The pandemic changed office spaces forever, but the remote work frenzy is slowly subsiding, and coworking spaces in India have made the most of this transition.

Many large companies are moving back to the office now. For instance, Zerodha moved to hybrid working in 2023. The company’s CTO Kailash Nadh said remote working was great for the first year, but lost its appeal soon after.

“It worked out great in the first year, started losing its sheen in the second year, and became detrimental to creativity and collaboration by the third year. The hard lesson we learnt is that effective, long term remote work requires specific skill sets and DNA to pull off,” he said.

Though the transition might have been easy for some, others continue to battle dilemmas to get back to work. According to reports, companies are now seeking help from legal firms to create clear contracts on remote working.

Two distinct phenomena are currently afoot. Firstly, the costs of office spaces have exceeded even the pre-pandemic levels. And secondly, the number of new-age companies needing office spaces went through the roof.

According to a report by Colliers, average rental costs in six major office markets (Delhi, Chennai, Mumbai, Bengaluru, Hyderabad and Pune) has surpassed the pre-pandemic levels. For instance, office space rental charges per square feet in Bengaluru have increased from INR 94.5 in 2019 to INR 96.7 in 2024.

This gap in supply and demand was exactly what Indian coworking startups craved for.

CBRE’s India Office Occupier Survey found that flexible space providers have captured more than 15% of the total office leasing market shares. Nearly half of the surveyed companies designated 10% of their total office space as flexible, and this number is set to grow to close to 60% in the next couple of years.

