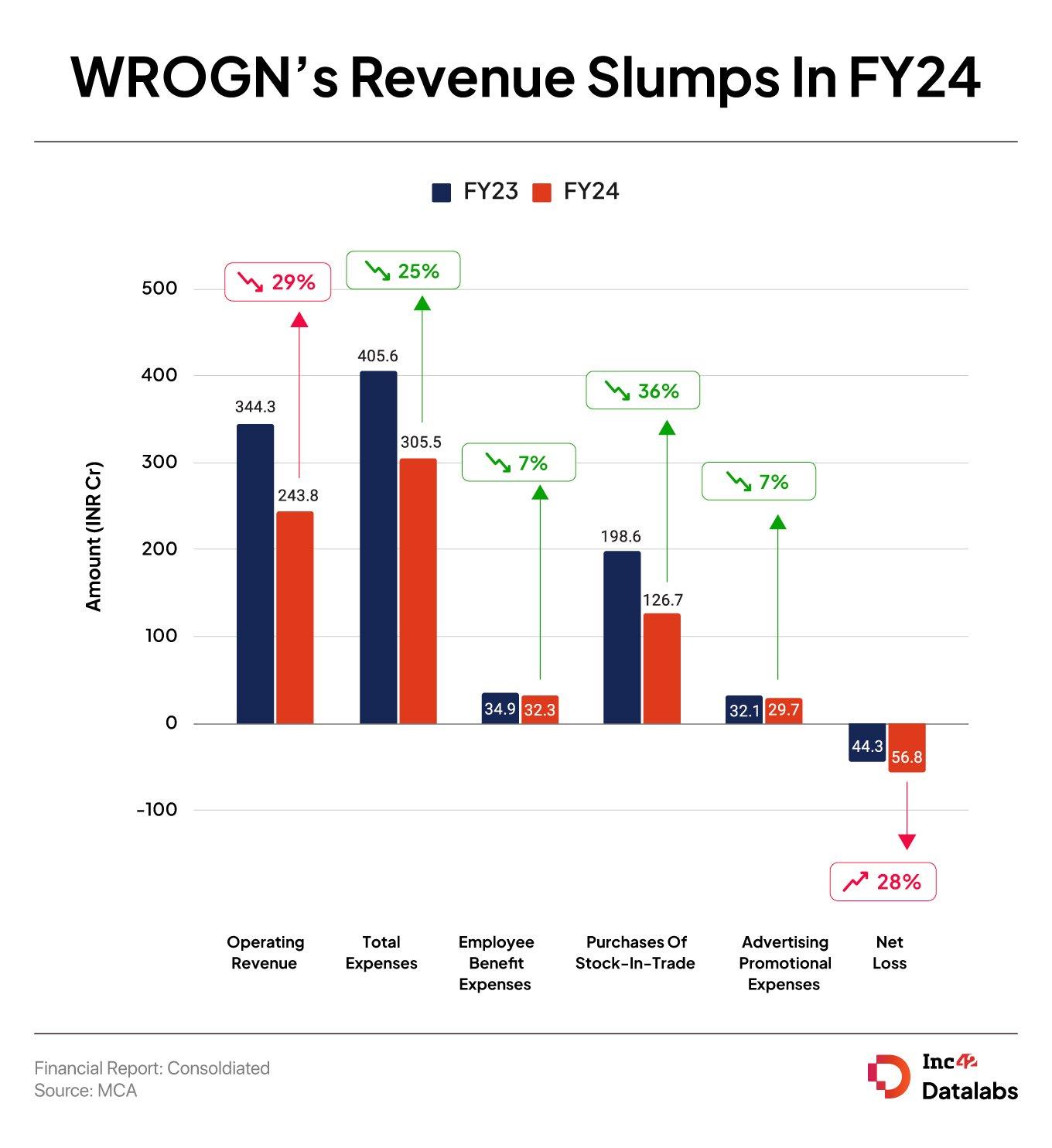

Universal Sportsbiz Private Limited (USPL), which operates Virat Kohli and Accel-backed youth fashion brand WROGN, seems to be struggling to scale up its sales. The startup’s operating revenue slumped 29% to INR 243.8 Cr in the financial year 2023-24 (FY24) from INR 344.3 Cr in the previous fiscal year.

Including other income, the startup’s total income declined 27% to INR 264.7 Cr in FY24 from INR 361.3 Cr in FY23.

Founded in 2014 by the brother-sister duo of Anjana Reddy and Vikram Reddy, WROGN is a D2C omnichannel men’s fashion brand which sells a wide range of casual wear, footwear and accessories. Earlier this year, Aditya Birla Group’s fashion and lifestyle venture TMRW acquired a 16% stake in Universal Sportsbiz Private Limited (USPL) for INR 125 Cr (about $15 Mn) in an all-cash deal.

In its filing with the Ministry of Corporate Affairs, the startup said it is “optimistic about the company’s business and hopeful of better performance with increased revenue in next year”.

Despite the decline in revenue, WROGN’s net loss rose 28% to INR 56.8 Cr during the year under review from INR 44.3 Cr in FY23.

Zooming Into Expenses: Amid the decline in sales, WROGN’s total expenses fell 25% to INR 305.5 Cr in FY24 from INR 405.6 Cr in the previous fiscal year.

Purchases Of Stock-In-Trade: Purchases of stock-in-trade continued to be the biggest expense for the startup. WROGN spent INR 126.7 Cr for purchases of stock-in-trade in FY24, an increase of 7% from INR 198.6 Cr in the previous fiscal year.

Advertising Promotional Expenses: The startup reduced its advertising and promotional expenses marginally to INR 29.7 Cr in FY24 from INR 32.1 Cr in the previous year.

Employee Benefit Expenses: WROGN’s employee benefit expenses declined 7% to INR 32.3 Cr in FY24 from INR 34.9 Cr in FY23.

WROGN has raised around $90 Mn in funding till date and counts the likes of Accel, Flipkart, Kohli, and Sachin Tendulkar among its backers. It competes with the likes of Roadster, and HRX, in the country’s crowded fashion market.