As Indian space research touches new heights, driven by the direct collaborations between the government and the private sector, the Indian Space Promotion and Authorisation Centre (IN-SPACe) has emerged as a key player in enabling public-private partnerships.

Established in 2022, the nodal agency serves as the regulatory watchdog and a “matchmaker” between the government and spacetech startups.

IN-SPACe has played an important role in influencing the Centre to set up an INR 1,000 Cr VC fund for the spacetech sector.

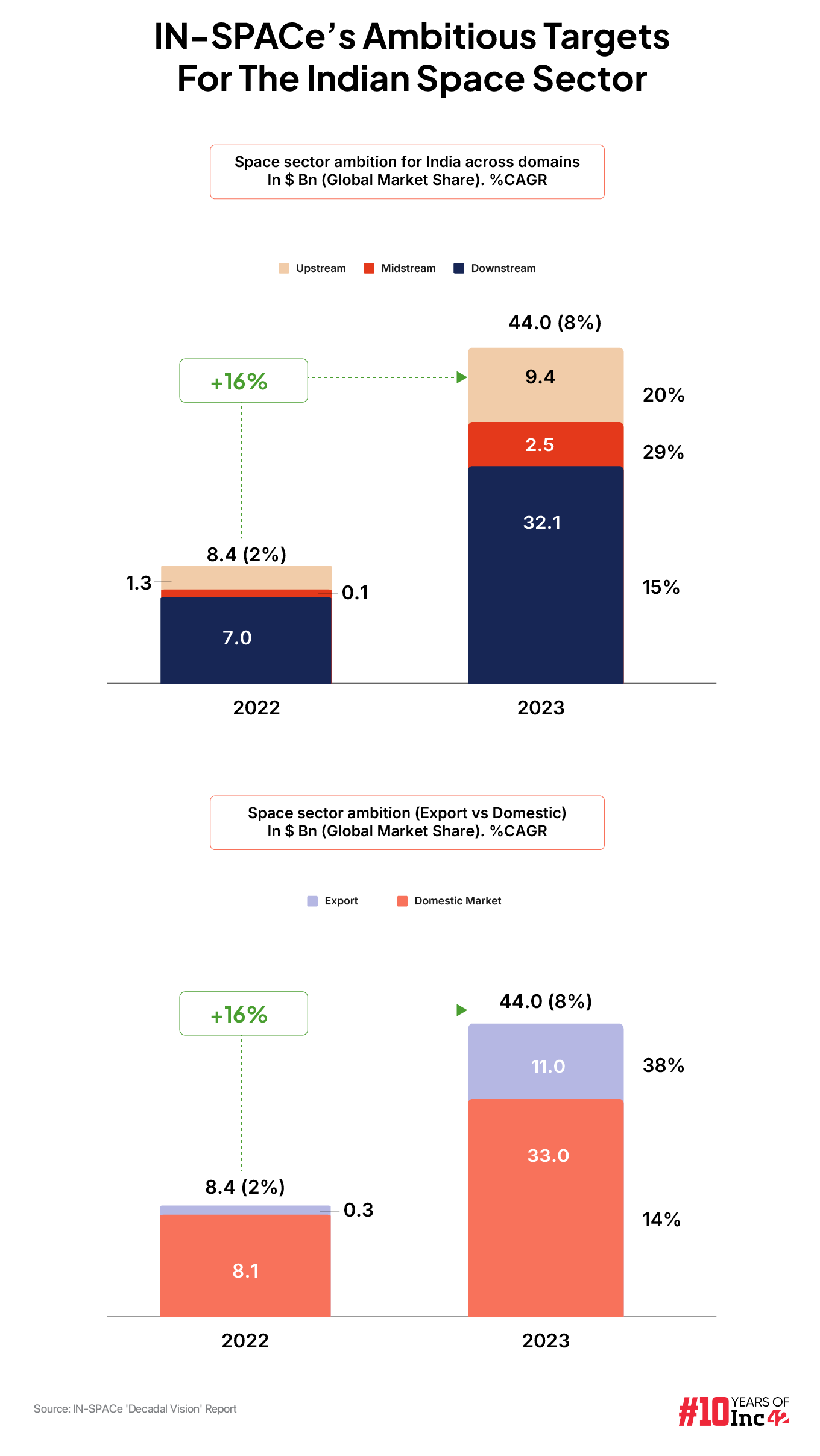

In its ‘Decadal Vision and Strategy for the Development of the Indian Space Economy’, the agency has set an ambitious target of taking the Indian space industry to a $44 Bn market potential, including $11 Bn in exports. This vision aims to create a collaborative ecosystem involving private, public, and startup sectors, following a “Whole-of-Nation” approach.

In 2022, the industry’s value stood at $8.4 Bn. However, it has gained significant momentum in the last two years, with names like Pixxel, Agnikul, Skyroot, Dhruva, and Digantara, making major headlines and capturing important global opportunities.

To gauge the impact of recent developments, understand the challenges faced by spacetech startups, and explore IN-SPACe’s role, Inc42 spoke to its chairman Dr Pawan Goenka.

With decades of experience in the automotive industry and working at companies like General Motors and Mahindra & Mahindra, Goenka says that it is the grit, energy and perseverance of Indian startups that inspire him the most.

“If you look at what spacetech startups are attempting to do, even large agencies globally sometimes hesitate because of the fear of failing…,” Goenka said.

Meanwhile, he also talked about the challenges and opportunities that the sector has ahead of it. But one thing that stood out the most was his excitement about seeing the the first unicorn in the Indian spacetech ecosystem. Although he did not put a date but expects one of India’s five biggest spacetech startups to enter the coveted unicorn club soon.

Here are the edited excerpts:

Inc42: India has made significant strides in building a thriving ecosystem for spacetech startups. However, where do we think we still lag? Is it on the policy front, regulatory or funding? What additional steps can the government take to address these gaps?

Pawan Goenka: While the funding for space startups in India is still relatively low, I don’t think these startups suffer from a lack of funding.

