India’s fintech sector, expected to reach a market size of $2.1 Tn by 2030, continues to grapple with issues such as manual intervention, inefficiency in credit assessment and fraud detection

However, a new breed of GenAI startups are disrupting the financial services industry with their India-specific vertical AI solutions

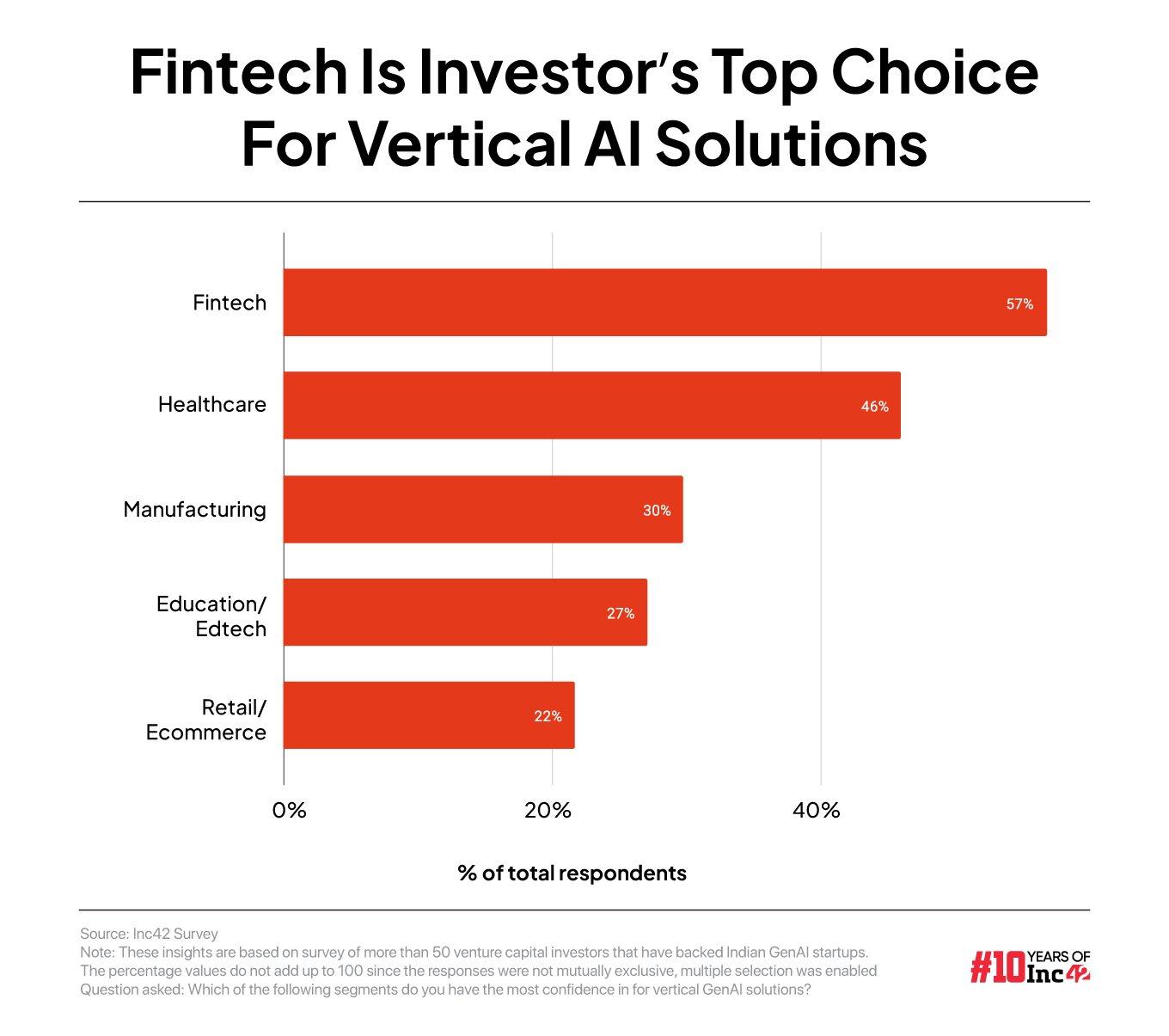

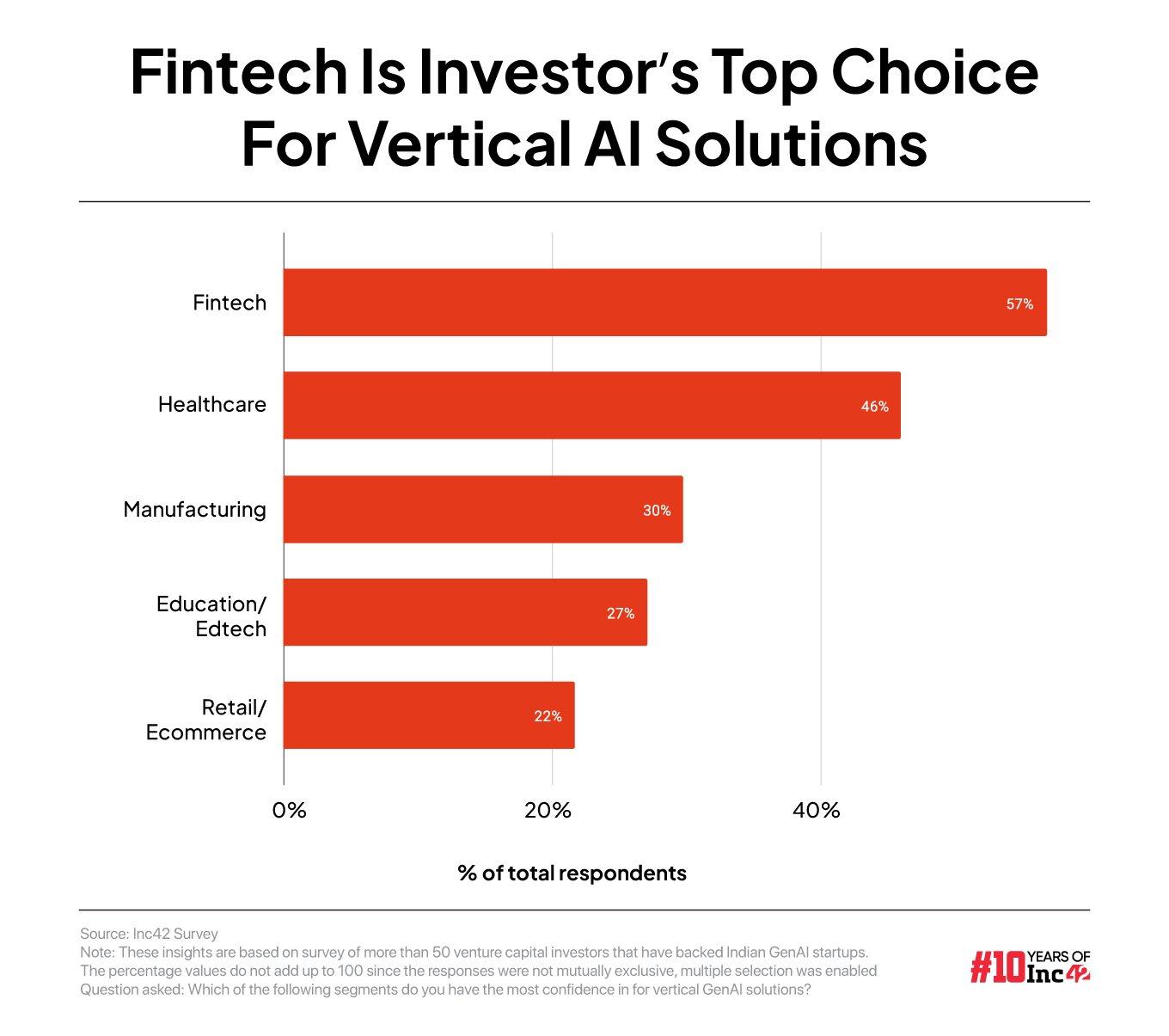

According to Inc42’s ‘The Rise Of India’s GenAI Brigade Report, 2024’, the fintech sector is investors’ top choice for vertical GenAI solutions

“In the last 40 years, nothing has been this big. It’s bigger than PC, it’s bigger than mobile, and it’s gonna be bigger than the internet, by far”. This is how Jensen Huang, founder and CEO of NVIDIA, described generative artificial intelligence (GenAI) in November last year.

These projections are indeed proving to be true for the US-based chipmaker. NVIDIA more than doubled its revenue year-on-year (YoY) to $60.9 Bn in FY24, thanks to the AI boom.

Just like the globe, India too has been gripped by the AI fever. The buzzword seems to have opened new avenues of innovation and spawned a wave of new-age tech companies, catering to both B2B as well as consumer use cases from healthtech to SaaS.

However, it is the banking, financial services and insurance (BFSI) sector that appears to have overwhelmingly embraced the emerging technology. As Inc42 reported earlier, large players like HDFC Bank, IDFC First Bank and startups like Policybazaar, Plum, and Fibe are leveraging AI to address multiple bottlenecks.