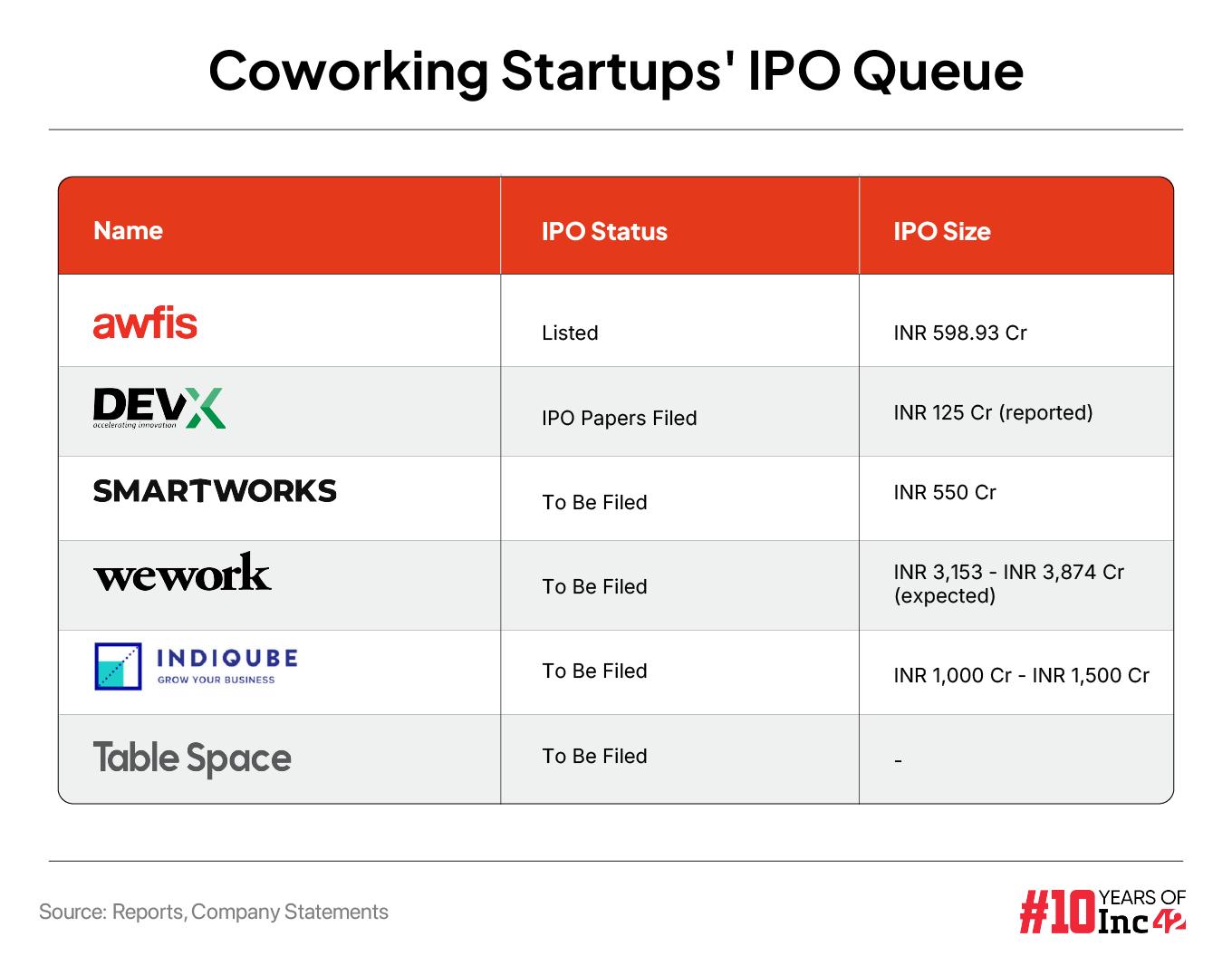

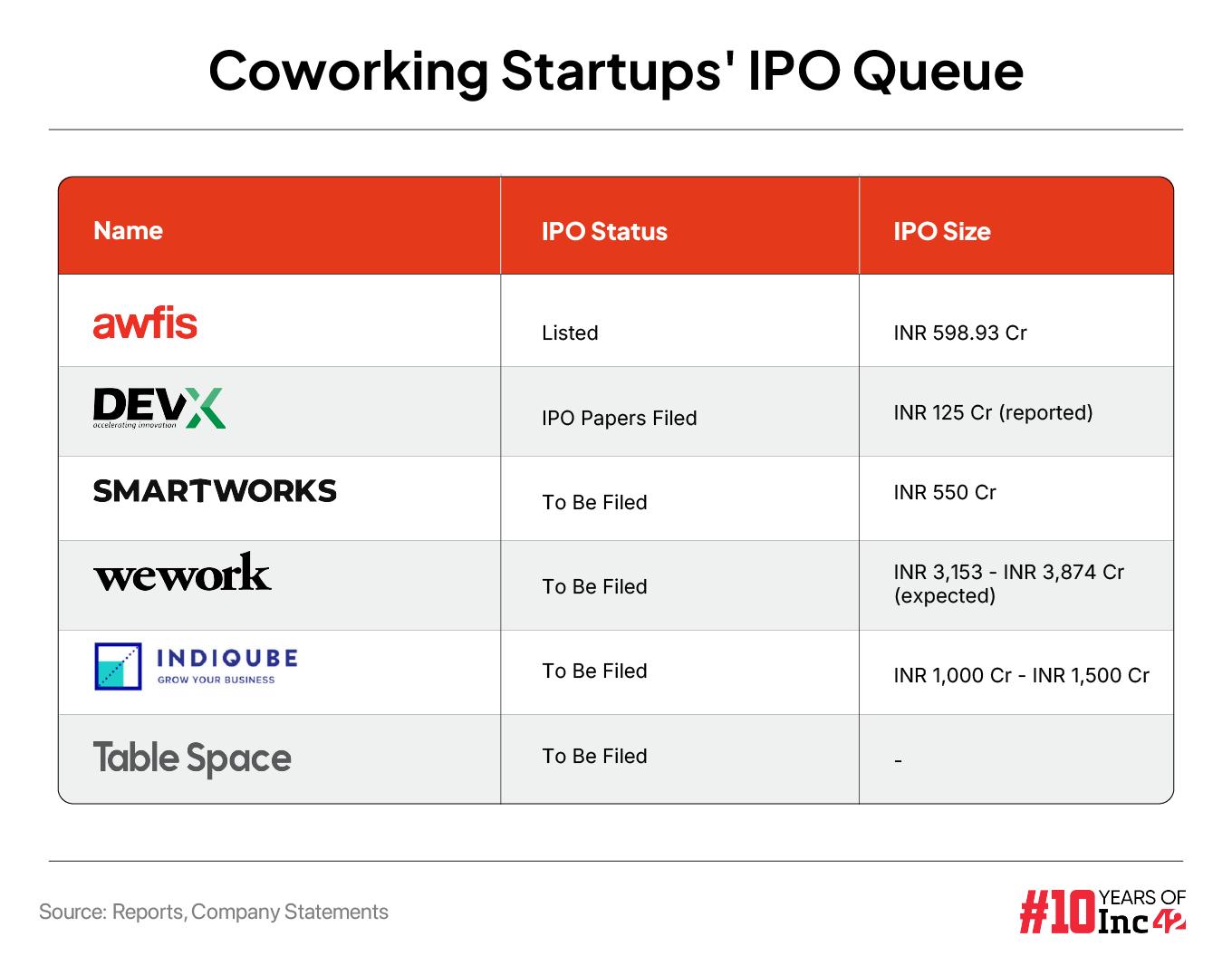

This boom has brought coworking spaces to the limelight, with Awfis listing publicly earlier this year, and the likes of Smartworks, DevX, Indiqube, set to join public markets soon.

