While the sale of used EVs between individuals will remain GST-exempt, old EVs bought by companies and then sold further will be taxed at 18% on the margin value

The GST Council deferred its decision on reviewing tax rates for food delivery platforms such as Swiggy and Zomato, citing the need for further review

The Council also provided clarity on payment aggregators, stating that transactions below INR 2,000 processed by aggregators will be exempt from the tax levy

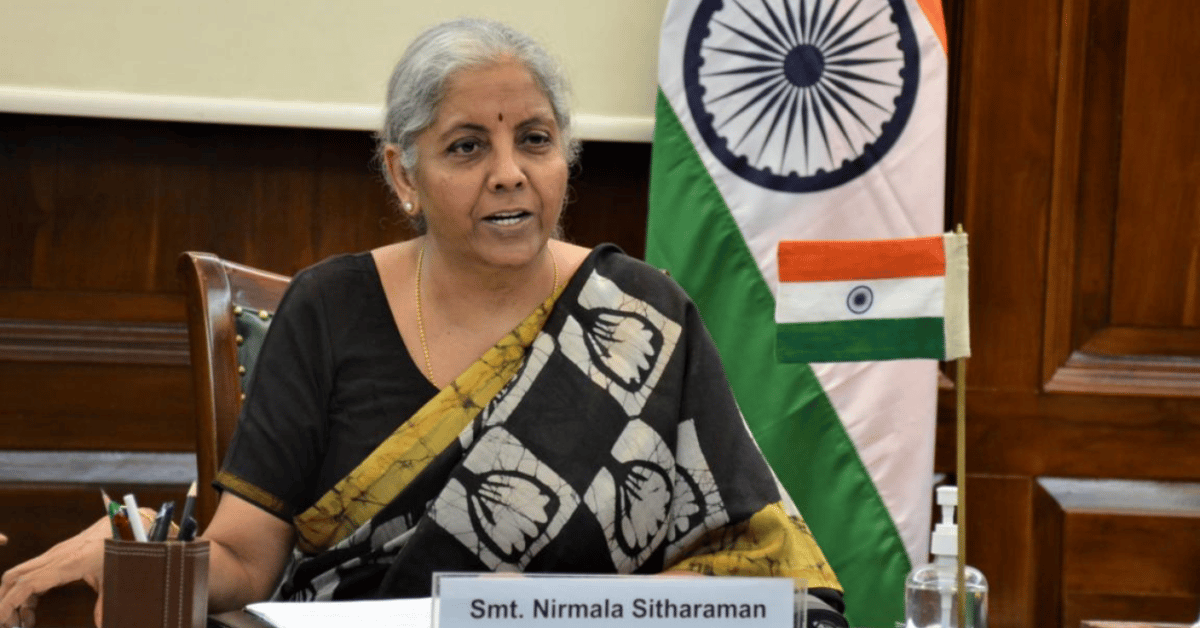

Finance Minister (FM) Nirmala Sitharaman on Saturday (December 21) clarified that new electric vehicles (EVs) will continue to be taxed at 5% goods and services tax (GST) rate. The FM, however, added that the sale of used EVs between individuals will remain GST-exempt.

FM Sitharaman made the comments while addressing the media following the 55th GST Council meeting in Rajasthan’s Jaisalmer.

In the same breath, she added that old EVs bought by companies (or those modified by sellers) and then sold further will be taxed at 18%. The GST rate will be applicable on the margin value between the purchase and selling price.

Currently, the government levies a 5% GST on new EVs while old and used EVs are taxed at 12%.

Addressing the media, FM Sitharaman emphasised that the decision to impose 18% GST on used EVs was not arbitrary, adding that the final decision was made after thorough discussions between the members of the GST Council.

On the other hand, the Council deferred its decision on reviewing tax rates for food delivery platforms such as Swiggy and Zomato, citing the need for further review. The delay appears to have put a spanner in the works for foodtech giants as reports recently hinted that the fitment panel was mulling lowering the tax levy on food delivery charges to 5% from 18%.

As per reports, discussions within the GST Council centred around whether the tax should apply to the delivery service or the food itself and whether the rate should be 5% or 18%. However, no conclusion was reached, which led to the deferment.

In addition, the GST Council also provided clarity on payment aggregators, stating that transactions below INR 2,000 processed by aggregators will be exempt from GST. However, the exemption will not apply to payment gateways or fintech services that do not settle funds.

Notably, this follows reports that the Council was mulling imposing an 18% levy on payment aggregators for facilitating small value digital transactions. The said proposal would have included charging aggregators 18% GST for processing transactions up to INR 2,000 made via debit and credit cards.

The Council also deferred deliberations on health insurance reforms, awaiting inputs from the Insurance Regulatory and Development Authority of India (IRDAI).