A few months ago, I asked a Cred

The answer came: “Well, you have to see this in a context. It’s similar to what many fintech companies currently have.”

The Bengaluru-based fintech giant has often been the target of ridicule for a muddled revenue model, a sprawl of products and its high valuation despite a ton of losses.

But in 2024, the answers to many of these questions are becoming increasingly clear. This year, the company launched a new product for personal finance management called CRED Money to go with an updated credit card and bill payments experience.

Besides this, there was the eye-catching acquisition of Kuvera, which CRED is leveraging to take on investment tech giants such as Groww, Zerodha, Upstox, Angel One, Paytm Money and others.

The agenda is clear: Together with the handful of products launched last year, CRED is looking to push forward on the revenue front. Today, CRED is a platform that caters to UPI payments, billing for credit cards, utilities and more, vehicle management, travel experiences, ecommerce, rewards and plenty more.

But are these various pieces of the CRED puzzle actually contributing to its top and bottom line? And if so, which of them has the biggest upside?

Before we look at the individual products and the monetisation potential within each of them, it’s important to recap CRED’s financial state overall before many of these products hit the market.

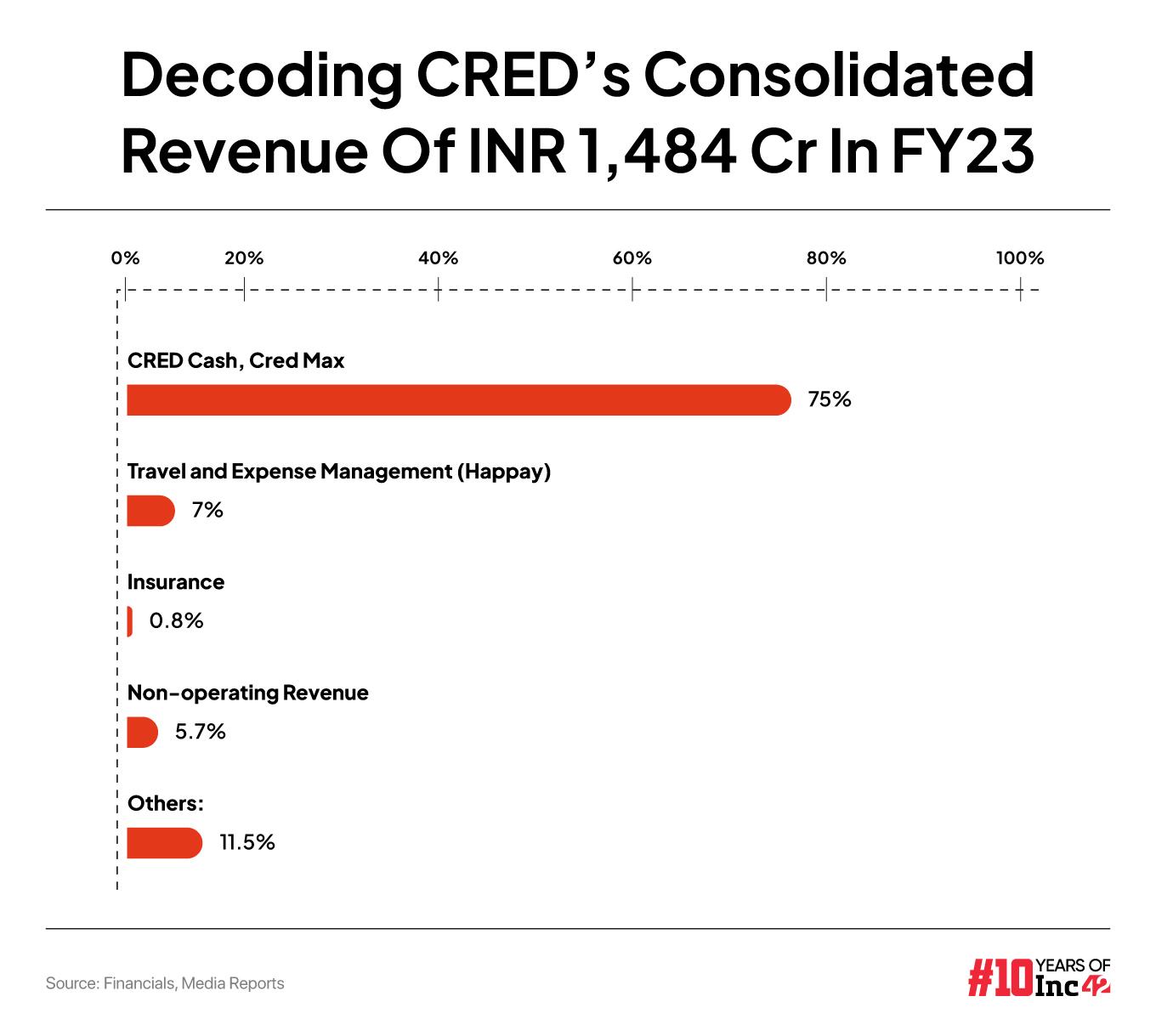

In its last reported financials for FY23, CRED saw a significant surge in revenue, reaching INR 1,484 Cr or roughly 250% higher than FY22. But, at the same time, CRED losses grew slightly (5%) from INR 1,280 Cr to INR 1,347 Cr in FY23.

The company claims to have achieved an 80% reduction in customer acquisition costs and a drop in marketing expenses (27%) from INR 976 Cr to INR 713 Cr in FY23. Despite this rationalisation in costs, CRED was only able to extract just over INR 2 for every rupee it invested in marketing in FY23.

This is one of the reasons why the company has taken the platform or super app approach, looking to cross-sell services and products to its users. We have covered this particular aspect, and from a strategic point of view, CRED seems to have the right formula, but is it working?

Given CRED’s valuation of $6.4 Bn, some valuation experts consulted by Inc42 consider the Kunal Shah-led startup to be overvalued.

