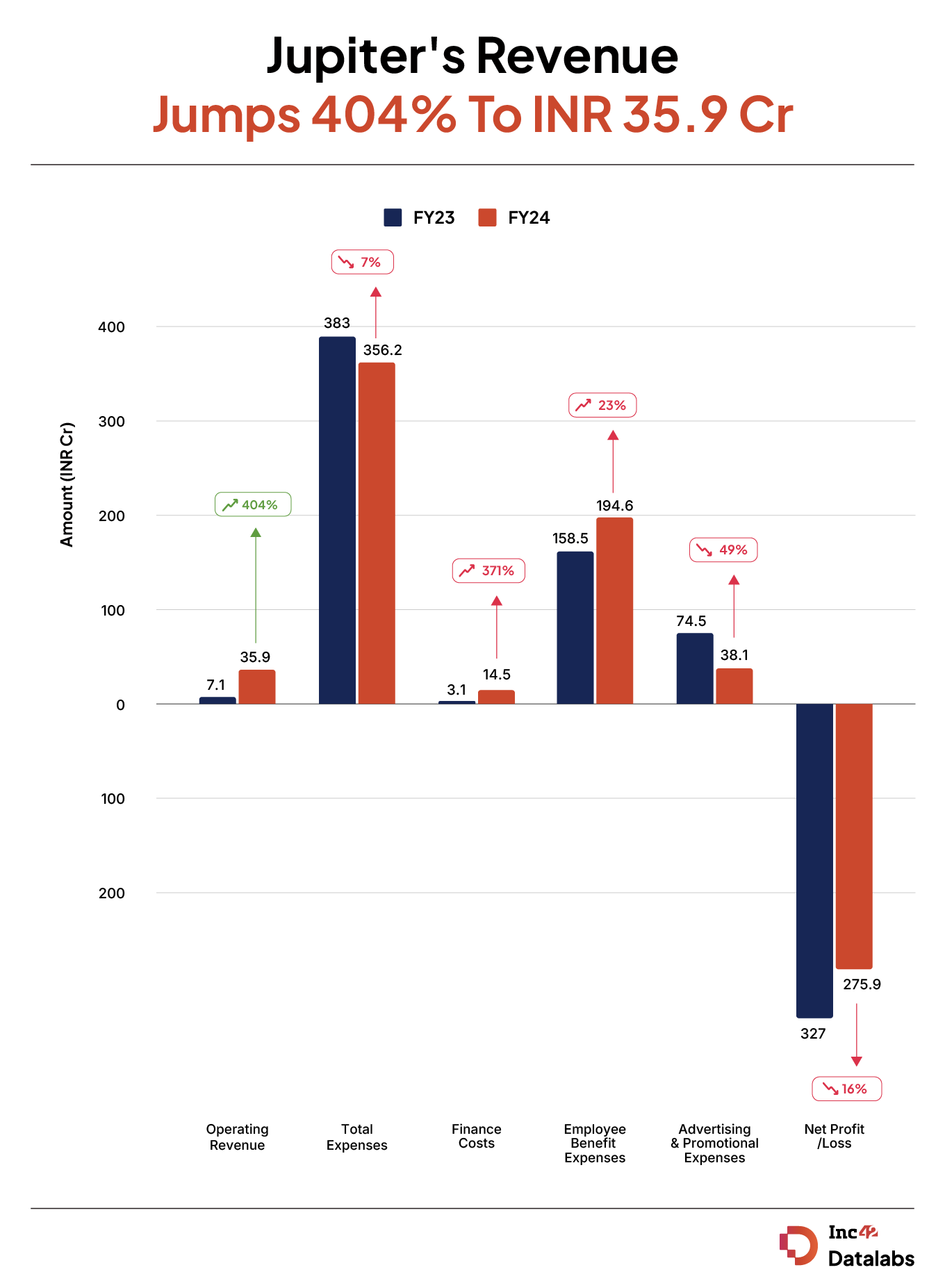

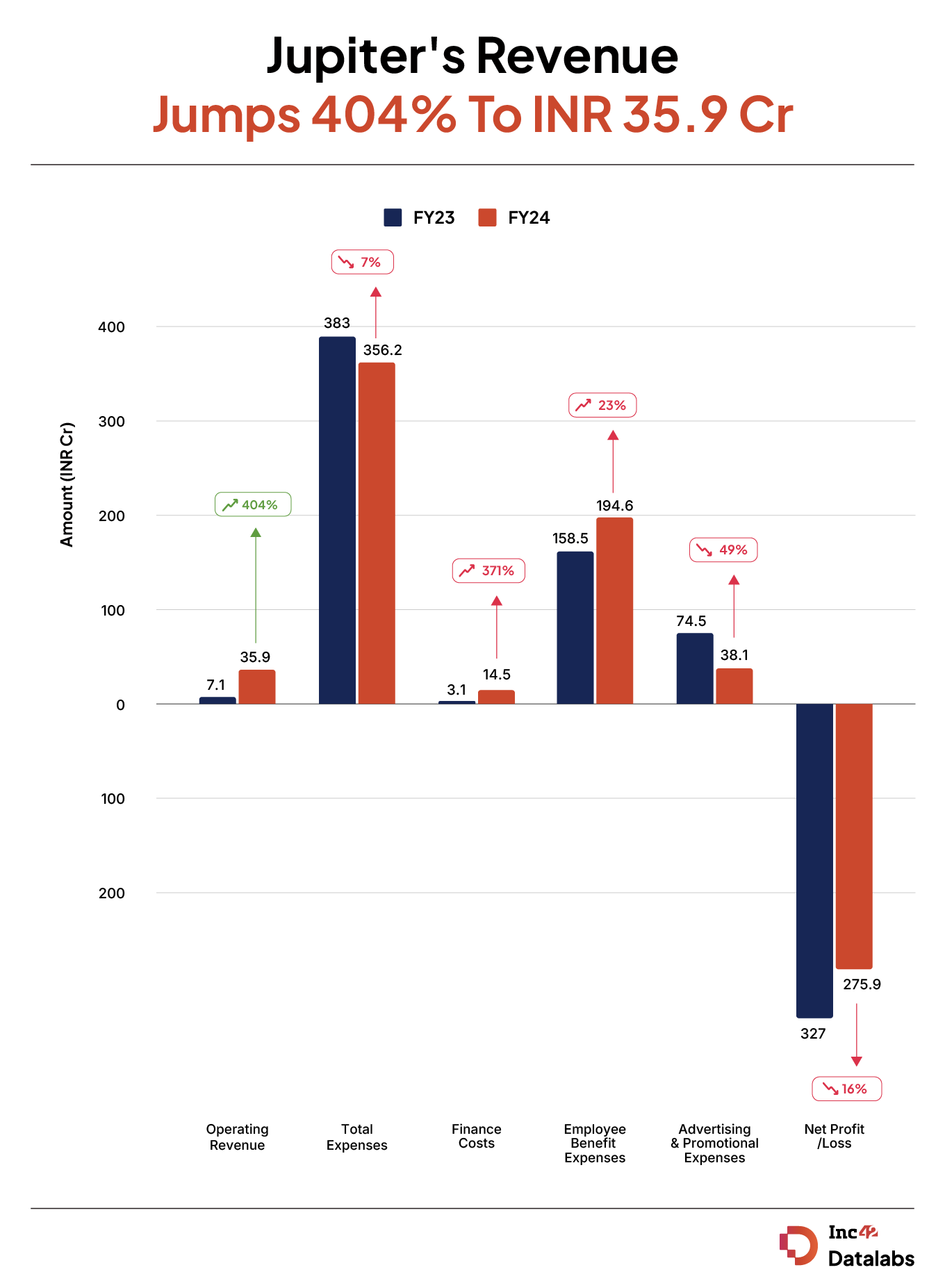

Jupiter managed to narrow its net loss by 16% to INR 275.94 Cr in FY24

Operating revenue surged fivefold to INR 35.85 Cr from INR 7.11 Cr in FY23

On a unit economics basis, Jupiter spent INR 9.94 to earn every rupee from operations in FY24

Neobanking startup Jupiter

The startup’s operating revenue jumped 404% to INR 35.85 Cr during the period under review from INR 7.11 Cr in FY23.

Founded in 2019 by serial entrepreneur Jitendra Gupta, Jupiter offers a range of financial services, including debit cards, SIPs, mutual funds, personalised savings options, expense management, and UPI payments.

The startup reported a total income of INR 80.51 Cr in FY24, up 43.81% from INR 55.98 Cr reported in the previous fiscal year.

Notably, operating revenue accounted for just 44.52% of the total income. Other income, which largely included interest on investments, stood at INR 44.66 Cr during the year as against INR 48.86 Cr in FY23.

A Look At Jupiter’s Expenses

Despite the fivefold rise in revenue, Jupiter managed to narrow its total expenditure by 7% to INR 356.22 Cr in FY24 from INR 382.95 Cr reported in the previous year.

Employee Benefits Expenses: Employee costs grew 23% to INR 194.62 Cr in FY24 from INR 158.49 Cr in the previous fiscal year.

Advertising & Promotional Expenses: Spending under the head declined 49% to INR 38.07 Cr from INR 74.51 Cr in FY23.

Finance Cost: The company spent a total of INR 14.47 Cr in FY24, a 371% increase from INR 3.07 Cr spent last year.

Miscellaneous Expenses: The startup spent INR 70.07 Cr under the head in FY24, a decline of 36% from INR 108.96 Cr in FY23. However, it didn’t give a breakdown of miscellaneous expenses.

On a unit economics basis, Jupiter spent INR 9.94 to earn every rupee from operations in FY24. This was an improvement from INR 54 it spent in FY23.

Earlier this year, Jupiter received a prepaid payments instrument licence from the RBI.

Overall, it has raised a total funding of over $171 Mn till date and counts the likes of Tiger Global, Peak XV Partners and Matrix Partners among its investors.