India’s edtech startups have been stuck in an existential crisis for the past two years. From unicorns to the early stage ecosystem, almost every edtech company in the country has faced upheaval during this period.

The only exception to this seems to be Physics Wallah, which has raised millions of dollars and expanded in the last three years. Mostly everyone has suffered since late 2021.

Economists and analysts talk about global economic cycles of hypergrowth followed by price corrections and resets.

In the case of edtech, the distribution model shift from online to offline has been the biggest pain point for founders, and there’s something to be said about their vision as well.

Most founders jumped at the opportunity to cater to the online learning wave amid the pandemic, but the subsequent downfall indicates that many did not have a long term vision that is especially critical in edtech.

One edtech investor recently told Inc42, “It’s something anyone should have seen. I think VCs made the mistake of not asking what after the pandemic. And the founders didn’t think they needed the answer for this question.”

This meant that there were too many niche business models during the peak funding period that didn’t survive after the pandemic. Some of them got snapped up by edtech unicorns in 2020 and 2021.

But in the aftermath of the lockdowns, startups realised that the education sector in India is capital intensive, which either requires healthy cash flow or constant access to VC money. Many of them burned their capital on acquisitions or expansion of products and verticals. The end of the pandemic’s restrictions on schools scuppered these plans.

“The 2020-21 edtech bubble was built on VCs showering money on edtech companies who had no unique problem solving solutions but were copying each other’s business models,” Monica Malhotra, managing director at publishing house MBD Group, told Inc42.

She also agreed that founders and investors underestimated the market requirements in the education sector, which although huge, is also diverse and one-size-fits-all solutions never work.

This coupled with aggressive sales and commodifying the social sector like education led to the industry’s downfall, Malhotra added.

Despite the headwinds in the industry, the downfall of one-time market leader BYJU’S, the silence of other unicorns such as Unacademy and Vedantu, some believe edtech is on the right path.

This year, for instance, also saw big ticket raises after a dismal 2023, when YoY funding nosedived by 88%.

Alakh Pandey-led test prep giant Physics Wallah raised $210 Mn in a Series B funding, while higher education startup Eruditus bagged $150 Mn in a Series F funding round led by TPG’s The Rise Fund. Skill development startup upGrad also raised $60 Mn funding from Temasek in late October.

But the number of company shutdowns, unreported number of job losses, corporate governance issues, cash flow concerns have dented investors’ faith in edtech as a sector. In particular, we are seeing founders move away from test prep and online learning as focus areas, and towards the skill development and higher education segment, which seems to have come out relatively unscathed after the pandemic.

So now the question is: will edtech bounce back after this period of misplaced optimism and where are the startups that are catering to this new reality?

More precisely, we are asking: where are the founders of the doomed edtech startups, or indeed CEOs of unicorns that are still alive, or the founders whose startups were acquired for millions during the funding rush?

To answer these questions, Inc42 tracked some of the founders of once-prominent startups that made up India’s vast edtech ecosystem in 2020 and 2021

What’s Happening With Unicorn Edtech Founders?

Let’s talk about the big league first or the unicorn CEOs who raised millions and billions of dollars with the promise of cracking India’s $117 Bn education sector. Many of these founders are now operating under the radar or are fighting grave legal battles from outside India.

Unlike fintech, ecommerce or SaaS unicorns, there was always something more grandiose about edtech founders.

Some edtech CEOs had a larger-than-life image in the mainstream and were seen as social heroes, others had a celebrity-like appeal among the ecosystem and were seen as visionaries by investors, even before they created a sustainable business.

The likes of Byju Raveendran, Unacademy’s Gaurav Munjal and Roman Saini, Physics Wallah’s Alakh Pandey, Vedantu’s Vamsi Krishna and WhiteHat Jr’s Karan Bajaj come to mind.

In many cases, these were educators who had turned into startup founders, and therefore they were expected to be driven by motivations other than commercial success—or at least that’s the image that was created.

Students and parents knew them as teachers and problem solvers rather than CEOs. Thousands thronged stadiums and auditoriums when Raveendran took the stage, even before the likes of Munjal, Pandey and Krishna entered the limelight.

