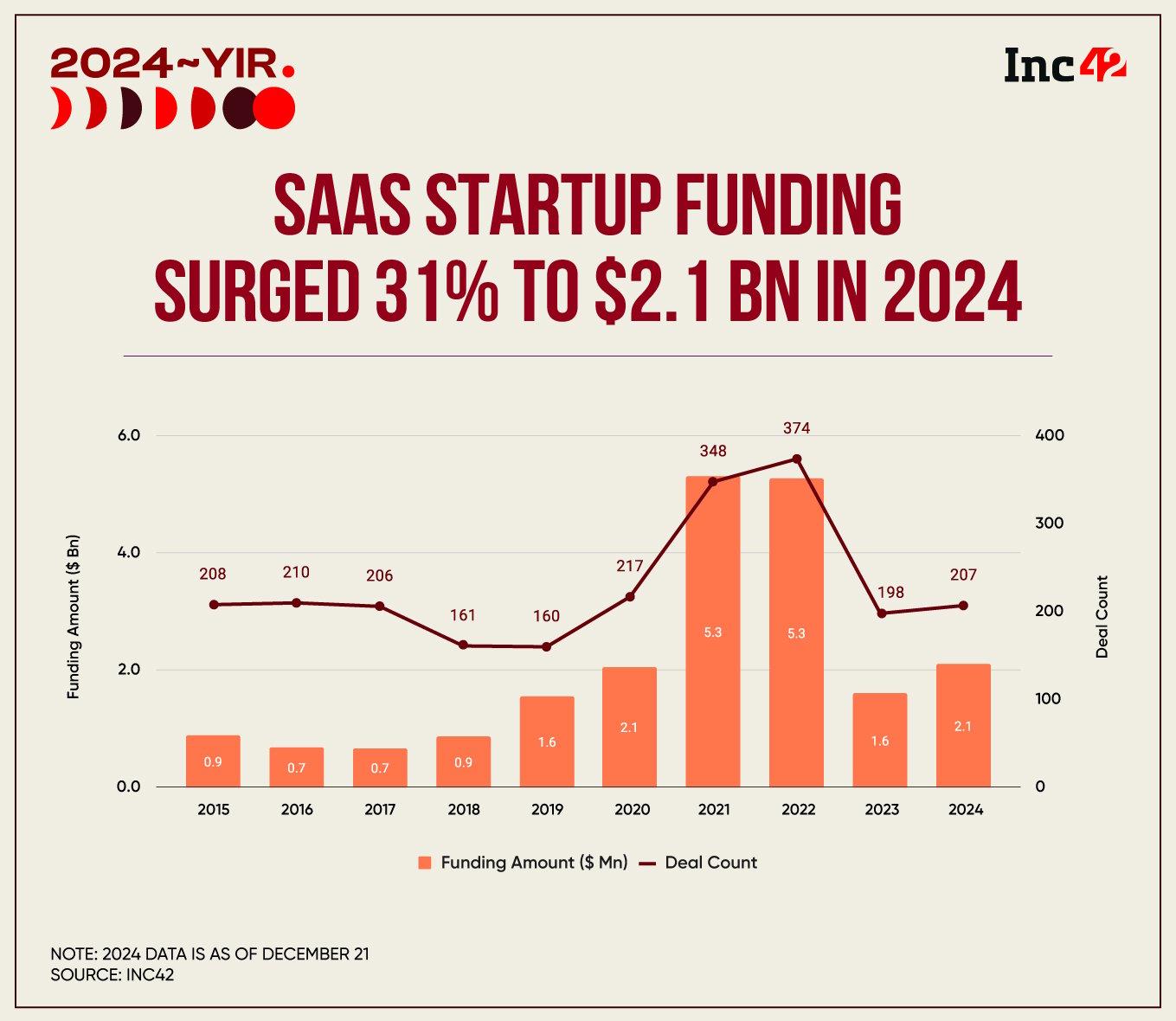

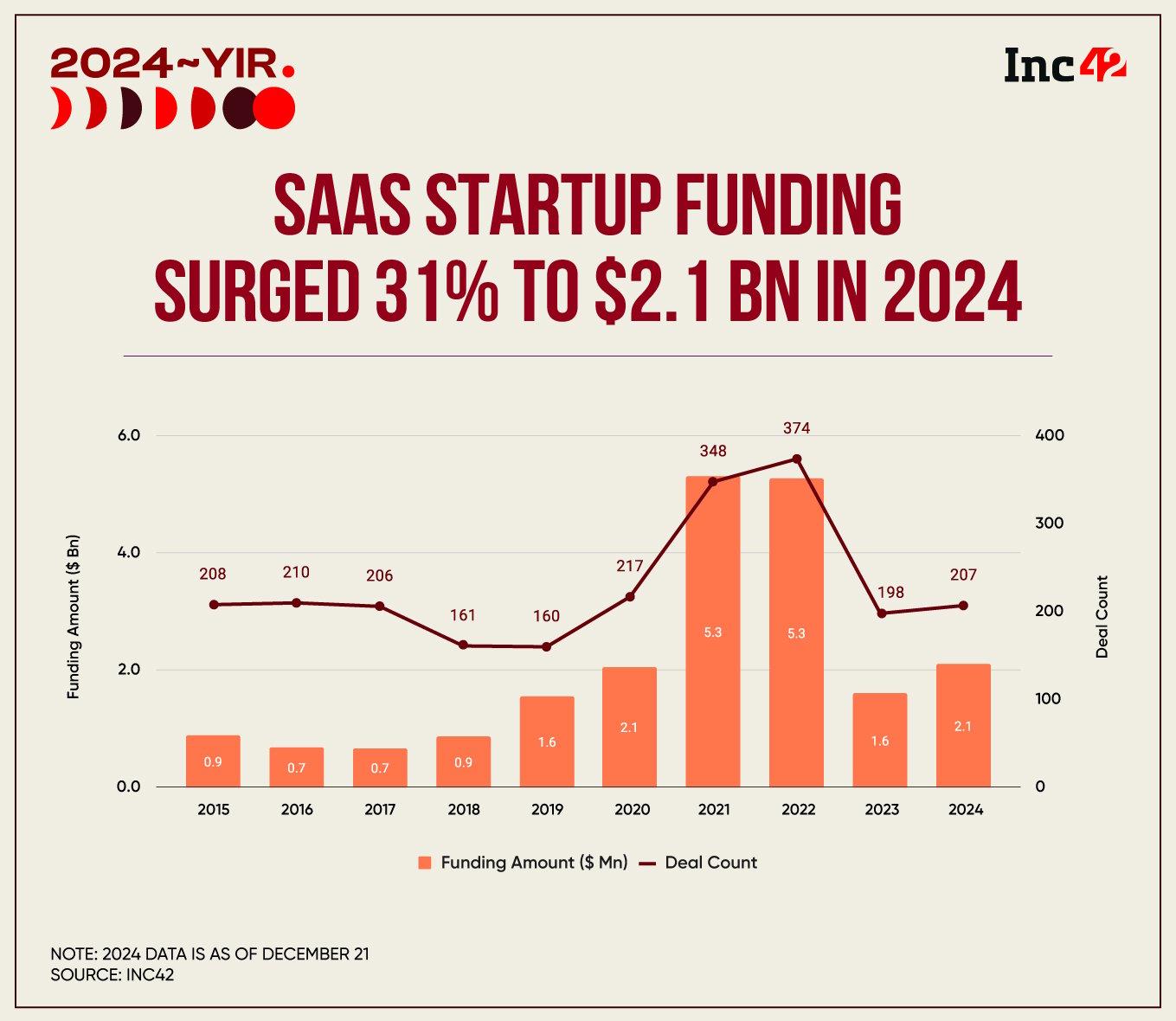

Alongside the funding increase, the deal count also rose 5% YoY to 207 deals

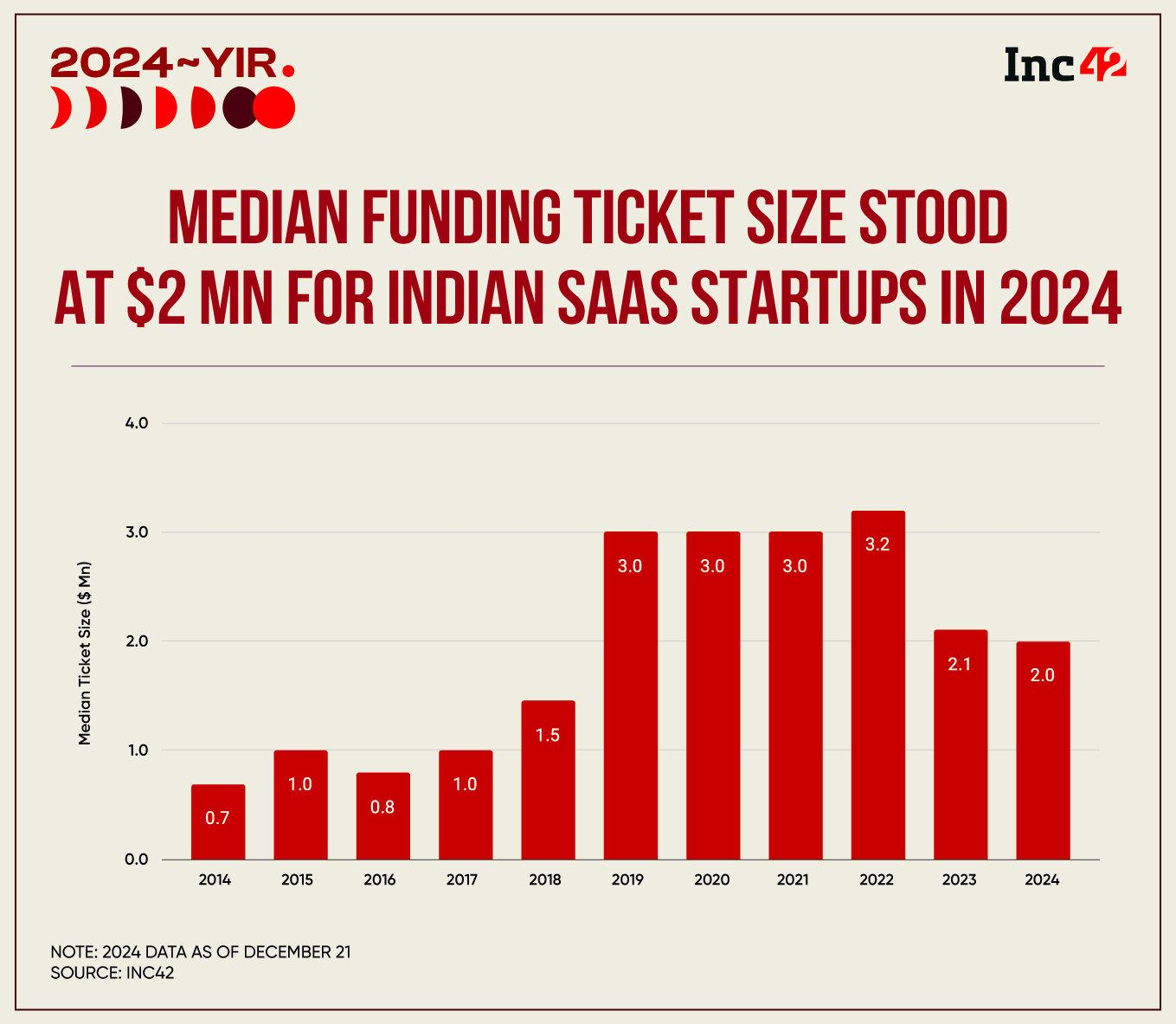

