February 22, 2024 — Headlines around India revealed an Enforcement Directorate lookout circular against BYJU’S

After months of turmoil at BYJU’s — starting in June 2023 — the spotlight was again on Raveendran, but an entirely different kind of spotlight.

Raveendran would have been used to the pressure of running an edtech empire, a $22 Bn company with business interests in India and the US, but this was one of India’s premier investigation agencies asking authorities to be vigilant of his movements.

Of course, the BYJU’S CEO and his family including cofounder Divya Gokulnath and brother and director Riju Ravindran were already out of India by the time the ED circular was issued.

Everyone in the ecosystem knew Raveendran had left India for the UAE, even as he was battling shareholders and allegations of financial misappropriation by lenders.

“Raveendran always had UAE as his second home. Besides, he kept shuttling between India, US for the past few years. But no one had spotted him in Bengaluru as well where the company’s lavish headquarters were,” a former senior manager at BYJU’S told Inc42.

In fact, Raveendran has not stepped back into India since leaving it at the end of 2023, much before BYJU’S came crumbling down. And now one year later, the future of the once-mighty edtech company hangs in the balance.

As we recap the year gone by — in our signature Year In Review series — it would be a huge oversight to not look back at what happened at BYJU’S over the course of the last 12 months. Here’s the BYJU’S story from 2024