The rapid customer acquisition, augmented by the pandemic’s restrictions, brought unprecedented success and the reputations of founders burgeoned. Many floated ambitious plans to hit the public markets.

Billions were poured into BYJU’S, Unacademy and Vedantu alone — and neither of these companies is living up to the rich unicorn valuation, according to several who have invested in them.

End Times At BYJU’S

Everyone knows the state of BYJU’S

“Raveendran’s envious business and political connections were the talk of the startup ecosystem in 2020 and 2021, and he was single-handedly raising more money than all other rivals combined. Byju is his own man. Although very calm and poised from outside, he has very few advisors which included his wife [and cofounder] Divya [Gokulnath], former CEOs Mrinal Mohit and later Arjun [Mohan],” a Bengaluru-based fund manager privy to BYJU’S operations told Inc42.

Raveendran and his family shifted base to Dubai just before India’s Enforcement Directorate issued look-out notices against the BYJU’S founder for alleged money laundering activities. But his so-called inner circle are on separate journeys.

“Raveendran has hired the best legal teams to assist him in fighting disputes in India and the US. He also has a few consultants in India but will not be shifting back anytime soon,” the source quoted above said.

Meanwhile, former BYJU’S India CEO Mrinal Mohit is reportedly rolling out an offline education venture, which is in line with Byju’s Tuition Centre-like model.

Another former CEO, Arjun Mohan, who spearheaded the troubled BYJU’S ship for a brief time earlier this year, is now authoring a book that delves into India’s edtech industry, according to his LinkedIn profile.

Besides this, Mohan is also an investor and independent consultant with a few edtech and fintech companies, given his experience with unicorns upGrad and BYJU’S.

Unacademy Hit By A Leadership Churn

Then there’s Unacademy, the second-largest edtech company by valuation and in funding after BYJU’S, which has seen a slew of exits at the leadership level since last year.

At one time, Unacademy group CEO Gaurav Munjal even had to deny speculation of the exit of cofounder Roman Saini, who was instrumental in building the startup’s test preparation platform.

While Munjal has been able to expand the business, Saini’s popularity with students and his domain knowledge have been crucial to Unacademy’s growth, as per those close to the company.

Sources added that Munjal has spent a large amount of this time in recent months in the US. Meanwhile, Unacademy is said to have held talks with other players for an acquisition.

At one point, the company was reported to be looking at a merger with K-12 Techno Services Private Limited (K-12 Techno). As Inc42 later reported, the deal did not go through, as Unacademy’s shaky unit economics made it unattractive to K-12, according to sources.

Incidentally, like its rival BYJU’S, Unacademy also went on an acquisition spree in 2021 and 2022. However, the company’s revenue needle did not move significantly as a result of these deals. Its top line has remained flat for FY24, despite a 60% reduction in loss, mainly through cuts in employee and marketing costs. However, these measures have not been enough to turn things around at Unacademy.

Many in the Bengaluru edtech ecosystem acknowledge the fact that Munjal is open to a merger or even an acquisition by big educational services companies. However, striking a deal will not be easy, given Unacademy’s high valuation and profitability concerns.

“This [K-12] was projected to be the edtech’s biggest deal till now, much bigger than the BYJU’S-Aakash acquisition. However, Munjal and his team are having a hard time convincing buyers why they should spend a couple of billion dollars on a company where only a few verticals are making money,” a CEO of an educational services company privy to deal talks told Inc42.

Where’s Vedantu?

Among the ‘older’ edtech unicorns, the third startup is Vedantu. Its K-12 business tanked severely after the pandemic, and it has struggled to regain relevance in the test prep arena, especially as competition intensified in the offline space.

Having seen a revenue decline since FY23 and with profitability nowhere in sight, Vedantu’s future,too, appears bleak. The company acquired Deeksha in 2022 for $40 Mn to push into offline learning. However, it’s unclear whether the deal has brought the revenue upside that Vedantu needed.

“Vedantu founder and CEO Vamsi Krishna, again a former educator, did not go on an aggressive sales drive like Byju Raveendran nor is he as assertive as Munjal,” a former Vedantu executive claimed.

The executive added that Vedantu’s K-12 model was very similar to BYJU’S, but it did not have the mammoth sales team that Raveendran could afford.

