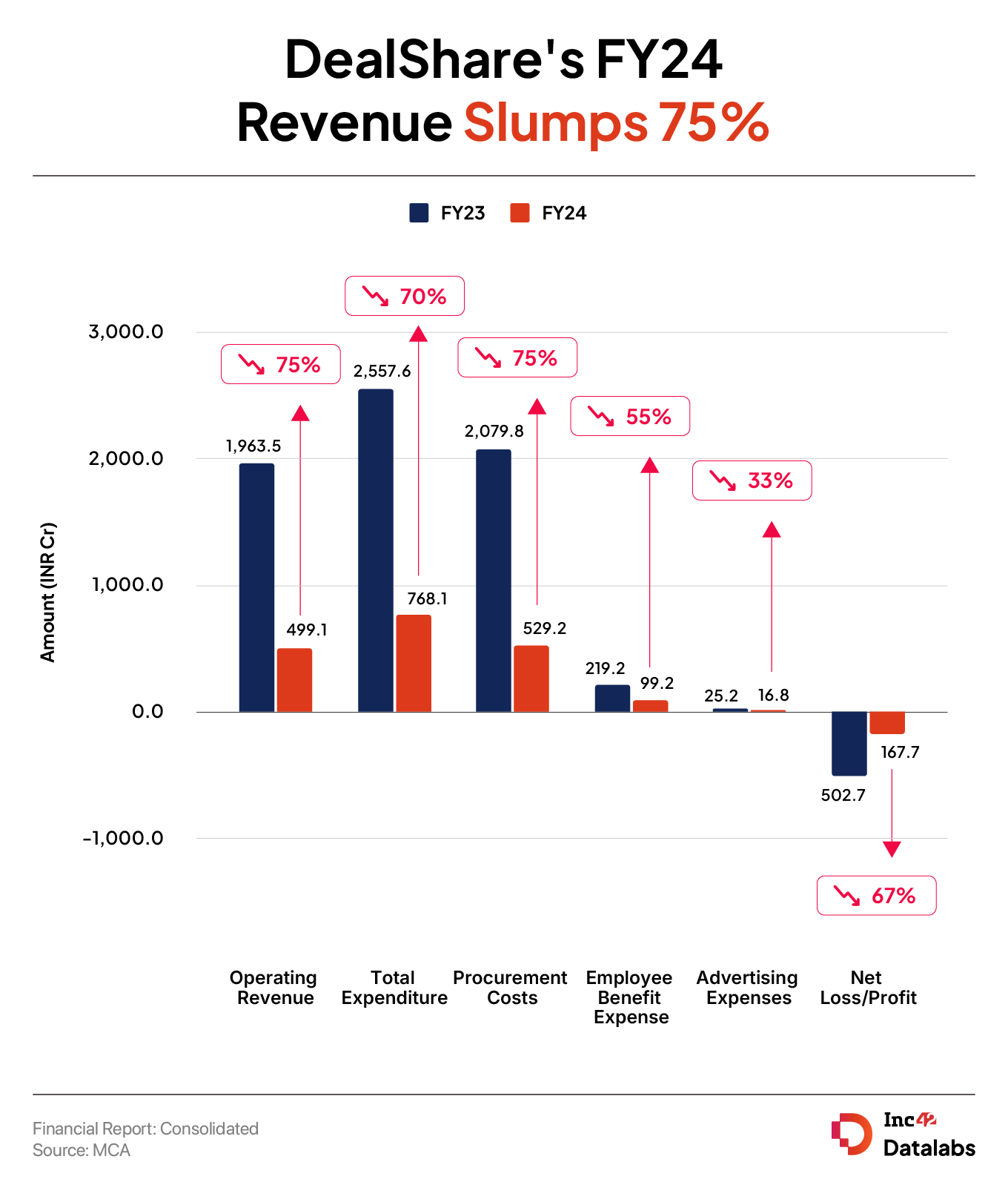

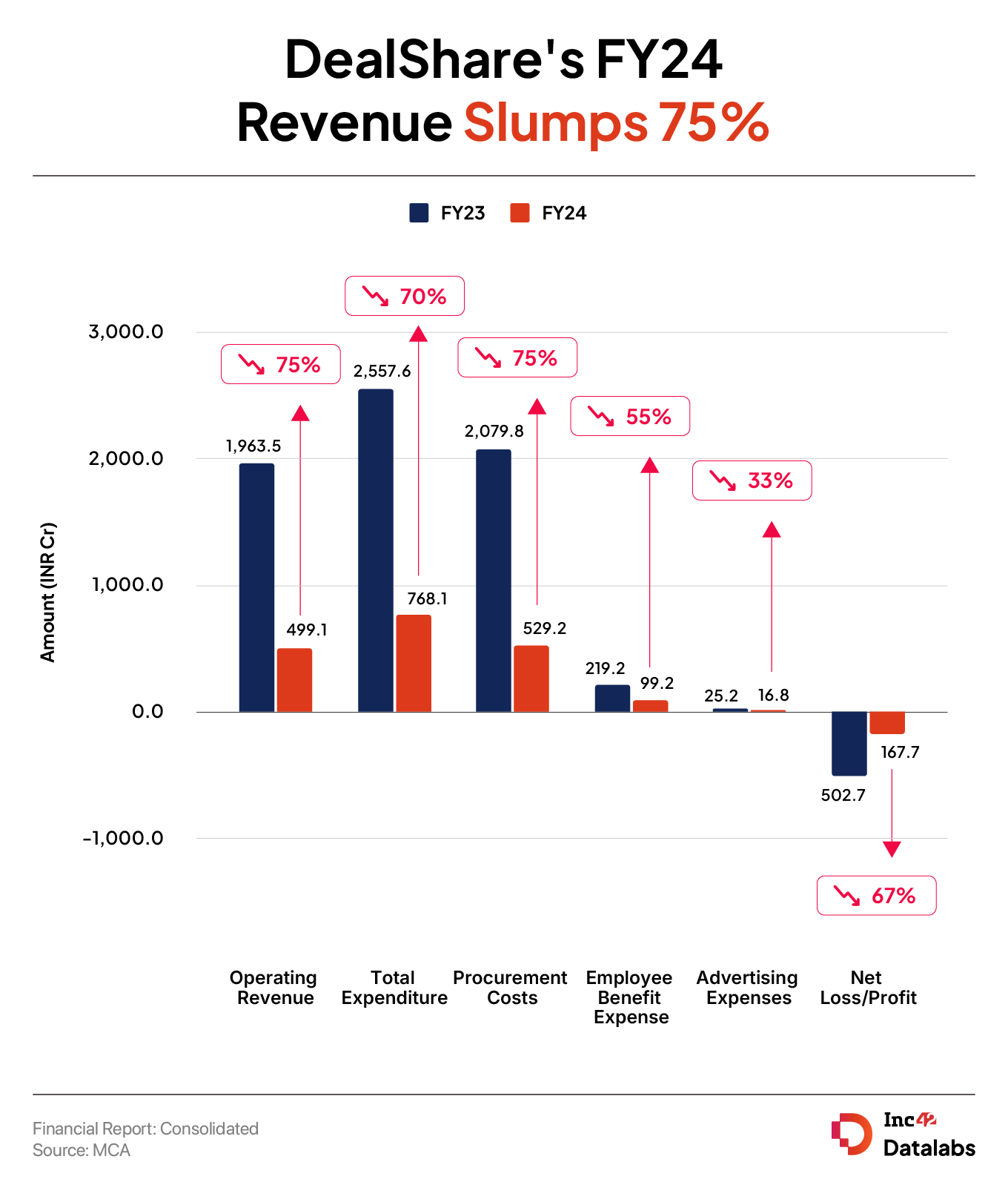

The Delhi NCR-headquartered startup reported an operating revenue of INR 499 Cr, a steep drop from INR 1,963.5 Cr in the previous fiscal year

In line with the fall in revenue, DealShare managed to lower its net loss during the year. Loss narrowed 67% to INR 167.7 Cr from INR 503 Cr in the previous fiscal year

DealShare cut its expenditure by 70% to INR 768.1 Cr in FY24 from INR 2,557.6 Cr in the previous fiscal year

Alpha Wave -backed ecommerce startup DealShare’s revenue slumped nearly 75% in the financial year ended March 31, 2024. The Delhi NCR-headquartered startup reported an operating revenue of INR 499 Cr, a steep drop from INR 1,963.5 Cr in the previous fiscal year.

Founded in September 2018 by Sourjyendu Medda, Vineet Rao, Sankar Bora, and Rajat Shikhar, DealShare

The sharp decline in its revenue was primarily due to the startup winding down its B2B operations in September last year to focus on its B2C operations. DealShare used to earn almost half of its revenue from its wholesale operations.

Besides this, the startup also scaled back its operations in several states across the country.

Including other income, DealShare’s total revenue fell 71% to INR 600.4 Cr from INR 2,054.9 Cr in FY23.

In line with the fall in revenue, DealShare managed to lower its net loss during the year. Loss narrowed 67% to INR 167.7 Cr from INR 503 Cr in the previous fiscal year.

Where Did DealShare Spend?

In a bid to improve its bottom line, DealShare cut its expenditure by 70% to INR 768.1 Cr in FY24 from INR 2,557.6 Cr in the previous fiscal year.

Procurement Cost: DealShares’ procurement cost dropped 75% to INR 529 Cr from INR 2,080 Cr in FY23, reflecting the smaller scale of the business.

