While lead shareholder Reliance Retail has agreed to infuse capital in Dunzo to keep the startup afloat, Dunzo CEO Kabeer Biswas told employees this week that other investors are still on the fence

According to sources, Biswas claimed that the company intends to deploy a small portion of the proposed funding into the B2C operations, after clearing its existing dues

Reliance Retail is looking to re-enter the quick commerce space through JioMart after having experimented with the model last year. Will Dunzo fit Reliance’s quick commerce plans?

Dunzo

After more than a year of negotiations and speculation, the startup’s current cash crunch is likely to be solved by its largest shareholder Reliance Retail. But this does not mean that Dunzo is completely out of the water yet.

Sources privy to the development told Inc42 that Reliance Retail may also end up acquiring the troubled firm at a throwaway valuation. The conglomerate currently holds more than 25% stake in Dunzo after it invested $200 Mn in January 2022.

Interestingly, Reliance has been in talks with the company for more than a year, as reports emerged in July last year about a potential lifeline for Dunzo, which has been mired in a severe cash crunch since early 2023.

At the time of its last funding round, Dunzo was valued at $770 Mn, but the Kabeer Biswas-led startup has fallen from grace since then.

Unable to hit the brakes on its marketing spending, employee costs and operational expenses and forced to sit out of the quick commerce boom, Dunzo turned to B2B deliveries as we reported earlier.

But now, the company is moving back to its older model — deliveries from retail stores to consumers — in a shift that’s clearly meant to protect the brand value inherent in Dunzo’s name.

Over the past year, Dunzo has seen the exit of two cofounders — Mukund Jha and Dalvir Suri — while CEO Biswas and the other cofounder Ankur Agarwal desperately try to bring in more funds to keep operations going.

Will Reliance Deal Go Through?

Biswas told employees on July 20 that key investors including Reliance Retail have agreed to infuse funds into the company, according to sources. He also claimed that the fresh capital will be deployed to clear the pending salaries and other dues owed to former and current employees as well as vendors.

lockquote>

In an email dated May 19, 2024, seen by Inc42, Biswas claimed that the company has closed 75% of the round, but there is no clarity on the final timeline for clearing employee dues as the company cannot yet access the funds.

In another email dated August 12, 2024, Biswas told employees that the ongoing fundraising process had hit a roadblock, with the management unable to close the transaction. If Dunzo is unable to close this deal, the company would most likely be further dragged into ongoing insolvency cases.

lockquote>

“Kabeer claimed the management is trying to get the signatures of all the investors to close the transaction as soon as possible and that Reliance has finally agreed to be a part of the funding. However the management did not mention whether the nature of the transaction will be a rights issue or an acquisition,” according to one of the employees who was a part of Biswas’ address.

Incidentally, having experimented with quick commerce through Dunzo Daily, the company had completely pulled out of the segment. Its B2C operations instead focussed on the original Dunzo proposition — hyperlocal deliveries for nearby grocery stores and those on the ONDC network.

Besides this, the company had also looked to become a delivery partner for retailers and merchants who had their own online stores. Inc42 has also reviewed communications between the management and employees which indicates that Reliance is likely to infuse funds to support the operational spending as well.

According to sources, Biswas claimed that the intention is to deploy a small portion of the proposed funds infusion into B2C operations, after the startup clears its existing dues.

lockquote>

Meanwhile, queries sent to the Dunzo CEO and Reliance Retail did not elicit any response.

Dunzo Goes Back To B2C

Interestingly, Dunzo is back to B2C mode, and is looking to scale down its B2B vertical aka Dunzo For Business. The B2B vertical was largely catering to Reliance’s ecommerce platform JioMart and Dunzo was banking on partnerships with ONDC sellers as a logistics, fulfilment service provider for the open network.

However, Dunzo did not have the nationwide network that is critical to scale up the B2B logistics business. For instance, the likes of Shiprocket, Delhivery, Shadowfax, Ecom Express have operations that cater to hyperlocal deliveries as well as intercity movement from marketplaces, D2C brands.

“Dunzo as such has not been able to expand its clients base when the industry saw exponential growth on the back of rise in quick commerce players and D2C ecosystem. Its multiple attempts to raise funding since last year have been blocked by several shareholders that acted as a roadblock. Besides, dependence on a few business clients for B2B has also not served it well,” according to a partner at a fund that has invested in Dunzo.

