Saroja Yeramilli-led D2C jewellery brand Melorra

Publicly listed jewellery giant SENCO Gold is reportedly in the last leg of due diligence before acquiring Melorra in a fire sale for INR 50 Cr.

That’s an unfathomable 94% fall from $120 Mn or INR 1,000 Cr, the valuation at which Melorra raised its last round in mid-2022.

And it’s not like the jewellery segment is going through a slowdown.

Melorra’s rivals are clearly on a different track. Premji Invest-backed GIVA recently raised INR 255 Cr; Gaurav Singh Kushwaha-led BlueStone is close to an IPO and has raised INR 1,000 Cr this year alone, while CaratLane’s acquisition by Tata-owned Titan was one of the biggest acquisition stories in the startup ecosystem.

But Melorra seems to have missed the bus. As one investor in the startup told us, “Jewellery is all about retail space and Melorra was quite late to the party.”

Since the end of 2023, Melorra has been in the news for layoffs, delayed salaries and a cash crunch. According to Inc42 sources, the startup is yet to clear the full and final settlement of several employees and has also shut down the majority of its stores. Plus, social media is flooded with customers frustrated over unpaid refunds and poor service experience.

Melorra founder Yeramilli declined to respond to Inc42’s questions about the state of the company.

So what exactly went wrong for the brand which once claimed to be building Zara for the jewellery industry in India?

How Melorra Grabbed The Limelight

Founded in 2015 by former Titan executive Yeramailli, Melorra quickly rose to prominence with its pitch of lightweight jewellery for daily usage.

Yeramilli’s vision was to make a fast jewellery brand that introduces new designs every week, and this was an attractive proposition in the nascent D2C space. In fact, Melorra’s model was embraced by several venture capital firms, and the startup raised $5 Mn in its seed round led by Lightbox in 2016.

To put things in context, such seed rounds were rare for the time, so Melorra had already grabbed the attention of the startup ecosystem. This capital helped Melorra gain brand recognition and establish its ecommerce presence.

The first four years for Melorra were all about creating a D2C brand. At the time, Melorra was designing lightweight jewellery using a proprietary platform and was entirely reliant on its online store, and Android and iOS applications for sales.

It must be noted that D2C brands had high customer acquisition and logistics fulfilment costs at this point in time, but Melorra was bullish about its asset-light model, whereas most other jewellery brands at the time had brick-and-mortar outlets to reach consumers.

For instance, according to Yeramilli, Melorra had seen 400% year-on-year (YoY) growth in FY19, soon before its next big round. This came in the form of a $12 Mn infusion from new and existing investors.

From 2019 to 2022, Melorra was a regular fixture on the yearly D2C funding charts, raising a total of $72 Mn in those three years. It was during this funding spree that Melorra also decided to join the omnichannel wave and launch physical stores.

Late To The Offline Party

Speaking to Inc42, many in the industry believe that Melorra missed a beat by not going for this model earlier in time. Those who track the jewellery space believe that despite Melorra’s asset-light pitch, jewellery has always been considered an asset in India, and is seen as an investment, regardless of whether it’s lightweight jewellery or more intricate designs.

One founder in the jewellery space believes that Melorra missed a beat by not offering the “touch and feel” experience to consumers before 2021, when it jumped into offline retail. “When it comes to jewellery, consumers prefer visiting the store, trying on products and then making the decision to buy,” the founder added.

Unlike online stores, consumers may spend more than an hour browsing through a store, which is significantly more than the time one would spend on an app or website.

Take GIVA, for instance, which was launched in 2019 and set up its first exclusive brand experience store in 2022. Another example in the early stage ecosystem is Bengaluru-based Aukera Jewellery, which focuses on lab-grown diamonds. It was founded in early 2023 and launched its first retail store the same year.

Even in the case of Bluestone, the company began operations in 2011 and ventured into offline touchpoints within two years of launch.

For Melorra, the reliance on online sales meant that the company was spending considerably on customer acquisition, brand marketing, influencer collaboration and other online marketing tools. While these may help brands create some buzz online, the real deal in jewellery is offline.

