Just days before Swiggy’s $1.3 Bn IPO, cofounder and CEO Sriharsha Majety responded calmly to a question about what Swiggy

The emphasis was on user retention and engagement across all verticals. “The target is really to see 110 Mn active users who transact at least 15 times a month across food delivery, quick commerce and other verticals,” Majety told Inc42.

The seemingly plain remark underscored Swiggy’s transition from a food delivery app to — soon — pretty much everything an individual needs at a short notice. All this in the push towards maximising the share of the consumer’s wallet — whether it is good ol’ food delivery, an Instamart order or indeed a concierge service.

This after the transition of the last 24 months to cater to the quick commerce boom, which has already changed the company’s approach to delivering convenience.

The quick commerce opportunity allowed Swiggy to see the bigger picture at the end of that road, and even as it has dedicated most of its time and energy in 2024 to the IPO, we are starting to see a glimpse of this bigger picture too.

lockquote>

In the year ahead, Swiggy might change even further if the company’s plans take off — and we will come to those — but for now, it’s time to bask in what was a monumental 2024 for the company.

Swiggy’s $1.3 Bn public listing is one of the largest among new-age tech companies in India, and while it did eventually arrive at the end of the year when there was already plenty of buzz for startup IPOs, this was not the case at the beginning of 2024.

Swiggy’s Road To The IPO

By the time, Swiggy had made its confidential filing with SEBI for an IPO in early 2024, Zomato had already reported three consecutive quarters of profits. So naturally, even before Swiggy’s financial state was clear, there were comparisons to Zomato’s bottom line/

As per its last financial statement, Swiggy was loss-making and at the time, the company had claimed some degree of profitability in food delivery, but nothing close to Zomato.

Naturally, there was uncertainty on whether Swiggy could sway the public markets with its scale alone. So the company focussed on cutting its cash burn earlier this year, became leaner and limited marketing expenses.

It began the year by laying off 400 employees in January 2024. Sources told us that these cutbacks targetted those with high paying roles in tech, marketing and business roles. With Swiggy investors such as Invesco and Baron Capital marking down the value of their investment in the company, much of the bullishness around a Swiggy IPO was waning.

Besides cutting costs, the company focussed heavily on revenue from the food delivery business. The platform fee addition in 2023 had helped to a large degree, but Swiggy also doubled down on ads for its restaurant partners and its going-out vertical Dineout.

A former senior marketing executive at Swiggy told Inc42 that the company halted many of its experiments at the time, as Majety clearly wanted to take the company public by the year end and that meant focussing on the bottom line.

“He [Majety] could not stretch the timeline because of investor pressure. And at the same time the company went conservative when it comes to expanding businesses despite Zomato and Zepto sitting on heavy cashpile and eyeing expansion,” the executive said.

lockquote>

Competition with Blinkit and Zepto was already heating up for Swiggy’s Instamart, and it became clear that the company had to dedicate resources for scale on quick commerce.

In fact, Zomato-owned Blinkit was close to reaching breakeven by the end of FY24, whereas Swiggy was still saddled with losses.

Then there was Zepto which raised billions of dollars to press ahead with the revenue advantage.

It’s not surprising then that there was nervousness around Swiggy’s IPO fortunes, and the confidential filings didn’t help soothe these nerves.

