The Indian D2C beauty and personal care (BPC) space is filled to the brim with stories of brands that started quite humbly only to become industry juggernauts later. One such case in point is of Mamaearth, which entered the BPC space with its onion-based products, including hair oil, shampoo and conditioners, but now rules the segment with an iron hand.

However, worth noting is the fact that Mamaearth isn’t the only mammoth in this burgeoning space, which has seen the rise of other trailblazers like WoW Skin Science, SUGAR Cosmetics, and mCaffeine, all of which are now on the brink of achieving the coveted unicorn status.

Another noteworthy example is Minimalist, a beauty and skincare brand, which in just eight months of its inception became an INR 100 Cr revenue-generating business. Also, how can we forget the Nykaa story?

Notably, this growth is being driven by millennials, who not only represent 34% of the country’s population but also possess significant purchasing power. It is particularly this class of individuals that has propelled these brands onto a hyper-growth trajectory.

Amid the current scheme of things, Inc42’s ‘State Of Indian Ecommerce Report H1 2024, InFocus: Beauty & Personal Care’, powered by Pay10, identifies the Indian BPC market as the fastest-growing ecommerce segment in the country.

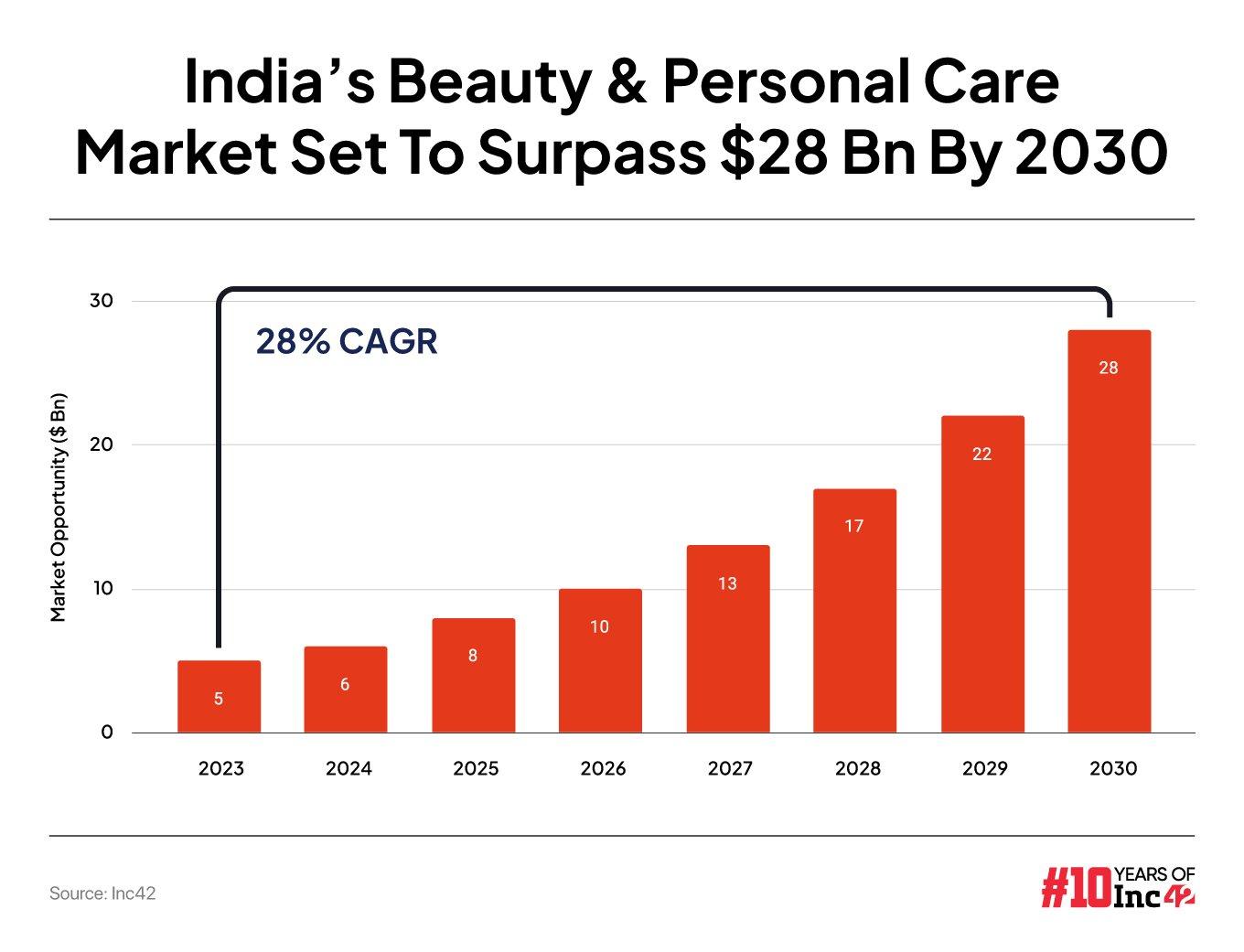

Valued at over $5 Bn in 2023, the country’s BPC market is expected to become a $28 Bn+ opportunity by 2030, accounting for 7% of the overall ecommerce market.

The Indian BPC startups have collectively secured over $1 Bn in funding between 2014 and H1 2024. Also, at more than 68 funded startups, BPC appears to be the most sought-after segment in the ecommerce sector after fashion and F&B, which foster 100+ and more than 150 funded startups, respectively.

In the first half of 2024 alone, the startup funding in this segment increased 3.2X year-on-year (YoY) on the back of bullish investor sentiments. Also, while Mumbai reported maximum funding in the segment between 2014 and H1 2024, Delhi NCR accounted for most deals.

It is imperative to mention that innovation, consumers’ willingness to upgrade their lifestyles, and high margins are some of the key factors that have kept the investor interest intact in this space.

