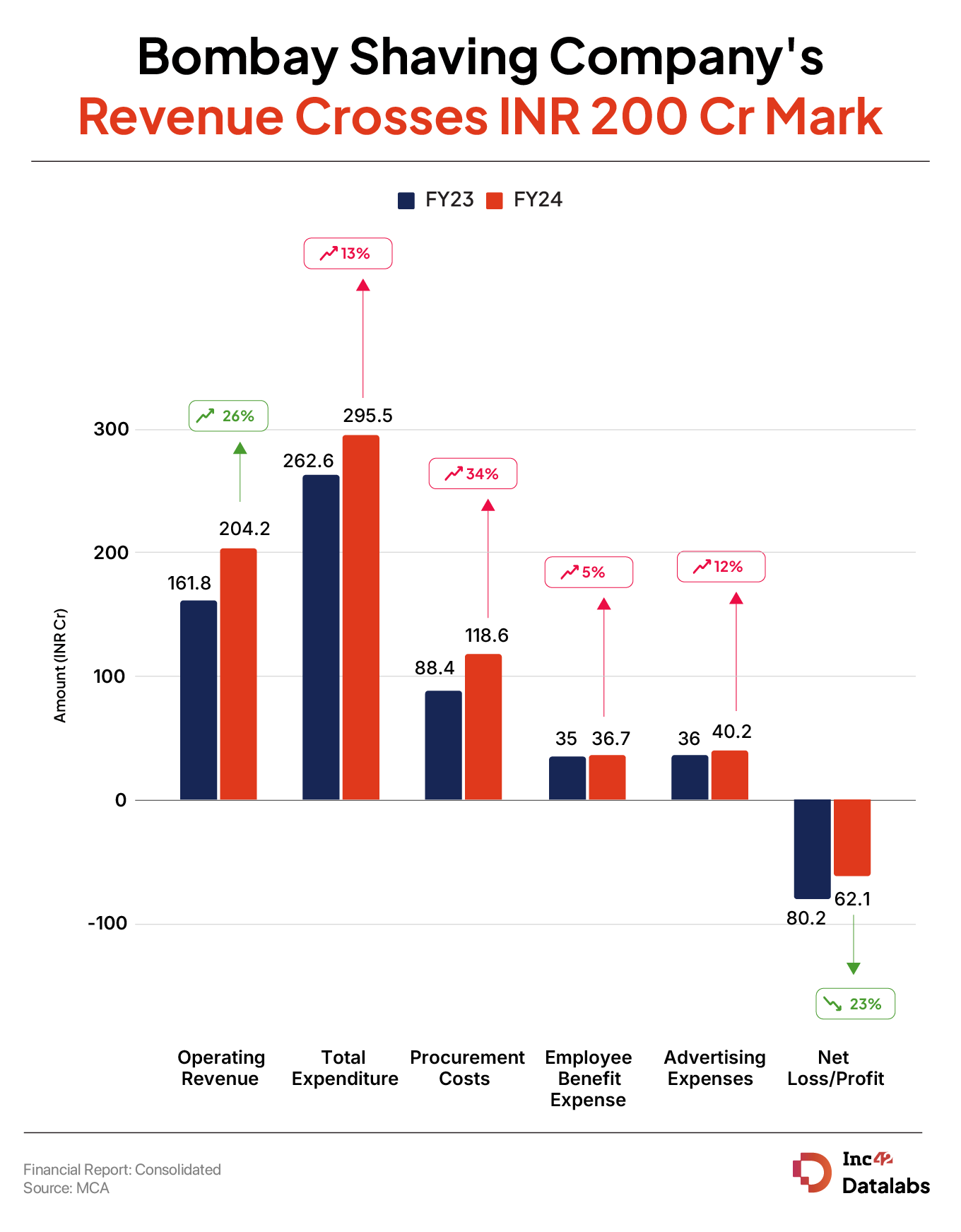

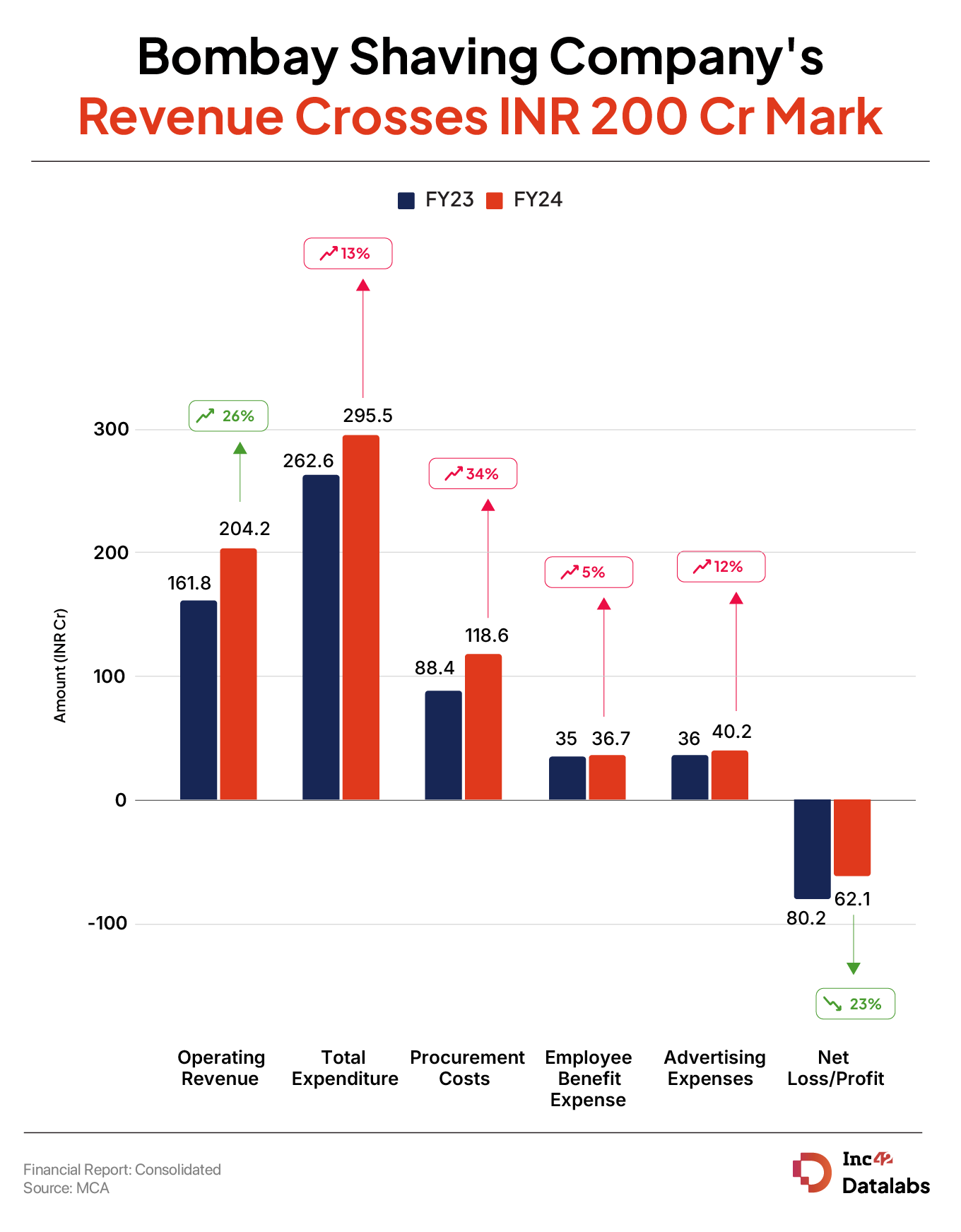

The D2C brand’s net loss declined 23% from INR 80 Cr in FY23

Bombay Shaving Company’s operating revenue breached the INR 200 Cr mark, rising 26% to INR 204 Cr in FY24

The rise in the startup’s expenditure was lower than the increase in its revenue. Its total expenses grew 13% to INR 295.5 Cr in FY24 from INR 262.6 Cr in FY23

Shantanu Despande-led D2C grooming and personal care brand Bombay Shaving Company’s net loss declined 23% to INR 62.1 Cr in the financial year 2023-24 (FY24) from INR 80 Cr in the previous fiscal year, as its top line rose and margins improved.

The startup’s operating revenue breached the INR 200 Cr mark during the year under review. Revenue from operations rose 26% to INR 204 Cr from INR 161.8 Cr in FY23.

Including other income, total revenue jumped to INR 233.4 Cr in FY24 from INR 182.4 Cr in the previous fiscal year.

Founded in 2016, Bombay Shaving Company

Besides men’s products, Bombay Shaving Company also operates Bombae, which sells products for women, like razors, trimmers, wax strips, among others.

Where Did Bombay Shaving Company Spend?

The rise in the startup’s expenditure was lower than the increase in its revenue. Its total expenses grew 13% to INR 295.5 Cr in FY24 from INR 262.6 Cr in the previous fiscal year.

Procurement Costs: The biggest expenditure was the procurement cost for products. Bombay Shaving Company spent INR 118.6 Cr under the head in FY24, an increase of 34% from INR 88.4 Cr in the previous year.

Advertising Expenses: Marketing expenditure jumped 12% to INR 40.2 Cr from INR 36 Cr in FY23.

Employee Benefit Expenses: The startup’s employee expenses increased a mere 5% to INR 36.7 Cr during the year under review from INR 35 Cr in FY23.

EDBITA margin improved to -26.1% in FY24 from – 46.4% in the previous year.

Bombay Shaving Company last raised INR 24 Cr debt from Alteria Capital to expand its offline presence to 25 cities from 12 cities. Back then, Despande said that the startup was expecting a 35% growth in its top line in FY25.

The debt round came almost two years after the startup raised INR 210 Cr in its Series C funding round, which saw participation from Gulf Islamic Investments, Malabar Investments, and Patni Advisors.

Bombay Shaving Company has raised close to $50 Mn to date. It competes against the likes of Ustraa, Beardo, The Man Company, among others.