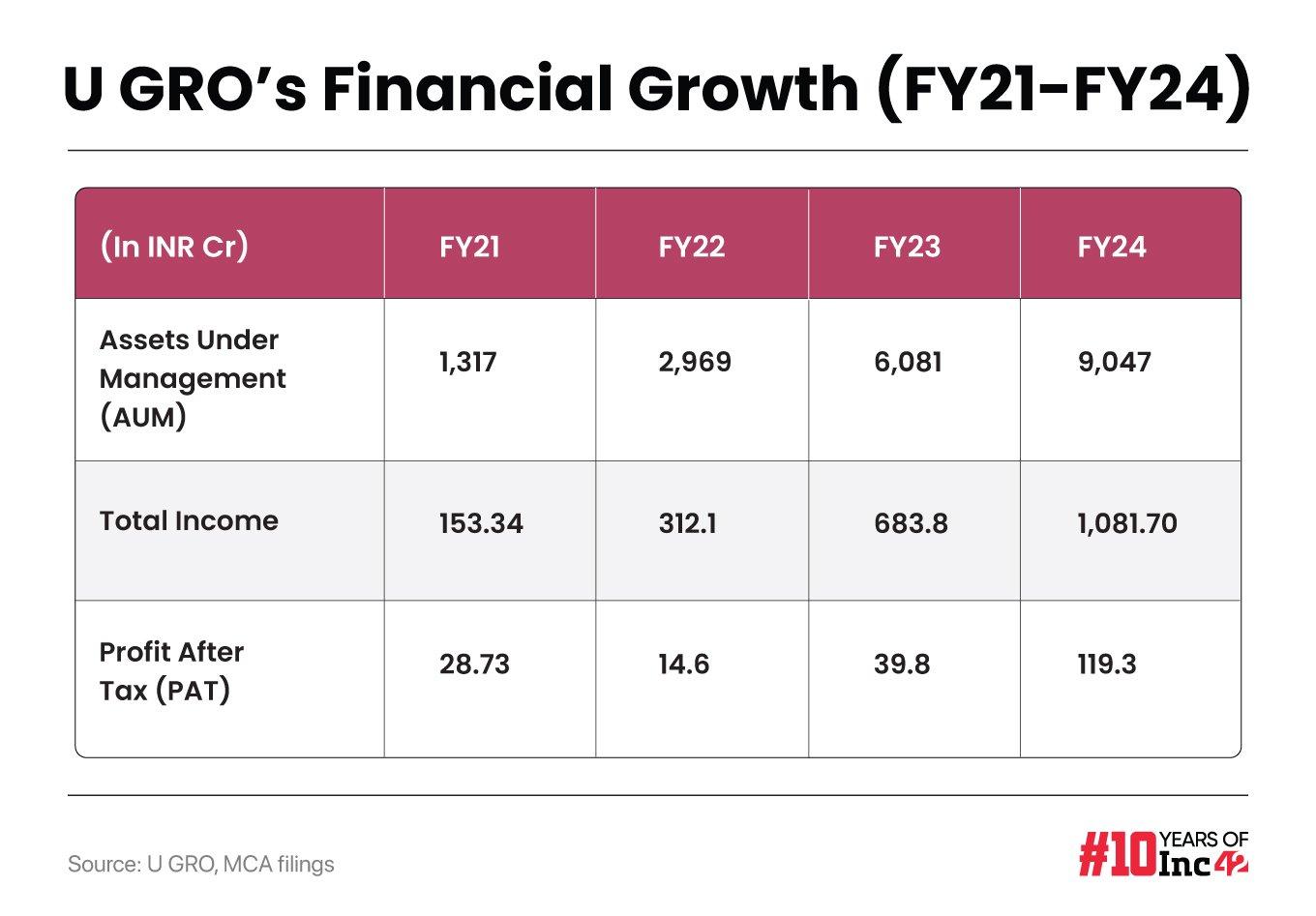

The NBFC’s profit after tax (PAT) soared to INR 119 Cr in FY24, a nearly 200% increase from INR 40 Cr in the previous financial year. Nath attributes the growth to U GRO’s proprietary data-centric underwriting model, expansion of distribution channels and a broadening lender base.

“I would say several factors triggered this success. For instance, the SBI lent INR 650 Cr as our partner bank. Also, we are driven purely by data and technology and spend INR 58 Cr+ annually on tech development. With INR 9K Cr+ AUM in FY24, we have emerged as an institutional company,” the founder added.

lockquote>

How U GRO Coped With Turbulence Soon After The Launch

Although U GRO has a commendable mission – that of addressing the small business credit need – no business can achieve success overnight. The NBFC’s remarkable performance in FY24 can be traced back to the strategic vision of its founder, who focussed on building a robust foundation from the outset.

U GRO was off to a sound start after securing INR 950 Cr capital by August 2018. But the company had to battle tough challenges in the following years due to the IL&FS liquidity crisis in 2018 (the infrastructure-focussed shadow banker, sitting on a debt of INR 94K Cr, defaulted on many bank loans), the DHFL loan fraud that came to light in 2019 (the housing loan NBFC allegedly disbursed loans fake borrowers and shell companies) and, finally, the YES Bank crisis in 2020 (triggered by overwhelming NPAs due to the NBFC crises and excessive withdrawals, compelling the RBI to step in to resolve liquidity and governance issues).

The onset of the Covid-19 pandemic disrupted businesses further and deploying credit was in the doldrums during those years.