Problems From The Very Beginning

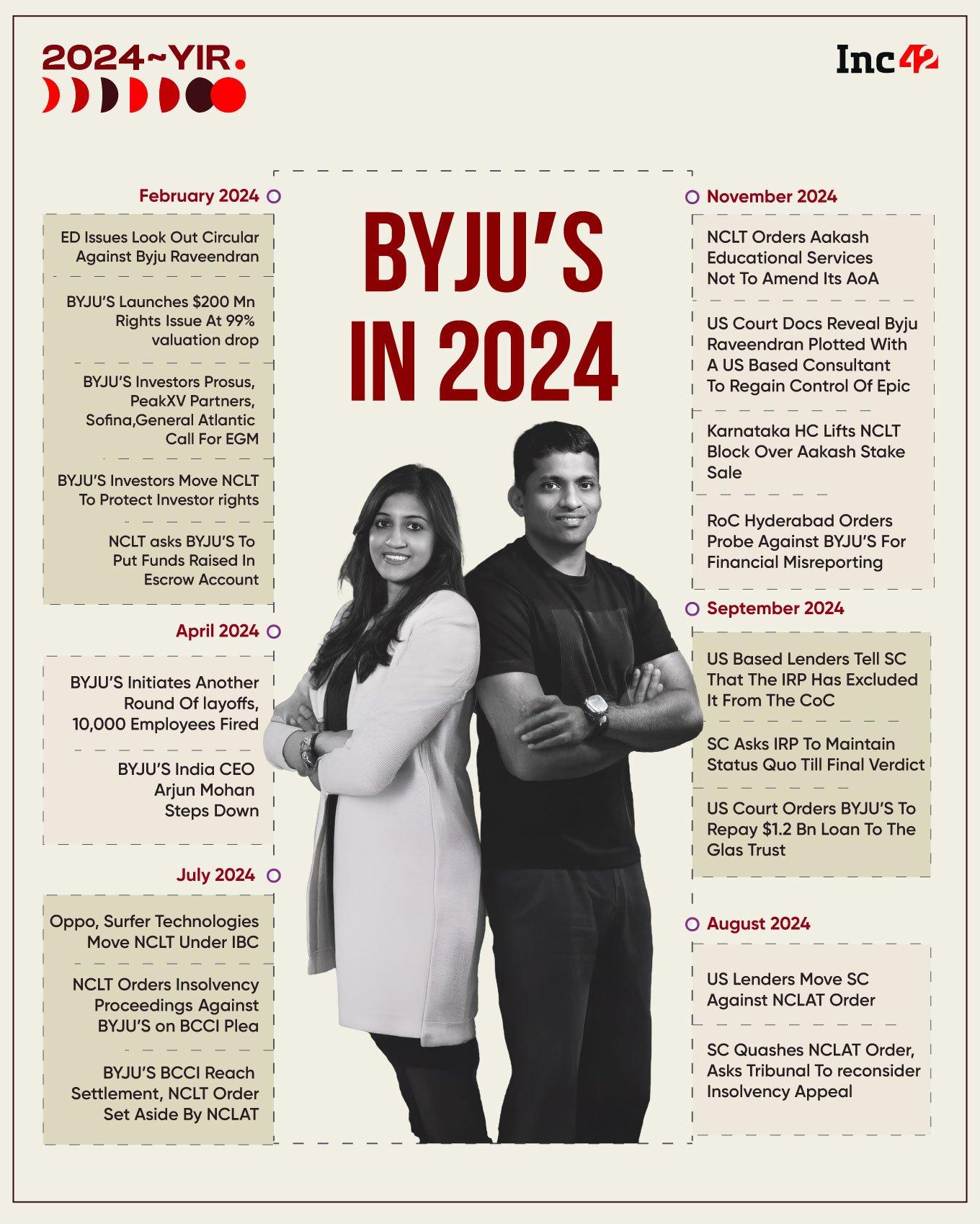

The year began with general counsel Roshan Thomas quitting the company, which spelt an ominous time ahead for BYJU’S in terms of its legal entanglements.

Soon after this, BlackRock slashed the value of its investment in BYJU’S by 95%, which led to the company now being valued at $1 Bn as opposed to $22 Bn till a few months ago.

The mark down in valuation would have mattered little had BYJU’S managed to show improved financial performance in FY22, the results for which were delayed by nearly two years by this time.

But that was not the case either. Consolidated net loss surged 81% to INR 8,245.2 Cr in FY22 from INR 4,564.3 Cr in FY21. This staggering loss of close to $1 Bn meant that BYJU’S was worse off than many believed.

The only silver lining was the profits for Aakash in FY22, but since then BYJU’S has lost majority control of Aakash after splurging nearly $1 Bn to acquire it.

Such was the state of the company that it did not have enough money to clear dues for vendors or employees, and naturally several challenges were raised in the NCLT regarding the near-insolvency situation.

And we hadn’t even left January yet. Before the end of the first month, BYJU’S announced a contentious plan to raise money via a rights issue. The company was seeking to raise $200 Mn at a staggering 99% haircut.

But a key group of investors at BYJU’S including the likes of Prosus, Peak XV Partners, Sofina, General Atlantic called for an Extraordinary General Meeting (EGM) seeking to oust Raveendran as the CEO and put in place a new management as well as governance structure to take the company forward, in case there is a rights issue.

This really put the conflict between the BYJU’S investors and the founders out in the open and was a clear cut indication that India’s once most valued startup is witnessing a disgraceful decline.

“These clutch of investors who together had lower stake in BYJU’S than the founders alleged that Raveendran has not been transparent in his dealings and management of the company. However, the cracks in the company were already evident when it was without a CFO from 2021 to 2023. And there were repeated delays in submitting annual reports. One can say there was complacency on the part of investors in putting these systems in place,” said a partner at a VC firm that had invested in BYJU’S.

Cash Crunch And The Investor Meltdown

The rights issue was a big thorn for investors. Raveendran had sent communications to all shareholders urging them to participate in the rights issue in order to maintain their stake in the company.

It was a cramdown round, which meant that those shareholders that don’t subscribe to the rights issue will see their stake effectively diluted to zero.

For instance, Prosus which had invested $500 Mn in BYJU’S over multiple rounds, was at risk of having all its equity wiped off if it didn’t subscribe to the rights issue.

While investors urgently called for an EGM in February 2024 to prevent the rights issue and remove Raveendran, the BYJU’S CEO decided to go ahead with it and moved the Karnataka HC alleging the EGM was invalid.

That is when a group of investors led by Prosus moved the NCLT alleging shareholder oppression and mismanagement. Once again, there was a call by investors to oust Raveendran and put new management in place, and one did wonder whether the company could have a future without its eponymous founder.

Even though BYJU’S and Raveendran managed to get the rights issue off the ground, legal challenges meant that the company could not touch these funds till courts and the NCLT had ruled on it.

BYJU’S tried to initiate another rights issue, but this too was blocked by courts, leaving the company to fend off bankruptcy challenges with whatever funds it had at the time.

Raveendran on his part has written emotional letters to his employees appealing them to stand united against investors and ‘foreign lenders’ who sought to bring the company down according to him.

He claimed that he had borrowed money personally to pay employees salaries and that if the company goes insolvent, it will be because of the investors and it will hurt employees.

Despite these overtures and the company’s efforts to get leaner — after layoffs and scaling down — BYJU’S was in a Catch 22 situation.

On the one hand, keeping the operations going required funds, but on the other, the funds would have only come had Raveendran stepped aside. Given that the latter was not happening, it seemed that the company was going to hit a dead end very soon.

