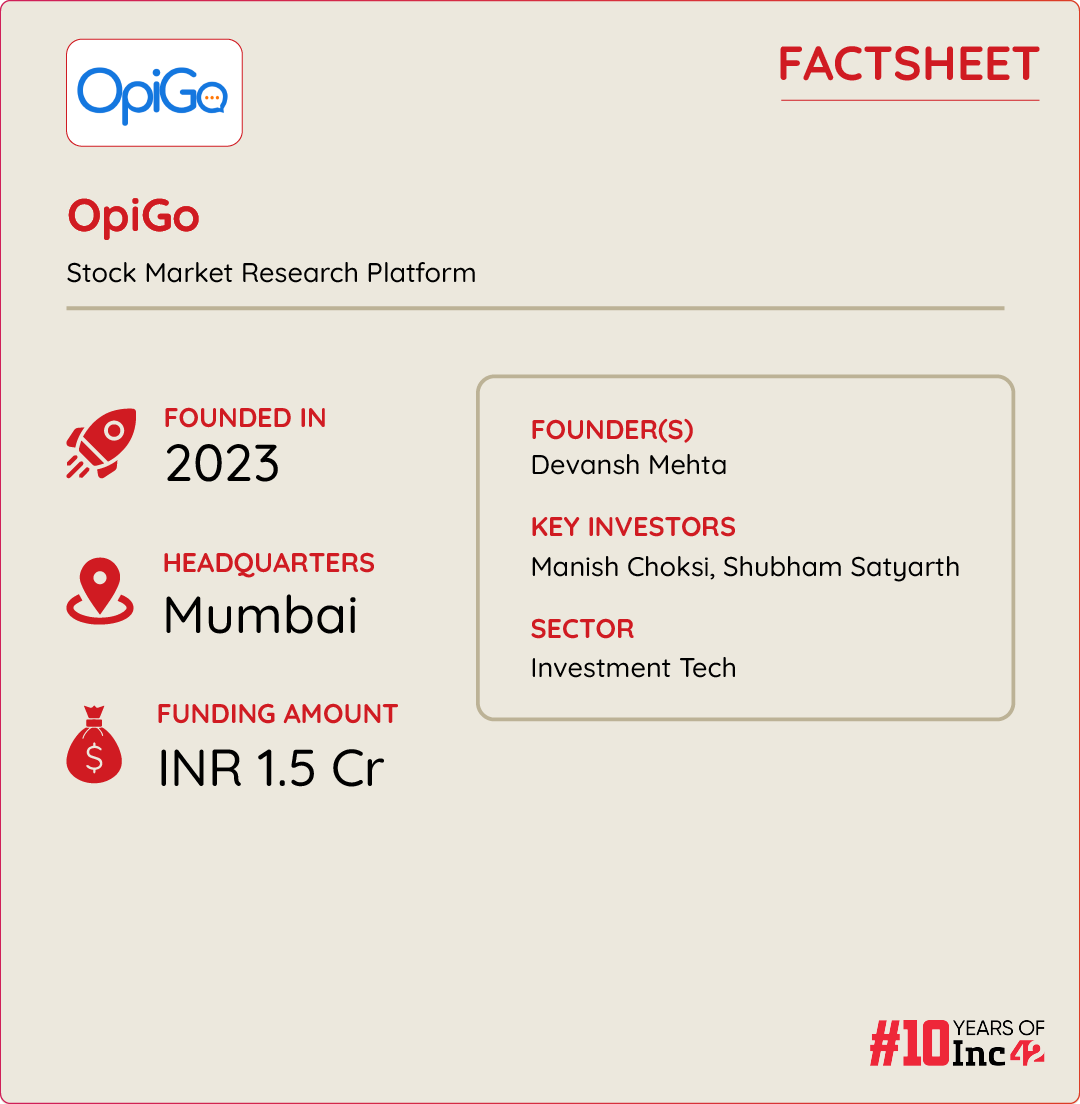

OpiGo is a tech platform that provides stock recommendations from SEBI-registered experts, giving insights into short-term trades, long-term investments, and industries or sectors

Since its inception, the startup has raised INR 1.50 Cr from investors like Manish Choksi of Asian Paints and Shubham Satyarth of Sharpely. The founder has set his eyes on raising additional funds in the first quarter of FY26

OpiGo’s monthly subscriptions are priced at approximately INR 700, while annual plans are available for around INR 5,000. It has a paid subscriber base of 1,000 individual

While stock markets intimidate risk-averse investors, the ones with a high-risk appetite can’t get enough of the thrill. Well, risk-averse or not, there is nothing like the euphoria when a bet pays off. However, even the most adept stock market investors were once beginners and exposed to poorly researched tips and shallow recommendations to survive the brutal stock market volatilities.

It is this white space that Mumbai-based Devansh Mehta decided to fill and built OpiGo, a platform to discover and share new stock ideas, in 2022. OpiGo is a tech platform that provides stock recommendations from SEBI-registered experts, giving insights into short-term trades, long-term investments, and industries or sectors.

Now, before we explain how Mehta is creating waves with its tech platform, let’s steal a glance at the founder’s journey so far.

Speaking with Inc42, Mehta said that he tasted the thrill of stock market returns when he was just 15 years old. Growing up in a family where investments and finance were discussed almost daily at the dinner table, it was only natural for him to learn the ropes, which he did quite early on in his life.

Given his interest in the field, he chose to become a chartered accountant (CA). After earning his chartered accountant (CA) degree, he started working with Blackstone’s India asset and wealth management business, ASK group, in 2019.