“Having registered an impressive growth last year while keeping the expenses in check, CRED is moving in the right direction by integrating more features such as Money to enrich consumers’ experience and launching better-margin products and services, such as travel, insurance and wealth management products which are expected to drive revenue and profitability,” a valuation expert told Inc42.

lockquote>

Let’s dive in and find out how each vertical contributes to the CRED revenue machine.

CRED’s FY23 Revenue Breakdown

In contracts with customers or merchants that include multiple services, CRED divides the revenue based on the individual price of each service. This price is usually determined by what the company charges customers or by calculating the expected cost plus a margin.

- Revenue From Loans: This is the biggest contributor to the revenue. CRED charges a 1% to 2% fee on loans facilitated and distributed by CRED Cash and CRED Flash. The fee is charged for acquiring the borrower, KYC facilitation, and customer service including monitoring of the loan or the loan portfolio for the NBFC and lending partners. Lending partners also share a piece of the interest paid by borrowers, which is accrued over time based on repayment schedules.

- Convenience Fees: CRED earns a convenience fee for facilitating rental transactions, educational fees and other bill payments. This is usually around 1% to 2.5% of the monetary value of transactions processed, but in some cases, special deals can be brokered with institutions and billers that can result in a higher fee.

- Advertisement Fees: If you open CRED, you are more than likely to see ads for D2C brands, travel plans and more. This is part of CRED’s engagement-centric features, where it claims to offer brands access to premium users and in turn charges fees related to advertising, for events such as clicks and conversions. CRED claims to offer 10% higher order and transaction value from its users, and 15% higher retention rate to its brand partners, which is part of its pitch for the ad services

- Service Fees From Merchants: The company charges a percentage of the transaction value from service providers.

- Other Income: CRED also earns income from technical infrastructure fees, which merchants typically pay for using its services. The revenue is calculated as a percentage of the income earned by the service recipient, depending on the partner.

Over the years, CRED has added various pieces to this above list — the insurance commission from CRED Garage and Kuvera being two examples — and as CRED’s super app strategy gets fleshed out, more such revenue pieces will be used to plug any gaps.

