Every four years, with the Olympics, we get to see spirit and competition that tend to become stories and legends. Records are broken and new challengers emerge. The story is similar for quick commerce in India, with Flipkart

And like any athlete that wants to challenge the leaders, Flipkart is fully geared up and is not shy about what it wants to do with quick commerce.

Coincidentally, quick commerce as a model gained traction four years ago, before the pandemic pushed the 2020 Olympics to 2021. Covid disrupted plans on the sporting side, and it certainly changed the game for ecommerce too.

This change is best evidenced by how Flipkart sees the category. While once instant delivery was about essentials, today it’s essentially everything.

While it’s early days for Flipkart Minutes, there are legitimate reasons why the incumbents – Blinkit, Zepto and Swiggy Instamart – need to be worried.

Before we find out why, a look at the top stories from our newsroom this week:

Learning Quick Commerce Tricks

Flipkart has already taken a couple of stabs at grocery delivery in 2015 and then in 2017. The first one was Flipkart Quick, which offered 30 to 90-minute deliveries in some cities, which was followed by Flipkart Supermart in 2017. Subsequently, Flipkart Quick was phased out in November 2022.

Supermart had the best chance to succeed, but instead of expanding dark stores to many corners of the country, Flipkart chose to go with fulfilment centres which have a wider inventory and typically a wider distribution radius.

The dark store model has more or less become the only way to do quick commerce today. Blinkit, Instamart, Zepto have chosen this route, while Tata’s BigBasket is also going this way.

This time around, Flipkart has gone for the dark store model and is competing in every category that Blinkit, Zepto and Instamart have added in the past year.

Flipkart Minutes currently offers free deliveries on all orders above INR 99 and is also levying a platform fee of INR 5 per order.

The vertical is being led by Hemant Badri, who is the vice senior vice president and group head of supply chain for Flipkart. His appointment indicates that Flipkart sees supply chain as a key component of the business.

Flipkart is said to be planning to open 100 dark stores across top cities. But Blinkit, in comparison, has over 639 dark stores as of now. The Zomato-owned company wants to have 2,000 dark stores by the end of 2026. So, in terms of scale, there’s a lot of catching up to do for Flipkart.

Sources say Zepto is on course to double its dark store count to more than 700 by March 2025. The company recently got a massive $665 Mn infusion to fuel this expansion.

Swiggy’s Instamart is also expanding its network ahead of the IPO in 6-12 months, and much of its focus in recent months has been on the quick commerce side, where it has seen a significant growth in revenue.

Flipkart’s Edge

What could work in Flipkart’s favour is its large existing user base, plus its strong brand recall in smaller towns, where Blinkit or Zepto might not yet have made inroads. Blinkit has done tremendously well in the past two years, but this has come largely from consumers in metros.

A majority or 80% of the new stores it opened last quarter were in the top eight cities, with Delhi NCR seeing the most investments. Delhi NCR is also the biggest contributor to Blinkit’s GOV and revenue, and well ahead of the other 25 cities that Blinkit currently has a presence in.

Earlier this week, Drools’ CEO Shashank Sinha predicted that Flipkart Minutes will outdo other quick commerce players in smaller towns and cities. Speaking at The D2C Summit by Inc42, Sinha said Drools came on board Flipkart Minutes because Flipkart can scale up quickly in these cities, even though the service is currently only live in Bengaluru.

In the past, Flipkart had rolled out the same-day delivery services for multiple products across 20 Indian cities, including Ahmedabad, Bengaluru, Bhubaneswar, Coimbatore, Chennai, Delhi, Guwahati, Hyderabad and Indore, among others. So, it does have the on-ground capability to fulfil the logistics needs for quick commerce in these cities, many of which would perhaps be getting a first taste of instant delivery.

