Non-banking financial company (NBFC) Aye Finance

The company plans to raise INR 1,450 Cr through its public issue, which will include a fresh issue of equity shares worth INR 885 Cr and an offer-for-sale (OFS) amounting to INR 565 Cr.

The funds from the new issue will be used to address the company’s future capital needs driven by business and asset growth. Additionally, Aye Finance plans to allocate the proceeds to support ongoing business operations.

In the OFS, institutional investors like LGT Capital and Capital G plan to sell shares worth INR 150 Cr and INR 136.8 Cr, respectively. A91 Fund and Alpha Wave will each sell shares worth INR 100 Cr.

MAJ Invest, Harleen Kaur Jetley and Vikram Jetley will sell shares worth up to INR 56 Cr, INR 14.5 Cr and INR 7.64 Cr, respectively.

Aye Finance’s net profit surged 291.7% to INR 171.6 Cr in the financial year 2023-24 (FY24) from INR 43.8 Cr in FY23. During the same period, operating revenue increased 66.86% to INR 1,040.21 Cr, compared to INR 623.42 Cr in the previous year.

The DRHP also said that the company’s profit jumped 37% to INR 107.80 Cr in the first six months of the fiscal year 2024-25 (H1 FY25) from INR 78.79 Cr in the same period of previous fiscal. Operating revenue increased to INR 692.24 Cr from INR 472 Cr in the corresponding period of the previous year.

The DRHP filing follows the company’s board approval on December 11 to raise up to INR 1,450 Cr through IPO

Founded in 2014 by Sanjay Sharma and Vikram Jetley, Aye Finance offers loans to small businesses across the country. It leverages its AI-powered credit assessment algorithms to assess risk in the absence of traditional business documents.