“Moreover, we are a listed entity, owning public money. We cannot burn cash like a VC-backed startup. So, we put about INR 861 Cr of our equity capital in the public market to earn money during those four to five years. Now, we are competing with the best [NBFCs] in the class,” said Nath.

lockquote>

The pandemic left a trail of business challenges in its wake, shuttering companies and killing jobs. But the NBFC seems to have bounced back with a vengeance. In the pre-Covid period, U GRO employed 120 people across nine locations. Post-Covid, it has 1,500 people at 105 locations. The NBFC’s data analytics team has been expanded from five to 275 and the number of lenders has surged from three to 60. It also works with several co-lending partners, including prominent names like the SBI, SIDBI and Bank of Baroda, among others.

U Gro raised around INR 2,013.66 Cr in the past two years from notable AIFs, HNIs, family offices and other domestic investors. It also acquired another NBFC called MyShubhLife to expand its embedded finance opportunity. The aim is to harness MSL’s potential to add 2 Lakh new customers in the next three years for an incremental AUM of INR 1.5K Cr.

As of June 18, 2024, the company had a market cap of INR 2.50K Cr and traded at a 52-week high of INR 319.85 on the Bombay Stock Exchange (BSE). Its AUM was worth INR 9,047 Cr in FY24, up by 49% from INR 6,081 Cr in the previous fiscal.

The Making Of U GRO Score, A Proprietary Tech Stack For Cornering Success

If India has to emerge as a $10 Tn GDP economy, FIs must address the viable debt gaps of 6.3 Cr homegrown micro, small and medium enterprises, accounting for 44% of the country’s exports and 31% of the workforce. In fact, increased economic activity spurred the demand for commercial loans by 29% in the July-September quarter of FY24, compared to the same period of FY23.

More importantly, MSME credit demand at NBFCs, earlier standing at 14%, grew fastest at 39% during that quarter. Delinquencies were down at 2.3%, clocking a -0.7% YoY change, and MSMEs are adopting digital technologies at a fast clip, thereby giving an edge to modern lending firms.

U GRO was aware of the upcoming opportunity from the beginning but also recognised the importance of a robust underwriting model. The reason? Even today, around 47% of the total debt demand of $1,544 Bn is not addressable, which means many of these enterprises are not financially viable or prefer informal sources to raise capital.

The scenario was not different before, and U GRO laid the groundwork to overcome these hurdles. The NBFC launched its patented underwriting model, GRO Score, right at inception, which employs advanced AI-ML algorithms to analyse more than 25K data points from an applicant’s credit bureau record and bank statements.

The model then consolidates banking and bureau scorecards to generate a unified score, further fine-tuned using GST data as an external input. These scores are then categorised under five heads, ranging from A to E, with E representing the lowest rating.

“GRO Score is India’s first small business credit scoring model using the data power of GST, banking and credit bureau. Several banks and NBFCs have already requested that we deploy this model. However, we have decided to use this proprietary model in-house only,” said Nath.

lockquote>

The NBFC’s data analytics team has helped it identify nine core sectors and 200+ ecosystems, featuring nearly 50% of the MSME lending market. These sectors include chemicals, education, auto components, healthcare, food processing, light engineering, hospitality, electrical equipment and micro-enterprises.

Additionally, its data analytics engine enables the NBFC to pinpoint states and locations for expansion, track portfolios and manage daily operations.

Its in-house business rule engine (BRE) also enables the swift rollout of new models, integrates various platforms and automates multiple processes. The system covers all operations of U GRO’s branch-led channel GRO-Plus, partnerships and alliances-driven GRO-Xstream, the supply chain financing-led Gro Chain and digital channel Gro-Direct, which allows MSMEs to apply for credit directly, with loans approved within 60 minutes.

Can U GRO Leverage The 7.5 Cr MSME Opportunity?

As per March 2024 data from the ministry of micro, small and medium enterprises, the number of MSMEs is projected to increase from 6.3 Cr to 7.5 Cr at a CAGR of 2.5%. However, only 2.5 Cr businesses have accessed credit from formal sources until now. A key reason for this gap is the need for a large financial institution exclusively servicing this segment.

Nath explained the persistent challenge fintechs and traditional lenders face in servicing MSMES. Primarily operating in unorganised markets, these businesses typically generate 90% of their revenue in cash, with only 10% coming from formal income streams. Their heavy reliance on cash-based incomes makes it difficult for formal lenders to assess their repayment capabilities accurately. Hence the credit squeeze.

He further added that as for fintechs, offering unsecured loans even at 30-40% interest rates leads to a substantial loss of 5-7%, whereas secured loans at an 11% interest rate (an advantage enjoyed by banks) result in a modest credit loss of 0.25%.

“Lending institutions must maintain a credit cost band of at least 2%. This balance can only be achieved through a diversified portfolio strategy, a method effectively employed by U GRO,” Nath added.

lockquote>

Despite many challenges, Nath believes that MSMEs require special hand-holding and there will be distinct improvements in the lending market. U GRO has set ambitious goals, aiming to double its return on equity (ROE) to 18% and increase return on assets (ROA) to 4% by FY26, up from 9.9% ROE and 2.3% ROA clocked at the close of FY24. The NBFC also targets an AUM worth INR 25K Cr by FY26.

As the country is rapidly transitioning from collateral-based to cash-flow lending, the likes of U GRO are pioneering this change. Nath is excited about the road ahead, as the strong credit demand, pushed by robust economic growth, will pave the path for NBFC growth and fuel the sector’s profitability. Like startup funding, the much-maligned ‘middle’ financing may soon play a pivotal role in shaping India’s fast-evolving growth story.

[Edited by Sanghamitra Mandal]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)