The fact that Blinkit, Zepto and Instamart have yet to penetrate deeper into the country provides an opportunity for Flipkart. Earlier, Zepto cofounder and CEO Aadit Palicha said that India’s top 40 cities provide enough growth headroom for Zepto and other quick commerce platforms. “If we execute well, we can realistically take this business from INR 10,000+ Cr top line today to potentially to INR 2.5 Lakh Cr top line over the next 5-10 years,” Palicha said, even though Zepto currently has a presence in just 10 cities.

Flipkart’s entry into the quick commerce space ahead of the 2024 festive season sales is also significant, as this allows the company to get the right mix of volume and order value. In this regard, Flipkart’s debut with non-grocery categories is key.

Zomato, in its most recent shareholder letter, said that an increasing number of non-grocery ecommerce users are shifting to quick commerce. D2C founders also believe there is attrition of brands and customers from marketplaces to 10-minute delivery.

For instance, Swiss Beauty cofounder Mohit Goyal highlighted that quick commerce has become the preferred mode for emergency beauty purchases, a category that was never being catered to before 10-minute deliveries.

Where Flipkart Minutes Stands Out

And the quick commerce trend has also trickled down to fashion startups and food delivery. It’s only right then that Flipkart Minutes has chosen to go all-in with a host of electronic products and some items such as cameras and large printers that are not available on Blinkit currently.

The number of SKUs in each category on Flipkart Minutes might fool some into thinking Flipkart has turned its entire platform into quick commerce. Though to be fair this is currently restricted to some postal codes in Bengaluru only.

In the short term, the company will have to invest heavily to expand Flipkart Minutes. The $1 Bn funding round led by Walmart and with Google as a backer is certainly going to be useful in that regard. But it will also have to restructure its distribution for quick commerce, from fulfilment warehouses to smaller dark stores and limited SKUs.

While Instamart, Blinkit and Zepto have added thousands of SKUs to their grocery aisles as well as new categories recently, their customer base is skewed towards urban users. It is not yet clear whether Flipkart Minutes can unlock the same appetite for new brands and faster deliveries for high-value items in smaller cities.

Given this, it is very likely that some Flipkart Minutes facilities will double-up as warehouses for inter-city deliveries and dark stores for hyperlocal quick commerce. The exact model is yet to be determined.

Flipkart Minutes is a key part of the ecommerce giant’s super app model. It is also investing in growth areas like digital lending, insurance distribution, travel and fashion verticals. But none of them have the revenue potential that quick commerce offers.

Goldman Sachs estimates that Blinkit is already worth more than Zomato’s food delivery operations. Zomato’s quick commerce revenue jumped about 2.5X YoY to INR 942 Cr and adjusted EBITDA loss also improved to INR 3 Cr in Q1 FY25. The turnaround from an adjusted EBITDA loss of INR 133 Cr in Q1 FY24 has turned quite a few heads.

Blinkit is on the verge of profitability after a shift to quick commerce from its older hyperlocal model in 2022, with 78.8 Mn orders in the most recent quarter, and monthly transacting user base of 7.6 Mn. This is the benchmark for Flipkart Minutes and other quick commerce competition.

Speaking of competition, there is plenty of depth in the Indian market, but then we are also talking about huge companies like Zomato, Swiggy, Flipkart, Reliance Retail, BigBasket and Zepto.

They will all want to justify their investments in quick commerce, and there will be a situation where the market is divided between five or six players. It will be interesting to see which of these giants gets impatient first and looks to end the battle of attrition by acquiring rivals instead of playing the long and patient game.

Will Flipkart be on the right side of the market when this happens?