Importantly, the UPI product has been key in converting the user base from low-frequency actions for credit card payments to high-frequency actions like daily small-ticket purchases. Garage or CRED Escapes (travel) or the CRED Store are all part of this effort to boost engagement among the most active users.

What New Revenue Streams Is CRED Banking On?

The above breakdown is applicable for FY23 only. Since March 2023, CRED has built or acquired new products which have significantly tweaked the revenue model.

The Critical Payment Aggregator Pillar

First up is the payments aggregator licence, which brings in 1.75%-4% per transaction as processing fee for CRED. However, the company has had to spend to set up the PA infrastructure and there is a high compliance burden on PAs as per RBI’s latest changes.

The payment aggregator licence will allow CRED to leverage its reach to acquire more partner brands and third-party merchants. Plus, the PA licence is critical for CRED to expand its commerce plays, where payments from customers to merchants can be settled in one go, instead of multiple operations. This reduces payment processing costs for CRED.

“A PA licence enables direct payment processing, enhancing the platform’s offerings like CRED Pay and CRED RentPay. However, it comes with regulatory challenges, including strict monitoring and compliance, similar to what Paytm has undergone. In case restrictions are slapped on a business, they can impact innovations and product scope,” Abhinav Paliwal, cofounder and CEO of PayNet Systems which develops a white-label neobanking software earlier told Inc42.

lockquote>

CRED has so far relied on third-parties such as Cashfree, Razorpay for payments gateway services, but having a PA licence means CRED has more direct control. The startup is also said to be developing its own payments gateway, as per sources, which will further help the company cut the reliance and spending on partnerships.

The CRED Travel Plan

Last year, CRED also launched CRED Travel, which was earlier called Escapes. Here, the company partners with various hotels and travel brands to offer curated travel experiences. The company earns a commission on bookings made through its platform, and each of these experiences is on the premium side, which is the differentiation that CRED is banking on

While CRED has positioned itself as a premium player to capture a portion of this lucrative luxury travel market segment, this segment is comparatively smaller in India and estimated to be around $3 Bn market. However, this is a crucial piece for CRED in its premium super-app play. Other fintech super apps such as Paytm or PhonePe offer typical flight and hotel booking on their platform where there is higher competition and relatively low margins.

This strategic focus on high-value offerings aligns with CRED’s target demographic of creditworthy individuals who are likely to spend more on travel experiences. And this also ties into the CRED Garage product philosophy.

Where CRED Garage Is Headed

Today, CRED claims to have over 4 Mn vehicles ‘parked’ on its Garage platform, which was launched with much fanfare last year.

Here, the startup offers services like vehicle insurance renewal, FASTag recharges, and roadside assistance through partnerships. The company earns commissions on the transactions made for these services through its platform. The product allows the company for targeted advertising opportunities for auto brands and dealerships and further monetisation opportunities on the platform.

Insurance brokerages, on average, get 10%-15% of the total premium amount processed through their platform. It’s not clear exactly where CRED falls in this range, but unlike other platforms where users specifically look for insurance, CRED Garage is a lifestyle play and in the long run, insurance will just be one piece of its revenue stack.

Kuvera’s Big Plans

In February this year, CRED made its long-awaited push into investments with the acquisition of Kuvera. Interestingly, Kuvera is a free investment platform offering direct plans at zero commissions. In fact, this is a key USP for the platform and many have questioned how Kuvera sustains itself.

Instead of fees from individuals, Kuvera earns revenue through B2B services i.e. working with large investment houses, and market data analytics.

Kuvera has assets worth $1.4 Bn+ under management, 300K users, an average SIP size of roughly INR 5K, but because of its free model, it pales in comparison to other players.

For instance, Zerodha earned $820 Mn in FY23, and Groww reported $150 Mn+ in revenue, but Kuvera’s operational revenue decreased from INR 90 Lakh in FY22 to INR 62 Lakh.

