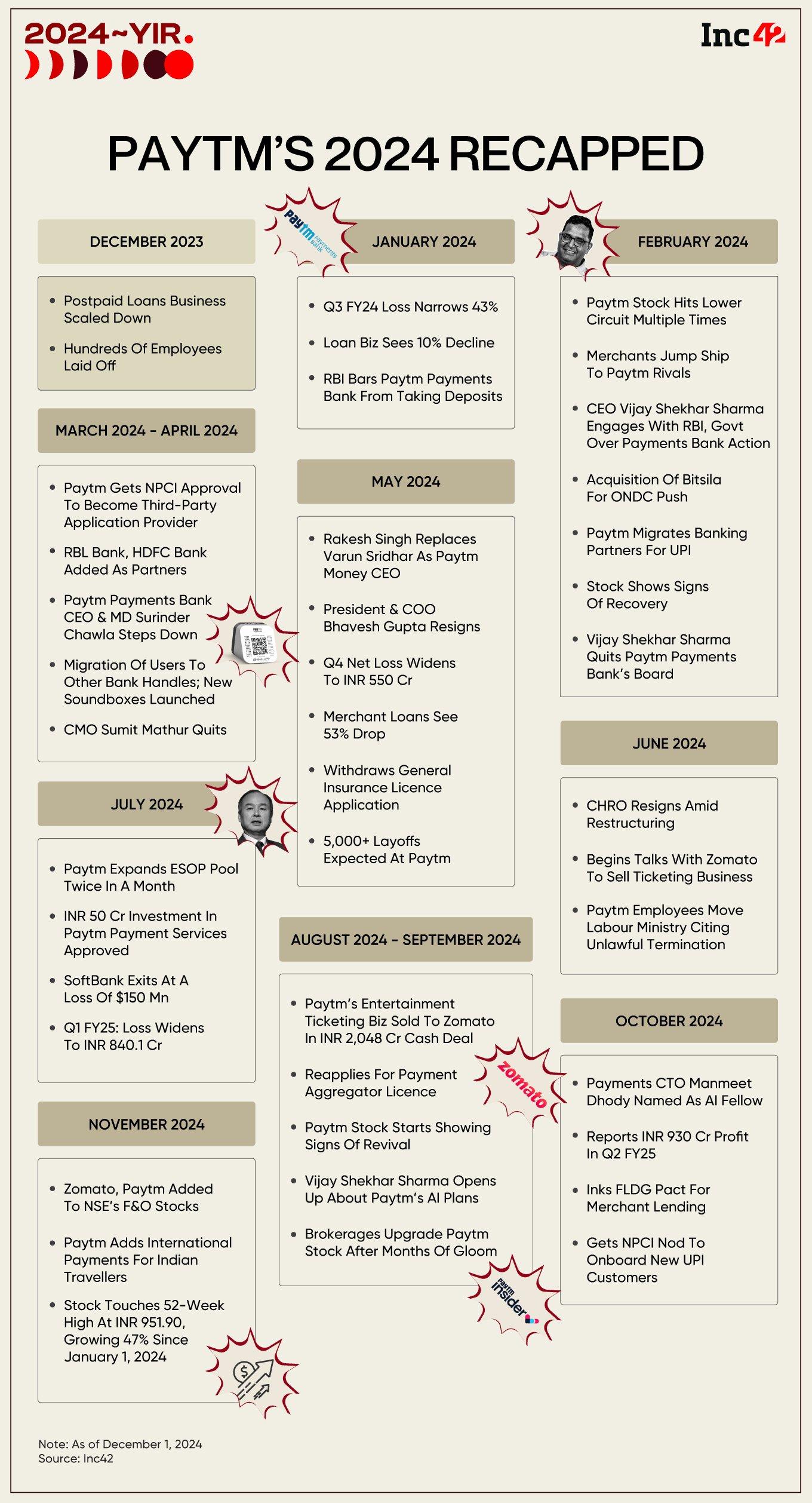

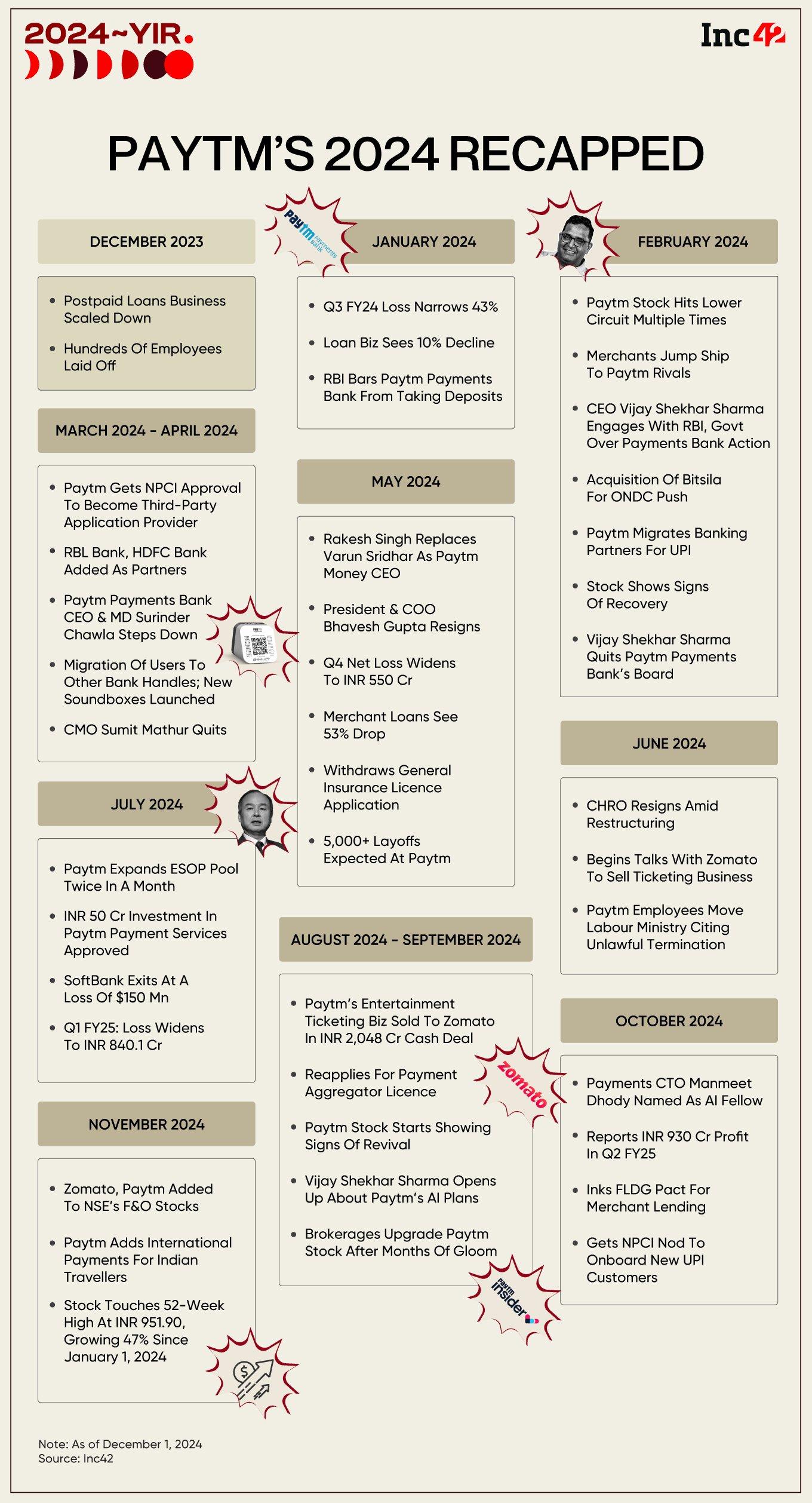

Paytm’s 2024 was a mirror image of 2023.

The fintech giant finished 2023 on a low after coming very close to cracking profitability, while in 2024, the tale was reversed — a bleak beginning followed by a more optimistic finish.

But if we have learnt anything from the past year, the road ahead is unlikely to follow this neat pattern for Paytm

Even though we have seen a lot of bullishness around Paytm towards the end of 2024, whether it continues will come down to how the company competes against rivals, especially sing they did not suffer the disruption that Paytm did earlier this year.

As we count down to 2025, it’s worth taking a look at why Paytm — the largest fintech company in India by revenue — is still not out of the deep waters, and look back at how 2024 treated the company.

But first, a look at our recap of other unicorns and listed giants from this past week:

- Reliance’s AI Era: Reliance ended 2024 by completing the $8.5 Bn deal with Disney, and adding to its Jio FInancial Services platform and prepared itself for the AI revolution with new partnerships and products

- Zepto’s Rapid Rise: If the $1.3 Bn fundraise was not enough for Zepto, the startup also outpaced Swiggy’s Instamart, and Zomato’s Blinkit in terms of revenue, earning more than both these giants combined. Here’s the Zepto in 2024 story

- Swiggy’s Monumental Year: Swiggy’s $1.3 Bn public listing eventually came when there was already plenty of buzz for startup IPOs, but this was not the case at the beginning of 2024 when there were several doubts about the company’s financial state