At this time, BYJU’S was a shadow of its former self — it had relinquished offices in Bengaluru, moved employees to remote working, and had taken its foot off the online learning model. Now, the focus was squarely on the offline tuition centres, but this vertical was also hanging by a thread.

And by the end of February, the ED lookout circular put Raveendran in a bind. It would seem that despite assurances from him, the company was deeply mired in issues. Naturally, these governance issues had dented BYJU’S standing among customers and teachers.

Even as early as the second month in the year, it was becoming clear that the era of BYJU’S was coming to an end.

BYJU’S Edtech Business In Doldrums

In August, Inc42 exclusively reported that BYJU’S had more or less pulled the curtains down on its offline vertical. Landlords had locked over 120 tuition centres across the country over non-payment of rent, electricity and water dues.

Employees — teachers and those on the operations side — had also not been paid in months, but they could not take any action against the company, except approach the Miinistry Of Labour. Even then, many of their concerns fell on deaf ears.

In fact, the situation was such that even if BYJU’S had somehow managed to get money to keep the company afloat, it was not a guarantee that employees would be paid.

“We were assured of our salaries by our senior managers, but little did we know that they were actually asking the last 5,000 employees to leave. The company had almost shut 80% of its operations by August,” said a former senior manager at operations who left the company in August.

Despite Raveendran’s show of solidarity and promise that employees would be paid, the company’s many issues created a ripple effect within the industry. “The employees who were laid off by BYJU’S took up jobs at 30%-50% lower salaries. This shook up the recruitment for the entire edtech industry as there was a huge pool of unemployed edtech workers. The other edtechs also slashed their salaries drastically since the supply was greater than the demand,” a rival edtech founder told Inc42.

But these issues — serious as they were — paled in comparison to the major allegations against Raveendran and BYJU’S from its creditors in the US.