Sunday Roundup: Tech Stocks, Startup Funding & More

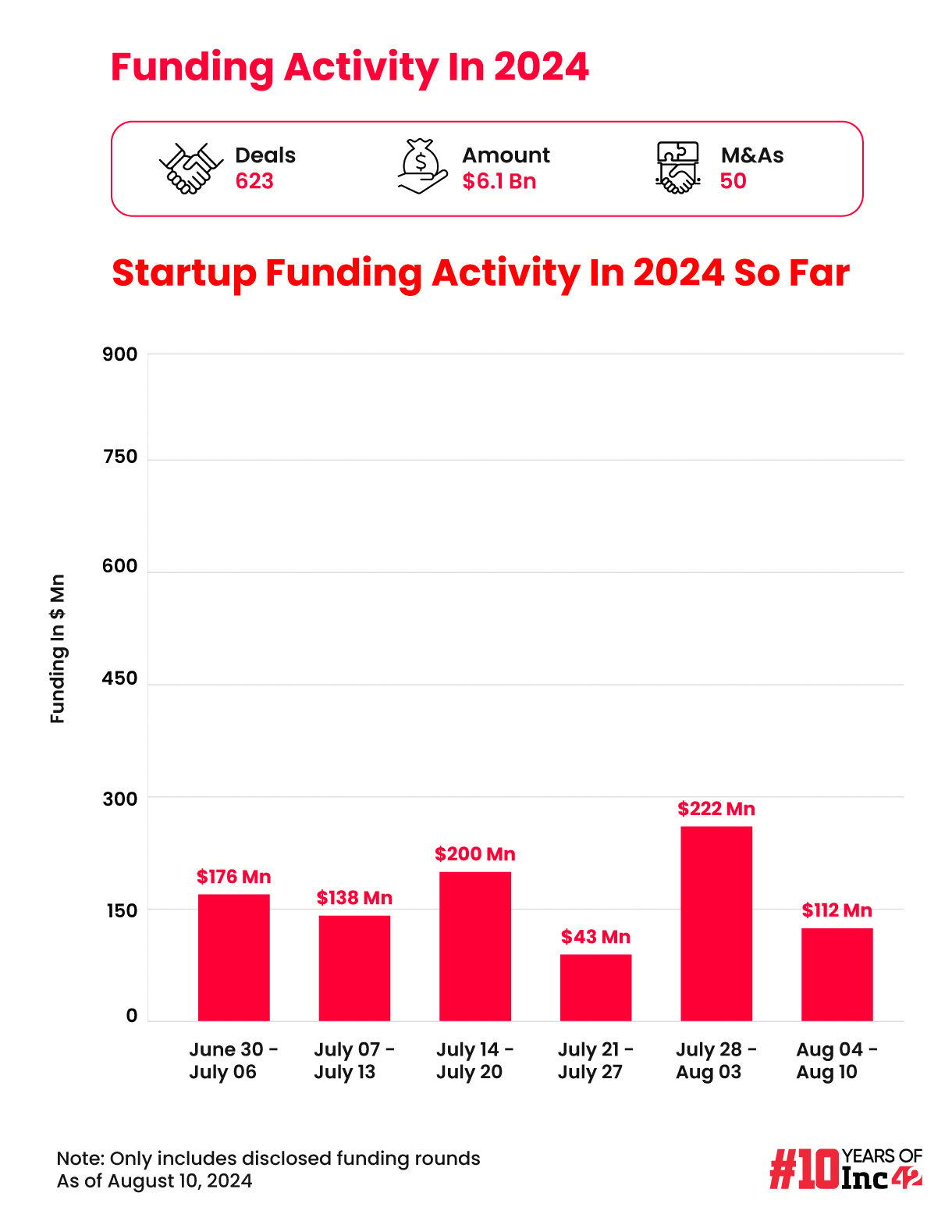

- The weekly startup funding tally fell by halve in comparison to the previous week, with startups raising $112 Mn via 22 deals this past week