Paytm Swallows The AI Pill

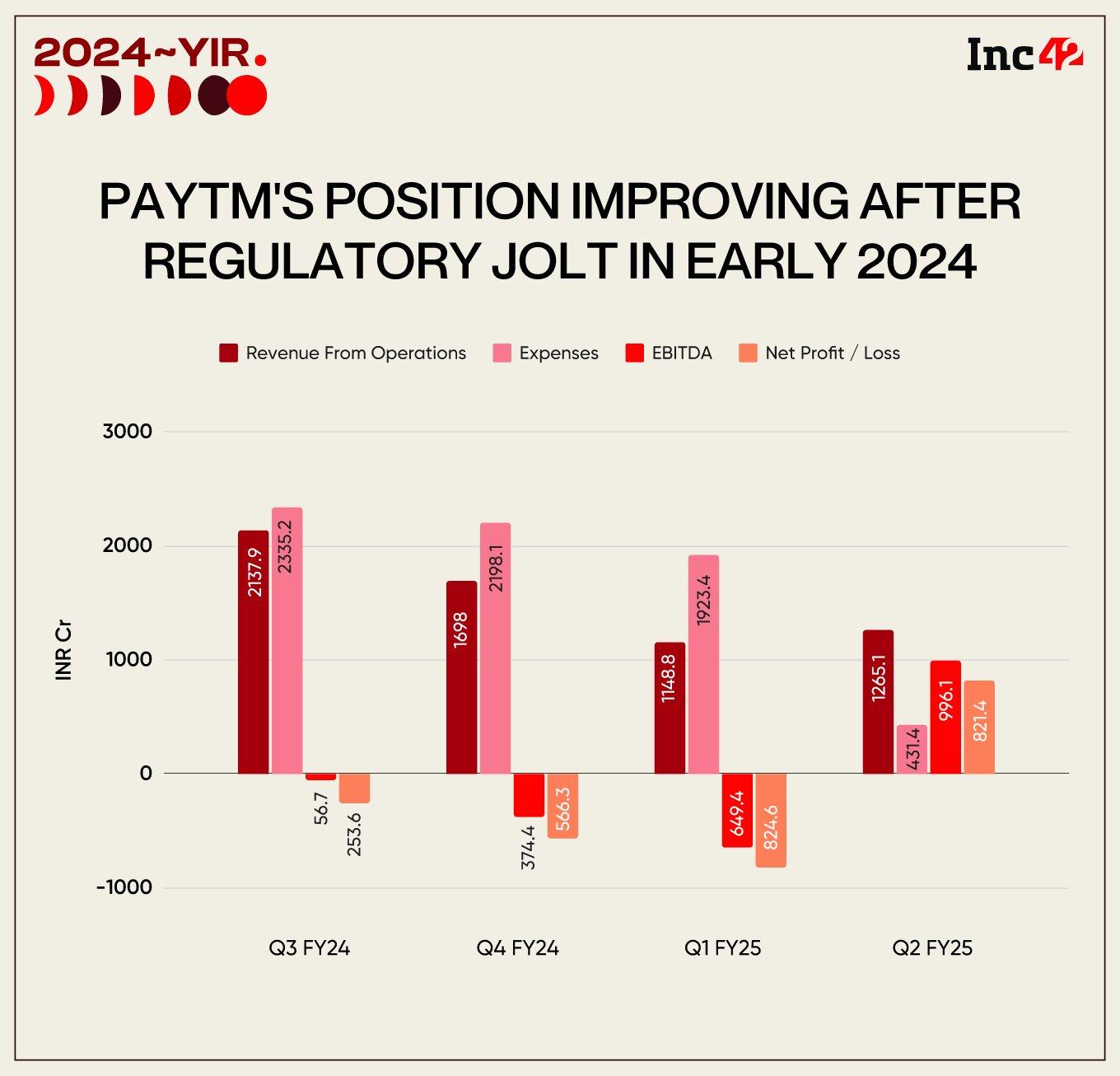

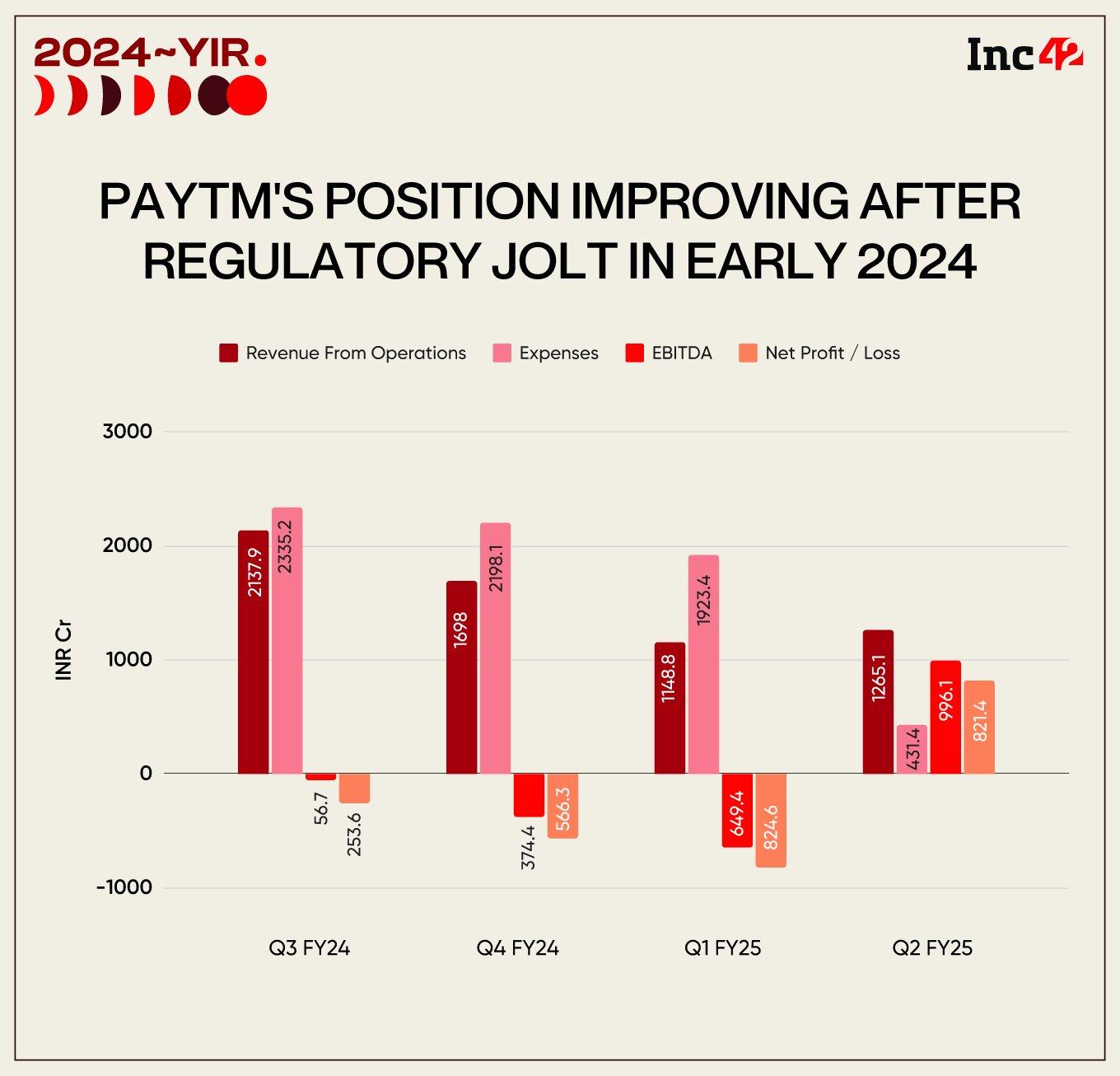

Towards the end of the year, Paytm founder and CEO Vijay Shekhar Sharma called on Indian entrepreneurs to build “AI-first companies”. That tells us a lot about what 2024 was all about for Paytm, especially after the RBI action on Paytm Payments Bank (PPBL) in the first quarter derailed all revenue momentum.

Everything that followed those testing months in the beginning of the year can be framed through the AI lens. Paytm had cautioned analysts that it had to cut around INR 500 Cr in costs, and AI and automation was one way to get there, besides laying off on-ground employees from the sales team.

At the AGM in September, Sharma, for instance, said that Paytm is leveraging AI to develop new technologies, and has already integrated the technology across all its business segments. “Some technologies being built are so good, if you fork it out, it could become a standalone business vertical.”