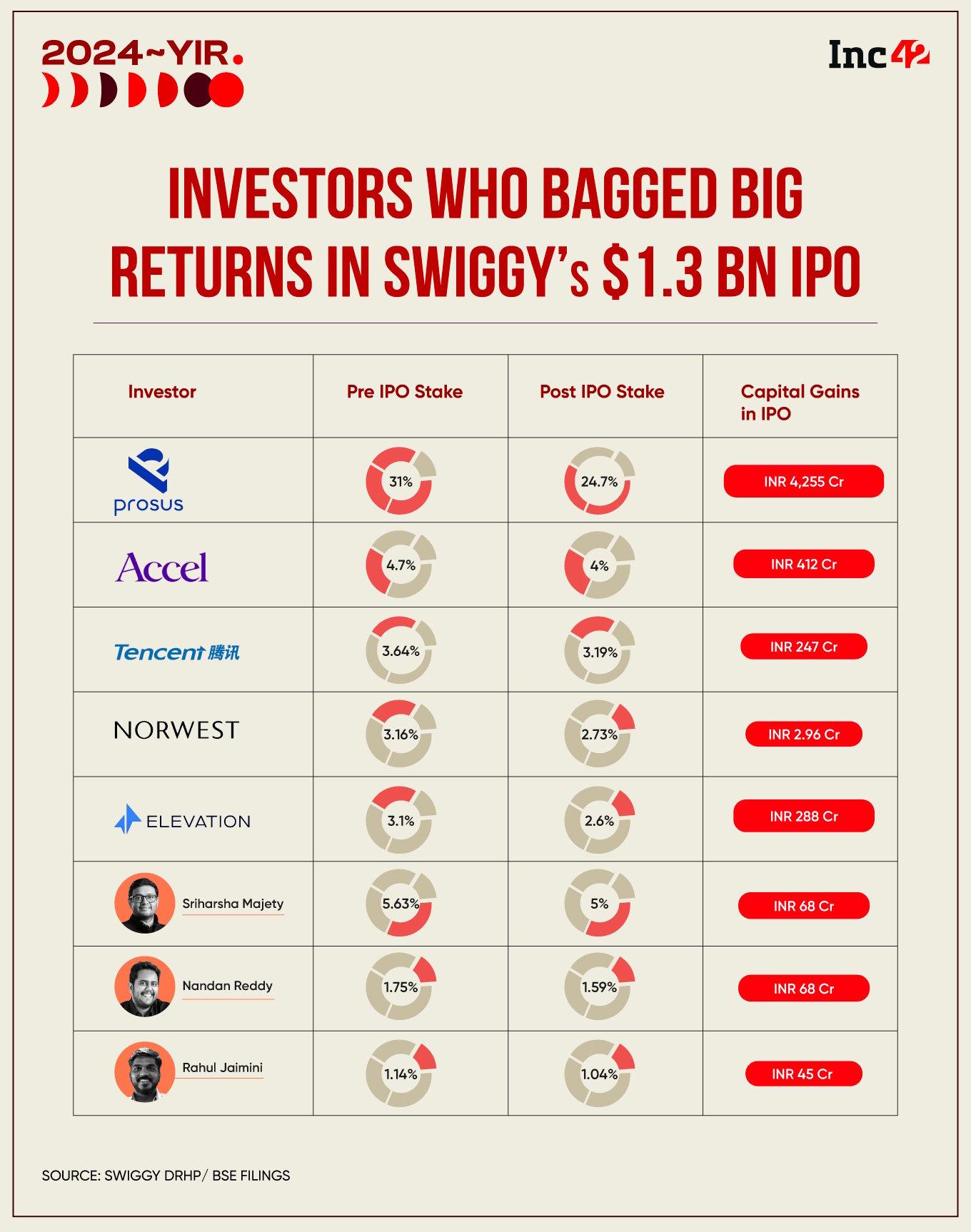

Some of those concerns were allayed when Swiggy backer Prosus which held a 31% stake in the company pre-IPO said that the company had hit the INR 10,000 Cr revenue mark in FY24. This was the first major positive sign for the IPO-bound company.

Confidential filings allow the company documents to remain private until the company receives a SEBI nod and finally plans to go ahead with the IPO.

“Swiggy was the first tech startup to go public via the confidential route. There were concerns about the confidential filing route especially when Zomato, Zepto were in headlines for a major part of the year. The revenue scale gave confidence to institutional investors, family offices which were looking to invest in the company before the IPO,” a partner with a brokerage company based in Bengaluru said.

lockquote>

Stabilising Food Delivery

Post March 2024, Swiggy’s focus was completely on maximising the profitability of its verticals. Food delivery was the first on the table.

The core food delivery business has remained a cornerstone in the company’s quest to attain profitability. Pretty much every new feature introduced by the company this past year has been in search of increasing either order volume or order value.

Swiggy Food CEO Rohit Kapoor claimed that food delivery will continue to be Swiggy’s forte for the foreseeable future, and the company has set a target of 5% EBITDA margin for this segment in the next few quarters.

“It is an underestimation that there may be saturation in the food delivery market in India currently. Food delivery services are built on top of the restaurant sales. And it is a fact that restaurant penetration in India is still very low compared to those economies where the food delivery market is huge,” Kapoor told Inc42.

lockquote>

He expects the next phase of growth to not be limited to metros or Tier 1 cities, but these will be the primary markets for the company.

One new addition to the food delivery plate is Bolt, Swiggy’s 10-minute food delivery service. The company is especially proud of the fact that it is not relying on pre-made food and heating up packets to fulfil this service.

Sources close to the management believe that bringing the entire restaurant industry on the same page to achieve 10-minute delivery will be a bigger feat than anything else tried before on this front.

Food delivery CEO Kapoor revealed that Bolt now constitutes 5% of overall food delivery volumes and this will be expanded to 400 more cities.

