Between 2014 and H1 2024, Indian startup ecosystem spawned the rise of 25 ecommerce unicorns, including Flipkart, boAt, Meesho, Snapdeal, among others

Home to over 5.1K ecommerce startups, India is witnessing a surge in digital economy as a growing number of Indians are flocking online for their shopping needs

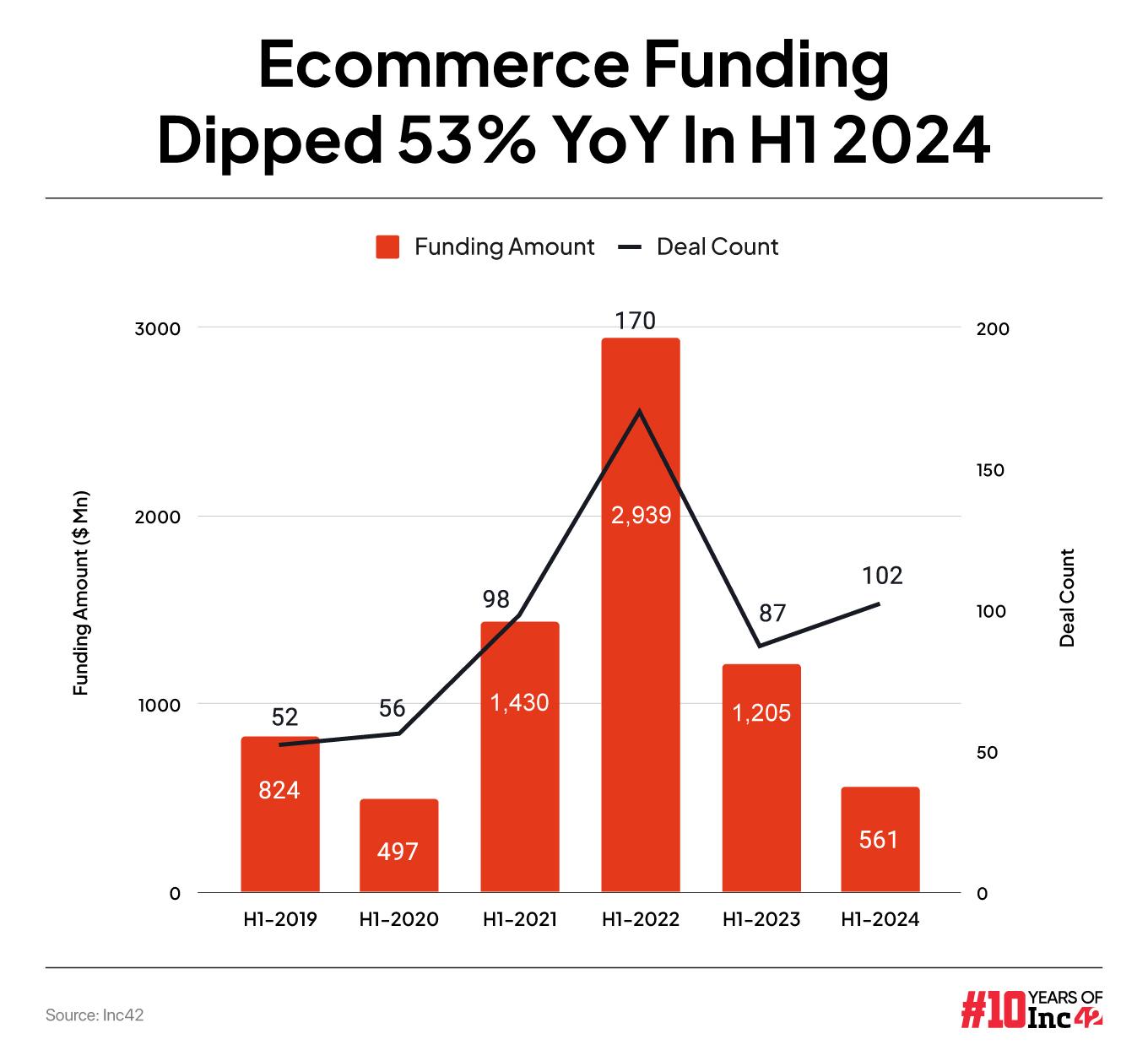

Oscillating between the funding boom of 2021 and the capital drought in years after, Indian ecommerce startups cumulatively raised $561 Mn across 102 deals in H1 2024

The Indian startup ecosystem grew by leaps and bounds over the last decade. The country’s startups raised a whopping $151 Bn between 2014 and H1 2024. An important contributor to this number was the ecommerce sector, which has been at the forefront of the startup boom in the country.