So far, small funding trenches from angels or VC have been sufficient. However now, as these startups look to raise tens of millions of dollars, things get a little complex. Not to mention, this is where the recent FDI policy has a significant role to play.

In my view, startups with a compelling story and a solid business plan will find the funding they need. Also, deeptech investors know that these investments will need them to be patient.

There are chances of failure in technology, but the potential returns can be huge if the technology succeeds.

Besides, IN-SPACe is working towards unravelling the whole investment situation – even the INR 1,000 Cr VC fund we have announced is in that direction. With all these elements coming together, I do not think funding will be a major bottleneck for spacetech startups.

Of course, some startup founders may think, ‘This guy doesn’t know what he is talking about,’ [laughs], but I still believe those who deserve will get funded either from private investors in India, global investors or the government.

Inc42: Besides funding, what additional steps can the Centre and IN-SPACe take to drive the growth of the ecosystem? Do you see any room for further development?

Pawan Goenka: We need to look at four or five factors for India’s private space sector to truly thrive.

The first one is the capacity of our startups, both physical and intellectual. I think we already have a strong foundation, which will continue to grow. So, this is not going to be a major concern.

The second factor is funding, which, as I said, is also not a concern and will be secured by the ones who deserve it.

However, the area that will require a significant amount of hard work will be demand creation. Now, the demand can emerge from three sources — from the private sector to the Indian government, from the private sector to the private sector, and from international markets to the private sector. We have to establish all three.

When we talk about the $44 Bn industry by 2033, we need to have $44 Bn worth of demand. So, our first attempt is to channel some of the government’s demand to the private sector. It has already started — some satellites made by the private sector are now being used by the government. We are working with multiple departments in the government to show what the private sector can do. Our initiative for earth observation constellation is also in this direction.

However, how do we create new demands within the government? There are certain things the government departments are doing today in terms of adoption but there is still scope for more. IN-SPACe’s duty is also to let the government know what else they can do and play the role of a matchmaker for their requirements with the right company building it.