It has also resulted in growing traction for those currently not looking to go public — the likes of Innov8, 91springboard, Spring House, Incuspaze and COWRKS.

Awfis founder and managing director Amit Ramani says the return to office has played a role, but it’s not the only engine driving adoption.

“The primary catalysts have been the rising demand fueled by the evolving modern workforce, the expansion of Global Capability Centers (GCCs) in India, a thriving tech and startup ecosystem, and a booming economy bolstered by strong reforms,” Ramani says

The Coworking Startup IPO Queue

Mumbai-based Awfis made headlines earlier this year with a bumper listing. After seeing its IPO getting oversubscribed over 108X, Awfis got listed at INR 432.25 on the BSE on May 30. Since listing, the startup’s share prices have increased over 60%.

Ramani believes that the listing’s success enforces the position as the top player in the segment.

Now, two other startups have recently filed their IPO papers. The latest to file for an IPO was Ahmedabad based startup DevX, which is looking to use the funds to enhance its brand appeal among its existing and potential customers, and expand its presence.

Gurugram-based Smartworks is also lining up for an IPO, and also intends to fuel its expansion from the capital raised in the public offering.

Besides this, as Inc42 exclusively reported in September, Bengaluru-based Indiqube is also looking to file its IPO papers before the end of the ongoing calendar year.

And more recently, reports indicated that WeWork’s India arm is also eyeing an IPO to raise between INR 3,153 – INR 3,874 Cr in the first half of 2025.

Adding on to the list is Table Space, which will also go public next year at a valuation of $2.5 Bn. Earlier in October, TechCrunch reported that the Bengaluru based startup has hired Axis as the bookrunner for the public offer.

Brijesh Damodaran, managing partner at Auxano Capital, an investor in The Office Pass, says that this IPO growth spurt opens up a lucrative opportunity for early investors securing comfortable, profitable exits.

He is of the opinion that as India Inc sees more new age companies seeking office spaces to accommodate their returning workforces, the market situation creates favourable conditions for investors and real estate signalling a recovering or growing market in commercial real estate.

“Early investors are looking for opportunities to realise their profits, or “exit,” from their investments, especially as the demand for office space increases with employees gradually returning to the workplace. There is potential for significant returns on investment in the current market,” he tells Inc42.

Where Are Coworking Startups Heading Next?

The underlying motivation for all the aforementioned prospective IPOs seems to lie in fuelling expansion plans. A report by Avendus Capital from earlier this year projects the flexible workspace sector to grow (as per land covered) to 126 Mn square feet by 2028, at a CAGR of 15%.

Bengaluru, which reigns over India’s startup scene, remains the largest market for commercial offices and flexible workspaces. The city accounts for nearly 31% of the flexible workspace inventory in Tier I cities.

For Awfis, the post-IPO timeline has seen it double down on its presence in the Bengaluru region. On August 21, the company announced the launch of two new centres in the city that offer 39,000 sq. ft. and 27,846 sq. ft. coworking space respectively.

However, the company has been more bullish on its expansion plans in non-metro cities. After partnering with Nyati group for an additional 3 Lakh sq ft of Grade-A workspace in Pune, the company unveiled a new centre in Gujarat International Finance Tec-City (GIFT City), Gandhinagar, in September.

The coworking company’s CEO Ramani believes that Tier-II and Tier-III cities are the next destinations for coworking space providers. This is also evident in Smartworks plans of expansion, which will see it expand its presence in Pune, GIFT City, Ahmedabad, Vadodara, Rajkot, Surat, Goa, Jaipur, besides the metro cities.

“India’s commercial real estate market is undergoing a significant transformation, with Tier 2 and Tier 3 cities becoming increasingly attractive to businesses-domestic and global. Flexible workspace providers are poised to capitalise on this growth,” Ramani adds.

As highlighted in Inc42’s “Indian Tech Startup Funding Report H1 2024“, investors are of the opinion that Pune, Hyderabad and Chennai will emerge as the next startup hotspots in the world’s third-largest startup ecosystem.

With growing demand for office spaces in the aforementioned cities, we can expect to see coworking space startups focus on expanding their presence in these regions moving forward.