Endorsing the sector for its wealth of offerings, Vinay Singh, partner, Fireside Ventures, said, “The segment continues to remaining interesting for us. Whether you look east or west, across European, American, Japanese, or Korean markets, there is enough innovation in terms of new ingredients, formats, and application methods.”

lockquote>

Besides, the rising per capita income in the country and the upgrade of what we refer to as “India 2” into mass premium products presents a substantial opportunity for growth in this sector,” he added.

While investors see several merits, what are the top factors propelling the Indian BPC growth story?

Rising Disposable Income Spurts Sectoral Growth

The rise in the disposable incomes of individuals, coupled with their willingness to spend on new BPC brands has been the primary driver for the growth of this segment of ecommerce in the country. Interestingly enough, the report anticipates this spending to increase 2.73X by 2030.

Another important point is that — India’s per capita spending on BPC products currently stands at $14 compared to $313 in the US and $38 in China.

“Currently, more than 80% of our customers have already replaced at least four out of the ten products they use with new-age brands, which could range from traditional Ayurvedic products to fully chemical-based solutions, such as retinol-based brands. The key point is that customers are willing to explore and switch to newer options. This shift is where we’ve been able to source and grow our customer base,” Swagatika Das, founder of Nat Habit, said.

lockquote>

Notably, incorporated in 2019, the startup became an INR 100 Cr revenue-generating brand in FY24 on the back of its fresh natural and ayurvedic beauty care playbook.

Adding to Das’ thought, Fireside Ventures’ Singh said that even if the average per capita income and spending on beauty products may not increase dramatically in the next seven years, the sheer number of households upgrading their consumption patterns will drive overall growth in the space.

Shifting Consumer Preference Towards Premium & Natural Products

Another key driver behind the growth of this segment is consumers’ increasing preference for natural and premium products.

“The BPC space initially lacked truly natural options, despite consumers actively seeking safe, nature-inspired alternatives. This gap presented a significant opportunity and several brands emerged tame the wave,” Swagatika Das, founder of Nat Habit, said. She added that consumers have shown a strong interest in homemade products that are chemical and adulteration-free.

Meanwhile, alongside the rising demand for natural products, the trend toward premium and tailored offerings is also gaining traction in the beauty and personal care market.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-ecommerce-report-h1-2024-infocus-beauty-personal-care/” target=”_blank” rel=”noopener”>Download The Report

Cashing in on it, Foxtale, which provides targeted skincare solutions, emerged as the highest-funded BPC startup in H1 2024, securing $32 Mn. Similarly, at $12 Mn, Renee Cosmetics netted the second-largest cheque in the first half of 2024.

Nikita Khanna, the founder of Moxie Beauty, a brand that provides solutions only for wavy and curly hair, too, is betting big on this trend by targeting a niche market. According to her, she enjoys an advantageous position in the haircare segment. “The central thesis is that haircare, unlike skincare and cosmetics, has not yet seen the level of innovation, which gives us enough headroom to expand and grow,” the founder said.

The Rise Of Omnichannel Distribution

Both online and offline shopping for beauty products are quickly becoming crucial ways for consumers to buy what they need, offering more products at greater convenience. This also means that there will be significant demand from Tier II cities and smaller towns.

Players like Nykaa, Mamaearth and SUGAR have shown how moving into physical retail has strengthened their online presence, creating a strong omnichannel strategy.

While the pursuit of a broader customer base is prompting startups and digital-only brands to go offline, an omnichannel strategy also offers a consumer experience that online-only approaches can’t match, as per industry experts. As per Nat Habit’s Das, in addition to reaching a new customer base, an omnichannel strategy also enables brands to provide products more quickly to existing customers.

“We haven’t ventured into offline retail yet, but we’re planning to start in the next four months. Our view on omnichannel is that it’s not only about reaching new audiences but also about being accessible to our existing customers across various platforms. Many of our current customers are asking why we aren’t available on platforms like Blinkit or Instamart, or why they can’t find us in local stores,” Das said.

lockquote>

For products like shampoo, face wash or henna paste, which are used regularly, customers want the convenience of finding them easily, whether online or in nearby shops, she added.

The BPC Road Ahead

In the early stages, companies often experience high burn rates due to significant investments in infrastructure, branding, and distribution channels. If their value proposition isn’t clear, this spending can quickly become unsustainable, Fireside Ventures’ Shah pointed out.

However, in the direct-to-consumer (D2C) model, the beauty and personal care (BPC) sector stands out for having the highest gross margins, which can reach up to about 80%, according Rohit Krishna, partner, WEH Ventures.

These high margins allow companies to invest heavily in brand development and marketing. Success in this model requires either a strong, compelling brand or a focus on addressing specific issues like hair loss. Once customers find a solution that works for them, they are less likely to switch.

On the other hand, more generic products like sunscreens or moisturisers often see consumers switching between brands. In contrast, specialised niche brands can achieve profitability more quickly and sustain their operations longer, even if they operate on a smaller scale compared to larger brands like Mamaearth.

Come as it may, the Indian BPC market is witnessing rapid growth, driven by rising disposable incomes, shifting consumer preferences toward natural and premium products, and the strategic adoption of omnichannel distribution.

Brands like Mamaearth, SUGAR Cosmetics, Nat Habit, and others have successfully capitalised on these trends, leveraging high margins to fuel their expansion.

Strong investor interest further bolsters the sector’s growth, particularly in niche brands that address specific consumer needs. Finally, as the market evolves, companies that can balance innovation, clear value propositions, and robust omnichannel strategies are poised to thrive in this dynamic landscape.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-ecommerce-report-h1-2024-infocus-beauty-personal-care/” target=”_blank” rel=”noopener”>Download The Report

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)