One senior executive at Kuvera told Inc42 optimistically, “The numbers are before the acquisition of course. You could expect a 20x+ revenue growth in the next two years.” So how do CRED and Kuvera hope to kickstart monetisation at scale?

lockquote>

Well, for one, Kuvera plans to add more investment products such as alternative investment funds and portfolio management services which will be paid services.

But the executive quoted above pointed to something else altogether, “If you look at CRED’s marketing campaign, it has been much more effective than the nearest competition. Kuvera will benefit from similar campaign programmes. There are certain points identified in the case of existing products and their market placements which will be addressed in the ongoing fiscal year.”

Improving consumer engagement, focusing on the order investment size and restructuring the product portfolio are high on the agenda for Kuvera. Kuvera being a recognisable name in the direct mutual fund industry, CRED is likely to continue to using the brand name even in the future.

Finally, Singing The UPI Tune

For so long, CRED had shied away from UPI and then came the realisation that it had to convert its low-frequency usage to high-frequency. CRED Pay is the key piece of the super app puzzle. It’s the UPI payments service that grabs the average fintech consumer and as their credit score improves, CRED starts pushing other services to these users.

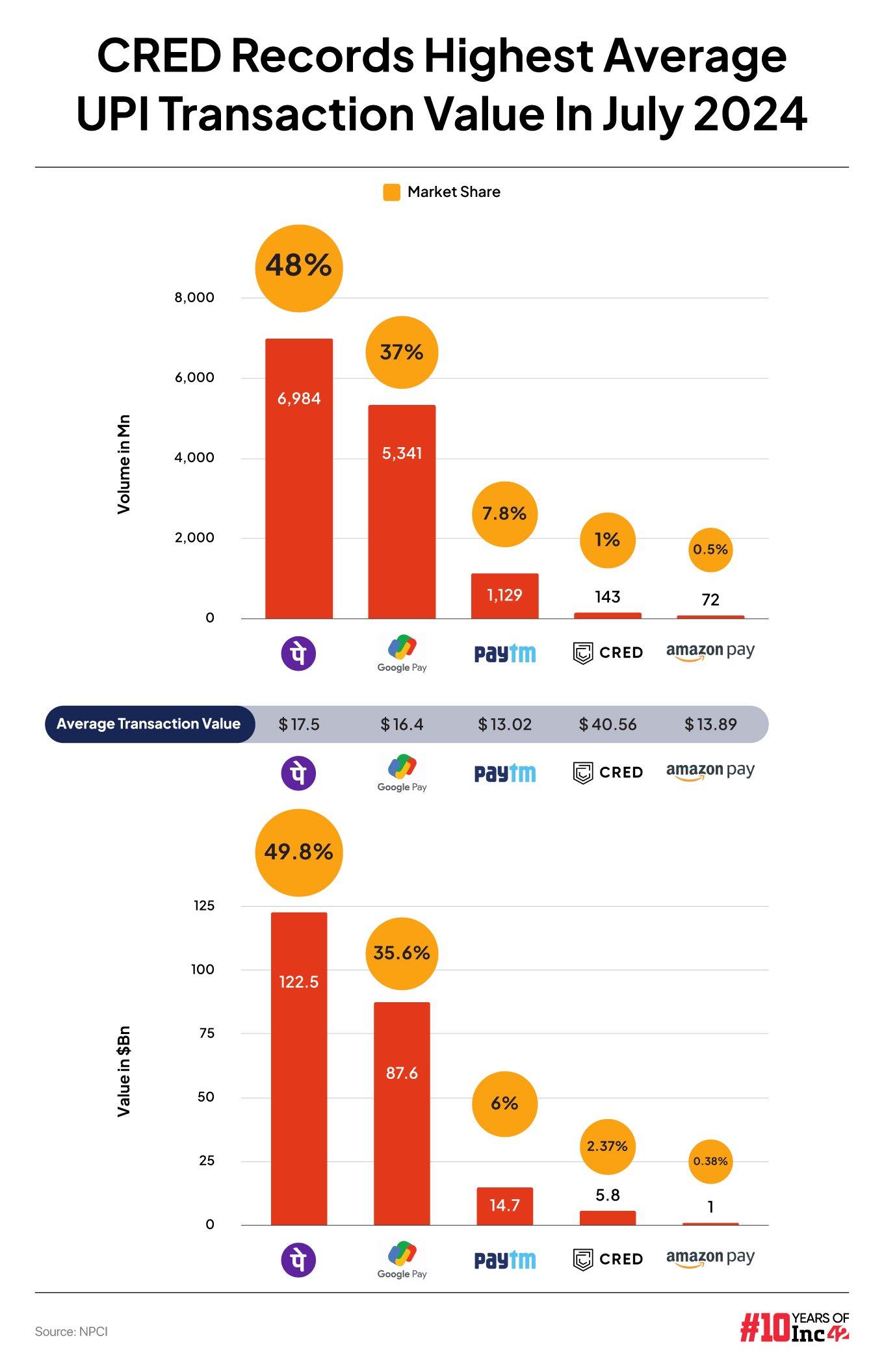

Despite having just one percent of the transactions, CRED has captured over 2.37% of the transaction value, registering the highest transaction value per consumer. This underscores the company’s claims that its customers are typically more spendy than the UPI users using rival apps.

We have said it before — without UPI, the Indian super app story crumbles as this is the top-of-the-funnel standard feature that all users expect in fintech apps these days. Without UPI, CRED does not have users returning on a daily basis, and growing the UPI base means CRED has had to spend heavily on cashback.

However, in the long run, this spending can create a captive base of users, who can be regularly plied with other services by Shah and team.

CRED Money: The Next Big Thing?

Most recently, CRED made a high-profile entry into the personal finance management space. This is an opportunity that many startups have tried to capture, but the monetisation outlook has always remained bleak.

CRED would be hoping that CRED Money will be the second strongest habit-creation product after UPI payments. It’s worth noting that since CRED’s Happay acquisition in 2021, the corporate expense management platform has registered a 2.5x growth from FY22 to FY23.