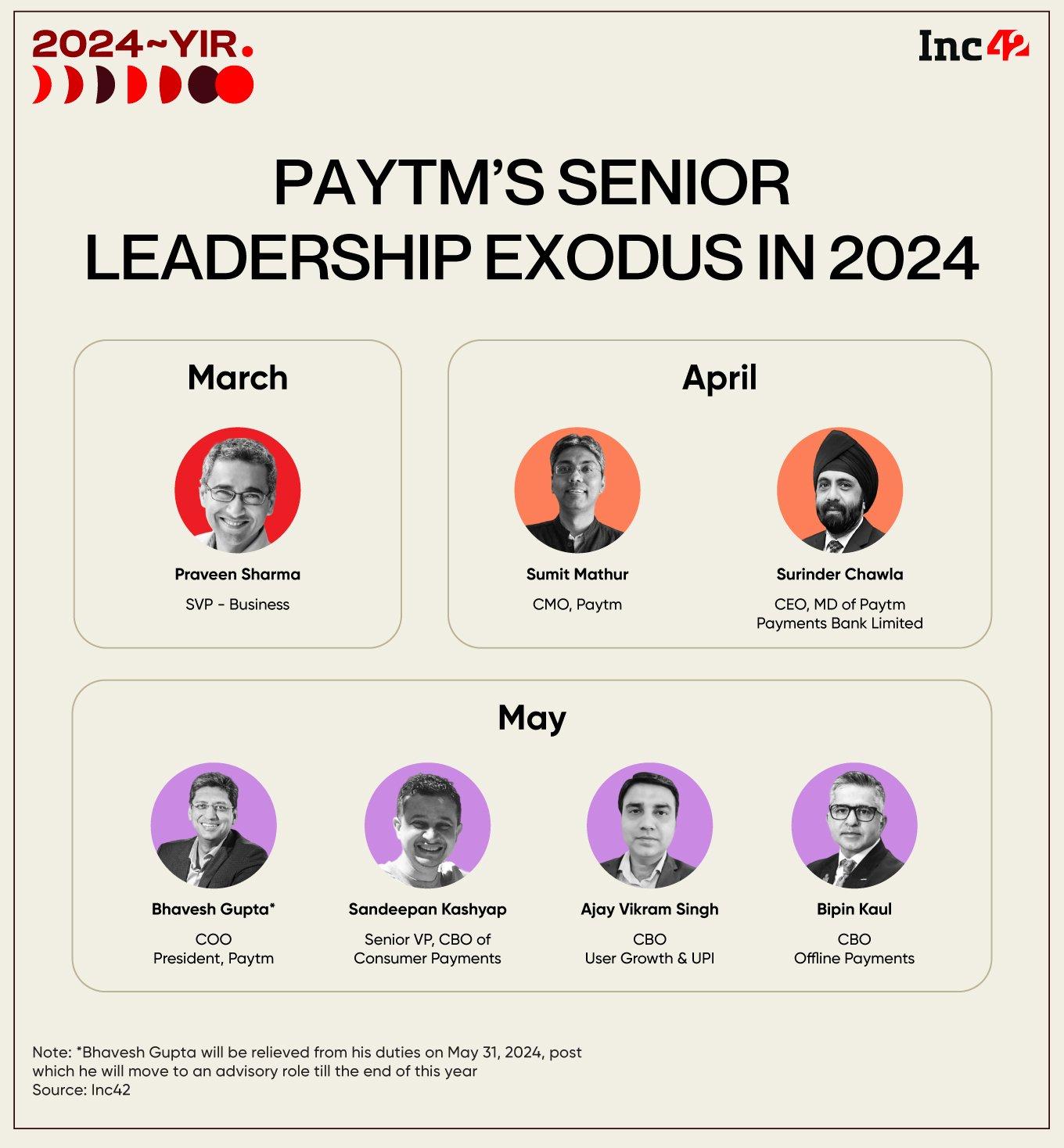

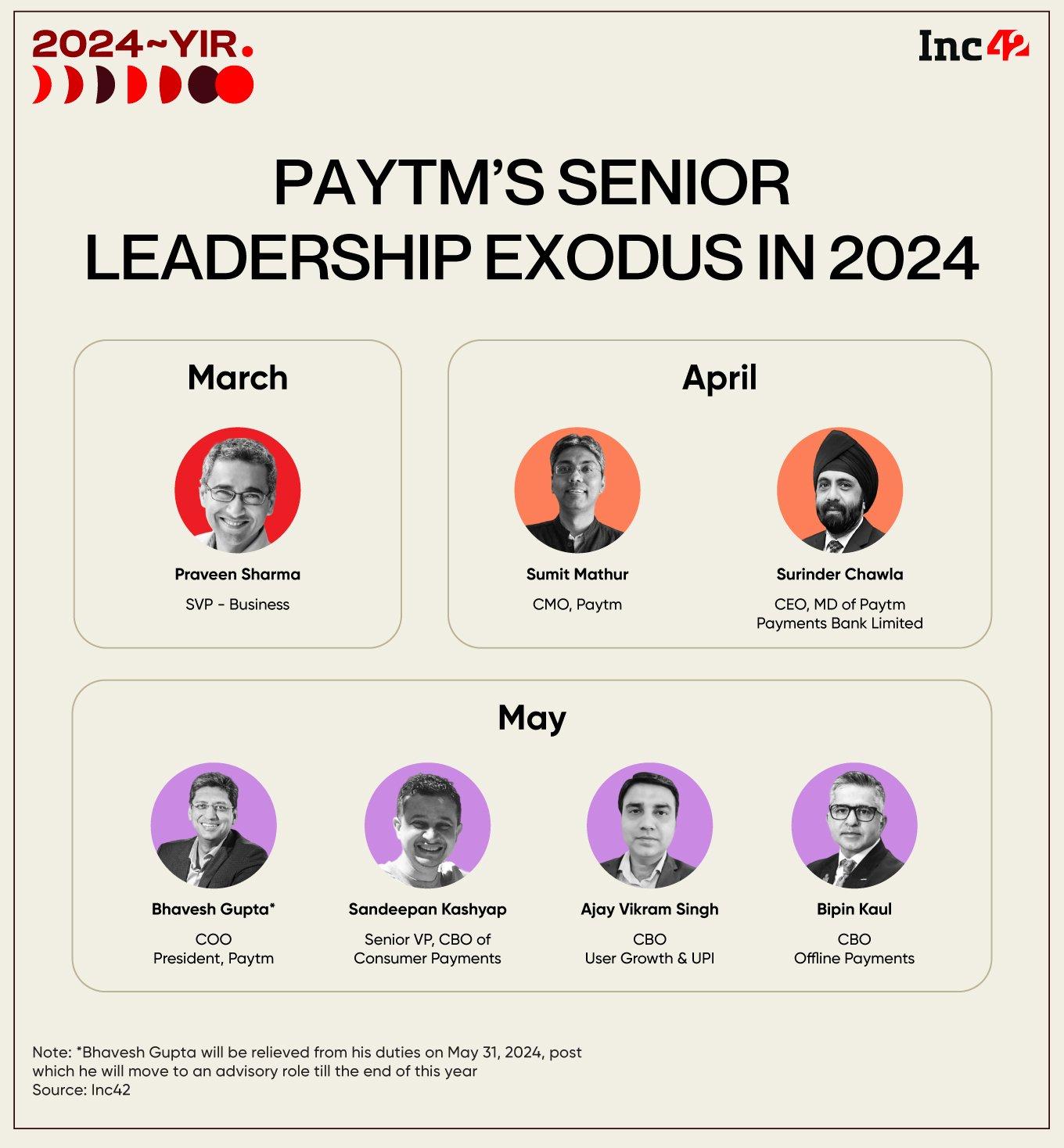

The past year was also a test of Sharma’s leadership as key employees such as COO Bhavesh Gupta, CMO Sumit Mathur, Ajay Vikram Singh (CBO of user growth and UPI), Bipin Kaul (CBO of the offline payments business) and Sandeepan Kashyap (chief business officer of the consumer payments vertical) all quit their positions.

