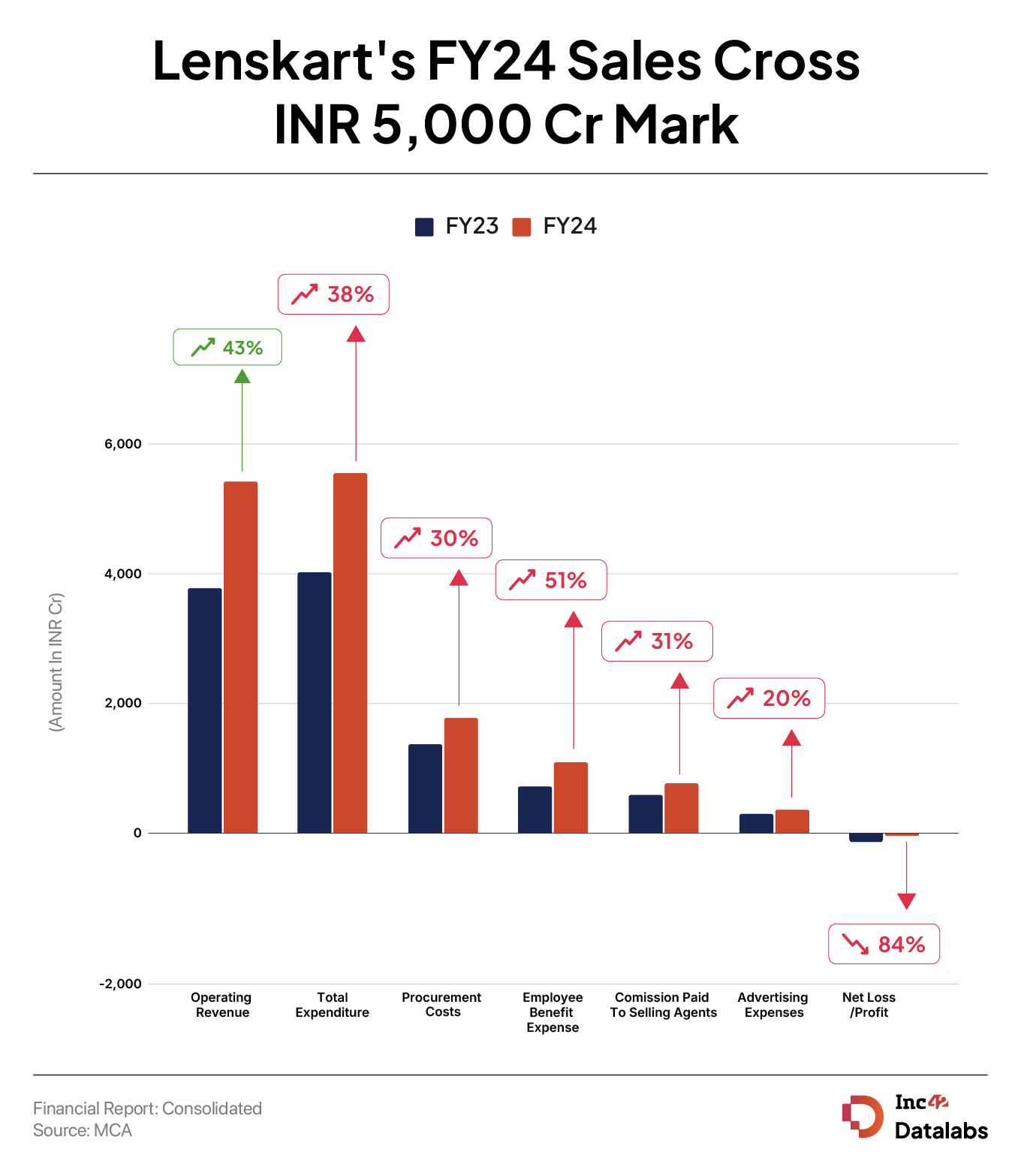

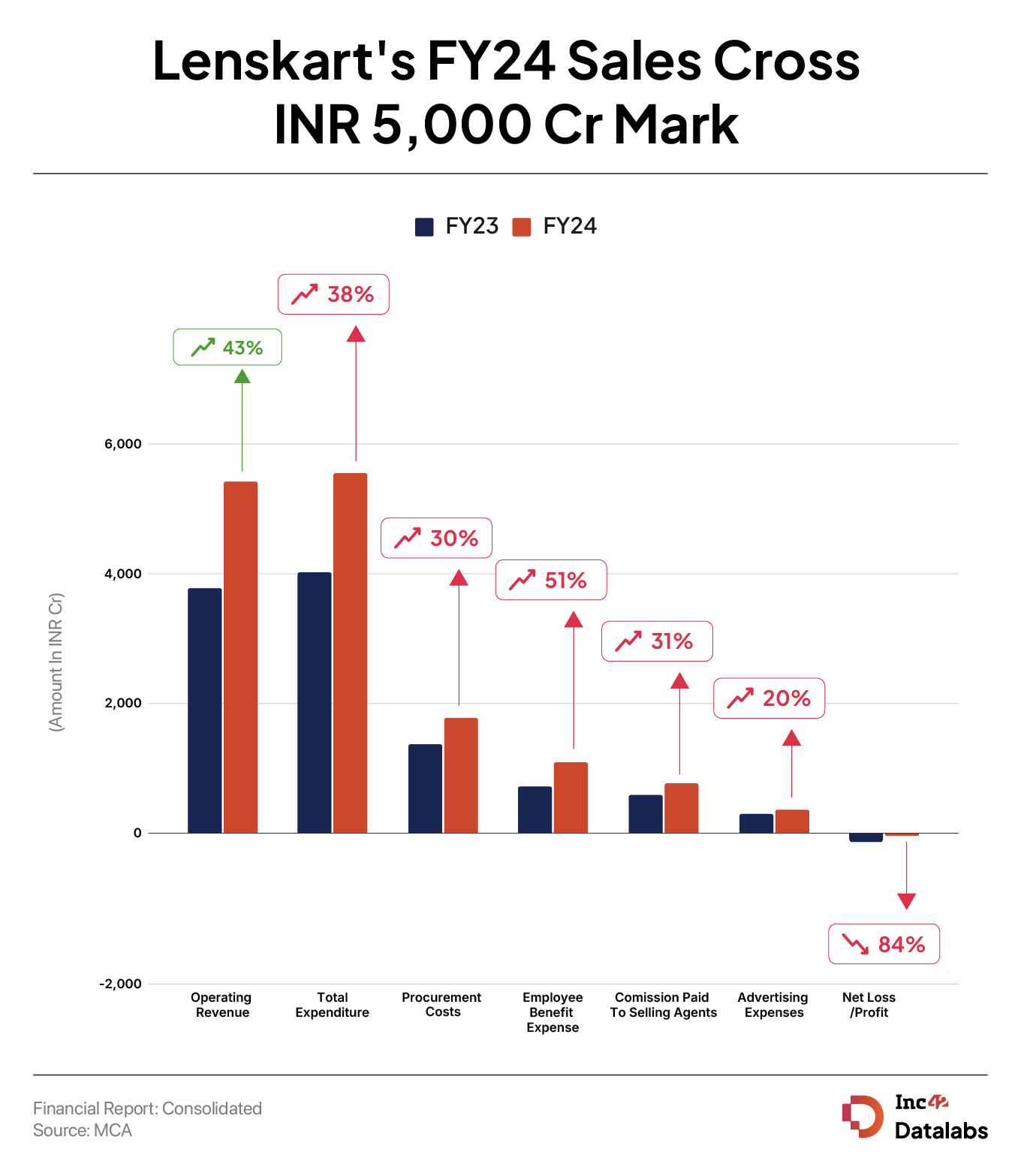

Peyush Bansal-led Lenskart’s operating revenue breached the INR 5,000 Cr mark in the financial year ended March 31, 2024. The eyewear company’s sales jumped 43% to INR 5,427.7 Cr during the year under review from INR 3,788 Cr in FY23.

The company primarily generates revenue by selling spectacles and eye lens. It generated INR 5,166.2 Cr from this, up 43% from INR 3,609.8 Cr in FY23. It also earned INR 104.5 Cr from lens fitting and membership programme during the year under review as against INR 82.7 Cr in the previous year.

Including other income, total revenue rose 43% to INR 5,609.8 Cr in FY24 from INR 3,927.9 Cr in the previous fiscal year.

Founded in 2010 by Bansal, Amit Chaudhury, and Sumeet Kapahi, Lenskart is an omnichannel eyewear retailer. Besides India, it has presence in the UAE, Singapore, Japan, among others. The company has more than 2,500 stores, of which around 2,000 are in India. It claims to have a customer base of 2 Cr.

On the back of the rise in sales, Lenskart managed to reduce its net loss by 84% to INR 10 Cr in FY24 from INR 64 Cr in FY23.

Where Did Lenskart Spend?

The company managed to control its expenses during the year under review, with the rise in sales outpacing the increase in total expenditure. Total expenses rose 38% to INR 5,549.5 Cr from INR 4,025 Cr in FY23.