“We are building Bolt for the long term and this is based on the demand we have seen being generated in the market for such deliveries. It should be emphasized that faster food deliveries are not necessarily based on cloud kitchen models which many are assuming. At Swiggy we are in fact working with branded restaurant chains for Bolt and making it operationally efficient. You are going to see many such Swiggy’s partnerships with existing and new restaurant partners announced soon,” he added.

lockquote>

It was also the year when Swiggy revamped its loyalty programme. In a bid to further shore up its revenue, the company launched an invite-only membership programme One BLCK in December at INR 299 for a three-month plan.

“Swiggy One BLCK is the business-class equivalent for our customers—refining the aspects that matter most to premium users: speed, reliability, and personalised care. With this launch, we’re setting a new benchmark for premium memberships in the industry,” Swiggy cofounder and chief growth officer Phani Kishan said at the time of the launch, indicating that One BLCK would stretch beyond food delivery and tie into other verticals.

Indeed, restricting any Swiggy analysis to food delivery is missing the point, so what happened with Swiggy Instamart in 2024?

Instamart’s Changing Colours

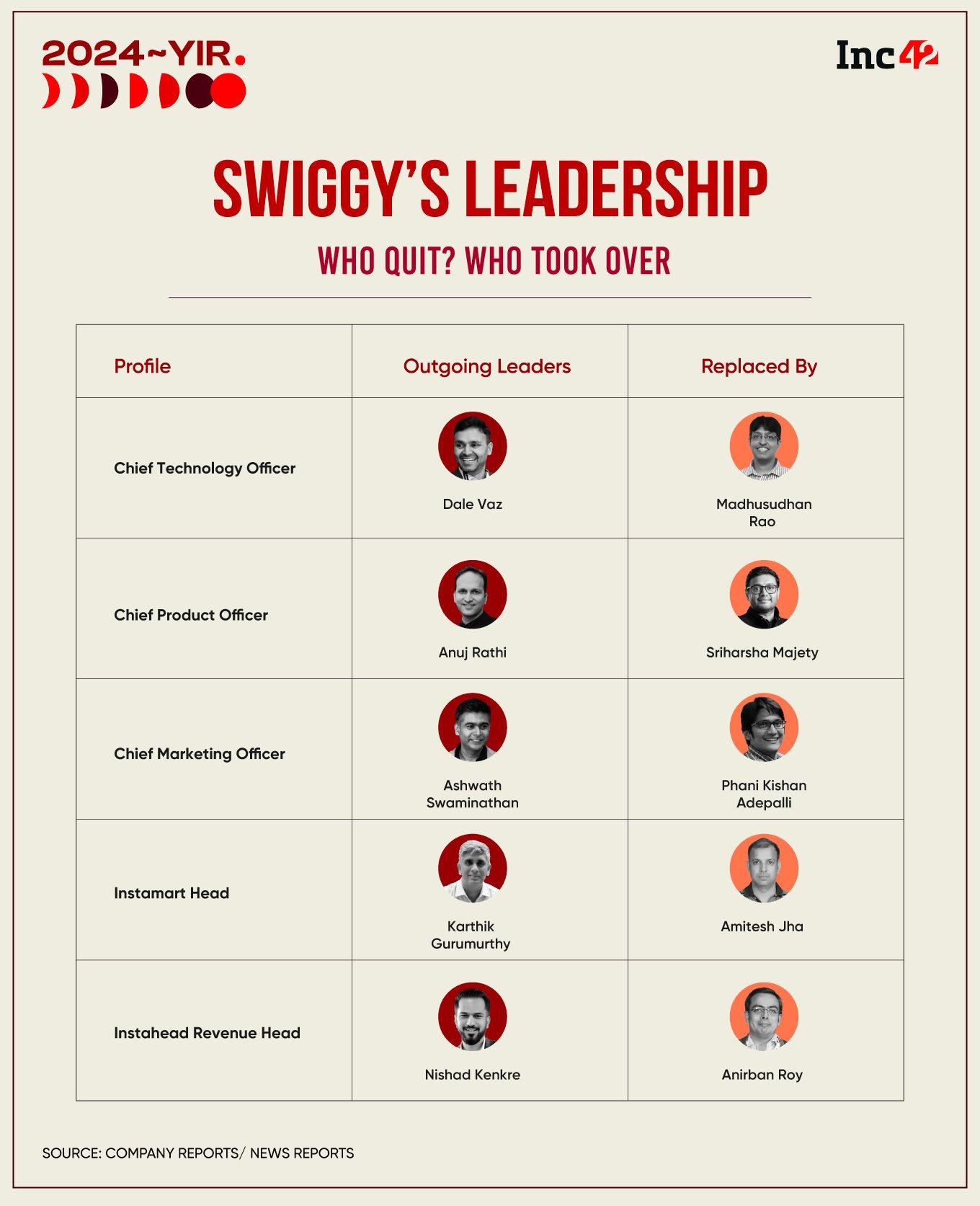

Even while Swiggy remained conservative in its approach in the first half of 2024 in its preparations for the IPO, Instamart’s expansion was the prime focus of the company. In fact, many of the personnel changes over the past year hint at the close eye on the leadership for Instamart.