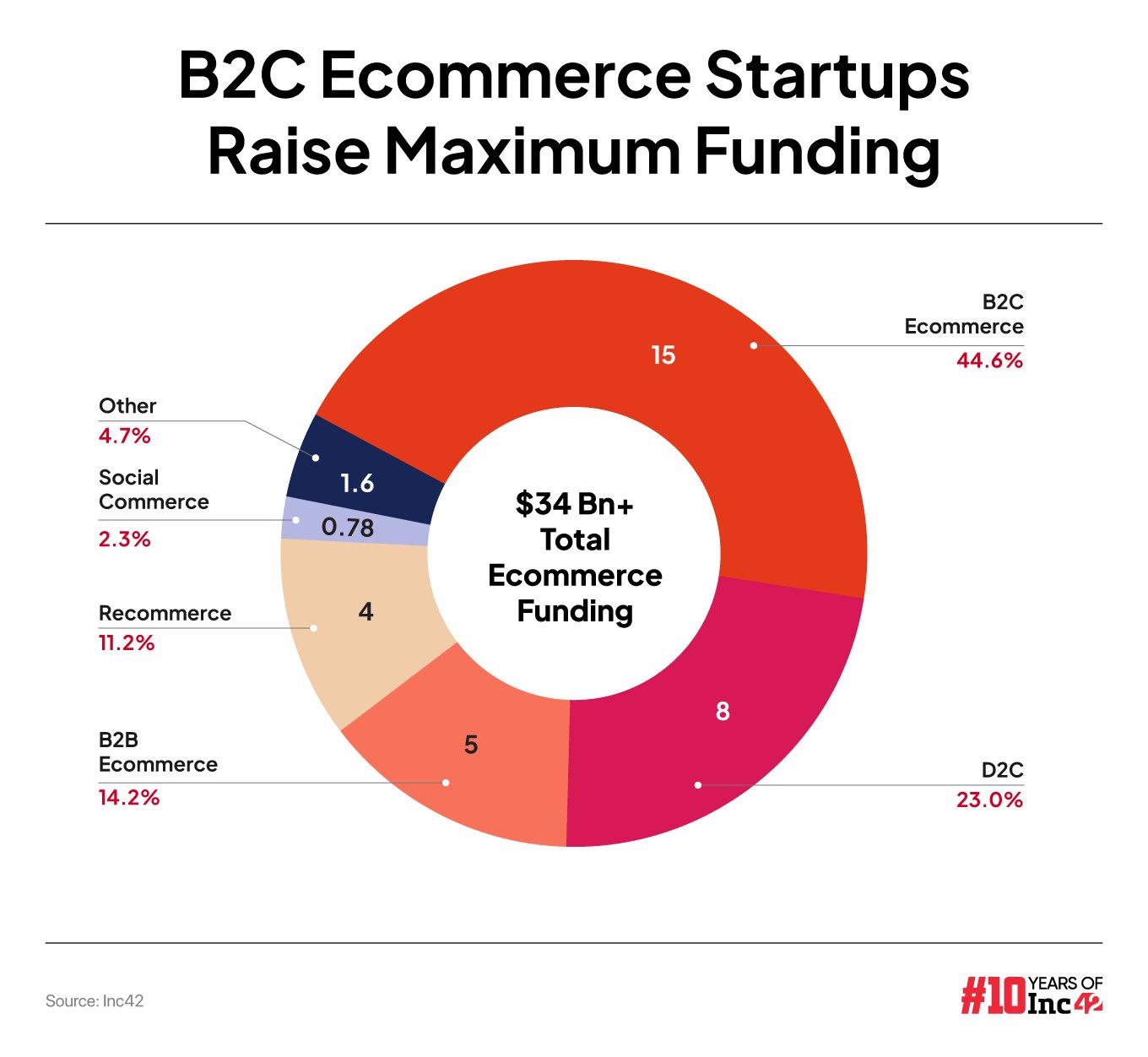

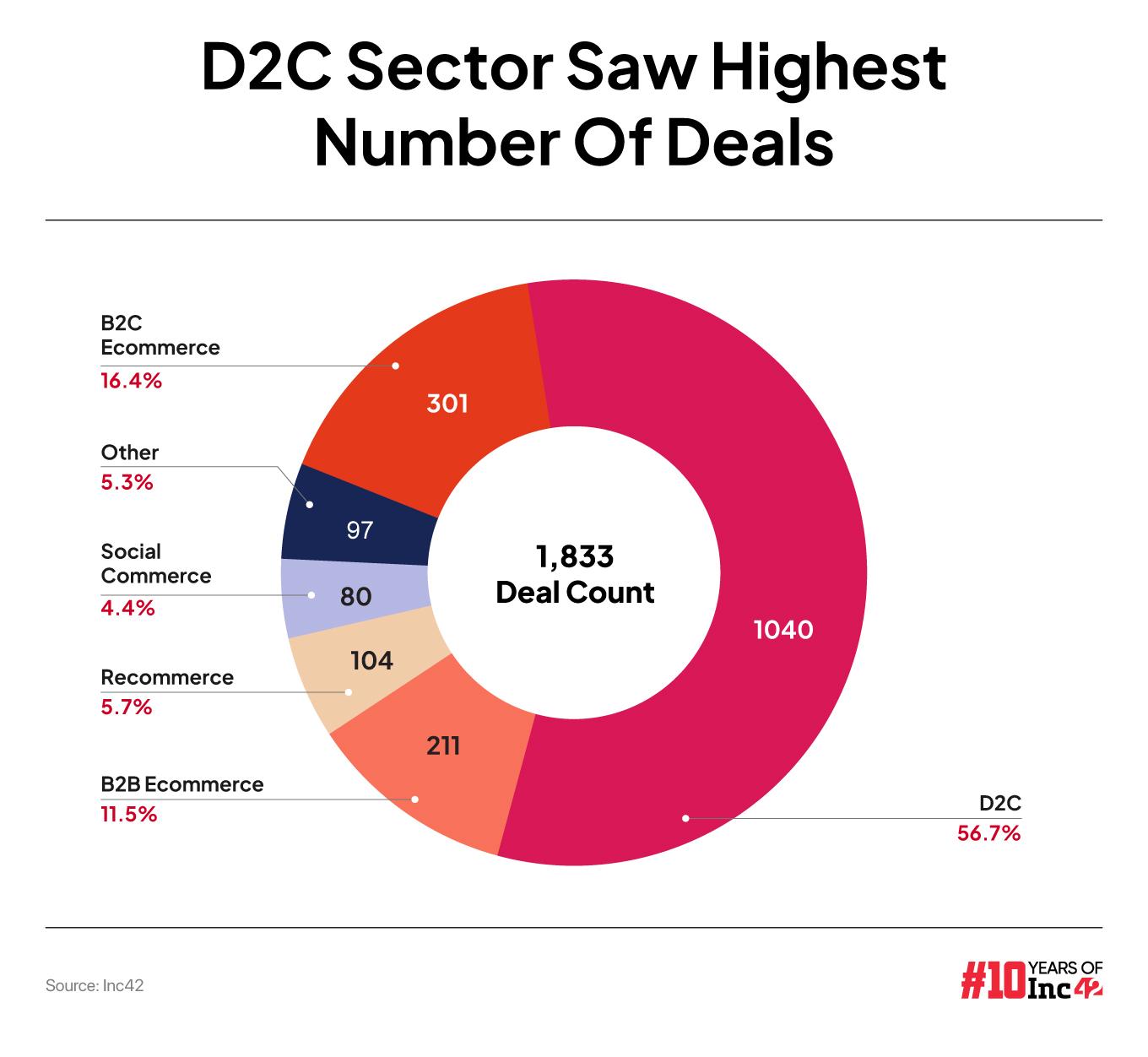

According to Inc42’s ‘The State Of Indian Ecommerce H1 2024’ report, Indian ecommerce startups cumulatively raised over $34 Bn via 1,833 deals between 2014 and H1 2024. This period saw 25 ecommerce startups, including Flipkart, boAt, Meesho, and Snapdeal, entering the unicorn club. These unicorns are cumulatively valued at over $89 Bn today.

