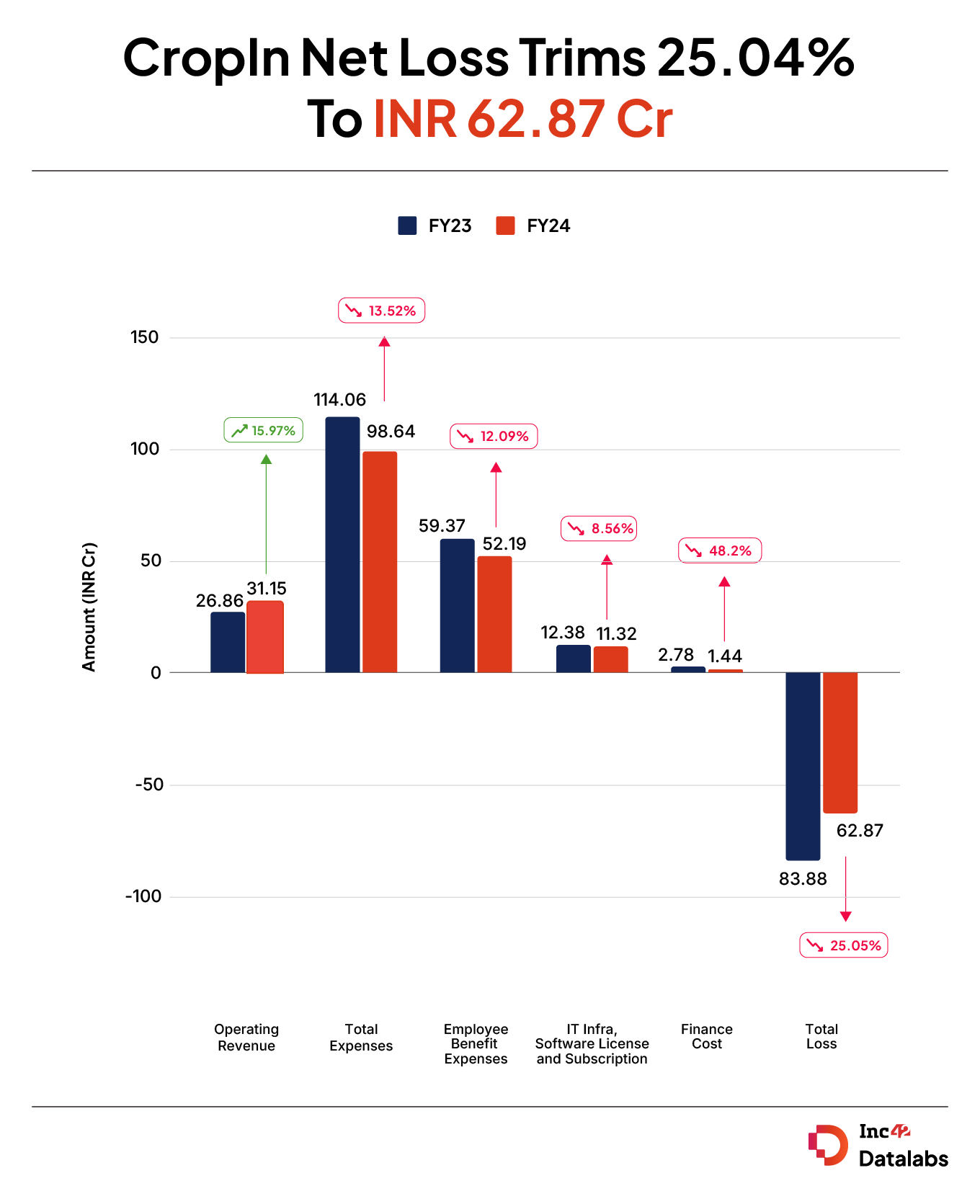

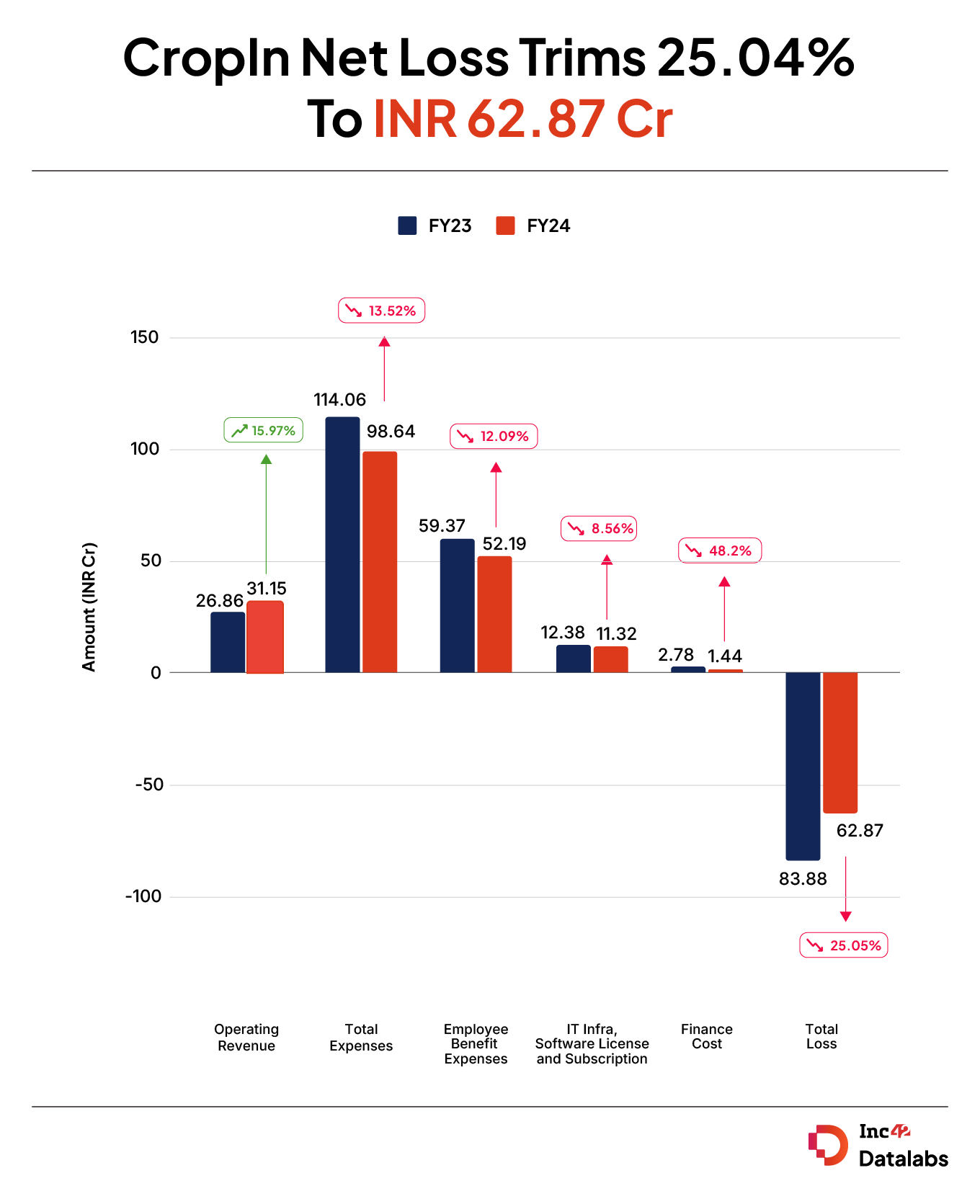

Its operational revenue increased by 15.9% to INR 31.15 Cr for the period under review, from 26.86 Cr in FY23

The company reported a total income of INR 35.76 Cr in FY24, up 18.48% from INR 30.18 Cr reported in the previous fiscal year

CropIn saw its total expenses narrow down 13.51% to INR 98.64 Cr in FY24 from INR 114.06 Cr reported in the year-ago period

Bengaluru-based agritech startup CropIn

The reduction in net loss came despite its operational revenue swelling 15.99% to INR 31.15 Cr for the period under review from INR 26.86 Cr in FY23.

The company reported a total income of INR 35.76 Cr in FY24, up 18.48% from INR 30.18 Cr reported in the previous fiscal year.

Notably, operational revenue contributed 87.10% to the total income in FY24, while the other income was INR 4.60 Cr.

Founded in 2010 by Krishna Kumar and Kunal Prasad, CropIn is a SaaS-based agritech startup which helps farm-to-fork businesses digitise their operations and make informed decisions that enhance farming efficiency, productivity and sustainability.

It claims to have partnered with more than 250 B2B customers, digitised 30 Mn acres of farmlands, benefitting over 7 Mn farmers worldwide.

