Run by Bengaluru-based Zinka Logistics Solutions, BlackBuck, an online marketplace for truckers and freight operators, is the latest to join the list of new-age tech startups preparing for public market entry in 2024. Backed by Peak XV, Accel, Tiger Global and other noted investors, the logistics unicorn recently filed its draft red herring prospectus (DRHP) with capital market regulator SEBI for an INR 550 Cr+ IPO.

The issue will be a mix of new shares worth INR 550 Cr and an OFS (offer for sale) of up to 2.16 Cr shares from promoters and existing investors. The three cofounders of BlackBuck

The IPO aspirant aims to utilise the proceeds to strengthen its sales and marketing initiatives and grow its NBFC subsidiary, BlackBuck Finserve.

As many as six new-age tech startups have listed in the current calendar year – four on the mainboard and two on the SME platform – raising over INR 5,598 Cr ($670 Mn). In all cases, shares exceeded the initial pricing range, highlighting the typical rush for IPOs in the Indian stock market. It also gives us a sense of déjà vu, bringing back to mind the 2021 startup IPO market, although with a few twists and turns, including smaller IPO sizes and more reasonable valuations.

lockquote>

Lately, IPOs in India have become more attractive with heavy retail participation, and several companies have been listed at a premium. Per a Fortune India report, 70% of the 30 main-board IPOs were listed at a premium, followed by 72% (out of 54 IPOs) in FY22 and 67% (out of 37 IPOs) in FY23. Interestingly, in the first nine months of FY24, 78% of the 54 main-board IPOs were listed at a premium.

Ola Electric, Swiggy, FirstCry and Unicommerce are among the most-awaited IPOs of the year, but these are still at various stages of preparation. A few others, like BlackBuck and Avanse Financial Services, are out with their DRHPs without any prior hint.

BlackBuck: Ushering In The Digital Drive To Redefine Road Freight

Before we weigh in the potential risks and rewards of the BlackBuck IPO, it will be pertinent to look at the company’s operations and how its business model stacks up against the country’s leading logistics players.

Founded in 2015 by IIT Kharagpur alumni Rajesh Yabaji and Chanakya Hridaya, along with Rama Subramaniam, the B2B marketplace specialises in inter-city full truckload (FTL) transportation. In simple terms, it seamlessly connects truck operators with small and big businesses with shipping requirements in real time via its tech-enabled platform and operates pan-India.

Although BlackBuck started as a truck aggregator, it currently provides a comprehensive range of solutions for load management, telematics, payment (fuel and FASTag or toll charges) and vehicle financing (with a focus on trucks).

lockquote>

It has an asset-light business model and generates revenue through platform fees, subscriptions and commissions (more on its business fundamentals later). The startup has raised over $360 Mn in funding and directly competes with Wheelseye, Vahak and FleetX Loconav, digital freight platforms catering to truckers in India.

BlackBuck says it is the largest digital freight platform for truckers in terms of revenue, accounting for 27% of the domestic market share. India’s road freight transport market, estimated at $140.3 Bn in 2024, is expected to reach $236.3 Bn by 2030, growing at a CAGR of 9.08% during the forecast period.

As road transportation, especially trucking, continues to grow due to increased economic activities and improved infrastructure, ventures like BlackBuck will likely witness exponential growth as a core component of India’s booming logistics industry.

The startup also claims to service the maximum number of truck operators. In FY24, it had 9.6 Lakh transacting users on the platform, accounting for 27.52% of the truckers in India, it said.

lockquote>

Over the years, many Indian logistics companies, including Blue Dart Express, Allcargo Gati, VRL Logistics and Delhivery, have taken the IPO route to grow their capital base and expand their business. Although part of their operations covers the FTL market, where BlackBuck is a specialist, the latter is the first to go ahead with a unique value proposition – providing a digital edge to the highly fragmented road freight transportation space.

Speaking to Inc42, an analyst at a brokerage firm said it could be a bit early to discuss BlackBuck’s IPO prospects, given the pending SEBI nod. However, it has a more ‘mature’ business model and stands out from the rest of its listed and unlisted peers in the trucking/logistics market.

