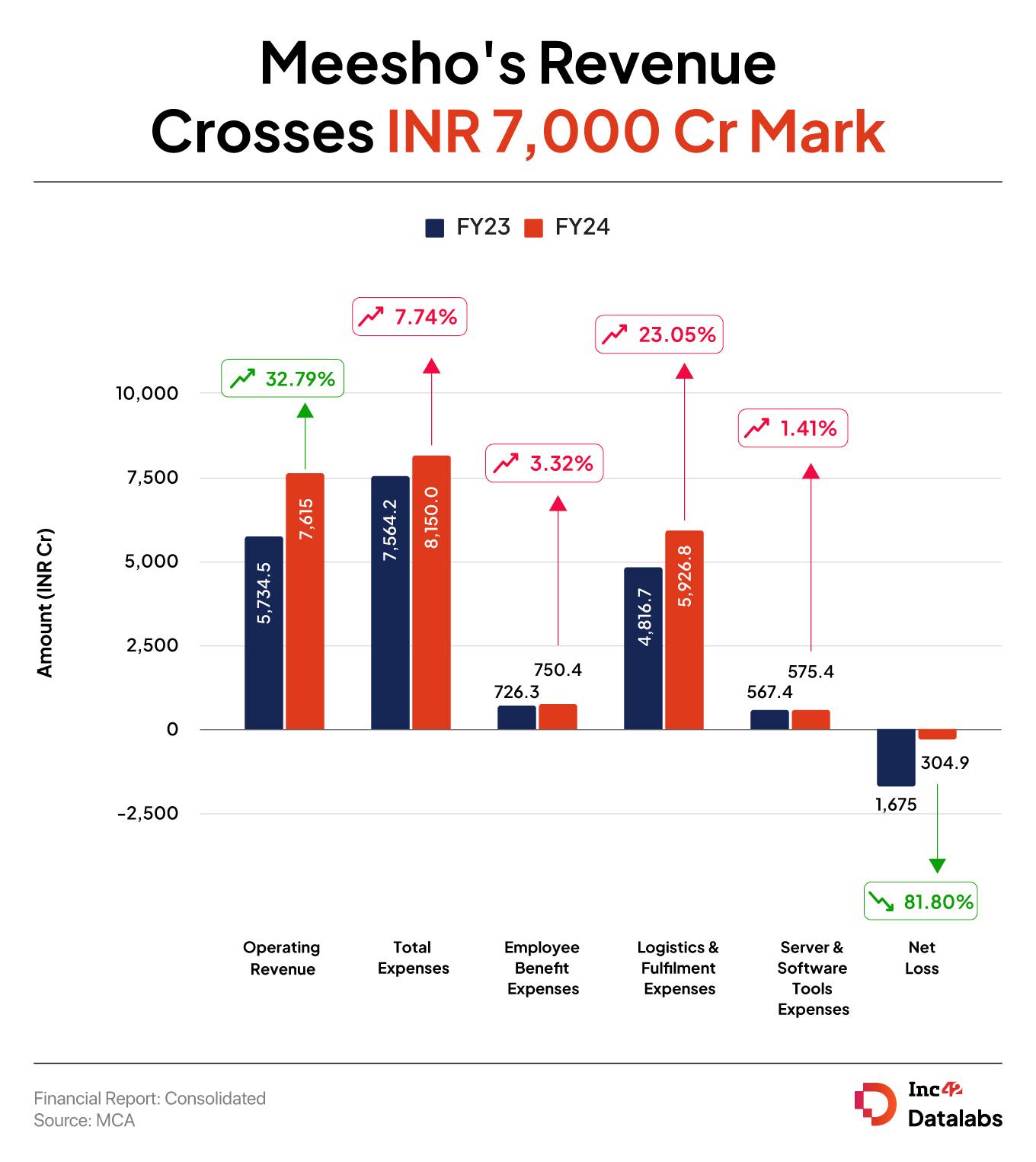

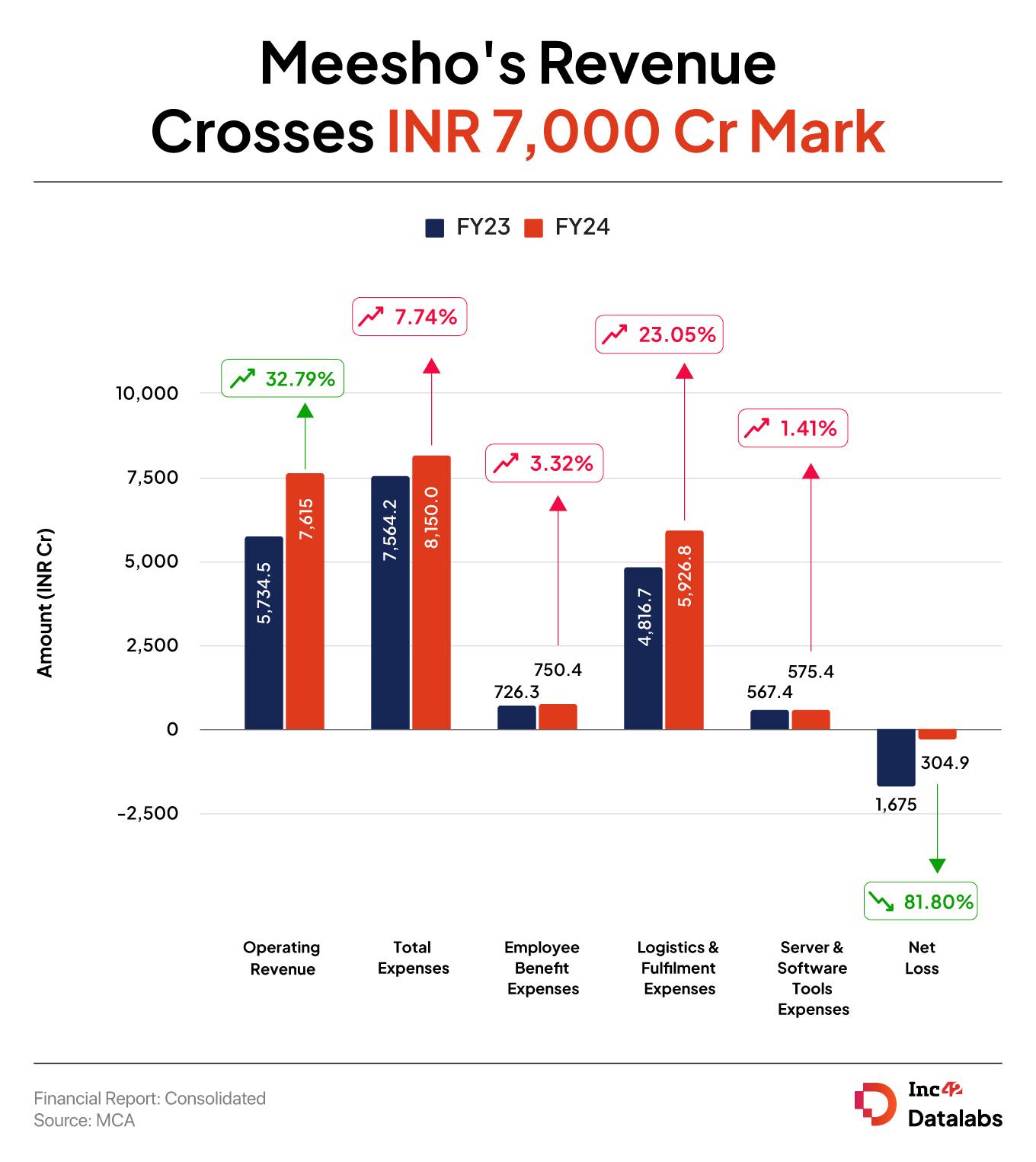

Meesho saw an improvement in its margins during the year under review, with the growth in revenue outpacing the increase in total expenditure

While operating revenue zoomed 32.8% YoY to INR 7,614.9 Cr in FY24, total expenditure rose 7.8% to INR 8,150 Cr

Earlier, Meesho said that it narrowed its adjusted net loss, excluding ESOP costs, by 96.6% to INR 53 Cr in FY24 from INR 1,569 Cr in the previous year

Ecommerce major Meesho

Last month, the company claimed that it narrowed its adjusted net loss, excluding ESOP costs, by 96.6% to INR 53 Cr in FY24 from INR 1,569 Cr in the previous year.

One of the reasons for the improvement in Meesho’s bottom line was a strong growth in revenue. Its operating revenue zoomed 32.8% to INR 7,614.9 Cr during the year under review from INR 5,734.5 Cr in FY23.

Including other income of INR 230 Cr, total revenue rose 33.2% to INR 7,845.1 Cr from INR 5,889.2 Cr in FY23.

Founded in 2015 by Vidit Aatrey and Sanjeev Barnwal, Meesho started as a social ecommerce startup. However in 2022, the company pivoted to a marketplace model to compete with giants like Flipkart and Amazon.

While Flipkart and Amazon are more popular in the metropolitan areas and suburbs, Meesho has Tier II & III cities as its moat. The company gets more than 80% of its revenue from these cities.

Meesho is one of the few companies which does not charge commission fees on its platform. It relies on advertising and marketing income from sellers.