It was only in December 2020, that Melorra set up its first offline retail store in Bengaluru and within three years, the store count rose to 32, covering Delhi NCR, Mumbai, Lucknow, Bhopal, among other cities. The majority of these stores were opened in late 2022 and 2023, said another source close to the company.

Melorra’s Model Sours

With these stores, Melorra had to bid adieu to its asset-light model. Now, the startup had to manufacture products up front to showcase them in its stores. Plus, offline stores meant that the startup didn’t have the luxury to design, make and deliver orders later — products had to be ready to be sold through the stores.

“In the gold industry, a brand has to pay up front to the gold supplier to source the raw materials. This means that the company is technically losing money till the time it is able to sell the item,” one person who has tracked Melorra closely told Inc42.

lockquote>

So in addition to its digital marketing costs, Melorra was now spending significantly more in building its inventory.

Procurement costs aside, it had a high capex for setting up and running these stores which were located in malls and high street locations. Even with the omnichannel approach, Melorra couldn’t afford to turn off the marketing faucet. It onboarded Bollywood actor Shraddha Kapoor as the brand ambassador, for instance.

In FY22, the startup spent INR 120 Cr on advertising in FY22, a 175% jump from INR 43.7 Cr in the previous year. Further, it spent INR 30 Cr on employee costs in the year, 50% higher than FY21. Melorra was ultra-bullish on its omnichannel model succeeding.

Revenue had reached INR 350 Cr by FY22, but it’s not clear where the startup went after that, since we don’t have the audited financials for the past two fiscal years.

What we know is that the startup was in dire need of funding. As per sources, Melorra was on the verge of closing a $10 Mn round at a valuation of $300 Mn in late 2023, after downsizing, but the round never materialised.

Faced with a cash crunch, sources claimed that Melorra wound down up to 12 stores across the country, resulting in several customers complaining about unfulfilled orders and refunds.

Competition in the jewellery space is cut-throat. Most companies look to stretch margins through cost optimisation and demand mapping.

Melorra failed on both these counts as it expanded. The cash crunch could not have come at a worse time for the startup.

By 2022, investors had become much more cautious about backing startups looking for growth capital to scale up.

Established players with deep pockets had the edge when it comes to brand recognition and trust. Melorra’s brand building over the years was heavily reliant on VC money, but without cost efficiency, the startup had nowhere to go.

Legacy brands such as SENCO, PC Jeweller, Kalyan Jewellers, Joyalukkas and Tanishq were also encroaching into Melorra’s territory and had the operational bandwidth — not to mention cash balances — to cater to the rising demand for lightweight jewellery.

Suddenly, Melorra found itself a small fish in a big pond.

Rivals Outshine Melorra

As per industry experts, one of the reasons why Melorra failed to scale was its inability to scale even online, which other brands cracked.