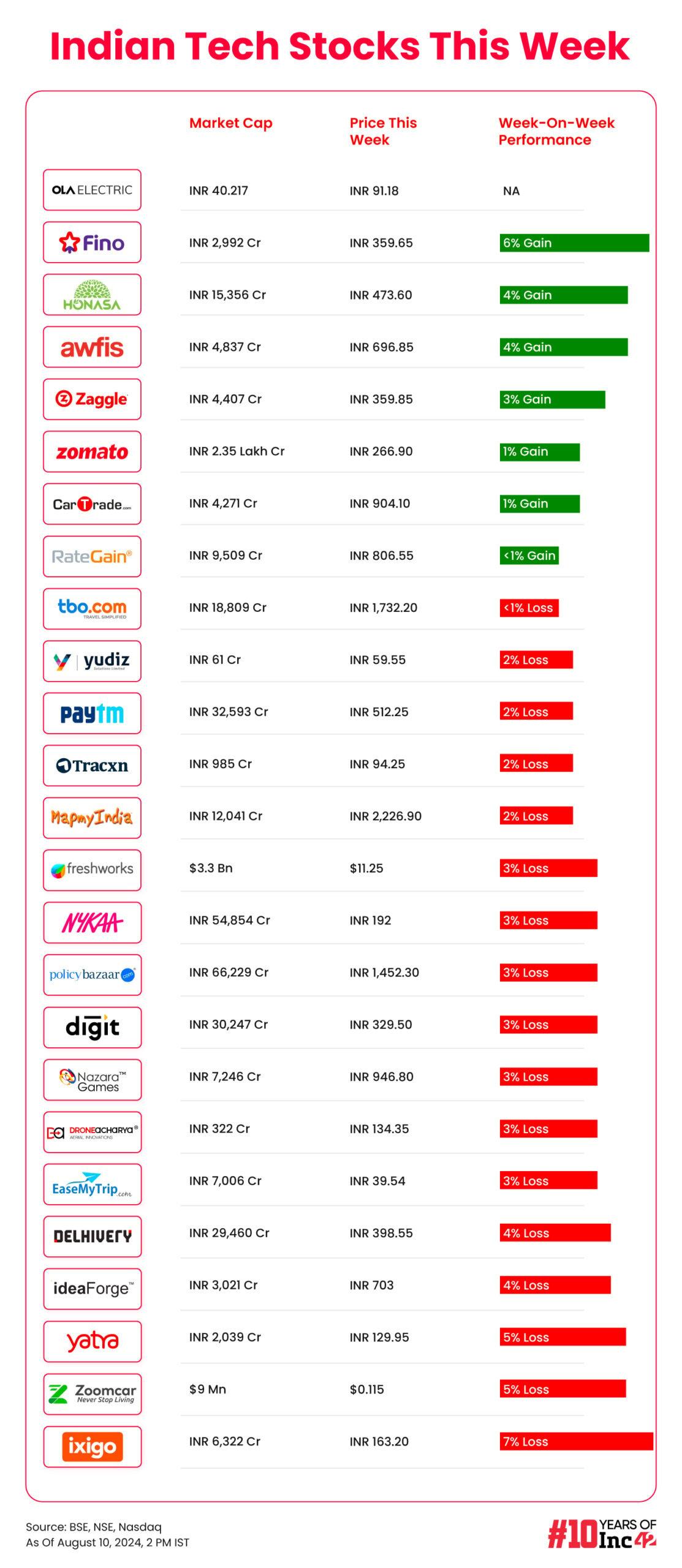

- Ola Electric made a flat market debut, listing at INR 75.99 against the issue price of INR 76. But by the close of the week, the stock was trading at INR 91, 20% higher than the listing price

- Ecommerce giants FirstCry and Unicommerce are also set to get listed in the first half of the week ahead after their public offerings closed this week with healthy oversubscriptions for both companies

- US-based lenders of BYJU’S have moved India’s Supreme Court to appeal against NCLAT’s order quashing insolvency proceedings against the company

- The Economic Offences Wing has made an arrest in the alleged BharatPe fraud case, taking custody of an individual linked to fake vendors allegedly being paid by Ashneer Grover and Madhuri Jain Grover

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)