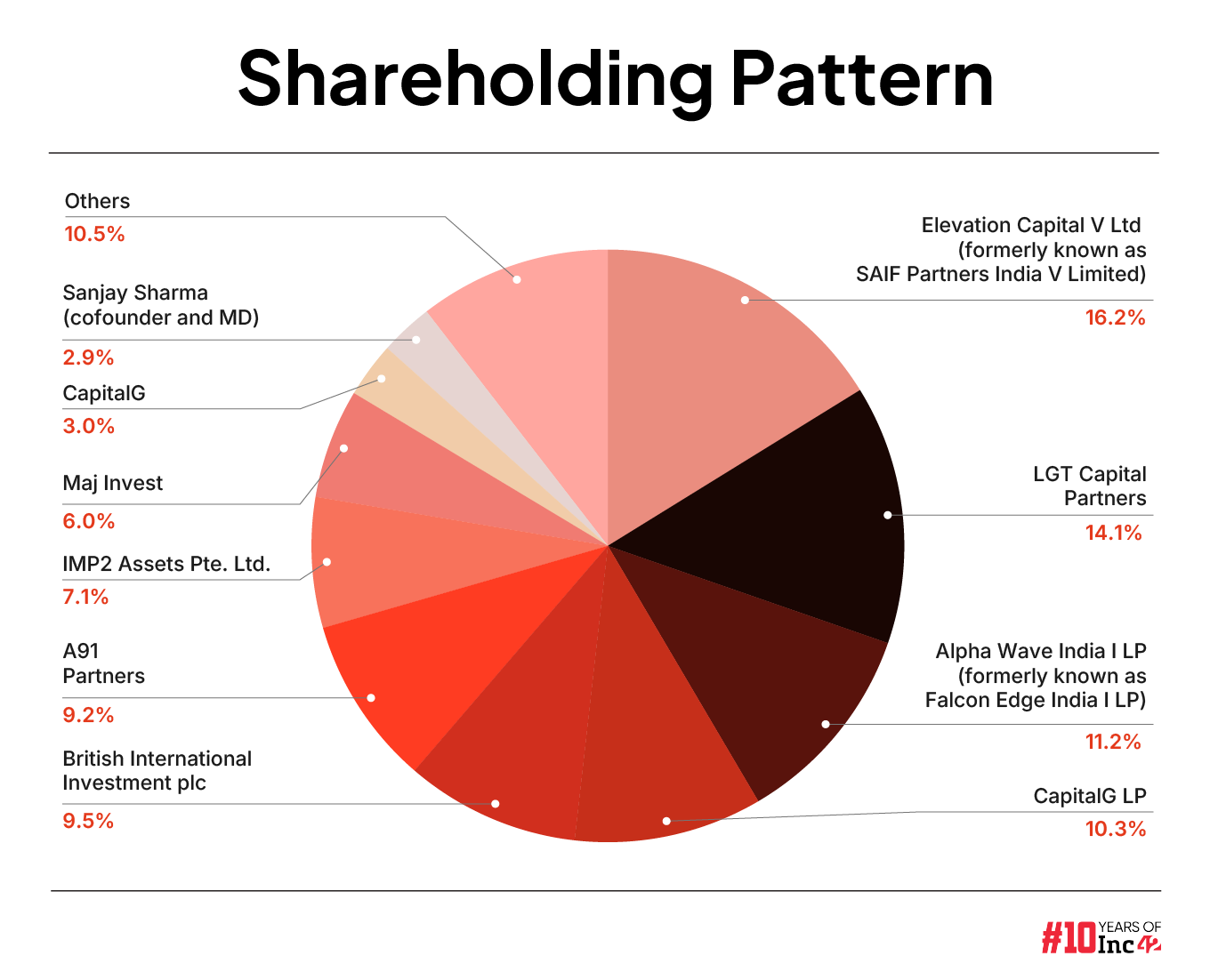

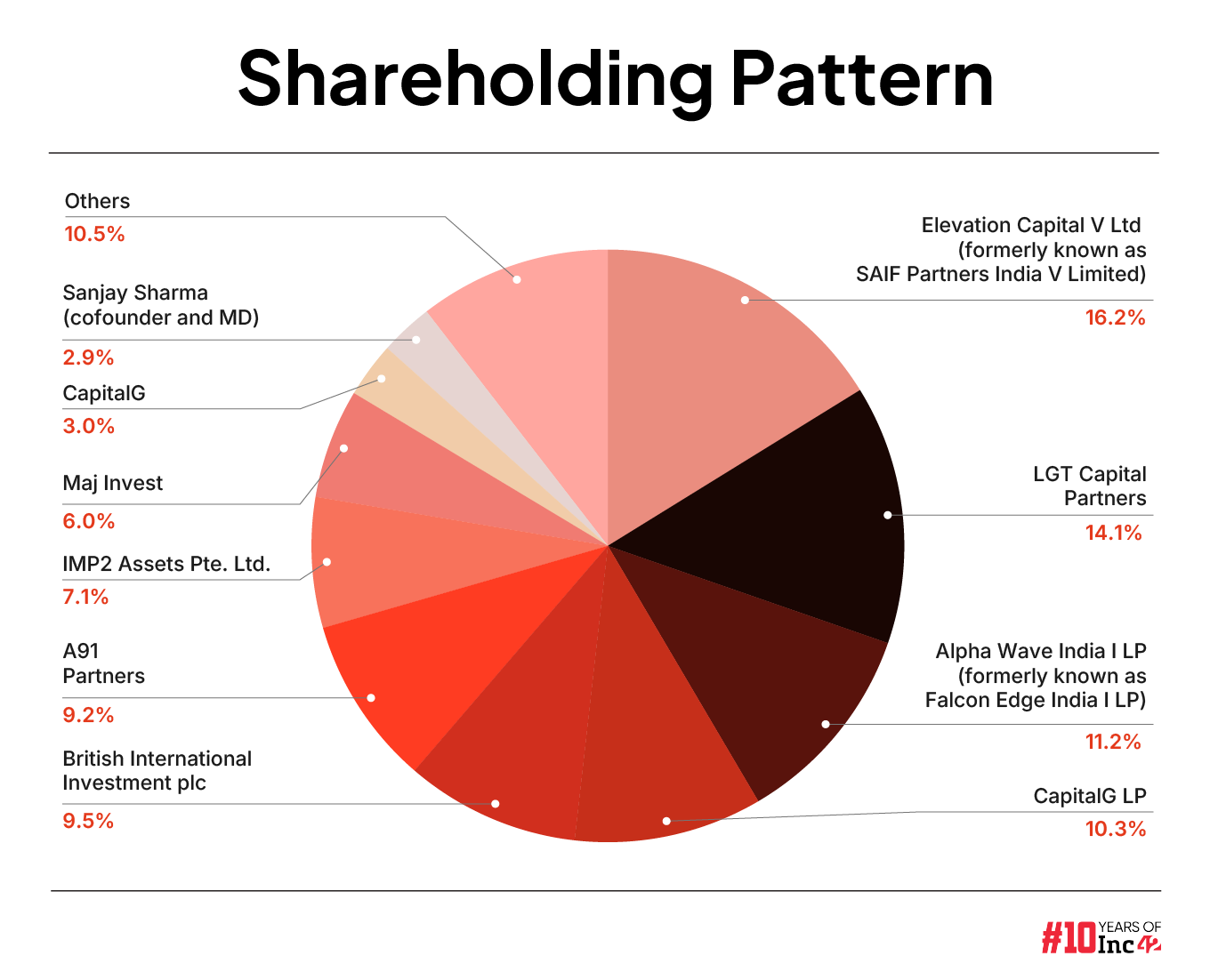

Now, let’s take a look at the key shareholders of the company.

Decoding Aye Finance’s Cap Table

Elevation Capital V is the largest institutional shareholder in Aye Finance with 16.19 % stake. However, it is not offloading any stake via OFS.

LGT Capital Invest Mauritius PCC with Cell E/VP owns a 14.13% stake in the company and is the second largest shareholder.

While Alpha Wave India I LP holds a 11.21% stake, CapitalG LP owns 10.26% of the company. British International Investment and A91 Partners own 9.51% and 9.23% stake, respectively.

Other major investors include IMP2 Assets and MAJ Invest Financial Inclusion Fund II K/S.

Among the individual investors, Aye Finance’s cofounder and MD Sanjay Sharma holds 2.89% stake in the company. Vikram Jetley who will be selling shares worth up to INR 7.64 Cr through OFS, currently owns 1.51% stake in the company.

Board Members

Govinda Rajulu Chintala

Govinda Rajulu Chintala is the independent director and chairperson of the board of directors of Aye Finance. He has been associated with the company since September 2023.

Chintala previously served as the chairman of the National Bank for Agriculture and Rural Development (NABARD) and the managing director of NABARD Financial Services Limited (NABFINS). Additionally, he has held positions as the director of the Bankers Institute of Rural Development (BIRD), a member of the board of governors of the Institute for Rural Management Anand, and a director on the board of the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Sanjay Sharma