Here, he would consult family offices and high-net-worth individuals regarding their investments. As days passed, he witnessed a common issue — many of his clients were investing without any in-depth research or knowledge about the company,

“I witnessed such unreliable stock recommendations and predictions clouding clients’ ability to make decent bets. This situation only got worse during the Covid-19 pandemic when the country saw a sharp rise in demat accounts,” the founder said.

During this time, he surveyed his clients (mostly retail investors spanning different ages and income brackets) to understand their investment theses. He was boggled to find that more than 70% of retail investors relied on suggestions from family and friends for their investments, while only a few depended on paid financial advisors or on their research.

Recognising this gap, the young finance professional began exploring ways to plug the gap. He then thought of a platform that could provide stock traders with diverse perspectives on their equity investment plans.

This inspired Mehta to build an online community of retail investors that could foster discussions and enable the integration of expert insights into investment plans.

The Genesis Of OpiGo

When Mehta sat down on the drawing board, he prepared the entire roadmap of a retailer’s investment journey. He realised that the stock investment path travels through four crucial junctures — brokerage platforms, research platforms, communities and advisory services.

While brokerage platforms like Zerodha, Upstox and Groww allow one to make their intended investments, research platforms like MoneyControl and Trendlyne influence their decision. Communities such as X and Telegram also serve this purpose. However, an extra cautious investor makes bids only after checking with an experienced consultant.

Mehta found his calling in community building and advisory, all while realising that he has to stay one step ahead of issues like spamming and junk suggestions (a major issue for existing communities) if his platform were to make waves.

“I decided to create an interactive platform that rewards users with financial incentives and recognition for accurate predictions,” Mehta said.

A keen observer of UI/UX trends, Mehta envisioned OpiGo as a platform with an intuitive design that even non-finance users could navigate easily.

While still employed at ASK, he initially engaged an agency to develop the app and its interface in late 2022. However, dissatisfied with the results, he assembled a team of freelance developers and directly supervised the project. By early 2023, OpiGo was ready for launch.

The platform provides investors access to community-driven opinions on various stocks. For example, if an investor is looking to buy a stock, he/she can explore OpiGo’s community to assess the collective sentiment on the stock.

Further, one can even conduct polls to gauge the market sentiment for a particular stock. Besides, a key USP of the platform is that it allows people to share their thoughts on the platform in the form of cards. These cards allow stock market experts or traders to outline expected upsides or downsides, specify timeframes, and include a brief rationale for their predictions.

The platform then scores users based on these predictions. The scoring system helps the company maintain transparency with its users about the recommendations they see on their screens and where they are coming from

The app also gives a thorough breakdown of critical investment information like price to earnings, price to book, return on equity, revenues, profit/loss, etc.

After its launch in March, the platform added 7-8K users within the first 10 months. To accelerate this momentum, the founder increased engagement with SEBI-registered investment advisors. These advisors now share their stock predictions on OpiGo.

The strategy has helped expand OpiGo’s user base to 50K investors. Now, the platform is targeting a user base of 1 Lakh by the end of the current fiscal year. To achieve this, the founder plans to stick with his thesis — securing more endorsements and stock recommendations from investment advisors and strategists.

OpiGo’s Revenue Model & The Road Ahead

About three months ago, the startup introduced a subscription model to support retail investors in direct equity investments, leveraging insights from a curated panel of SEBI-registered experts.

With a single subscription, users gain access to recommendations from multiple experts. The system automates buy/sell alerts via WhatsApp and the OpiGo app.

Monthly subscriptions are priced at approximately INR 700, while annual plans are available for around INR 5,000. The platform’s paid subscriber base has grown to 1,000.

The platform has another revenue stream, which is smartly interlaced with its commissions or reward system.

“Successful predictions earn wallet credits, which can be redeemed as discounts on gift cards, making the process rewarding and engaging. On every gift card purchase, we earn a commission of 1-5% from the brands,” Mehta said.

Meanwhile, the founder is focussed on creating multiple revenue streams to attain an annual revenue run rate (ARR) of $5 Mn by the end of the fiscal year. For instance, in the short term, the startup plans to offer branded gift cards at a discount to users with a fixed margin. This distribution will work by the startup offering users gift cards based on their scores.

In addition, OpiGo is creating a B2B revenue stream, which plans to take live by the end of the month. Under this, OpiGo will aggregate curated SEBI-registered experts and their recommendations to stock brokers via API solutions. The startup is also looking to expand its horizons to include mutual funds, unlisted shares, and insurance advisory as well.

However, all these plans as of now are dependent on the startup’s ability to raise external funding. Since its inception, the startup has raised INR 1.50 Cr from investors like Manish Choksi of Asian Paints and Shubham Satyarth of Sharpely. As of now, the founder has set his eyes on raising additional funds in the first quarter of FY26.

Moving on, the founder’s journey until now has been focussed on streamlining the investment journey of a modern-day investor, who is exposed to the cacophony of half-baked stock ideas and shallow predictions.

With his community-driven platform, run by SEBI-registered experts, the founder seeks to provide a credible alternative to the world of financial advice, which is currently being overshadowed by the growing community of finfluencers.

Not to mention, the lack of authenticity and the risk of falling prey to fraudulent schemes have made the need for regulated and reliable platforms like OpiGo more pressing than ever.

For now, while the real challenge lies in maintaining trust and scaling sustainably in a sector where misinformation and quick gains often overshadow informed decision-making, the platform’s future is strongly linked to the ever-evolving regulatory volatility in the country.

[Edited By Shishir Parasher]