One of the most talked about developments in the country’s media and entertainment industry over the last year and a half has been the merger of Reliance’s media assets with Disney India.

Putting an end to months of speculation, the two giants officially announced the signing of binding agreements earlier this year to create a joint venture, merging Viacom18 with Star India Private Limited.

The combined entity is anticipated to host more than 100 TV channels and two of the country’s most prominent OTT platforms – Disney+ Hotstar and JioCinema. Initially, the merger was expected to be completed by the end of the third quarter of FY25, according to Reliance Industries’ quarterly earnings statement. However, recent industry chatters hint that it could be finalised as soon as this month.

As the two platforms come together, the attention has turned to how Reliance Industries Limited (RIL) plans to manage both platforms, especially with Disney+ Hotstar’s market leadership and JioCinema’s rapid rise.

While the situation largely appears skewed in the favour of the oil-to-telecom conglomerate, let’s explore priorities, opportunities and hidden challenges that this joint venture between the two media giants brings.

Content May Not Be The King Right Now

As of now, RIL is set to infuse INR 11,500 Cr into the joint venture — an investment that has raised concerns within the OTT industry. Known to disrupt any sector it enters, the capital infusion is expected to pave the way for more content on the platforms, leading to stiffer competition.

However, things are not that simple, even for a deep-pocketed giant like Reliance. As per industry sources, RIL is cautious about content spending, as this segment takes quite a long time to generate RoI. A Bollywood producer that Inc42 spoke with said that Jio Cinema has completely frozen the budget and is not striking deals with any producers.

A top priority right now is to manage the integration of two massive organisations with distinct corporate cultures. As per industry experts, a primary focus for both companies right now is balancing the power dynamics between their respective workforces and senior leadership teams. Besides streamlining the processes, the challenge is to align the visions of two media powerhouses.

Since the merger announcement, Disney+ Hotstar has seen several high-profile exits, signalling the complexities of the ongoing integration. Key figures like Sidharth Shakdher, former EVP and CMO of Disney+ Hotstar, left to join Ola Mobility before the merger was announced.

Recently, Sajith Sivanandan, head of Disney+ Hotstar in India, stepped down amid the integration efforts, following the report of K Madhavan’s, country manager and president of Disney Star, departure from the company.

According to multiple sources, more exits are likely as key executives adjust to new power dynamics and organisational changes.

On the other hand, Viacom18, part of Reliance’s media business, has been strengthening its leadership to handle the merged entity. Kiran Mani, a former Google executive with extensive experience in digital business, has been leading JioCinema for about a year. Additionally, Viacom18 has brought in another former YouTube executive, Ishan Chatterjee, as JioCinema’s new chief business officer.

However, Karan Taurani, the EVP of Elara Capital, sees it as a normal phenomenon during a merger. “When two major entities like Jio Cinema and Hotstar come together, there’s bound to be some overlap. However, the primary focus should be on user experience — how well Jio Cinema can match up to Hotstar. User experience will play a crucial role in subscriber retention and motivation,” Taurani said.

Need For A Highly Efficient Tech Stack

While Disney+ Hotstar already has a strong technological foundation, JioCinema, per industry sources, is currently focussed on bolstering its tech stack. Notably, JioCinema has often been criticised by users for lags during important sports events, issues with its user interface, and other technical shortcomings. Hence, before expanding its content offerings, JioCinema aims to ramp up its tech infrastructure to meet the expectations of its growing user base.

Amid all this, a key question has emerged — Which platform will absorb the other? Initially, there were discussions about Reliance running two separate OTT platforms. However, concerns over pricing, business models, and advertising rates led to complexities.

Now, RIL is planning to retain Disney+ Hotstar as the sole streaming platform, absorbing JioCinema in the process. This reshuffle positions Disney+ Hotstar as the primary streaming service for the combined entity, with plans to stream the Indian Premier League (IPL) 2025 on Disney+ Hotstar.

An industry executive noted that maintaining two platforms won’t be sustainable, given the content and maintenance costs. It would be challenging to generate decent average revenue per user (ARPU) from two separate platforms, and charging high subscription fees for both make little sense.

Advertisers had started preparing rate charts for both platforms when RIL was still considering running them separately. However, it remains uncertain whether JioCinema will be shut down entirely.