In July, the company inked a partnership with Google Gemini to roll out a real-time GenAI-powered agri intelligence platform to help customers manage farms globally by predicting yields, disease and other key insights.

Meanwhile, in April, the company launched ‘aksara,’ an open-source micro language model aimed at supporting climate-smart agriculture.

CropIn has raised $44.08 Mn in total funding to date. It competes against the likes of DeHaat, AgroStar and BharatAgri, among others.

Where did Cropin spend:

CropIn saw its total expenses narrow down 13.51% to INR 98.64 Cr in FY24 from INR 114.06 Cr reported in the year-ago period.

Employee Benefits Expenses: The company trimmed its employee benefit expenses to INR 52.19 Cr in FY24, a 12.09% decline from INR 59.37 Cr in the previous fiscal year.

IT Infra, Software License and Subscription: The IT Infra, Software License and Subscription expenses for the given year also declined 8.56% to INR 11.32 Cr from INR 12.38 Cr in FY23.

Finance Cost: The company spent a total of INR 1.44 Cr in FY24, an 8.20% reduction from INR 2.78 Cr spent last year.

Depreciation and Amortization Cost: The depreciation and amortization bucket for the company also witnessed a stark reduction to INR 62.55 Lakh in FY24 from INR 1,03 reported in the previous fiscal year.