Swiggy

Try as they might to set themselves apart, Zomato and Swiggy are intertwined in more ways than one. Not only are the only major food delivery apps in India, but their business models more or less mirror each other. So naturally, everyone wants to know whether Swiggy will pay off like Zomato has done, with over 3X growth in stock price in the past year.

All this comes with a caveat of course: Zomato was listed in 2021 as a loss-making company, but its profits have grown steadily in the past five quarters after it reached profitability in the April-June quarter last year.

Swiggy has not matched Zomato in this aspect, even though it is close to Zomato’s total revenue in FY24. Gurugram-based Zomato posted revenue of INR 12,114 Cr in FY24, as compared to Swiggy’s INR 11,247 Cr, and clocked a profit of INR 351 Cr vs Swiggy’s loss of INR 2,350 Cr.

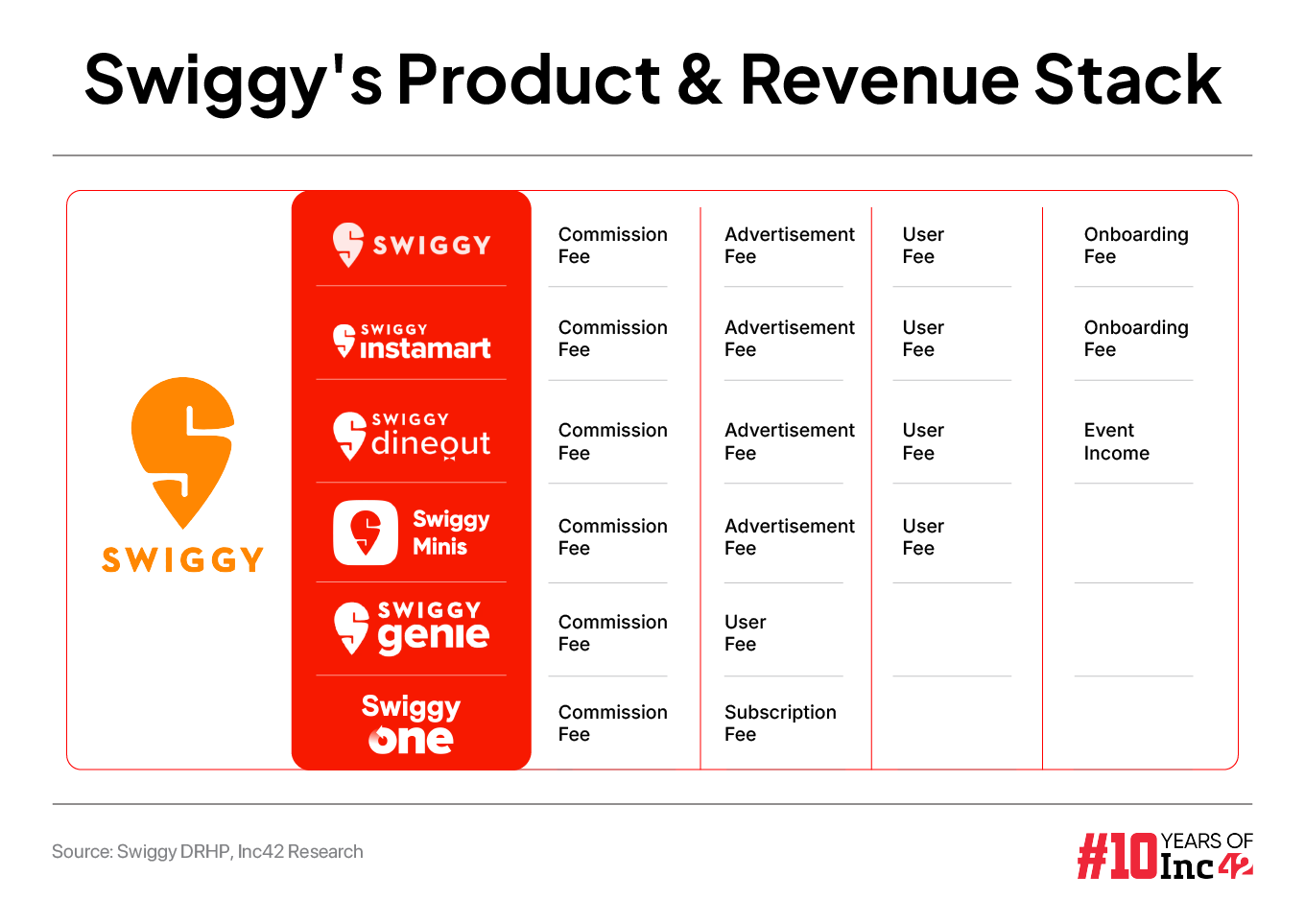

The food delivery business is the core vertical for Swiggy, but it’s also betting big on the quick commerce play which has the bigger revenue upside, as per analysts.