Creating Content Pipeline

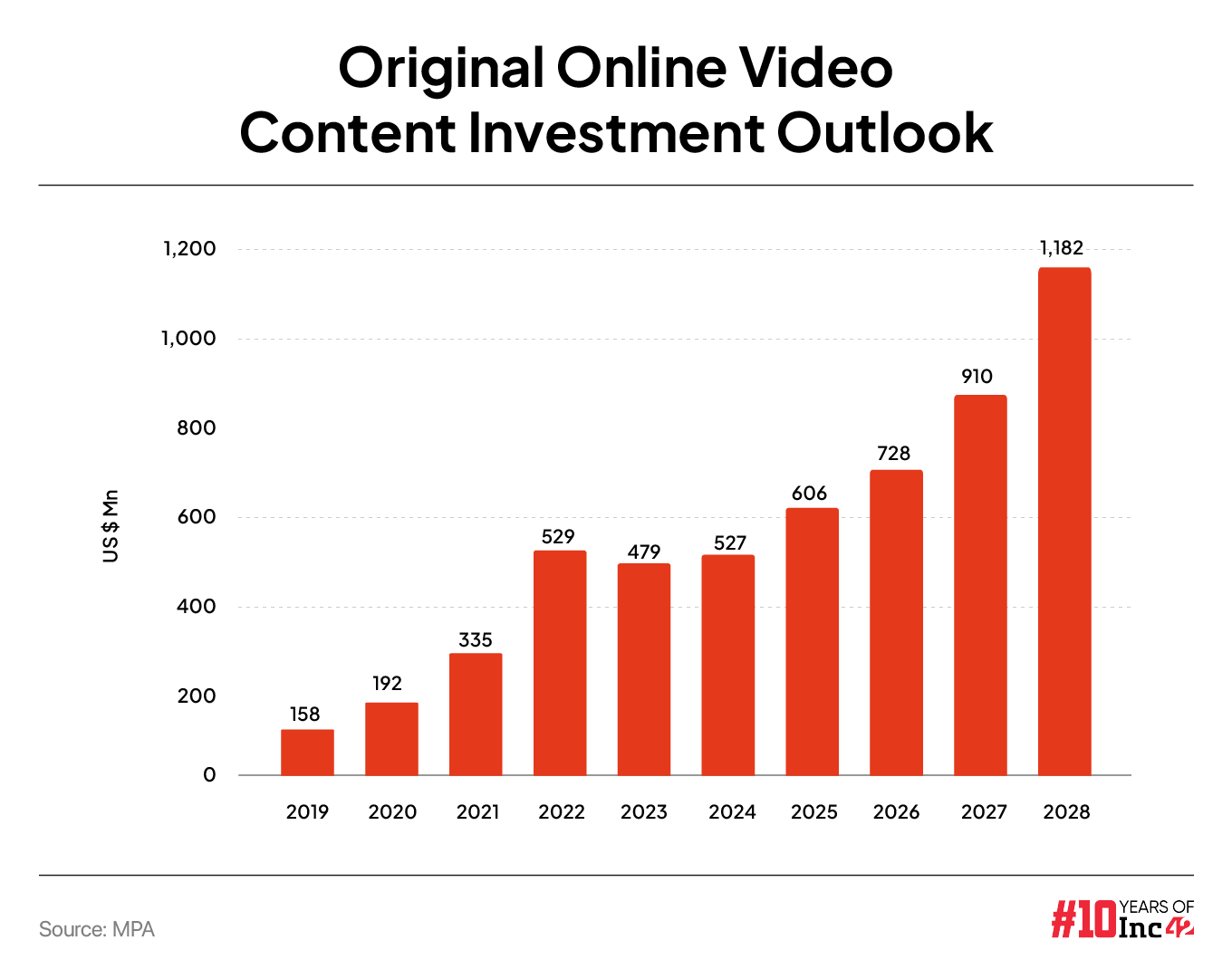

As hinted above, RIL plans to be cautious with content spending, especially after investing heavily in acquiring rights for premium cricket events and international content from HBO.

In terms of releasing original content, RIL is likely to follow a more conservative approach, similar to Netflix’s recent strategy, which focusses on the acquisition of films and reality shows.

As content budgets for producers have also been reduced across the industry, RIL, too, is unlikely to burn excessively, as maintaining an edge in the content business will require a steady flow of high-quality content throughout the year, which involves careful planning and investment.

To enhance its content library and expand market reach, Viacom18 has entered into an exclusive content partnership with Warner Bros. Discovery. As part of this deal, JioCinema will stream content from HBO, Max Originals, and Warner Bros., with new releases premiering on JioCinema in India on the same day as their US release.

This partnership is expected to bolster the platform’s content depth, attracting a broader audience with premium international shows and movies.