Ultimately this business model failed when offline learning made a strong comeback. “Krishna did try to raise debt and go for a buyout but there were no takers,” a former Vedantu senior executive said, a claim corroborated by several other investors in the edtech space.

Inc42 has previously reported how it’s difficult for edtech companies to raise funds to pivot to offline learning without a proof of concept. This is one of the reasons why Physics Wallah’s recent deal took months to be completed.

Vedantu CEO Krishna has also set his eyes on expansion in the offline segment and teaching in vernacular languages. But it remains a challenging task, given the paucity of funds.

Why PW Seems Unaffected

Talking about edtech unicorns and missing Physics Wallah would be a blunder.

PW has been a shining spot in the otherwise gloomy edtech story. The only profitable edtech unicorn in FY22, it slipped into losses in FY23 and FY24, but PW cofounder Prateek Maheshwari is confident of turning profitable in FY25.

Commenting on PW’s advantages, a CEO of a growth-stage edtech startup said the company’s strong offline centre network (built on a franchise model and asset heavy PW Centres) is one of the reasons why VCs are bullish on this company.

Even though PW has stepped into online courses in a major way in the last year, the emphasis is on offline growth. A PW CXO said the dynamics between the cofounders Pandey and Maheshwari are clear.

“Maheshwari has been on top of the business expansion, steering growth in financials, whereas Pandey who is the face of the company focusses on product, policy and student connect. Both are imperative for running the business.”

We were told that Pandey is keen to connect with students, teachers and parents, as that’s his style of operating.

The Fate Of Edtech’s Biggest M&As

According to Inc42 research and data collated from Tracxn, the edtech sector has witnessed more than 100 acquisitions between 2014 and 2024.

Notably, a majority of these acquisitions have happened in the 2020-2022 period when the valuations were sky high and big startups like BYJU’S, Unacademy, upGrad, and Physics Wallah were ready to splurge to foray into different verticals.

Some, such as PW, have continued their acquisition spree even in 2023 and 2024. But what’s happening to some of the founders who sold their companies to unicorns, especially those who made a windfall?

The most prominent exit was of WhiteHat Jr, which was acquired by BYJU’S in 2020 for $200 Mn. Founder Karan Bajaj, who sold his startup after just 18 months of operations, joined BYJU’S and led WhiteHat’s transition into the BYJU’S empire.

He quit exactly one year after the deal was announced. In 2022, he was appointed as special advisor to Goa chief minister to advise on social initiatives.

However, according to Bajaj’s website, he is currently exploring geographies outside India, has written a few books and is also open to the adaptation of his books into movies. Bajaj likes to call himself a yogi and claims to be helping aspiring authors publish a book in 12 months through some free courses.

WhiteHat Jr does not seem to have fared as well as Bajaj. The company has been all but written off by BYJU’S after years of underperforming and failing to find a product-market fit in the post-pandemic world.

BYJU’S made another costly acquisition of Toppr, a $150 Mn deal signed in 2021, to strengthen the company’s presence in the class 5-12 segment.

Zishaan Hayath, cofounder of Toppr, exited the startup in July 2021 and was in the news last year for buying a sea-facing real estate property in Mumbai for INR 40 Cr. Though Hayath is yet to announce his next venture, he often pens down his travel diaries on Twitter and Instagram.

Incidentally, BYJU’S has stepped out of the K-12 vertical completely, and as a result, the Toppr acquisition did not exactly pan out for the edtech giant either.

Another noteworthy acquisition in the edtech space was Unacademy’s deal for Handa Ka Funda in 2021. Handa later went on to join Unacademy as a content sales director before quitting in 2022.

Handa, who later announced early retirement, is a well-known commentator and personality on X (Twitter) and often shares ideas about investments, stock markets and early retirement planning.

There have been other notable acquisitions as well. In December 2022, Physics Wallah made an acquisition of iNeuron in a $30 Mn deal to foray into tech-focussed upskilling.

iNeuron’s founder, Sudhanshu Kumar, is on a professional break now and has taken to podcasting to talk about life, success mantras, and more.