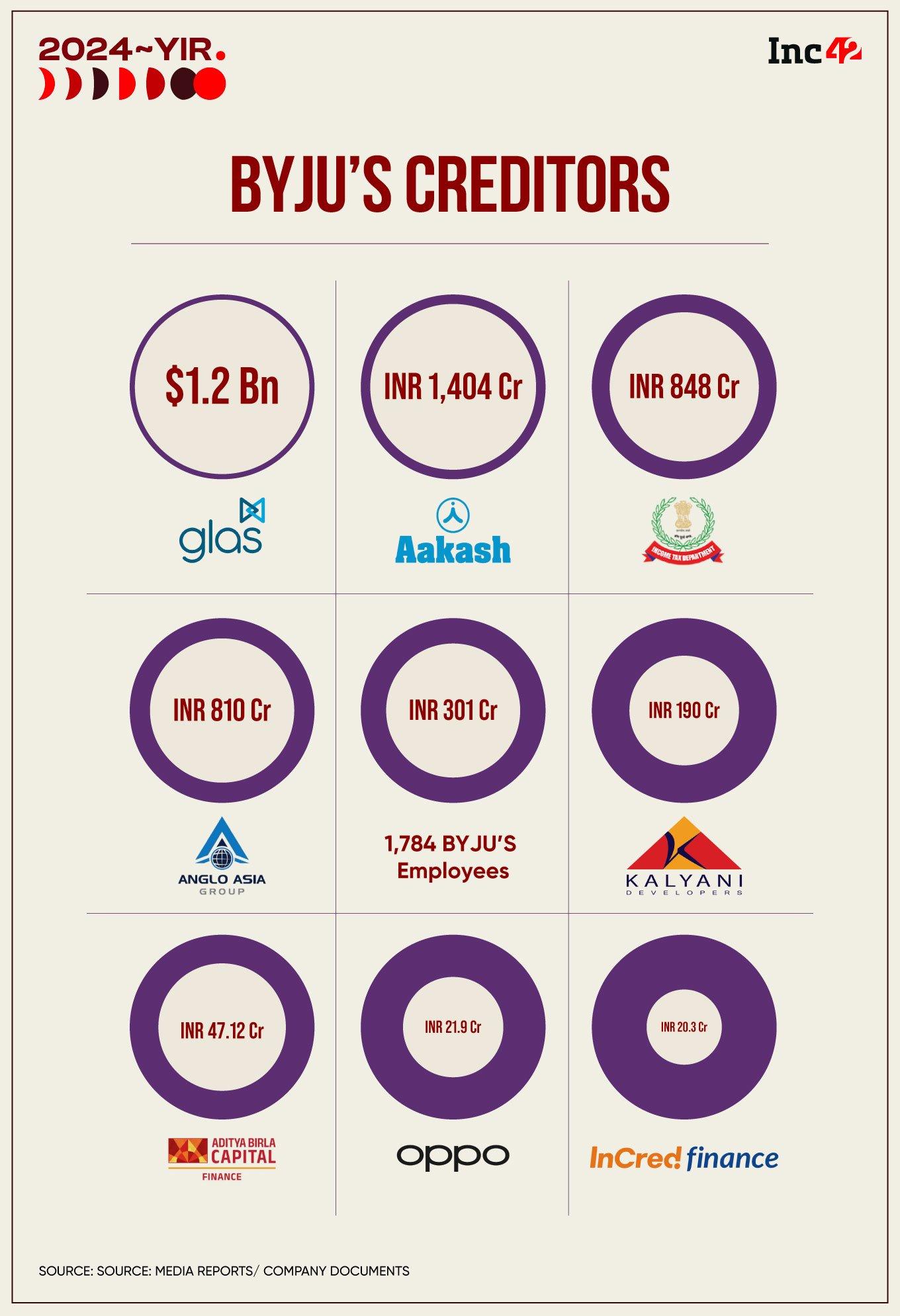

Chief among the allegations was the contention that BYJU’S and Raveendran had syphoned off $533 Mn from the $1.2 Bn term loan B raised in 2021.

In the months to follow, the entire focus would shift from the Indian operations to the US creditors and their battle with the company and by the end of the year, there would be more grave allegations against Raveendran as well as indications of foul play in the US in an effort to thwart the lawsuits by its creditors.

US Lenders Come Knocking

One can even say that the $1.2 Bn Term B which the edtech firm availed in November 2021 has become the strongest roadblock for Raveendran.

In 2023, creditors alleged that the company had not paid dues for 17 months and had failed to come to any kind of negotiation on restructuring the loan. Creditors also accused Raveendran of syphoning off funds in contravention to the loan terms.

The group of creditors moved bankruptcy courts in the US and sought to enter BYJU’S-owned US companies Epic and Tangible Play into insolvency to recover the funds.

These creditors, represented by Glas Trust, also moved the NCLT in Bengaluru seeking initiation of insolvency proceedings against BYJU’S. By then NCLT was also hearing several cases including the Board For Control Of Cricket In India’s (BCCI) appeal against BYJU’S for non-payment of INR 158 Cr.

As it turned out, this case was the one that brought BYJU’S to its knees, and was the reason for the NCLT allowing insolvency proceedings to go ahead against the edtech giant.

“Raveendran on his part kept organising select press conferences, wrote emailed communications to employees to demonstrate that he will not concede defeat. But the odds were stacked against him,” Sriram Subramanian, founder and MD, InGovern Research told us.

Another edtech investor spoke about rumours about Raveendran starting another edtech venture with the cash he earned from secondary share sales at BYJU’S.

“On one hand thousands of employees have not been paid for months together, then investors are accusing him of hiding money and then there were reports of another venture. It did not seem ethical despite Raveendran’s appeals,” the edtech founder quoted above added.

The Brouhaha Amid The Insolvency Process

After months of back and forth, including a feud with investors and the tussle with creditors in India and abroad, the NCLT officially initiated insolvency proceedings against BYJU’S in July 2024.

This was an unprecedented event for an Indian startup of BYJU’S magnitude. The NCLT appointed an insolvency resolution professional to manage the day-to-day operations of BYJU’S and form a committee of creditors to settle the various claims against the company.

Ordinarily, this would have resulted in some clarity on what happens to the company under insolvency, but BYJU’S is no ordinary company when it comes to such matters.

This process as per Insolvency and Bankruptcy Code (IBC) of India allows the committee of creditors 330 days to find a buyer for the company. In case the CoC is unable to find a suitable buyer, the creditors are allowed to liquidate the company assets.

Thus far though, the committee of creditors and the insolvency professional have been accused by US-based creditors of colluding with the company, and allegedly blocking the possibility of the US-based creditors being made whole after the insolvency.

The question now is whether the US-based Glas Trust will actually get a fair hearing in India for the insolvency. The NCLT’s Bengaluru bench has questioned the resolution professional Pankaj Srivastava’s decision to not include Glas Trust and Aditya Birla Finance (ABF) in the committee of creditors (CoC).

Glas Trust and ABF believe that the resolution professional is looking to shut them out and has colluded with the company to get BCCI to withdraw its insolvency plea. This would block any attempt to recover the amount lent to BYJU’s by Glas or ABF.