Procurement Cost: The biggest expenditure was the procurement cost of raw materials to manufacture eyewear. The company’s procurement cost rose 30% to INR 1,776 Cr from INR 1,368.1 Cr in FY23.

Employee Costs: Employee expenses shot up 51% to INR 1,086.4 Cr in FY24 from INR 717.5 Cr in FY23. Employee costs comprise employee salaries, PF contribution, and other expenses.

Commission Paid To Selling Agents: The company spent INR 761.4 Cr on commission provided to selling agents, up 31% from INR 583.3 Cr in FY23.

Advertising Expenses: Advertising expenditure jumped 20% to INR 352.1 Cr in FY24 from INR 293.8 Cr in the previous year.

Lenskart’s cash and cash equivalents stood at INR 302.1 Cr at the end of FY24 as against INR 334.3 Cr in the previous fiscal year.

It must be highlighted that Lenskart raised $600 Mn in funding from Chrys Capital and Abu Dhabi Investment Authority (ADIA) at a valuation of around $4.5 Bn last year amid the funding winter. Earlier this year, Temasek and Fidelity infused $200 Mn in Lenskart at a valuation of around $5 Bn. The startup also bagged $19 Mn from all of its founders.

Last year, Lenskart turned heads with the acquisition of Japanese eyewear brand OWNDAYS for $400 Mn to expand its footprint in Japan.

Lenskart competes against the likes of Titan Eyeplus, Himalaya Optical, Dayal Opticals, among others in India.