Besides, the Indian ecommerce sector also has 18 soonicorns like Drools, Country Delight, BlueStone. The combined valuation of these startups exceeds $6 Bn.

Overall, there are over 5.1K Indian ecommerce startups, out of which over 940 are funded. These players are looking to expand their businesses on the back of the growing number of Indians flocking to digital channels for their shopping needs.

As per the Inc42 report, the number of online shoppers in the country will cross the 500 Mn mark by 2030. Consequently, the Indian ecommerce market is estimated to become an over $400 Bn opportunity by 2030.

In terms of funding trends, the year 2021 was a game changer for India’s ecommerce sector, in line with the funding boom in the broader startup ecosystem. With investor interest soaring in online businesses during the Covid-19 pandemic, the funding raised by ecommerce startups in 2021 surged 10X to $10 Bn from $1 Bn in 2020.

However, ecommerce funding took a hit as a funding winter engulfed the startup ecosystem in 2022. With startup funding declining to $25 Bn in 2022 and further plummeting to $10 Bn in 2023, ecommerce sector also felt the chills of the funding winter.

While ecommerce startups managed to raise $4 Bn via 300 deals in 2022, this number fell to $2 Bn raised via 191 deals in 2023. This represented a 47% year-on-year drop in funding as the sector saw muted investor interest.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-ecommerce-report-h1-2024-infocus-beauty-personal-care/” target=”_blank” rel=”noopener”>Download The Report

B2C Ecommerce Startups Attract Maximum Interest

In the decade filled with ups and downs, B2C ecommerce led the charts on a sub-sectoral level in terms of funding. The B2C ecommerce sub-sector, which includes startups like Nykaa, Flipkart, and Meesho, cumulatively raised $15 Bn via 301 deals in the last 10 years, accounting for 44.6% of the total ecommerce funding pie.

Trailing behind B2C ecommerce was India’s fledgling D2C ecosystem, which saw startups raise $8 Bn via 1,040 deals during the decade. The cumulative funding raised by D2C startups made up 23% of the total ecommerce funding.

Inc42 estimates that India’s direct-to-consumer (D2C) market will reach a size of $100 Bn by 2025.

Meanwhile, B2B ecommerce, a sub-sector which houses unicorns like Udaan, Moglix, and Infra.Market, was the next major ecommerce sub-sector in terms of fundings. B2B ecommerce startups cumulatively netted over $5 Bn via 211 deals over the last decade.

Now, let’s take a deeper look at the funding trends observed in the first half of the ongoing calendar year.

Ecommerce Funding Halves In H1 2024

Ecommerce startups raised $561 Mn in 102 deals during the first six months of 2024. This was a decline of 53.44% from $1.2 Mn raised by them in the first half of 2023 via 87 deals. Further, it was also a far cry from the $2.9 Mn raised by ecommerce startups via 170 deals in H1 2022.

The major factor behind this dip in funding was diminishing investor interest in late stage ecommerce startup investments. Late stage ecommerce startups saw a decline of 87% YoY in the funding raised by them at $116 Mn in H1 2024. This amount was raised via eight deals. The median ticket size also declined 32% YoY to $14 Mn.

However, the silver lining was the increase in the number of seed stage investments as investors turned bullish towards new startups.

Seed stage ecommerce startups bagged $116 Mn during January-June 2024, a jump of 358% from $25.3 Mn in the year-ago period. The deal count for seed stage ecommerce startups also jumped 4% YoY to 47. Moreover, the median ticket size for investments in early startups rose 283% YoY to $1 Mn.

Growth stage ecommerce startups also saw a moderate 19% YoY increase in funding to $215 Mn in H1 2024. The number of deals stood at 26, a 100% increase. However, the median ticket size fell 38% to $6 Mn during the first half of 2024.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-ecommerce-report-h1-2024-infocus-beauty-personal-care/” target=”_blank” rel=”noopener”>Download The Report

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)