Following this exodus, Sharma is said to have stepped in and taken charge of these key verticals, directly overseeing day-to-day operations and governance. This was also when the company decided to bank on AI and machine learning to fill the gap.

It named CTO Manmeet Dhody as “AI Fellow” to drive its projects related to AI innovation in business, and elevated senior VP of Technology Deependra Singh Rathore as its new CTO-Payments.

Interestingly, these two appointments showed that Paytm is thinking about the tech side of fintech, whereas many of the executives that quit had more extensive experience in the financial services industry.

Without explicitly saying it, Paytm flipped the AI switch and is now arguably putting technology first, while also cleaning up the verticals that increased its compliance and costs burden.

Sharma exclaimed that Paytm’s support staff costs have gone down by 60% in the past ten months. “The AI models that we are deploying and the costs that we are incurring are significantly low. I am happy to tell you that we have reduced 60% of our manpower cost on support in the last 10 months,” Sharma said in October this year.

Building A War Chest

The other big crutch that Paytm used was selling assets and bolster its cash reserves position. The sale of Paytm Insider to Zomato for INR 2,048 Cr in Q2 FY25 helped the company report a profit.

One can expect a similar boost for Paytm IN Q3, after the sale of its stake in Japanese digital payments firm PayPay Corporation for INR 2,364 Cr ($279.19 Mn) to SoftBank’s Vision Fund 2. These two deals, combined with the dependency on AI has put Paytm on track to take on the highly capitalised competition of PhonePe, Groww, CRED, Flipkart Super.Money, Jio Financial Services and others.

This was the biggest fear for Paytm in the weeks after the RBI action in January 2024. And now in 2025, the company can look to use its improved cash position to either raise an institutional round — like Zomato, Zaggle and Nazara — and push ahead on Sharma’s vision of getting back to the top of the consumer payments pile.

Some might say that Paytm lost its competitive edge when it decided to put all its eggs into the wallet business around 2021 and reduce its reliance on UPI. This meant that the company was very dependent on the PPI licence and this was severely dented by the RBI action on PPBL.

Paytm Steps Into 2025 Arena

Paytm is today gung-ho on being a UPI payments app, and has also looked to improve its margins on the lending side with default loan guarantee arrangements for merchant lending. But competing in the B2C fintech arena will not be easy especially after Paytm lost some of its market share this year.

PhonePe retained its top spot despite seeing a dip in its monthly numbers, with 7.4 Bn transactions in November, down over 6% from the prior month. Similar dips were seen by Google Pay and Paytm in second and third place. While Google Pay processed 5.7 Bn UPI transactions in November, 1.1 Bn transactions were facilitated by Paytm.

Flipkart-backed fintech super app super.money, Navi, CRED and Amazon Pay are hot on the trails of these market share leaders, and it’s looking increasingly like the UPI market share is determined by how much companies spend on customer acquisition.

This is exactly why Paytm’s improved cash position and its reliance on AI for service distribution and customer success can be a key weapon. But the competition is also going in this direction — technology is not a long-term advantage, but allows Paytm more room to compete.

Having said that, Sharma will continue to face pressure for profitability in 2025. Before the RBI action, Paytm was on track to hit profitability, but that’s now been pushed further into 2025. On paper, Paytm has improved its position in 2024, but this is just precursor to a competitive war in the fintech space.

Can Vijay Shekhar Sharma steer Paytm back to where it was in 2023?