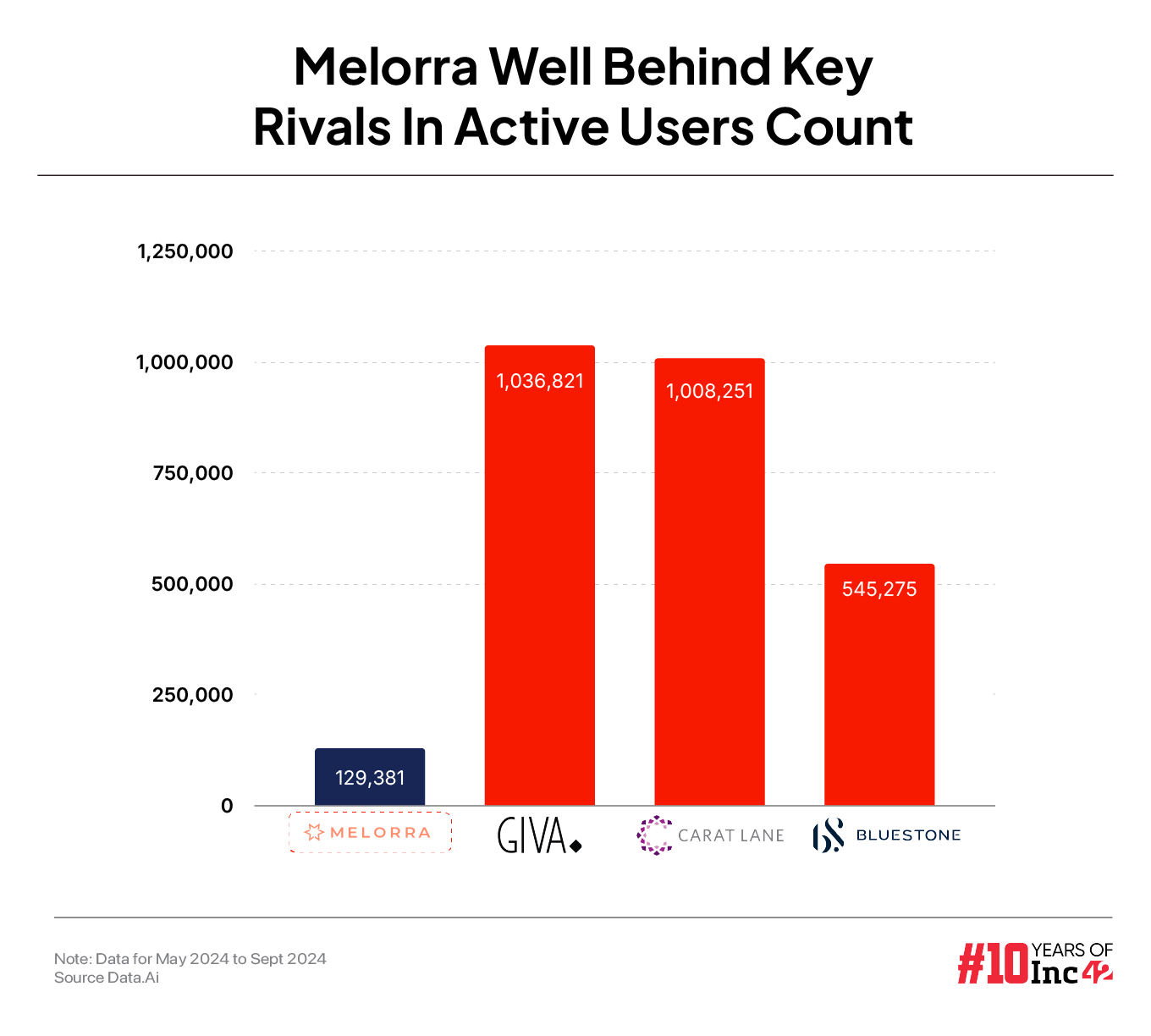

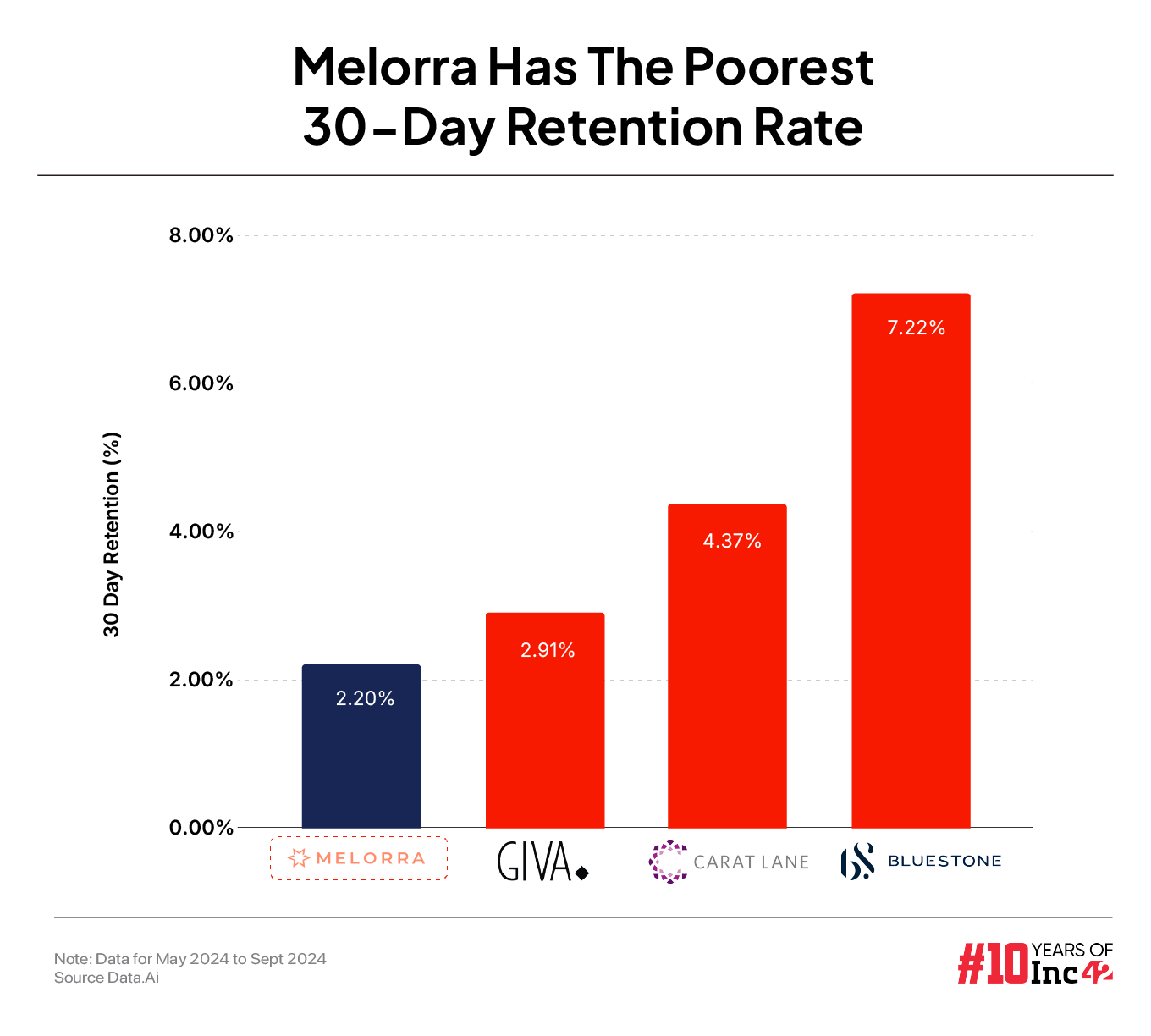

According to data from Data.ai, Melorra has seen its active user base dwindle in comparison to the competition. Over the last five months, its average monthly active user base was just 129K, compared to BlueStone’s 545.2K.

Besides this, even if we talk about user retention rate, Melorra had the lowest numbers among new-age competition. With just 27K downloads in the last five months, Melorra had slipped far behind newer players such as GIVA.

Ahead of the distress sale, Melorra had to sacrifice some parts of its operations as well, and failed to retain key leaders. For instance, while Melorra’s Android app is functional, the iOS app has been removed from the Apple App Store.

Further, chief technology product officer Nirdosh Chouhan, a former Apple and OYO executive, quit the startup in February 2024 to join athleisure brand Agilitas.

At the time, founder Yeramili said Chouhan’s “international exposure in implementing Apple’s world-class omnichannel consumer experience is going to prove beneficial in offering a best-in-class global shopping experience to our customers – online or offline.”

However, Chouhan quit in less than two years coinciding with the cash troubles for Melorra, and since his departure, the CTO post has remained vacant, as far as we can tell from the website.

The Curse Of The First Mover

Despite entering the D2C jewellery space well before the term D2C was even popularised, Melorra let its early-mover advantage slip.

The biggest fault in the Melorra model was its failure to gauge consumer sentiment in the jewellery space. The late omnichannel entry and stiff competition meant the company could not create a niche for itself.

As of October 2024, the startup has to pay financial lenders including Oxyzo, Incred, Northern Arc, among others a tune of INR 100.5 Cr, according to charges seen on Tofler.com.

Ironically, this is almost twice the amount that Melorra is likely to get for acquisition. While debt investors will likely be able to recover some of the funds invested in the company, the equity investors are unlikely to make any money in the acquisition.

Melorra’s example shows that being early is only an advantage as long as startups evolve and move in line with market trends. Rivals — even those that were launched years after — caught up to the company and accelerated past the lead that Melorra had accumulated .

And as it often happens in such cases, instead of a gold medal, Melorra is now taking home the wooden spoon.

Edited By Nikhil Subramaniam

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)