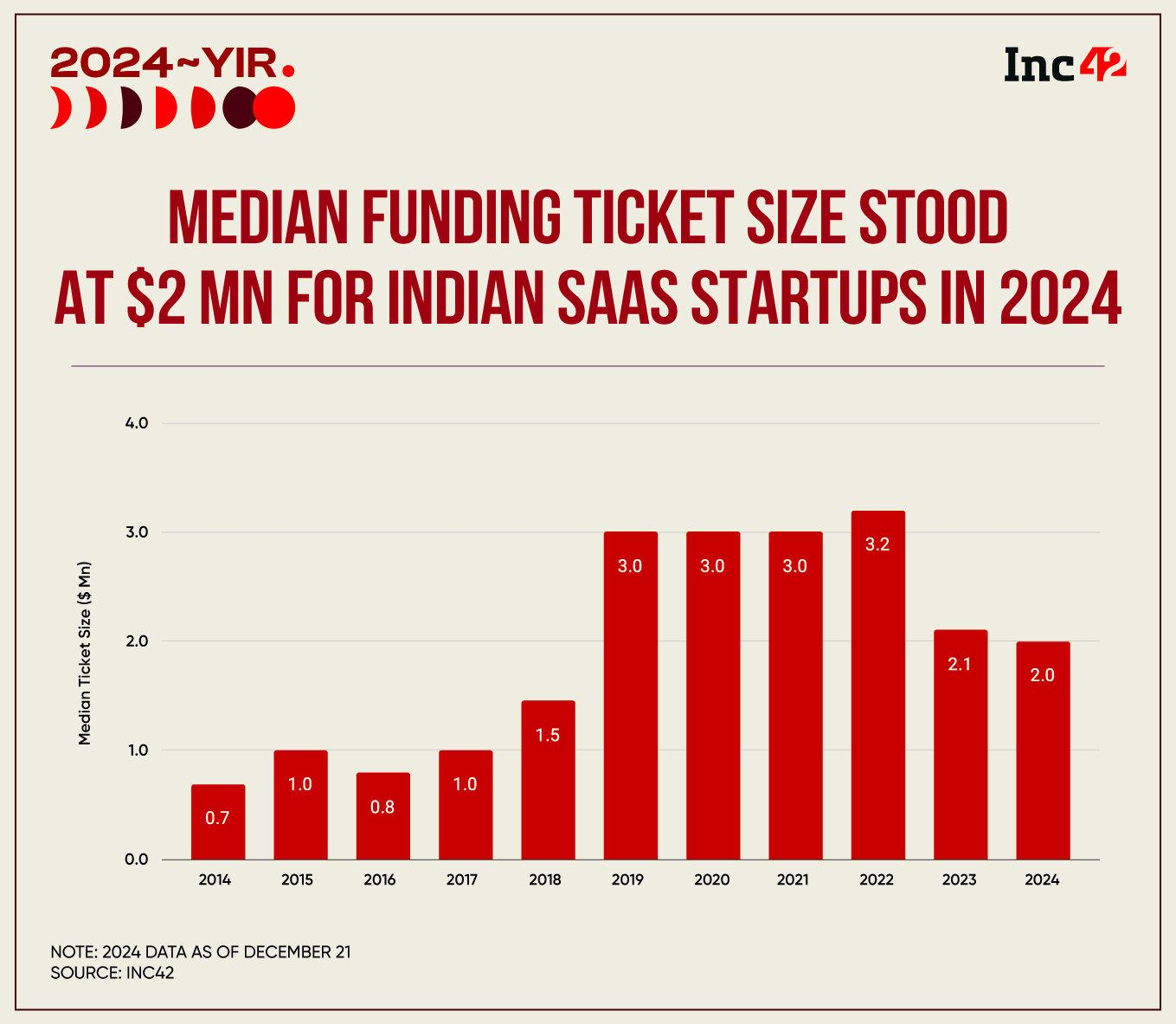

Despite the increase in funding and deal count last year, the median ticket size for SaaS investments was almost flat at $2 Mn in 2024 as against $2.1 Mn in 2023

Vertical SaaS startups raised $800 Mn in 2024, which constituted over 38 of the total capital bagged by SaaS startups last year

At the outset of 2024, things appeared bleak for India’s SaaS sector. SaaS startups experienced a massive funding decline in 2023, dropping to 2019 levels at $1.6 Bn. This sharp decline came after the funding boom of 2021 and 2022, when Indian SaaS startups raised a whopping $5.3 Bn each during the two years.