Also, in India, there is less appreciation in the private sector for what space startups can do for them. Creating that awareness and having the private sector become a big demand generator for the space sector is another area we are looking into. Once the demand from the private sector opens up, spacetech here will grow very rapidly.

Coming to the third aspect of this demand, I think Indian space startups can do well in the international arena in two different ways. The awareness here has begun but that has not converted much into demand yet. These startups will find a majority of their demand from the international market going forward.

Inc42: Could you elaborate on the INR 1,000 Cr VC fund? What are its mechanisms and average ticket size?

Pawan Goenka: It’s going to work just like any other VC fund. It will be announced as a SEBI-registered AIF Category II fund, with a fund manager, an advisory committee, an IC committee, and trustees. The only differentiating factor is that the fund is getting the bulk of its money from the government.

As we establish the fund, it will be open to contributions from other investors, who will add to the INR 1,000 Cr committed by the government.

We have decided that the average ticket size of each investment will be somewhere between INR 30 Cr to INR 40 Cr. Now, depending on the private money inflow we see in this fund, there will be a cap of INR 60 Cr on the upper side and no investment will be below INR 10 Cr. So, if we take an average of INR 30 Cr, we will end up investing in about 35 startups.

The fund will hopefully be operational by the first quarter of FY26. I would have liked to see it happen in the fourth quarter of this financial year, but there is a long process of SEBI registration, among other things. The first important step is to select a fund manager, which will also take time.

Inc42: Has the fund started receiving requests from any startups for investment?

Pawan Goenka: Yes, a lot of them have started reaching out. Somehow, they have a feeling that IN-SPACe can decide to give them this money, but it is not like that. It works like any other VC fund.

Inc42: Is there any update on the private-public partnerships front?

Pawan Goenka: Although I spoke about the matchmaking part, it is only a small part of what we do at IN-SPACe. The big part is crafting various initiatives to include startups, and the VC fund is one such initiative.

We are also looking to have an earth observation satellite constellation, which we want a startup or a large private company to build. This will be an investment of approximately INR 1,200 Cr, which will be the largest private-sector investment in India’s space sector to date. The government is investing about 30% of the money in the company as a grant.

Similarly, we are working on two or three more schemes, which are not in the public domain. While I cannot talk about it just yet, we are expecting startups to come forward and take advantage of them

When we started, we put in some kind of price support mechanism to help companies get access to government infrastructure at a lower-than-market cost.

So again, just to help them get started, we constantly keep thinking of new schemes. For example, we are working with state governments to set up manufacturing clusters where companies can come and set up their production facility.

Inc42: How are Indian spacetech companies doing on the revenue front?

Pawan Goenka: Revenue generation has already started. If you look at the top few space startups — Skyroot, Agnikul, Digantara, Dhruva, Pixxel, Bellatrix, GalaxEye – almost all of them, except the ones doing launch vehicles, now have a revenue stream. The launch vehicle startups are expected to start generating revenues by next year.

Now, the question I ask myself is when will India have its first spacetech unicorn?

So far, the highest valuation we have seen is about a quarter billion dollars. As activities increase, these valuations will go up fast. Right now the country needs to see one or two big success stories.

Inc42: When do you think India will see its first spacetech unicorn?

Pawan Goenka: I have a date in mind but will not tell you [smiles]. I am waiting to see if my estimates are right. But the unicorns will be among the top five or six startups. And this will happen when they have a concrete demonstration of their technology and a revenue model in place.

If you look at the likes of Skyroot and Agnikul, they are talking about 10-12 launches every year and each of them could bring them about INR 40 Cr-INR 50 Cr, that’s a big number.

Inc42: Are the regulations going to get easier to enable this?

Pawan Goenka: People think regulations are coming in the way, but they are there for a purpose. Space sector is one such place where if you are not careful, mishaps can happen in terms of safety, security, and international obligations. Also, we have to be careful with the entry of bad actors getting into the space activity. As a regulator, no compromises will be made on these four factors.

[Edited By Shishir Parasher]