The last hearing on this matter was on December 11, 2024 and nearly six months after the company went into insolvency proceedings, things continue to be murky for BYJU’S.

Can BYJU’S Actually Bounce Back In 2025?

While these proceedings are likely to continue for most of next year, one does wonder whether BYJU’S and Raveendran can bounce back. For his part, the CEO has claimed multiple times that BYJU’S will come back stronger and will continue to disrupt the education industry.

But things could not be any bleaker for Raveendran and the company he founded.

Historically, in India, companies in asset-heavy industries are able to bounce back from insolvency proceedings since they have assets to sell off. However, in BYJU’S case, there are no such assets and it would be a tall ask for the company to make its creditors whole.

InGovern’s Subramanian sees very little chance of BYJU’S being rescued.

“The liquidation process being seen over by NCLT can also involve settlement of corporate debts. In this case the corpus of debt is huge and the promoters have been unable to negotiate settlement in earlier talks. It also looks unlikely that they are able to find a buyer of the company since it is an asset-light business model and the demand for edtech products remains low. Furthermore, the company’s reputation has suffered a serious dent which also impacts any chances of the business revival,” he added.

What makes matters worse for Raveendran is that he’s fighting off insolvency proceedings in two geographies. In September 2024, even the Delaware Supreme Court in the US ruled in favour of Glas Trust stating that BYJU’S defaulted on the loan payments along with interests amounting to $1.5 Bn, and that the lenders were entitled to take the requisite action against the company.

This effectively meant that Raveendran had lost control of US-based subsidiaries Epic and Tangible Play’s Osmo after acquiring them for a cumulative $900 Mn.

BYJU’S also wrote off White Hat Jr after acquiring the coding startup for $300Mn, and its core test prep business in India was also reeling after scaling back in 2024. “The offline model was thought of as a saviour but education is a capital intensive market which requires asset ownership and payment of timely salaries. The working capital issues plagued BYJU’S for months, and then NBFC partners cut off ties with the company, which further worsened the issues around student enrollment” a former BYJU’S senior executive explained.

Finally after splurging $1 Bn to acquire Aakash, BYJU’S lost control of the offline learning giant after failing to meet the terms of the acquisition. Manipal Education And Medical Group’s Ranjan Pai is now the leading shareholder in Aakash after coming in as a white knight earlier this year.

As for Great Learning, while it achieved profitability in FY24, the company also revealed that it is being run by a group of creditors since October 2023. BYJU’S was reportedly looking to sell Great Learning to settle its debt obligations with US-based creditors, but was unable to find a buyer and as a result lost control of Great Learning as well.

Raveendran’s efforts to sell a part of his stake in Aakash was blocked by the Supreme Court of India. Both the US-based lenders as well as Blackstone (which holds a stake in Aakash) have opposed any changes to Aakash’s structure which could strip them off their investor rights.

Will Byju Raveendran Return To India?

Finally, this is the most important question for BYJU’S — reputation-wise, Raveendran returning to India could solve a lot of the issues that could be perceived as problematic.

If indeed the company goes under water, one expects Raveendran to stand up and take accountability for this disaster.

Instead, the CEO has resorted to attacking investors. There was also troublesome testimony in the US related to Raveendran resorting to shadow tactics to get witnesses to not testify in court or coercing them to take potentially illegal steps to avoid an adverse verdict.

So the question of Raveendran’s potential return to India will probably not be answered in 2025, if at all.

As optimistic as the BYJU’S CEO sounds in recent media interactions and despite saying that he is not hiding from anyone, his claims have found few takers in India.

“When you have several governments probing your business models, the ED after you, foreign and domestic creditors who feel cheated, it is not only unethical but also unrealistic for him to return. I don’t know how he is asserting this with full confidence,” a VC fund manager who was a former partner at a Big Four told us.

Like this fund manager, others have told us over the past few weeks that the harm caused to the edtech industry in India due to BYJU’S will also make it difficult for Raveendran to step foot in India again. His acrimonious fallout with investors and customers is also likely to prevent his return.

Legal experts we spoke to said that Raveendran’s extradition to India and even his arrest could only be possible if there is a clear cut verdict from the Supreme Court on the same. However in absence of any criminal litigation and with the settlement of dues still possible, Raveendran may plan a gradual return to India in a few years if not in 2025.

Indeed it is a sad turn of events for the entrepreneur, once known to have filled up entire stadiums filled with students. These days it’s hard to find any audience with Byju Raveendran.

[Edited By Nikhil Subramaniam]