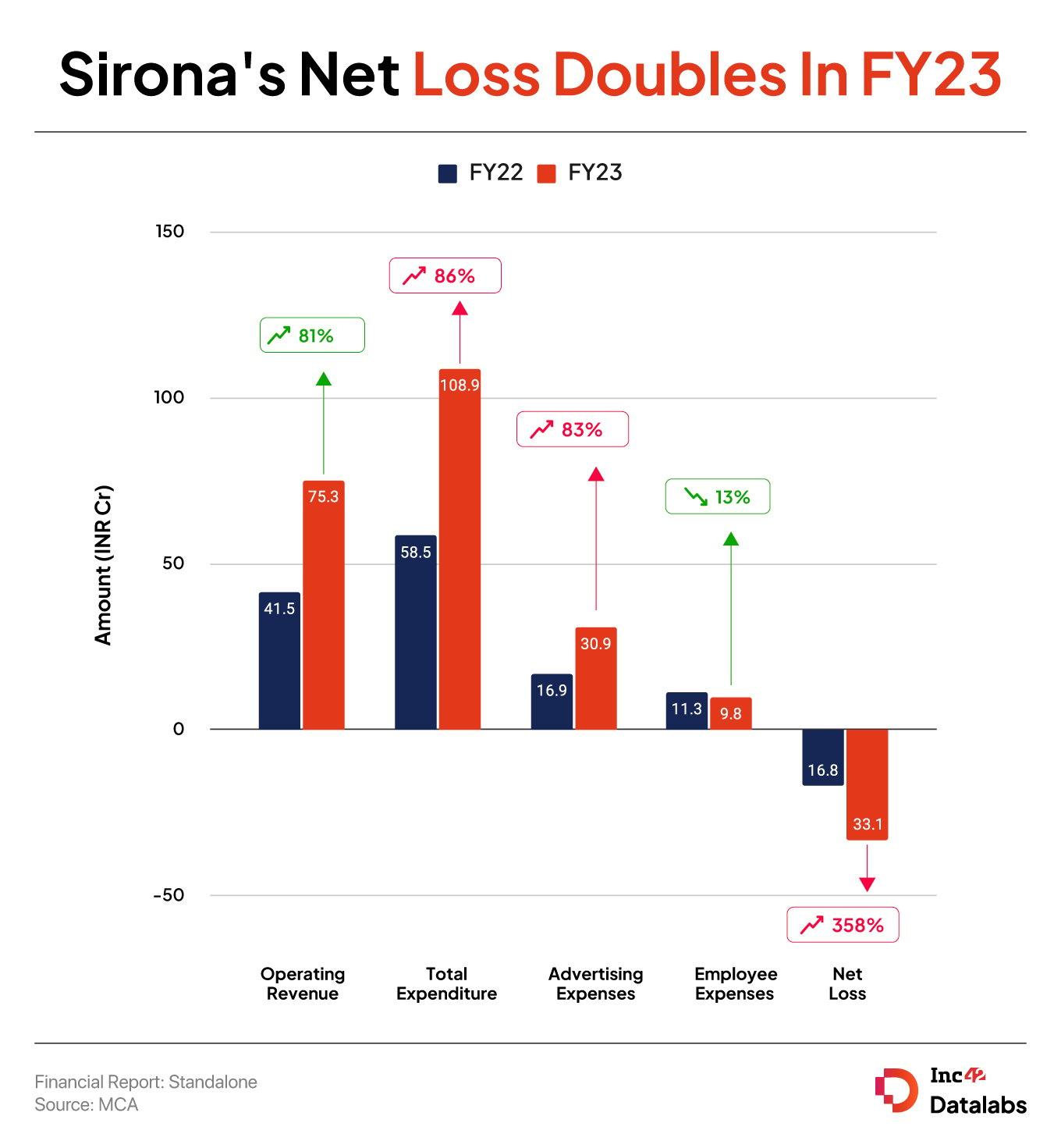

The Good Glamm Group-owned D2C feminine hygiene startup’s net loss rose to INR 33.10 Cr in FY23 from INR 16.83 Cr in the previous year

Operating revenue grew 81% to INR 75.28 Cr during the year under review from INR 41.51 Cr in FY22

The Good Glamm Group first acquired a stake in Sirona in 2021 and increased its ownership to to 50.58% in FY23

The Good Glamm Group-owned D2C feminine hygiene startup Sirona’s net loss surged 97% to INR 33.10 Cr in the financial year 2022-23 (FY23) from INR 16.83 Cr in the previous fiscal year on account of higher cash burn.

The D2C brand’s operating revenue grew 81% to INR 75.28 Cr during the year under review from INR 41.51 Cr in FY22.

While the startup earned a majority of revenue from the sales of its products in India, it also managed to bolster its international play during the year under review. It earned over INR 10.77 Cr from trade outside India, almost double from the INR 5.57 Cr it earned in FY22.

Including other income, total revenue grew 80% to INR 75.75 Cr in FY23 from INR 42.20 Cr in the previous fiscal year.

Founded by Deep Bajaj and Mohit Bajaj in 2015, Sirona sells an array of female hygiene products such as herbal pain relief patches, period stain remover, oxo-biodegradable sanitary napkins and menstrual cups.

Content-to-commerce platform The Good Glamm Group first acquired a stake in the startup in December 2021 by investing INR 100 Cr. It increased its stake in Sirona to 50.58% by the end of FY23 from 41.15% at the start of the fiscal year.

However, earlier this year, the founders of Sirona, along with another startup acquired by The Good Glamm Group – The Moms Co, and the Indian Angel Network (IAN), reportedly filed default notices against the content-to-commerce platform. They claimed that The Good Glamm Group did not make the final payments due to them.

Despite the rise in its loss in FY23, Sirona acquired vegan condom brand Bleü in May 2023 to enter the sexual wellness category.

Where Did Sirona Spend?

The startup’s total expenses zoomed over 86% to INR 108.85 Cr in FY23 from INR 58.50 Cr in the previous fiscal year.

Advertising Expenses: Advertising and promotional activities continued to be the focus of the D2C brand in FY23. Its ad expenses shot up 83% to INR 30.90 Cr during the fiscal from INR 16.85 Cr in FY22.

Employee Expenses: The D2C startup managed to decrease its employee expenses by 13% to INR 9.82 Cr in FY23 from INR 11.29 Cr in the previous year.

Miscellaneous Expenses: The expenses under this head, which included bad debts written off, assets written off, contractual staff costs, saw a big increase. The startup spent INR 13.98 Cr on these expenses in FY23 as against INR 2.99 Cr in the previous year. Its provisions for doubtful debt jumped to INR 37.63 Lakh from INR 4.03 Lakh in the previous fiscal.

Purchase Of Stock In Trade: The expenses under this bracket shot up to INR 32.89 Cr for Sirona in the fiscal, an increase of 73% from INR 18.92 Cr it spent to make the purchases of finished goods required for conducting its business in FY22.

Sirona competes with the likes of Soothe, Paree, Sofy, and Evereve. As per estimates, the country’s feminine hygiene market is expected to reach $1.79 Bn by 2029, growing at a CAGR of 14.85% from 2024.

Meanwhile, Sirona’s parent The Good Glamm Group saw its net loss widen 153% to INR 917 Cr in FY23 from INR 362.5 Cr in the previous fiscal year. Operating revenue rose 185% to INR 603 Cr from INR 211.4 Cr in FY22.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)