The food delivery business is the core vertical for Swiggy, but it’s also betting big on the quick commerce play which has the bigger revenue upside, as per analysts.

Arch rival Zomato is miles ahead in the quick commerce game — Swiggy Instamart, which competes with Blinkit on paper, but the latter’s revenue of INR 2,300 Cr last year is more than double of what Instamart reported.

So clearly, on paper, Swiggy trails the competition in many aspects. But what retail investors would be more keen on knowing is whether the difference in revenue scale also manifests itself in the unit economics.

Has Swiggy improved on its take-rates and margins such that it is in a prime position to report profitability soon after listing? Here’s a look at how this has evolved over the years.

Into Swiggy’s Core Food Delivery Biz

In FY24, Swiggy saw its food delivery business grow significantly as it continued to onboard restaurant partners and customers.

On most metrics, Swiggy’s food delivery business is growing in double-digit percentages, but the bigger question is how the startup is performing at the unit economics level.

A key metric here is the average order value, which has grown from INR 416 in FY23 to INR 428 in FY24 and INR 436 as of Q1 FY25,

Given the rise in average order value, Swiggy only had to make slight tweaks to its discounts and cost structures to improve the contribution margin. Plus, the addition of platform fees has bolstered Swiggy’s take rates.

As a result, the contribution margin for an average food delivery order has improved by almost 4X to INR 24.4 in FY24 from INR 6.4 in FY22. This is the key component in Swiggy’s push towards profits.

Inching Forward In Profitability

While the increase in AOV over the past two years, as highlighted above, has indeed helped in improving the startup’s contribution margin, there are other factors at play.

The take rate or the commission from restaurant partners has grown steadily, along with a rise in advertising fees from restaurant partners.

While Swiggy explicitly hasn’t offered the percentage of the commission fees it charges restaurant partners, it has clubbed together commission fee and advertising fees. Industry sources say Swiggy and Zomato earn between 10%-25% in commissions on each order depending on the partner and the scale at which the restaurant operates.

Even though Swiggy’s average order value increased since FY22 has never increased over 3% on a yearly basis, the commission fees and advertising revenue has steadily increased by over 7% on a yearly basis.

Reports ahead of the IPO indicate that Swiggy will now levy a commission on the gross order value for restaurants outside metro cities, which is further going to strengthen its unit economics and shore up the margins.

This is particularly important as food delivery as a revenue stream needs to shed its reliance on the metros and top Tier 1 cities for order volumes.

The improvement on the startup’s food delivery has improved the startup’s adjusted EBITDA turn positive to INR 57.8 Cr from – INR 43.1 Cr in Q1 FY23.

Some of this can be attributed to the per-order platform fee which was introduced in April-May 2023 at INR 1, but has now risen to INR 6 in Q2 FY25. Despite this, the contribution from “fee from user and other enablement services” has declined from 5.95% in FY24 to 5.32% in FY23. This stood at 5.03% in the first quarter of FY25.

It’s not yet clear whether the revenue collected from these fees includes charges other than platform fees, such as surge or rush hour fees, handling charges and other ancillary items.

Discounts Back In The Shed

The other major change for Swiggy is its steadily reducing reliance on discounts to acquire and retain customers. While on an individual order basis some users may be given bigger discounts than others depending on promotions, as a whole, Swiggy has reduced the amount it spends to fund user discounts.

Once again, as order value has increased, Swiggy has turned off its discounts pipe.

In the DRHP, Swiggy says it will reduce the net discount provided to consumers on costs such as delivery fees, since it believes consumers place a higher value on convenience than minor discounts.

Swiggy’s Quick Commerce Margins

Even as the core food delivery business has taken big strides towards profitability, Swiggy seems to have let slip on its first mover advantage in the quick commerce space.

Swiggy was the first to enter the quick commerce business in 2020, and since then, it has doubled down on Instamart, adding non-grocery category and other experiments to boost average order value.

In fact, Swiggy’s fundraise of $700 Mn in 2022 was to primarily strengthen its quick commerce infrastructure and dark store network. The startup has even earmarked INR 982.4 Cr of its IPO proceedings, the largest portion, to add to its dark store network.