Sunday Roundup: Tech Stocks, Startup Funding & More

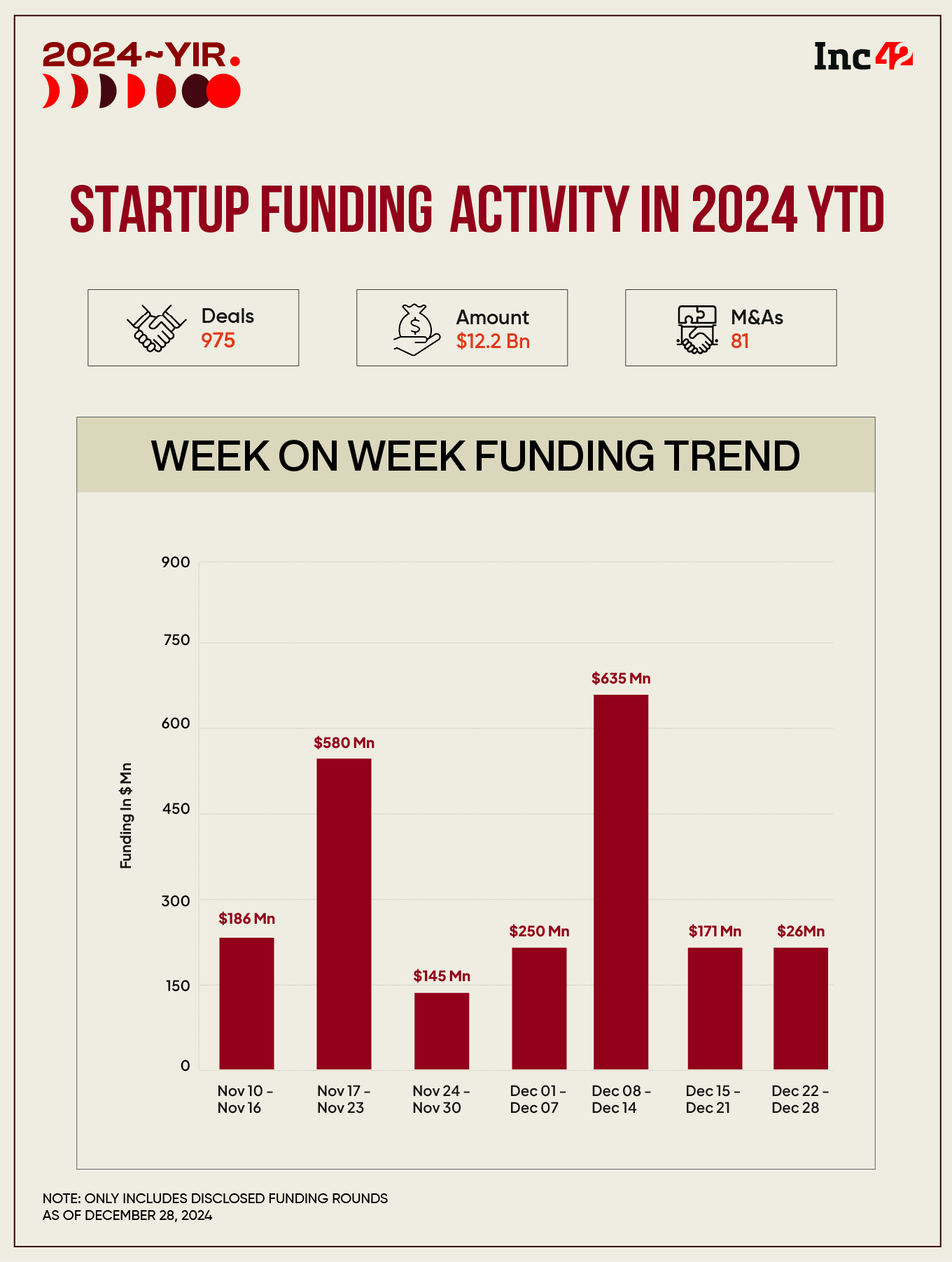

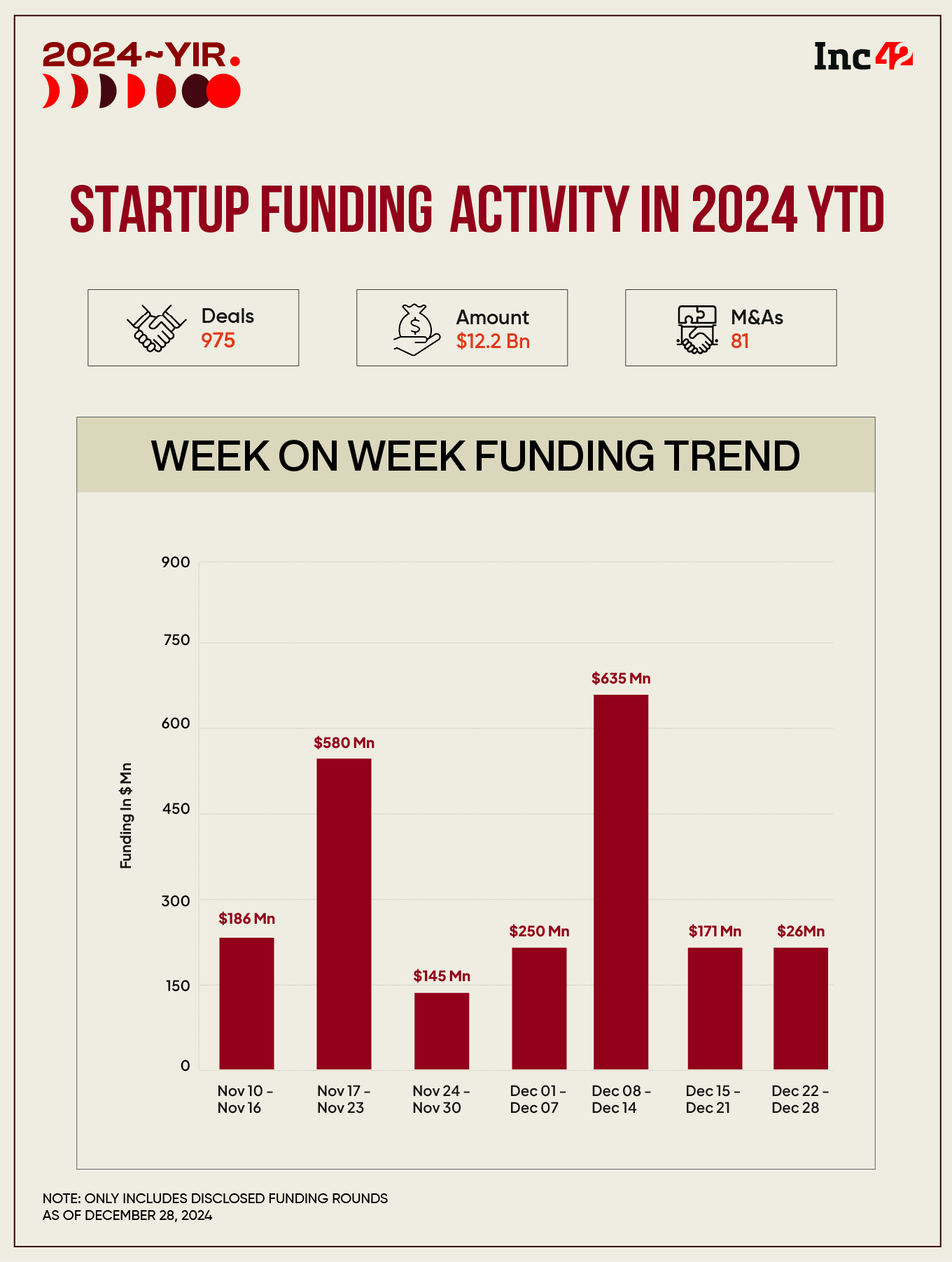

- Inc42’s ‘Annual Funding Report 2024’: Indian startups cumulatively netted more than $12 Bn in fresh funds during the year, up over 20% from last year, and stabilising to 2020 levels

- Jio Calls For Less Regulations: Week after closing its $8.5 Bn deal for Disney+, Reliance Jio has reportedly opposed the telecom regulator’s proposal to bring OTT content services under Indian Telecommunications Act, 2023