While things are still a far cry from the funding boom era, it appears that the sector is now on the recovery path, much like the broader Indian startup ecosystem. In 2024, SaaS startups in India raised a cumulative $2.1 Bn in funding, marking a year-on-year (YoY) growth of 31.25%, according to Inc42’s ‘Indian Tech Startup Funding Report 2024’. Alongside the funding increase, the deal count also rose 5% YoY to 207 deals.

So, what fuelled the uptick in funding numbers? The rise of artificial intelligence (AI) disrupted the sector as VCs rushed to invest in AI-driven startups and companies. In addition, Indian SaaS players have always been a mainstay of investors on account of their offerings catering to global audiences as well as a high-quality and affordable talent pool in the country.

However, the recovery remains modest. The caution in SaaS funding stems from the lessons learnt by investors from the market correction after the boom of 2021. At the height of the capital-fuelled era of 2021, SaaS startups were often valued at inflated multiples, leading to bloated valuations.

According to Sanjay Swamy, managing partner at Prime Venture Partners, SaaS is at an inflection point now due to the impact of AI. However, investors are not as enthusiastic about investing in AI-driven sectors as they were earlier.

“Looking at 2024, and possibly parts of 2025, it seems people are becoming more cautious about placing big bets. The earlier wave of enthusiasm, where companies were rushing to invest in AI without complete clarity, has passed. While some cheques were written liberally during that time, the approach now feels more measured,” added Swamy.

As a result, caution prevails even though investor interest in the SaaS sector remains strong.

Median Ticket Size Remains Flat

Despite the increase in funding and deal count last year, the median ticket size for SaaS investments was almost flat at $2 Mn in 2024 as against $2.1 Mn in 2023. This was significantly lower than the $3 Mn and $3.2 Mn median ticket size recorded in 2021 and 2022, respectively.

Ashwin Raguraman, partner at Bharat Innovation Fund, attributed this decline to the overvaluations during the 2021 and 2022 period. He said investors had to write big cheques then to maintain the same level of ownership. Besides, there was ample liquidity then and a fear of missing out on lucrative deals.

Another reason for the decrease in median ticket size, compared to the previous years, is the rise of micro VCs in India, who are now writing more checks at the early stage. Raguraman said that there has been about a 50% increase in seed rounds compared to 2021-2022, as a result of which the SaaS ecosystem is seeing smaller fundraises.