Sanjay Sharma is the founder and managing director of Aye Finance. He holds a bachelor’s degree in mechanical engineering from the Indian Institute of Technology Bombay and a postgraduate diploma in management from the Indian Institute of Management Bangalore.

Sharma began his career in banking and financial services with the Hongkong and Shanghai Banking Corporation Limited in 1988. He has held senior positions with Standard Chartered Bank in India and the UAE, served as vice president at HDFC Bank leading the direct banking business, and played a pivotal role in launching retail asset products at ICICI Limited.

Sharma had also worked as senior vice president – customer operations and service delivery at Max New York Life Insurance Company Limited and as the CEO of Tamweel International, a UAE-based mortgage finance company.

Sanjaya Gupta

Sanjaya Gupta is an independent director of Aye Finance. He has been associated with the company since September 2023.

Gupta has extensive experience in the financial sector, having served as managing director at PNB Housing Finance Limited. He has also been a director on the board of India Shelter Finance Corporation Limited and previously worked with HDFC Bank, ABN AMRO Central Enterprise Services Private Limited Bank, and American International Group Inc.

Kanika Tandon Bhal

Kanika Tandon Bhal is an independent director of Aye Finance. She has been associated with the company since September 2023.

Bhal is a professor in the department of management studies at the Indian Institute of Technology, Delhi. She holds a bachelor’s degree from the University of Lucknow, a master’s degree from Kanpur University, and a PhD from the Indian Institute of Technology, Kanpur.