In Q2 FY25, Swiggy’s Instamart business has grown impressively by 114% to touch adjusted revenue mark of INR 513 Cr while its GOV zoomed by 76% YoY to INR 3,382 Cr. This is roughly half of what Swiggy earned in all of FY24.

Even so, this pales in comparison to Zomato’s Blinkit, which has 2X higher revenue, or Zepto, which has 4X higher revenue.

This is not a worry for Swiggy given the transitions in the quick commerce space and the fact that new competition is emerging. A lot of this early revenue accumulation by Zepto and Blinkit will eventually be distributed among the competition.

For Swiggy, the focus is on mixed deliveries to cater to the transition in quick commerce from grocery to non-grocery. This the company believes will unlock profitable growth in the long run. The next big focus for Swiggy is on megapods or large dark stores where the company is looking at a mixed assortment of products, and staggered delivery timelines depending on the product category.

Crucially, megapods enable Swiggy to enter new categories at scale, if the management deems it necessary. The success of the recent pharmacy launch in Bengaluru could more quickly be replicated in other large dark stores in Delhi or Mumbai, for instance.

At a time when ecommerce giants Flipkart and Amazon India are making a foray into quick commerce, Swiggy’s management is unfazed. In fact, Swiggy CEO Majety has gone on record saying that assortment of categories and SKus, and quality will take precedence over speed in the long run.

lockquote>

With everyone having enough capital, the success factor will come down to product and consumer experience. Swiggy CFO Rahul Bothra told Inc42 earlier that discounts will not be a key lever to attract or retain consumers in the long run.

”We don’t think it will be a duopoly like food delivery. However, we have been able to scale our quick commerce rapidly from 30 minutes to 10 minutes delivery within a year, and we are not deterred by the entry of ecommerce giants. These players have operated in different market conditions and will need to first establish dense networks of fulfilment stores. Some of them tried their hands at 30-minute deliveries, but could not succeed,” Bothra told us earlier.

Then Came The IPO And Fat Returns For Investors

In the run up to its mega $1.3 Bn IPO Swiggy drew unique interest from Bollywood actors, sportspersons and other celebrities for its pre-IPO shares.

“The participation of celebrities including Amitabh Bachchan, Madhuri Dixit, Rahul Dravid, Zaheer Khan among others also intrigued the public markets working in Swiggy’s favour. They also priced the IPO right. An IPO of this size needed a modest valuation and Swiggy did just that which made it sail through,” the brokerage analyst quoted earlier in the story added.

lockquote>

According to BSE data, the issue received the highest interest from qualified institutional buyers (QIBs). The QIBs bid for 52.3 Cr shares against the 8.69 Cr shares on offer, translating to 6.02X subscription.

This was the sign of a premium listing, if not a blockbuster IPO. Early investors and Swiggy employees were sitting on potential blockbuster returns from listing, and it delivered.

Investors like Prosus which had already cashed out more than $1.5 Bn while paring down its stake in Swiggy made $500 Mn during IPO. Notably, Prosus had invested a cumulative $1.3 Bn in Swiggy for 31% stake. It still has a 24.7% stake in Swiggy worth more than $3 Bn at the current market price.

This has been a landmark for Prosus which also had to write off big cheques in BYJU’S in the same year.

Swiggy’s mega IPO returns in fact has given Prosus new zeal to write big ticket cheques for other new age companies in India, something which the company had eased off on earlier.

Fabricio Bloisi, chief executive officer of Prosus, earlier said that Swiggy is on a strong growth trajectory as a public company after having diversified into new categories and expanding into new cities.

“India remains a key growth market for Prosus given the country’s impressive digital transformation in the consumer and enterprise sectors. We are excited about the region and see huge opportunities for value creation including a strong IPO pipeline within our current portfolio,” he added.

lockquote>

In addition, we also saw investors like Accel, Tencent, Norwest sitting on pretty gains on their early bets.