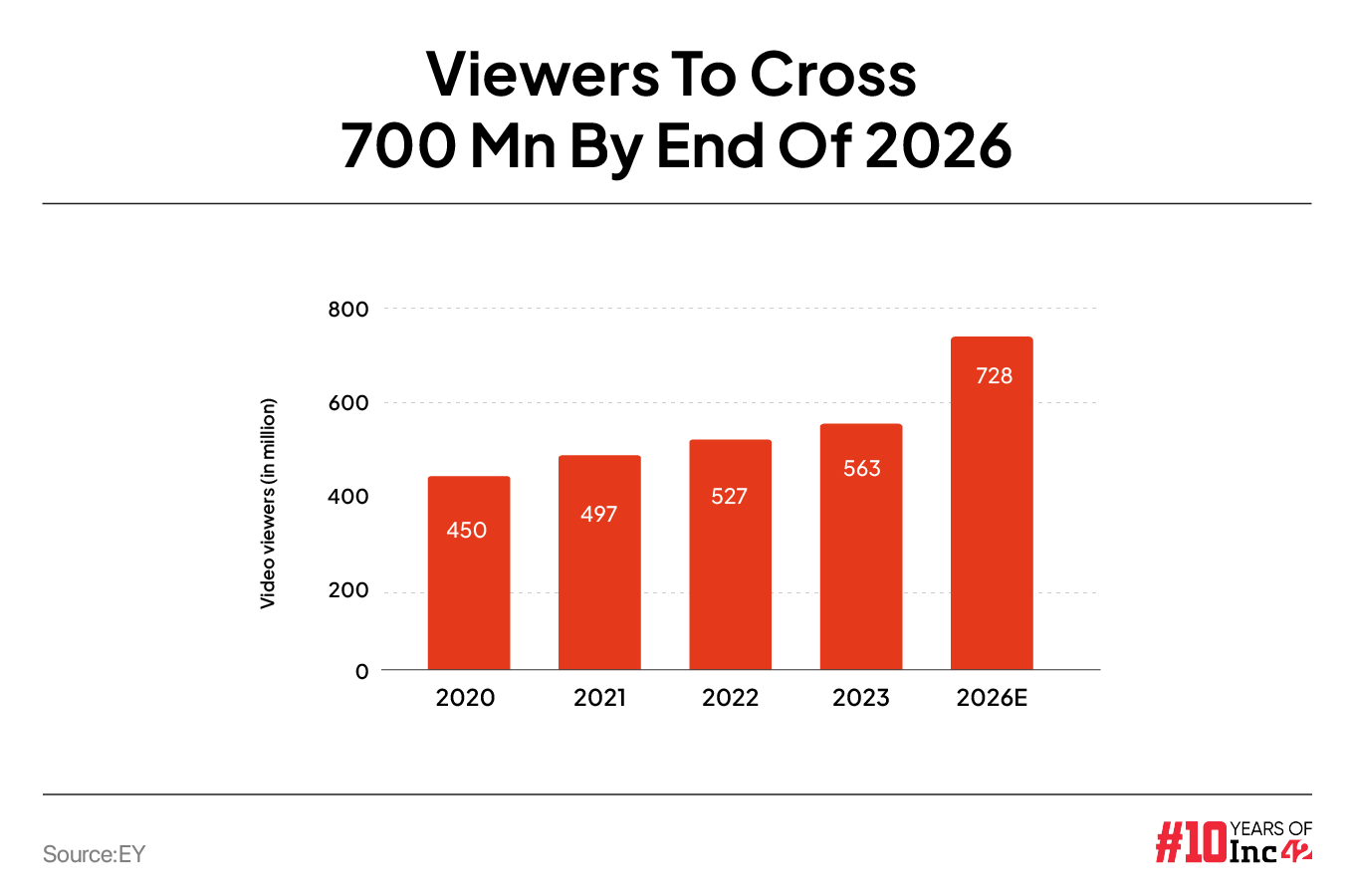

JioCinema has already succeeded in attracting a large viewership by streaming IPL for free. During the opening weekend of the cricket tournament, JioCinema reported 5 Cr new app downloads, underscoring the platform’s ability to leverage high-demand sports content to draw in users.

JioCinema has also experimented with original show formats, such as “Indian Angels”, a show described as the world’s first angel investment series, where angel investors support emerging startups, and viewers are invited to become investors. However, the show did not achieve significant fame, and industry experts speculate that future efforts might shift towards more mainstream content.

According to RIL’s annual report, JioCinema reached 225 Mn monthly active users, while Disney+ Hotstar led the way with 333 Mn monthly active users in Q4 2023. Disney+ Hotstar reported 35.5 Mn paid subscribers as of June, despite a decline in its customer base, whereas JioCinema, as of September, became the fastest-growing subscription-based OTT platform, surpassing 16 Mn paid subscribers. Network18’s recent earnings further underscore JioCinema’s two-fold quarter-on-quarter growth in its paid subscriber base.

“Regarding pricing, Reliance has a potential advantage due to its strong last-mile reach. Reliance can tap into its vast Jio network. This distribution capability allows Jio Cinema to set competitive pricing, likely at more affordable rates. Unlike competitors that may realise only 30-40% of rack-rate pricing due to revenue sharing with telecom and OEM partners, Jio Cinema’s direct reach enables them to capture a larger share of revenue, leading to better ARPU and increased subscription revenue,” Taurani said.

While Disney+ Hotstar is going to run the show as per reports, the competition with international giants like Netflix and Amazon will be worth watching. Amazon, after its merger with MX Player, is eyeing low-hanging fruits, while the failed Zee-Sony merger leaves Zee5 and SonyLIV as distant contenders.

However, from the content perspective, Jio Cinema’s offers a broader range compared to Hotstar, and with Hotstar’s library now included, this variety will only expand further.

While content variety isn’t a concern for the merged entity, the key challenges will lie in user experience and technology. To compete on a global scale, platforms like Jio Cinema need to ensure that their technology meets the standards set by global players like Amazon and Netflix.

[Edited by Shishir Parasher]

The post Reliance-Disney Merger: What’s Happening Behind The Scenes? appeared first on Inc42 Media.