There is a catch, though, the analyst pointed out, requesting not to be named. “BlackBuck is a B2B tech company helping truckers leverage the on-demand economy and shaping the future of freight. Considering its multi-pronged approach, this narrative is a bit more complicated than Zomato or Nykaa, the [B2C] platforms people used regularly and understood their businesses better. In this case, investors may require more time to comprehend the entire business model or the long-term value proposition. But as I have said, it is too early to gauge the market sentiment,” he explained.

lockquote>

Meanwhile, BlackBuck’s profitability at the operating level positions the company well for the public markets, the analyst added.

A Deep Dive Into BlackBuck’s Fundamentals Reveals The Pros & Cons

As per its DRHP, BlackBuck was a loss-making entity and reported INR 194 Cr in net losses in FY24. But compared to the previous financial year, this was a 33% drop from the INR 290.4 Cr loss posted in FY23, marking a significant improvement.

Meanwhile, it turned profitable at an operating level in FY24 with an adjusted EBITDA of INR 13.3 Cr against a loss of INR 154.5 Cr in FY23.

lockquote>

The startup said its adjusted EBITDA showed restated loss before tax from continuing operations, adjusted for finance costs, depreciation and amortisation expenses, employee share-based payment expenses and other net gains/losses. Its other net gains/losses amounted to nought in the reported year.