Learnings from Happay have contributed to CRED Money. Besides allowing users to analyse spends, CRED Money will remind them of recurring payments that will surely drive higher usage of CRED’s own services for these payments. In particular, the Money product offers a great potential for CRED to scale up revenue from bill payments and other recurring payments such as insurance premia, EMIs for loan and more.

Why CRED Is Not Worried About The Competition

One could say that the fintech super app space is one of the most competitive battles in the Indian startup ecosystem. From Paytm to PhonePe to Google Pay to Groww, and even Flipkart and Jio Financial Services, everyone wants a piece of this action.

Planning a super app and launching products is one thing, but scaling it up will be just as critical for CRED. However, unlike other platforms, CRED’s marketing strategy has been about treating its users as members, while offering products in the form of experiences.

PhonePe invested billions of dollars in scaling it up, just like Paytm or Google Pay, Amazon Pay or others. While the market is undoubtedly large, competition makes it hard to acquire and retain users, which is where perhaps CRED is looking to differentiate itself by going after the cream of the market.

But those leading CRED believe the company has now successfully created an Apple-like premium niche and ecosystem. But this has not yet translated into that other very Apple thing: profits.

Vertical integration is undoubtedly super critical for super apps. “The existing user base, which manages their credit cards and expenses via CRED may prefer to consolidate their financial activities under one roof, thereby allowing CRED to gain some mileage and catch up with Zerodha and Groww,” Kalindhi Bhatia, partner at transactions law firm BTG Advaya, told Inc42 earlier about the super app strategy.

In the early days, CRED struggled to retain users because its offerings were too limited. As it added more products over the years, CRED is also changing and embracing users that have high aspirations but perhaps don’t yet qualify as premium users.

The clearest indication of this change is CRED’s high reliance on personal loans for revenue generation. As it looks to scale up, CRED may be forced to cede some ground as far as the premium target audience is concerned. How will this change CRED in the long run?

[With inputs from Nikhil Subramaniam]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)