“Typically, the companies that got acquired by the corporates or large startups have these CEOs and founders heading a business unit, and they report to the board once a month. The acquirer also deploys its workforce to oversee the operations of the acquired company,” Arun Prakash, CEO of GUVI App acquired by HCL Technologies told Inc42, explaining why founders typically move on after a period of transition.

Unacademy, of course, acquired the likes of TapChief, Mastree, and PrepLadder among others in 2020 and 2021. Many of these products have been shuttered due to scaling up challenges.

However, TapChief cofounder Shashank Mural continues to be a part of the Unacademy Group. He’s currently the CEO of Relevel by Unacademy, the startup’s jobs-focussed vertical. The other two TapChief founders have moved on, with Arjun Krishan joining Google’s product team last month.

Other examples of founders persisting in the acquiring companies after the deal include Doubnut’s cofounder Aditya Shankar, who continues to be the CEO of the company, even after Allen Career Institute acquired it for $10 Mn in 2023.

The Edtech Startups That Tanked

Edtech has the unenviable record of having the most shutdowns and layoffs in the past two years. Several founders stepped away from the sector and ventured into new territories. Will these experienced and battle-hardened entrepreneurs return to the edtech fold in the years to come?

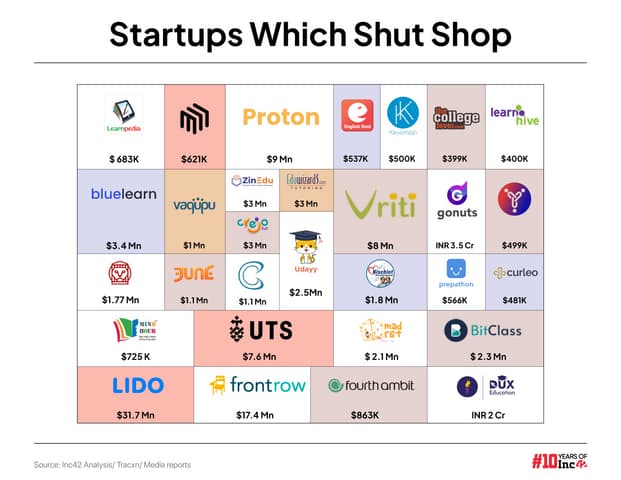

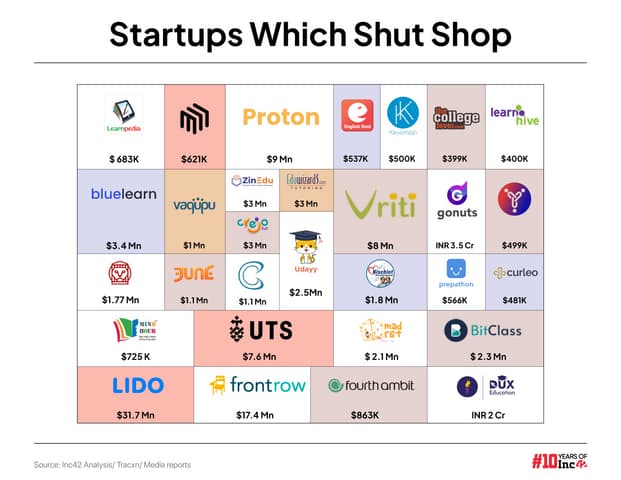

This may well be the key to reviving the edtech sector. As per Inc42’s data, five out of the eight shutdowns recorded in 2022 were from the sector, while in 2023, three more joined the list. In 2024, we saw BlueLearn and Stoa shut shop and BYJU’S being forced to scale back its entire offline learning ops.

Inc42 spoke with industry experts and analysts to understand why edtech suffered the worst of the downturn in the past two years. What we were told makes for ominous reading, but it does show that the shutdowns were largely a result of products failing or bad market timing, rather than bad leadership.

“It is a fact that any edtech company with a revenue less than INR 1 Cr has shut shop. They were waiting to get access to funds, find product-market fit; however, it has been too long a wait. VC money especially in early-stage edtech startups has dried up,” a growth-stage edtech founder from Bengaluru said.

Edtech’s Reputation Dented

One of the prominent examples of a promising edtech startup shutting down is Lido Learning. The online learning platform raised $32 Mn in its lifetime and filed for bankruptcy in September 2022 after laying off its employees and unable to pay off debts. Lido Learning employed 1,100 employees at one point.