lockquote>

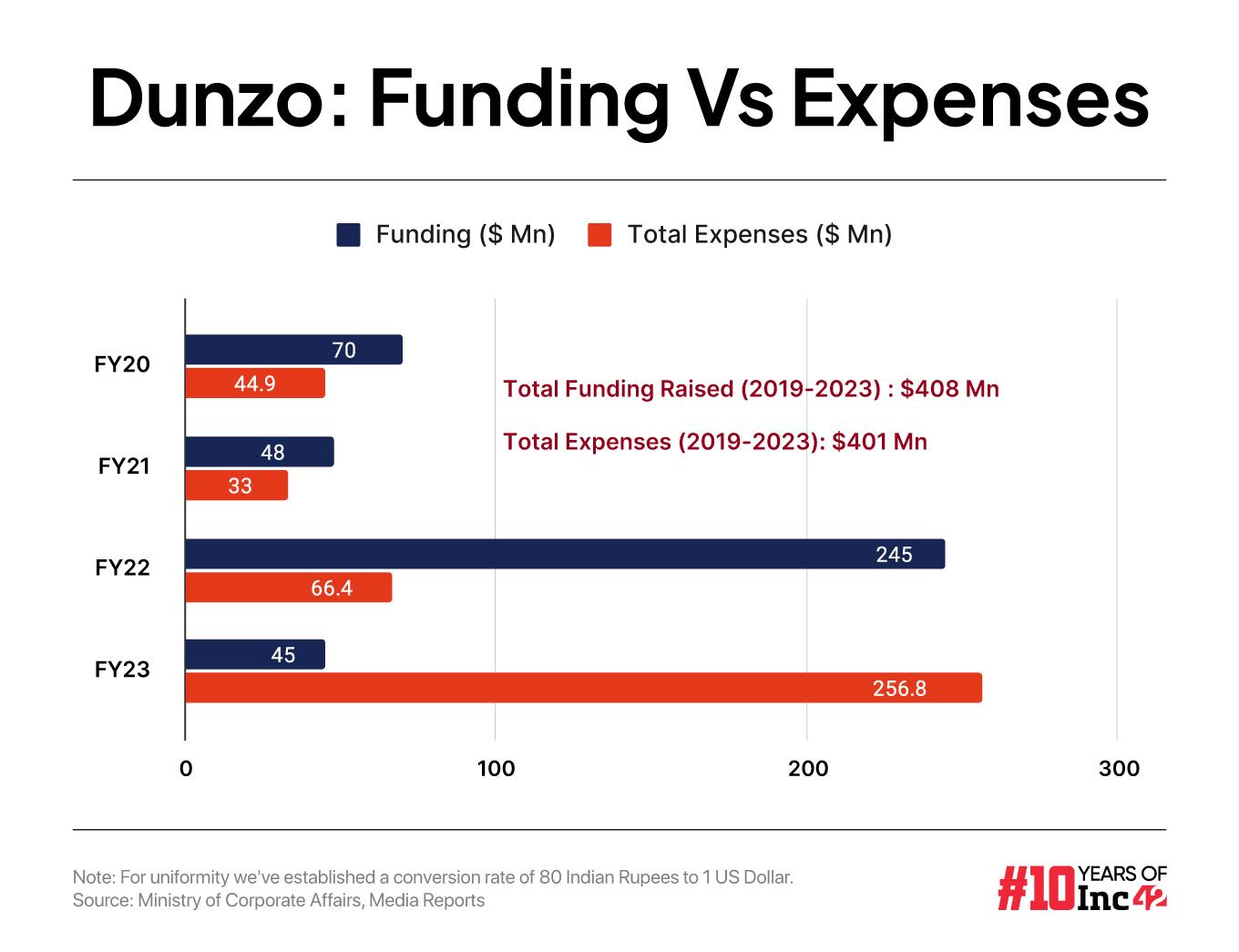

As its quick commerce bid failed, Dunzo’s losses surged to INR 1,801 Cr in FY23, up from INR 464 Cr in FY22. As we reported last December, cumulative losses have grown to over $150 Mn (INR 2,000 Cr+) vs revenue of just around $12 Mn (INR 100 Cr+) from 2018 to 2022

This wide disparity is not likely to have been solved in FY24. While the losses for FY24 are likely to be much lower as Dunzo cut costs, the startup would have also seen a dip in revenue as per most sources in the industry. This is also indicated by the fact that the company had severe cash flow issues all through FY24.

In addition, Dunzo defaulted on payments to two key vendors who have taken the ecommerce company to NCLT for recovery of the dues. Betterplace Safety Solutions moved the NCLT in Bengaluru against Dunzo for unresolved payments to the tune of INR 4 Cr. Both companies are currently in talks for a settlement.

Further, a group of creditors — Invoice Discounters of Dunzo Digital — filed an application under section 7 of Insolvency and Bankruptcy Code, 2016, alleging that the Reliance Retail-backed startup has cleared only 50% of its dues to such creditors.

The NCLT also admitted Velvin Packaging Solutions Private Limited’s insolvency plea against the quick commerce startup. In addition, Dunzo’s advertising partners and vendors including Google India, Facebook India, Glance among others are collectively owed approximately INR 11.4 Cr, as per earlier reports.

Is Quick Commerce On The Cards Again?

Even as Dunzo was one of the few early movers in quick commerce in 2021, its inability to scale operations beyond Bengaluru and shore up volumes in several key markets have led to its downfall. Despite having Reliance Retail’s backing, Dunzo missed out where Blinkit, Swiggy Instamart and Zepto cashed in.

While all talk is about Blinkit turning profitable, Zepto raising nearly a billion dollars and Instamart becoming the lynchpin for Swiggy’s IPO push, no one is looking at Dunzo. Instead, the focus is on Flipkart, BigBasket and JioMart on the quick commerce front.

lockquote>

Incidentally, Flipkart, which launched Flipkart Minutes last week as a pilot in Bengaluru, was reportedly in talks with Dunzo for an acquisition.

Surprisingly, Reliance shut down its 90-minute delivery services through Jio Mart last year, and is now reportedly planning to enter this space as the demand for instant deliveries across metros, Tier 1 India surges.

Will Dunzo become a part of JioMart’s push and finally see a piece of the elusive quick commerce boom? But for now, Dunzo, despite raising nearly $500 Mn in its lifetime, needs to rely on Reliance for something a lot more basic — funding to live another day.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)