Employee Benefit Expenditure: Employee costs fell 55% to INR 99 Cr from INR 219 Cr in FY23. The drop in employee cost could be attributed to the two rounds of layoffs undertaken by the startup during the year, which impacted more than 200 employees.

Advertising Expenditure: The spending under this head narrowed to INR 16.8 Cr from INR 25.2 Cr in FY23.

Despite the steep decrease in expenditure, DealShare’s cash and cash equivalents stood at INR 10.8 Cr at the end of FY24 as against INR 107.5 Cr a year ago.

DealShare’s Troubles

Riding on the popularity of social commerce, DealShare raised a total funding of $300 Mn from the likes of Tiger Global, Dragoneer Investments, Unilever Ventures, among others, and also turned into a unicorn. However, it struggled to make profits.

The problems at DealShare came to light early last year when it fired over over 100 employees, or around 6% of its workforce of 1,500, in a bid to reduce its monthly burn rate and turn profitable.

Later in July 2023, its cofounder Vineet Rao stepped down and DealShare shifted its headquarters to Delhi NCR from Bengaluru.

Amid all these, DealShare’s investors decided to take control of the operations, which resulted in cofounders Sankar Bora and Sourjyendu Medda quitting the startup.

Earlier this year, DealShare’s board appointed Kamaldeep Singh as the CEO of the company. Singh, who was earlier the chief executive of Big Bazaar, joined DealShare as a president at the end of last year. His appointment as the CEO by the board was a clear indication that the investors wanted DealShare to move towards offline space. Earlier this year, the startup opened its flagship store in Jaipur.

DealShare currently competes with the likes of Meesho, Amazon, Flipkart, among others.