Lido Learning founder Sahil Sheth, a serial entrepreneur who sold his earlier venture Infinite Student to BYJU’S in 2015, found himself in the middle of employee accusations and complaints.

It is not clear whether Sheth returned the funds raised to Lido investors, and the entrepreneur is yet to launch a new venture after the Lido experience.

On the other side of the spectrum are founders who earned some goodwill by publicly explaining why their business models failed, and some even returned investor funds while shuttering down their ventures.

Take Ishaan Preet Singh, founder of FrontRow, a celebrity-centric skilling and hobby development company. The startup raised $17.5 Mn in total and shut operations in 2023.

Singh is now an investor at VC firm Lightspeed India and focusses on deals in consumer internet and AI segments.

“We definitely had blinders on, and went into all-out growth mode. We did honestly believe a) we could rapidly improve operations and margins while growing, and b) that a large top line would enable us to raise the next round, and do even more. I’d let myself get carried away and focus on external metrics, despite knowing the pitfalls fully well,” Singh said in his farewell message as the FrontRow founder.

Another example is Goa-based Bluelearn, which shut operations in July this year. Having raised $3.5 Mn in three years of operations, founder Harish Uthayakumar revealed on social media that the startup would shut down and he planned to return 70% of the money raised to investors.

He also documented the last meeting at Bluelearn and is now working on some side projects on coding and design as claimed on his Youtube channel.

Yet another example is Gurugram-based Udayy, which closed down in June 2022 after raising $10.5 Mn.

Udayy founder Saumya Yadav was open about why her startup couldn’t take off, stating that the post-pandemic situation resulted in bad unit economics and poor monetisation. “We also evaluated partnering with schools and realised that schools looked at edtech companies as their competition rather than a supplement.”

Yadav, unlike many edtech founders, was candid about the fact that her venture was a pandemic baby, which could not survive the shifts in the market after the pandemic restrictions were lifted.

Competition from good old schools and traditional coaching institutes was too tall to be surmounted, even with $10 Mn.

Who Will Bring Edtech Back?

Yadav’s anecdotes perfectly encapsulate what went wrong with the edtech industry overall. The highs and optimism of 2020 and 2021 were never going to last. The end of that hype cycle crushed companies that were even born before the pandemic.

In fact, things look bleak for Unacademy and Vedantu, but the fact that they have managed to come through this period without a more adverse result is arguably commendable. The same cannot be said for BYJU’S.

The failure of BYJU’S and fall from grace for its founder and leader Byju Raveendran has tainted the image of the sector.

It’s perhaps one reason why some edtech founders — especially those with a track record of multiple startups in this sector — have not returned to the edtech fold. The scathing experience of the past two years has created a paucity of entrepreneurs willing to solve the problems in education, or, perhaps, they are waiting for the arrival of patient capital.

Education as a sector is arguably an impact investment area. It’s not possible to build a sustainable business without the patient capital that impact investing brings.

India’s impact investment space is rapidly growing, especially as more and more domestic limited partners and HNIs are backing impact funds. This domestic capital could very well refuel the hopes of India’s edtech ecosystem in the next couple of years.

In the past, we have written about why second-time founders and serial entrepreneurs are key for India’s startup and tech ecosystem to mature. Being a repeat founder is a major advantage since such entrepreneurs come with deep insights into the industry and have tried to solve problems in the past.

In many cases, they already have the faith of investors and pass due diligence easily at the seed stage because of their domain knowledge. Due diligence is thin in the case of early stage investing, but gets even thinner in the case of a notable founder.

Investors also claim that past experience reduces the chances of failure in many cases, particularly in terms of unit economics and product-market fit.

The edtech industry has undergone a huge reset, and getting things back on track or reviving the value will not be easy. Today, it looks like the future of edtech is about painting within the lines drawn by traditional and legacy coaching players.

Offline coaching is the only game in town that’s getting funds. Changing this requires new energy and fresh ideas, perhaps even more first-time founders. But a lot of the onus will lie on those who have already tried their hands and burnt their fingers in the cauldron. Will these edtech founders rise to the challenge?

[Edited By Nikhil Subramaniam]