The Transition In SaaS Market

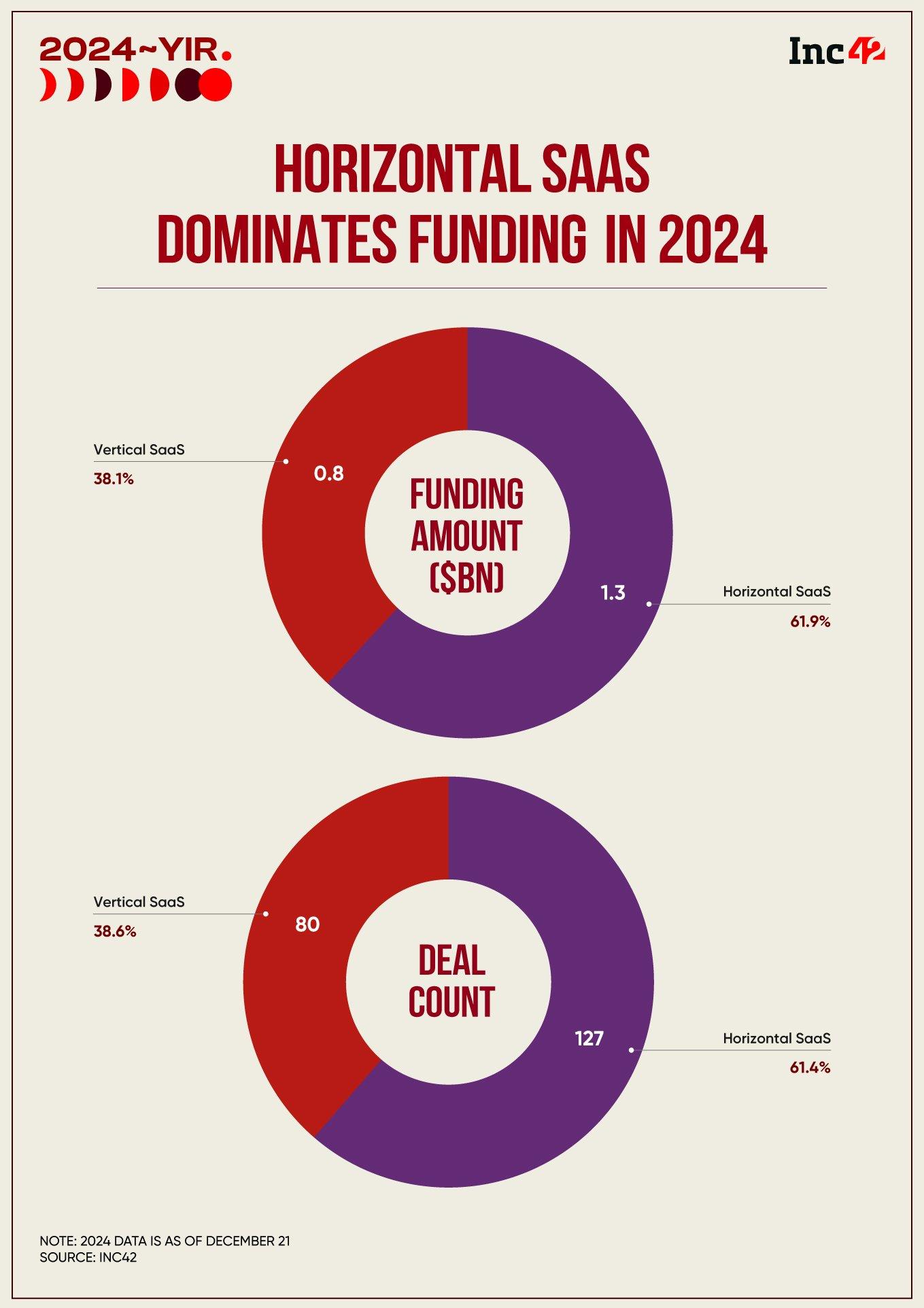

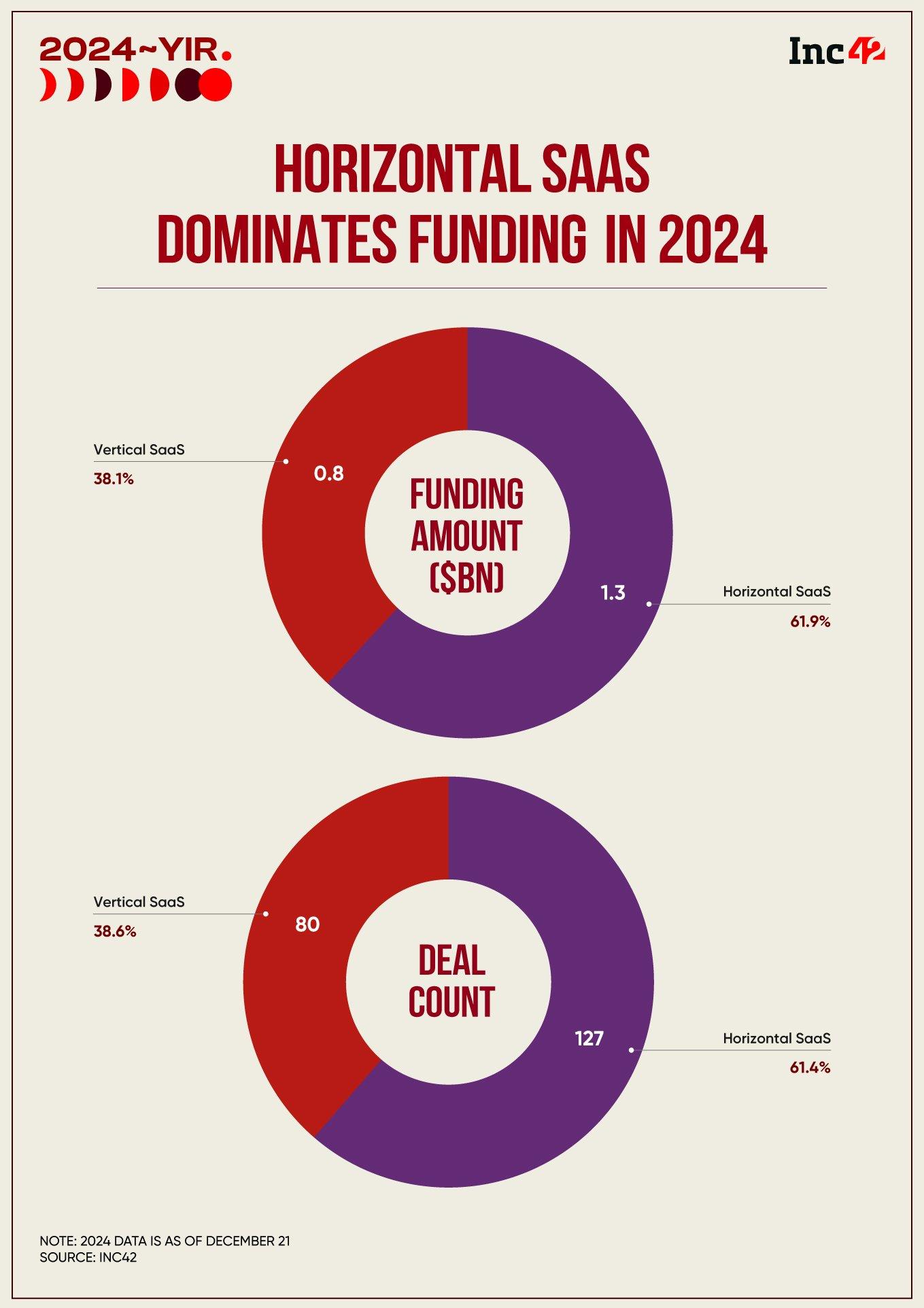

Horizontal SaaS dominated the funding landscape in 2024, which is unsurprising. These startups bagged $1.3 Bn in funding, accounting for over 60% of the total funding. The deal count stood at 127, which was also more than 60% of the total deals.

In contrast, vertical SaaS startups raised $800 Mn in 2024, which constituted over 38 of the total capital bagged by SaaS startups last year. This trend was also reflected in the deal count, with vertical SaaS players closing 80 deals, or about 38.6% of the total deals.

For context, while vertical SaaS platforms cater to a specific group in a specific industry, horizontal SaaS players build solutions that have a bigger audience and diverse use cases spanning industries.

Despite vertical SaaS trailing, Prime Venture’s Swamy feels that it is becoming appealing because horizontal players are often too focused on large-scale opportunities to address niche markets. With AI, small to mid-market companies can now access tools and capabilities previously reserved for enterprises, he said.

“However, directly competing with these big players in horizontal SaaS feels risky unless the problem being solved was previously unaddressed. This is why vertical solutions remain attractive, especially in enterprise markets and the mid-market segment,” Swamy added.

Meanwhile, BIF’s Raguraman said that while the emergence of GenAI is now a significant driver, use cases and applications, which will ultimately propel the AI vertical, are still developing. While this layer has advanced rapidly globally, India is expected to see substantial progress in the coming years, he added.

He also noted that investments so far have been concentrated in the foundational and middle layers, such as observability and security, rather than the use case layer. Although a number of companies have emerged, the maturity of the sector is yet to be realised as the ecosystem continues to evolve at a rapid pace.

Raguraman said that significant traction in GenAI use cases might begin next year or the year after, adding that the investment in traditional workflow SaaS will continue to decline and more investment will go into AI-led SaaS.

According to a recent Inc42 report, vertical SaaS clocked an 18% compounded annual growth rate (CAGR) in terms of funding between 2018 and 2023, outpacing horizontal SaaS which grew at 10%. A similar trend was seen in terms of deal volume. The CAGR of deal count in vertical SaaS was 6% during this period compared to horizontal SaaS space’s 3%.

In the next six years, the vertical SaaS market size (based on total revenue) is projected to surge from $5 Bn to $26 Bn. Meanwhile, the horizontal SaaS space, currently valued at $9 Bn, is estimated to reach $44 Bn.

[Edited By Vinaykumar Rai]