Vinay Baijal

Vinay Baijal is an independent director of Aye Finance. He has been associated with the company since August 2024.

Baijal has previously served as the chief general manager with the Reserve Bank of India and was associated with Microfinance Institutions Network. He has also been a member of the World Bank Task Force on International Standards on Credit Data Reporting and the National Core Committee for FATF Assessment of India in 2009.

Padmaja Nair

Padmaja Nair is an independent director of Aye Finance. She has been associated with the company since October 2024.

Nair currently serves on the board of UC Inclusive Credit Private Limited. Previously, she was general manager at the State Bank of India and vice president at SBI Capital Markets Limited.

Aditya Misra

Aditya Misra is a non-executive non-independent director of Aye Finance. He has been associated with the company since September 2024.

Misra is currently a director of investments at ABC Impact, a member of Temasek Trust Asset Management Pte. Ltd. He previously worked with Omidyar Network India Advisors Private Limited and A.T. Kearney Limited.

Key Leaders At Aye Finance

Krishan Gopal

Krishan Gopal is the chief financial officer of Aye Finance. He has been associated with the company since May 2023. Gopal has held senior positions in various organisations, including group chief financial officer at DMI Finance Private Limited and chief financial officer at Satin Creditcare Network Limited. He has also been associated with Price Waterhouse, Deloitte Haskins & Sells, and PNB Housing Finance Limited.

Vipul Sharma

Vipul Sharma is the company secretary, compliance officer, and chief compliance officer of Aye Finance. He has been associated with the company since January 2024. Previously, Sharma held roles in organisations such as AU Small Finance Bank Limited, Satin Creditcare Network Limited, Hero Group, Jubilant Bhartia Group, and Jaypee Group.

Niraj Kumar Kaushik

Niraj Kumar Kaushik is the deputy chief executive officer of Aye Finance. He has been with the company since March 2019. Prior to this, he served as executive vice president and head of central underwriting at Religare Finvest Limited and as national head of credit PSBL at Bajaj Financial Services Limited.

Ujual George

Ujual George is the chief operating officer of Aye Finance. He has been associated with the company since December 2020. George previously served on the management committee of RBL Bank as the chief of staff and head of transformation and held senior roles at Abu Dhabi Commercial Bank PJSC and Barclays Bank PLC.

Jinu Joseph

Jinu Joseph is the chief technology officer of Aye Finance. He joined the company in January 2023. Joseph has held senior technology positions at IDFC First Bank, Abu Dhabi Commercial Bank PJSC, Barclays Bank PLC, and other notable organisations.

Nancy Gupta

Nancy Gupta is the chief risk officer of Aye Finance. She has been associated with the company since May 2016. Gupta joined Aye Finance after completing her postgraduate studies.

Piyush Maheshwari

Piyush Maheshwari is the head of credit and field operations at Aye Finance. He has been associated with the company since March 2015. Maheshwari previously worked with organisations such as RBS Business Services Private Limited and J.P. Morgan Services India Private Limited.

Sovan Satyaprakash

Sovan Satyaprakash is the head of strategy and product at Aye Finance. He has been with the company since May 2016. Previously, Satyaprakash was associated with Tata Consultancy Services.

Ankur Sharma

Ankur Sharma is the head of human resources at Aye Finance. He has been with the company since February 2018. Sharma has previously worked with Raymond Limited, Dr Reddy’s Laboratories Limited, and Evalueserve SEZ.

Tejamoy Ghosh

Tejamoy Ghosh is the head of data science and artificial intelligence at Aye Finance. He joined the company in March 2019. Ghosh has previously been associated with Quatrro Processing Services Private Limited and WNS Global Services Private Limited.

Kapil Goyal

Kapil Goyal is the head of internal audit and vigilance at Aye Finance. He has been with the company since November 2023. Goyal is a chartered accountant and has previously worked with Home Credit India Finance Private Limited and Jubilant FoodWorks Limited.

Akash Damodar Purswani

Akash Damodar Purswani is the head of collections at Aye Finance. He has been associated with the company since September 2019. Purswani has previously worked with Religare Finvest Limited, Bajaj Finserv Limited, and Citicorp Finance (India) Limited.