The investment in quick commerce has continued unabated since then. In the last two months, Swiggy has launched its Instamart operations in 11 new cities including Rajkot, Thirussur, Trichy, Udaipur, Amritsar, among other Tier-II cities.

So why has Swiggy fallen behind Zomato’s Blinkit and even Zepto?

Ever Growing Service Fees

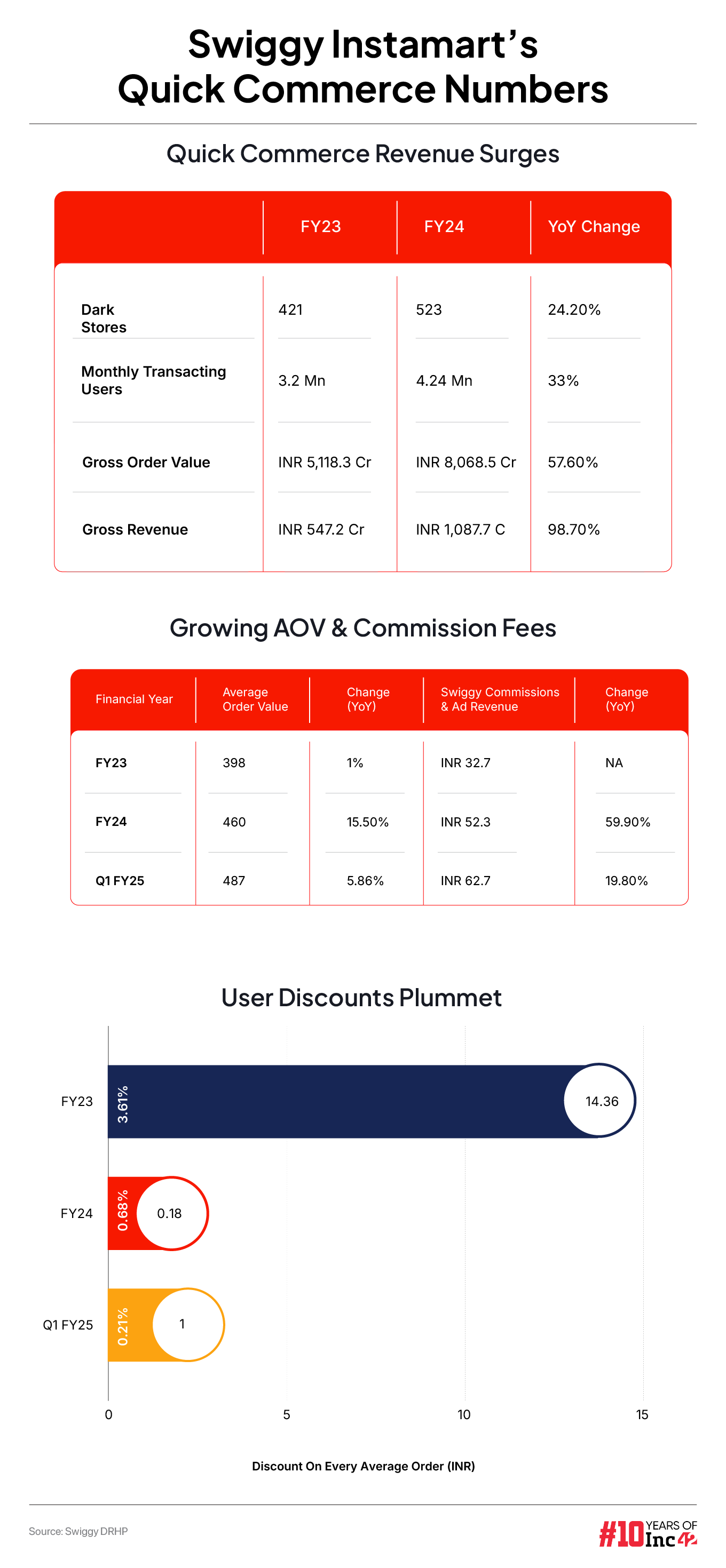

Even as the vertical’s revenue has not grown as rapidly as Blinkit or Zepto, Swiggy Instamart has significantly reduced its losses, going from losing INR 93.7 on an average order (INR 398) in FY23 to losing INR 15.4 on an average order of INR 487 in Q1 FY25.