This has spawned a number of vertical GenAI startups that are riding the AI wave to give the change-resistant sector a tech makeover. Treading judiciously, these fintech-focussed GenAI startups are steering clear of building cash-guzzling Indic large language models (LLMs) and are instead solving India-specific vertical challenges.

And investors are rewarding this approach of startups for skipping general-purpose GenAI solutions. According to Inc42’s ‘The Rise of India’s GenAI Brigade’ report, the fintech sector is investors’ top choice for vertical AI solutions. As many as 57% of the 50 venture capital investors surveyed showed the highest confidence for fintech-focussed vertical GenAI solutions.

So, what is driving this confidence?

Reshaping Fintech With GenAI

Speaking to Inc42, fintech-focussed GenAI startup OnFinance’s cofounder Anuj Srivastava said that many financial institutions are still reliant heavily on outdated systems and manual intervention. This, he said, offers a white space for GenAI startups to enable financial enterprises to automate tasks and streamline operations.

OnFinance is one of the over 200 GenAI startups that are transforming the fintech sector by automating key operational tasks like compliance, allowing financial institutions to scale their operations while reducing employee costs.

While many startups in the space are offering full-stack customer communication solutions, others are helping businesses automate credit profiling and compliance for SME lending.

Anirudh A Damani, managing partner at Artha Venture Fund, said that GenAI-led innovations can prove crucial for fintech companies looking to boost customer engagement and reduce operating costs.

“GenAI is upgrading fintech by addressing inefficiencies across the credit cycle, from improving risk assessments to streamlining debt recovery. Beyond these applications, there is immense potential in fintech intersecting with niche areas to create innovative funding models,” Damani added.

Vertical GenAI startups are also revolutionising the way insurers approach fraud detection. A case in point is IDfy, which provides AI-based solutions for authentication, fraud detection and risk identification for both domestic and global markets. The startup claims that it verifies over 2 Mn individual profiles per day and counts HDFC Bank, Axis Bank, Paytm and PhonePe among its clients.

Addressing The Fintech Pain Points

India is the third largest fintech economy in the world. The homegrown fintech market is expected to become a $2.1 Tn opportunity by 2030. Over the last 10 years, fintech startups witnessed a staggering 500% growth and attracted investments worth over $31 Bn, Prime Minister Narendra Modi said earlier this year.

However, India’s fintech sector continues to be ailed by persistent pain points today, particularly those rooted in labour-intensiveness of manual tasks, high operational costs and the complexity of analysing huge amounts of financial data, as per OnFinance’s Srivastava.

“Creditworthiness assessment, for example, still relies heavily on traditional models that don’t always capture the full range of risk factors, leading to inefficiencies in lending and underwriting. Similarly, compliance processes often remain manual, time-consuming, and prone to human error, exposing firms to regulatory risks,” he said.

Besides, the fintech sector also faces challenges such as systemic risks from overleveraged NBFCs and inefficiencies in credit assessments. By streamlining or automating these tasks, vertical AI can deliver tangible business value, allowing the fintech industry to unlock new efficiencies.

Artha Ventures’ Damani believes that vertical AI solutions have immense potential to alleviate these concerns. “AI tools that enhance creditworthiness assessments, optimise customer segmentation, and streamline compliance processes can improve profitability and reduce systemic inefficiencies,” he said.

The Road Ahead

At the onset of this year, Inc42 predicted that 2024 will be a breakout year for vertical AI with growing enterprise adoption opening up opportunities for a new generation of entrepreneurs. And this is what appears to be happening on the ground.

Unlike the horizontal approach taken by global tech giants like OpenAI and Anthropic, Indian fintech-focussed GenAI startups are solving industry-specific challenges. While vertical GenAI startups have been successful in alleviating some of the concerns faced by the fintech sector, gaps remain.

The Indian fintech ecosystem still faces significant hurdles such as data privacy concerns, integration with legacy systems, and the need for more granular local solutions, according to Srivastava.

“Looking to the future, vertical AI solutions will likely become even more integrated into the core functions of fintech companies. These solutions will not only automate existing tasks but also provide predictive capabilities, enabling institutions to proactively address issues like fraud, regulatory changes, and emerging financial risks before they escalate,” Srivastava said.

On top of that, there have also been instances of AI hallucinations, which have adversely impacted the reputation of this nascent technology and players deploying it.

While Indian GenAI startups have a long road ahead of themselves to create trust among enterprises, the growing adoption of the emerging technology and its many use cases could pave the way for gradual ascent of the ecosystem in the future. For now, Indian GenAI startups will have to focus on high quality products that resonate with their clients and have applicability globally.

[Edited By Vinaykumar Rai]