- UPI Boost: The RBI has announced that Prepaid Payment Instruments (PPIs) or digital payments wallets with full KYC will now be able to make UPI payments through third-party apps

- Ola Electric Exodus: Ola Electric CMO Anshul Khandelwal and CTPO Suvonil Chatterjee resigned this week, days after the exit of CHRO Balachandar N from the EV giant

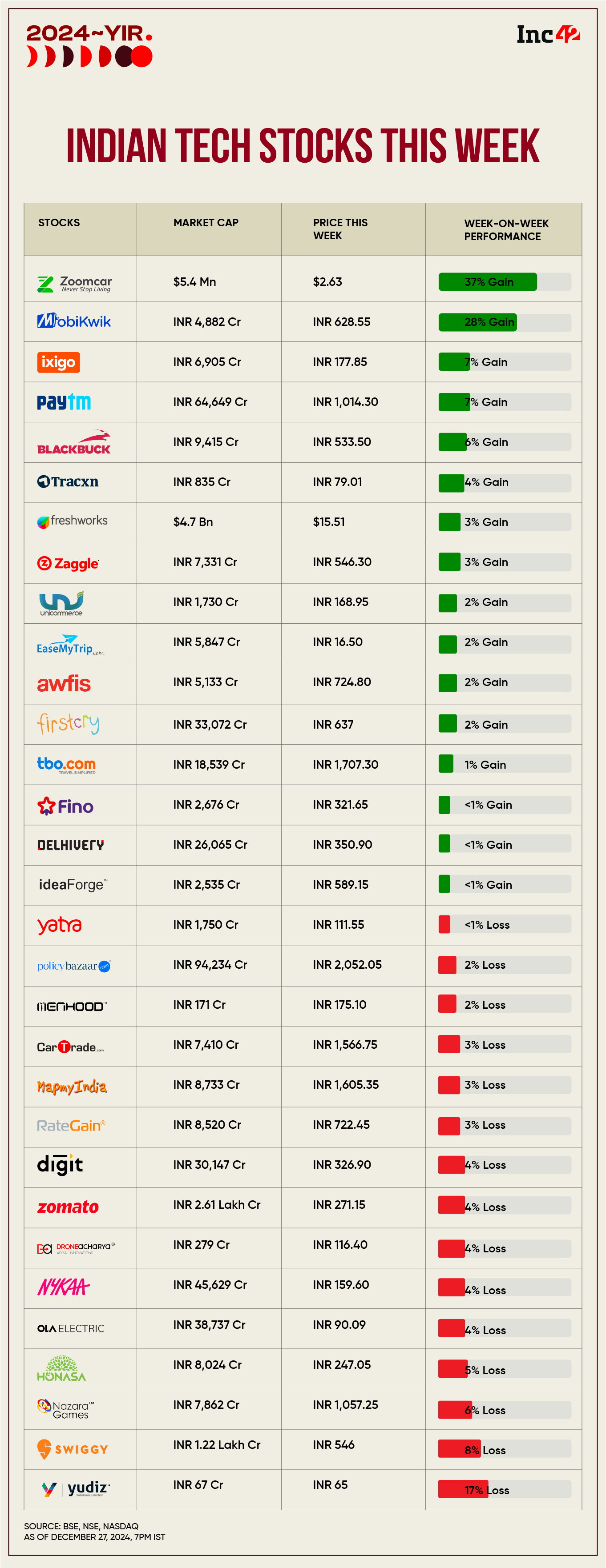

- Peak XV’s Bulk Deal: VC giant Peak XV Partners sold fintech major MobiKwik’s shares worth INR 81.63 Cr this past week via a block deal, after the stock saw a big rally