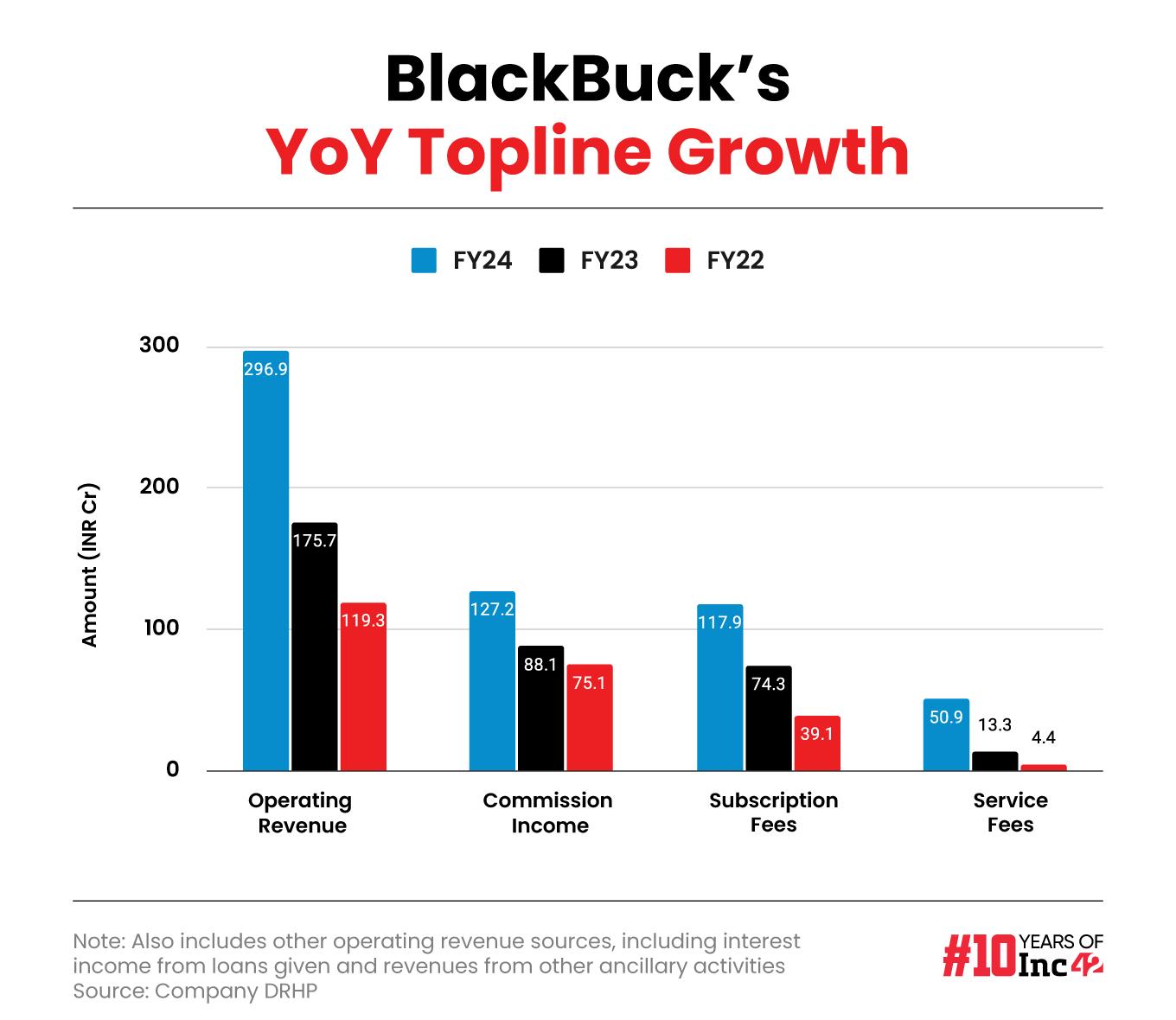

BlackBuck’s EBITDA loss stood at INR 138.8 Cr in FY24, but its operating revenue jumped 69% YoY to INR 296.9 Cr during that year.

A close look at the startup’s revenue channels and its parent company’s business commitments will further clarify how the venture is faring overall.

