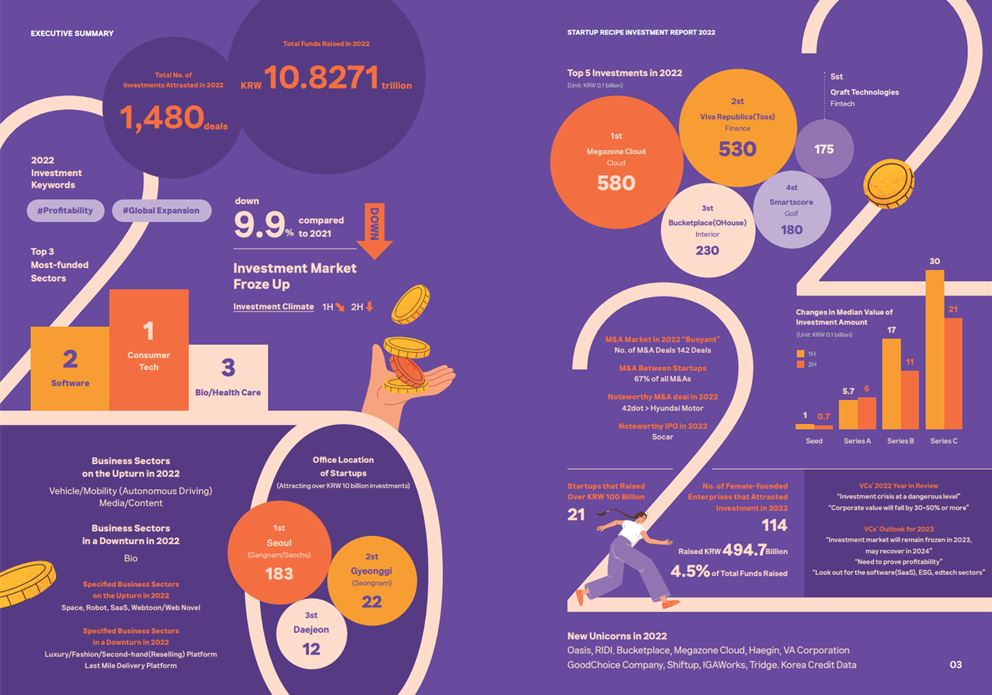

Korean startups saw a total of 1,480 investment deals in 2022, attracting 10.82 trillion won (USD 8.3billion), according to the annual investment report published by Startup Recipe, a Korean startup media outlet.

Investment activity slowed, with a 9.9% drop compared to the previous year. This decline was particularly evident in the latter half of the year as the economy began to slow and investors placed more emphasis on a startups’ profitability rather than its growth potential.

The report also showed that the most invested areas in 2022 were Consumer Tech, software, and bio/healthcare, with rising sectors being mobility driven by autonomous driving and media/content which drew attention from K-content. Fintech and B2B SaaS also gained popularity among investors.

The top five startups that attracted the most investment were: Megazone Cloud, Viva Republica, Bucket Place, SmartScore, and Craft Technologies.

While the investment market was sluggish, the M&A market was active with 142 cases, with 67% of these being mergers and acquisitions between startups. One notable M&A was Hyundai Motor’s acquisition of 42DOT. The IPO market, however, saw a significant shrink, with unicorn startup Curly withdrawing its IPO and Socar being the only one to successfully go public.

Despite the arrival of the investment winter, 11 companies became unicorns in 2022, including Oasis, RIDI, Bucket Place, Megazone Cloud, Haegin, VA Corporation, Goodchoice Company, Shift Up, IAG Works, Tridge, Korea Credit Data.

Investments in female-led startups amounted to 494.7 billion won(USD 380million), representing 4.5% of the total investment. However, this figure was a decrease of more than 50% from the previous year, and the overall ratio also decreased by more than 3% compared to the previous year, indicating a limited role for female-led companies in the startup scene.

Venture capitalists in Korea predict that the investment environment will remain challenging in 2023, with investments continuing in areas such as B2B SaaS, ESG, and space.

The Startup Recipe Investment Report 2022 is available for free download here, and was produced with the support of D-Camp.