The startup claims to have over 15 Lakh sellers on its platform from across India and more than 140 Mn annual transacting users. So far, it has raised over $1.08 Bn.

Earlier this year, the company was mulling to raise about $600 Mn – out of which it closed about $275 Mn via a mix of primary and secondary share sales.

Zooming Into Expenses

Meesho managed to control its expenses during the year under review, with the rise in revenue outpacing the increase in expenditure. Its total expenses rose 7.8% to INR 8,150 Cr in FY24 from INR 7,564.2 Cr in the previous fiscal year.

Employee Expenses: Employee costs rose 3.32% to INR 750.4 Cr from INR 726.3 Cr in the previous year.

Logistics & Fulfilment Expense: Being an ecommerce marketplace, logistics and fulfilment was the biggest expense for Meesho. It spent INR 5,926.8 Cr under the head in FY24, up 23.5% from INR 4,816.7 Cr in the previous year.

Advertising & Sales Promotion: Meesho halved its advertising and sales promotion expenses in FY24. It spent INR 459.2 Cr under the head, down 50.51% from INR 927.8 Cr in the previous year.

Communication Expenses: The company reduced its communication expenses by 7.11% to INR 207.7 Cr from INR 223.6 Cr in FY23.

Server & Software Tools Expenses: The server and software expenses for the company remained almost stagnant at INR 575.4 Cr in FY24 as against INR 567.4 Cr in the previous fiscal year.