How exactly has Swiggy turned things around for quick commerce? One key measure was pushing the accelerator on the commission and advertising fee, which has grown across the quick commerce industry as more and more brands view online shelf space.

Although Instamart’s AOV has grown over the years, the rise in commission fees has clearly outpaced the AOV increase.

Quick Commerce Deliveries Get Cheaper

Just like on the food delivery side, Swiggy has gradually reduced its reliance on discounts for quick commerce.

Further, Swiggy Instamart has also reduced the cost of delivery to improve its contribution margin. In FY23, the startup paid around 13.05% of the AOV of roughly INR 400 to delivery partners or roughly INR 52. This dropped by over 10% to INR 45.1 and the average order value shot up to INR 460. In the first quarter of FY25, the delivery cost further decreased to 9.57%, and the AOV shot up to INR 487.

Besides commission fees and delivery cost, the startup has also decreased the variable costs from 17.59% in FY23 to 8.20% in the first quarter of FY25. All these have contributed to the margins improving on the quick commerce front.

Instamart’s adjusted EBITDA improved to a negative INR 1,309 Cr in FY24 from a negative INR 2,026.7 Cr a year ago.

It will be interesting to see how this changes after the huge push during the ongoing festive season. Quick commerce competition is intensifying, and costs such as delivery fees and discounts are likely to go up during the peak sales season.

Going Out Becomes Big

Swiggy has often claimed that it entered quick commerce because it noted that convenience is a big factor for consumers when making online purchases. And that theme is strong in Swiggy’s DineOut acquisition and the subsequent push for the SteppinOut vertical.

Looking to take on Zomato’s District, SteppinOut will look at ticketing, live events and other experiences and will be combined with DineOut as a line of business for Swiggy.

Swiggy ventured into the dine-in business with the acquisition of DineOut from Times Internet in 2022. Compared to the other verticals, this business is relatively new, and the startup has been experimenting with it by adding outdoor events.

The vertical posted an operating revenue of INR 157.1 Cr, an increase of 102% from INR 77.6 Cr in FY23. The contribution margin improved to 2.45% on an AOV of INR 3,129 from 1.29% on an AOV of INR 3,344.

Swiggy’s Revenue Hunger

As is evident from the AOV, dining out and SteppinOut offer significantly higher revenue potential than food delivery or quick commerce. Swiggy is hoping to leverage its one-app strategy to cross-sell all three verticals to its engaged user base.

Zomato, on the other hand, is focussed on three separate apps for food delivery, quick commerce and dining out. While Zomato is looking at each vertical as a standalone business that has its own scaling-up and profitability maths, Swiggy is banking heavily on the vertical integration.

Sources watching the food delivery space feel that this vertical integration can unlock huge value for Swiggy, but so far, it has not yet displayed this potential.

Average order value is a key metric in the food delivery and quick commerce space. For Swiggy, it’s even more critical because of the vertical integration it is going for.

But to Swiggy’s credit, it’s not just looking at adding to the order value, but unlocking new use cases for its users.

One example is the launch of Swiggy Bolt, a feature under the food delivery vertical, where the company is looking to deliver food items in just as much time as an Instamart order. Swiggy Bolt neatly ties into Swiggy Cafe, which is an Instamart feature.

This kind of vertical integration means Swiggy can benefit from operational efficiencies in both food delivery and quick commerce. A similar approach is likely to be seen on Dineout, where restaurant partnerships will likely be extended to SteppinOut and live events.

And at the end of the day, brands and restaurants will not only benefit from Swiggy’s distribution but also its ability to drive sales for events and other activities through the SteppinOut vertical.

But pulling this off will require some serious intent on Swiggy’s part. CEO and cofounder Sriharsha Majety will have his work cut out, but the company is bullish about the public markets

In fact, Swiggy has revised its IPO size from the originally planned $1.25 Bn to $1.4 Bn. This means Swiggy’s IPO will be the fourth largest on Indian stock exchanges and only second to Paytm among new-age companies.

There’s little doubt that Zomato has stolen the limelight when it comes to quick commerce and food delivery in the past year, thanks to the meteoric rise of its share price.

Many analysts and observers say that Swiggy’s leadership has not come out in the public limelight as much as Zomato and that needs to change. But from a fundamentals point of view, Swiggy is on an upward trajectory.

The biggest unknown was the profitability and meeting Zomato’s timeline in reaching there. By most indications, it’s not far off and the past year has seen an overhaul on the revenue front, which is starting to pay off for Swiggy.

Edited By Nikhil Subramaniam

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)