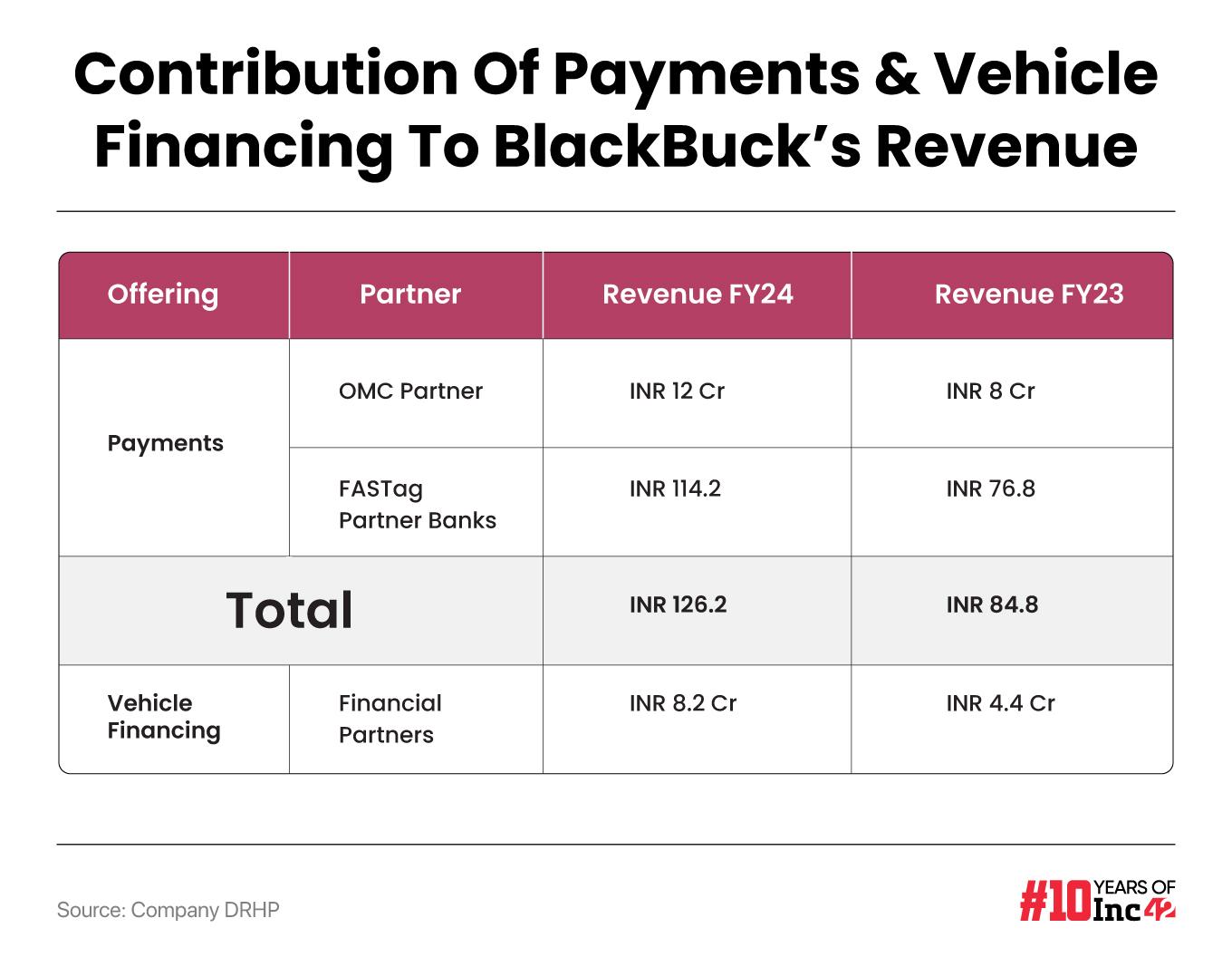

BlackBuck generates revenue from its payment solutions for toll taxes and fuel charges, deployment of telematics (remote monitoring of vehicles) data to truck owners, vehicle financing and other service fees.

A significant portion of its operating revenue comes from commissions (incomes from banks and oil marketing companies for the distribution and management of FASTags and fuel cards, respectively) and subscriptions for telematics-based fleet management and platform services. Its overall revenue from trucking services stood at INR 296.1 Cr in FY24, growing nearly 69% YoY.

Its parent entity, Zinka Logistics, runs other subsidiaries, including TZF Logistics Solutions, BlackBuck Finserve, ZZ Logistics Solutions and BlackBuck Netherlands B.V.

Among these, BlackBuck Finserve received its non-deposit-taking NBFC licence on August 1, 2023, and commenced lending in October last year. It provides financing solutions for various assets such as plants and machinery and vehicles like buses and trucks.

In its DRHP, BlackBuck states that the vehicle financing business (backed by BFPL and its finance partners) enables truck operators to buy used commercial vehicles or get financing on existing ones. With this model in place, the startup generates revenues from interest incomes and loan processing fees.

lockquote>

The logistics major is too keen to pursue this revenue channel, as its draft filing reveals.

As per its DRHP, the net proceeds invested in the NBFC subsidiary will be used to finance the augmentation of its capital base to meet its future capital requirements and not towards further acquisitions or repayments of its existing loans.

This approach is understandable since Indian think tank NITI Aayog estimates that the number of trucks on Indian roads will quadruple, from 4 Mn in 2022 to 17 Mn by 2050. With the concept of Vikshit Bharat set to culminate by 2047 and fuel India’s economic growth, the country’s core development areas, like manufacturing and supply chain logistics, are set to gain unprecedented momentum. This will throw open new growth opportunities for ventures like BlackBuck looking to finance different asset types, from infrastructural facilities and components to road freight essentials.

As of March 31, 2024, the NBFC arm disbursed 4,035 loans totalling INR 196.8 Cr. The interest income contributed around 0.23% to BlackBuck’s total consolidated revenue from operations in FY24. The finance and payments businesses contributed 45.26% to the startup’s consolidated operating revenue in FY24.

On the flip side, BlackBuck noted in its DRHP that any regulatory changes in the payment ecosystem or electronic toll collection technologies, among a few other global policy-related shifts, could have a material adverse effect on its payments and telematics business, which contributed to more than 94% to its consolidated operating revenue in FY24.

The Road To Riches Will Be A Litmus Test

Supported by a clutch of marquee investors such as Peak XV, Tiger Global, Tribe Capital, IFC Emerging Asia Fund, VEF, Goldman Sachs Investment Partners and Accel, BlackBuck emerged as a unicorn in 2021.

After building a strong foothold in the trucking and logistics industry for nine years and undergoing bumpy rides to achieve a billion-dollar valuation, BlackBuck is finally ready to leap forward and go public when several other prominent household names are also on track for an IPO.

But more than the tussle for market attention, BlackBuck needs to get its house in order. The startup has civil, tax and criminal proceedings against the company, its promoters and its directors worth INR 277.2 Cr. Among these, one litigation worth INR 275.8 Cr involves a company director.

lockquote>

Still, what matters most is the ultimate litmus test. A blessing of tech unicorns is leaning towards initial public offerings now that private capital has grown scarce due to a harsh funding winter. Capital market investors, on the other hand, are genuinely excited to see high-growth startups making their debut. However, profit remains the prerequisite for success in today’s market scenario, and people can soon pull their money out without solid business outcomes.

[Edited by Sanghamitra Mandal]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)