Swiggy’s employees led by its leadership including Majety, and cofounders Rahul Jaimini and Nandan Reddy have also made a fortune from the company’s November listing.

“It’s been a long phase of sinking in for me and today is just another day of that sinking in. The last few months have been preparing for this day and what comes after and here we are,”Majety said during the Swiggy’s listing ceremony.

Besides this, 500 Swiggy employees who were allotted stock options across various tranches over the past few years, realised $1 Bn in gains from the listing, with many choosing to sell their shares and becoming millionaires overnight.

Truth be told, there was plenty of nervousness about a potential dud listing for Swiggy, which might have dented the company’s momentum, but despite stiff competition and some much-needed cost correction, the company is stepping into 2025 with plenty of enthusiasm, and big plans.

Testing New Waters

If the beginning of the year was about Swiggy taking cautious approach and not approaching much in the run up to its IPO, the company made some bold bets in the latter half of the year especially post IPO.

“There is a marked difference between how a VC funded company and a public limited company operates. These companies, although accountable to retail, institutional investors are not under pressure to give exit to VCs. That gives the company’s leeway to expand into new business verticals and experiment with new products. Majety, although a very careful leader, also has to try different revenue streams when disposable incomes are also growing in India,” said a former Swiggy executive, who worked in famed ‘M team’ led by Majety.

lockquote>

That’s the team that makes the key decisions around the verticals. And it’s been a busy few months for the M team.

Besides Bolt and pharma deliveries, which we touched on earlier, a big push has come on the going-out front. Swiggy is adding Scenes, a ticketing and events platform to the Dineout mix, as it looks to take on Zomato’s District.

Swiggy Food’s Kapoor emphasised that Swiggy’s dining out business model is working along the expected lines and that the company expects this to be profitable by next year. Besides dining out is expected to be even a bigger business with expansion into ticketing, events business through Scenes.

Unlike Zomato, which spent INR 2,048 Cr to acquire Paytm Insider, Swiggy is not looking at acquisitions just yet. Kapoor told Inc42, “The idea definitely is to make each business operation a sustainably profitable business for the long term as good public companies do.”

Another big bet is Rare Life, Swiggy’s concierge service, which is currently in pilot for the past two months, and is likely to be a major focus for the company given the revenue upside. Swiggy Rare Life membership begins at INR 50,000 per year for now, but more details on this will emerge in 2025 as the service makes an official launch.

Then there’s Yello, where we don’t quite have a clear picture, but it’s akin to Yelp in the US, where consumers can book and review service providers around them. Unlike Urban Company, Swiggy is staying true to its aggregator roots with Yello.

These are not exactly industry first bets but Swiggy has a reputation for being conservative with experiments. The Swiggy in 2025 might just surprise many.

The Big Target: Profitability

Undoubtedly, now that it has hit the IPO milestone, Swiggy will be gunning for profits. Zomato reached there more than a year after it got listed.

Swiggy Food CEO Kapoor told Inc42 that the company also expects to post a profit on a consolidated basis in the next 4-5 quarters.

In its last earnings report, Swiggy said that it expects its business to achieve adjusted EBITDA profitability on a consolidated level in the third quarter of FY26.

While Majety led firm said that the food delivery business is already profitable and its going out business is expected to be profitable by the end of FY25. The big burden is on Instamart.

Karan Taurani of Elara Capital said Swiggy can reach breakeven at a consolidated level in next two years, even though Instamart is still posting a loss. As a result of the competitive intensity, Swiggy’s execution has improved, he believes.

When it comes to the public markets view, Swiggy still has a lot of room for growth in valuation. The company may see a 20% valuation discount to Zomato by the time it reaches profits, due to the relatively lower scale of revenue.

Swiggy has said Instamart is still in its investment phase, and has outlined a target of FY27 for standalone profit in this vertical. But considering Zomato’s Blinkit is almost near breakeven, a stretched timeline between the profitability of two rivals which are also public limited companies now can impact its market cap.

lockquote>

Going public means Swiggy has to work under a bigger spotlight than ever before. Naturally, Zomato has set a benchmark when it comes to scaling up a consumer services company, but Swiggy is going for a completely different approach, looking to add hundreds of millions of engaged users across several verticals —creating a consumer services stack, in some ways.

Theoretically, this is a great strategy to boost profitability in any business if each vertical has scale by itself, but Swiggy also has to invest in growth for each vertical over the next few years to truly unlock the profits. This will be a bit of a tightrope walk.

And for much of 2025, till at least the food delivery vertical turns profitable, Swiggy has to manage this balancing act.

[Edited By Nikhil Subramaniam]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)