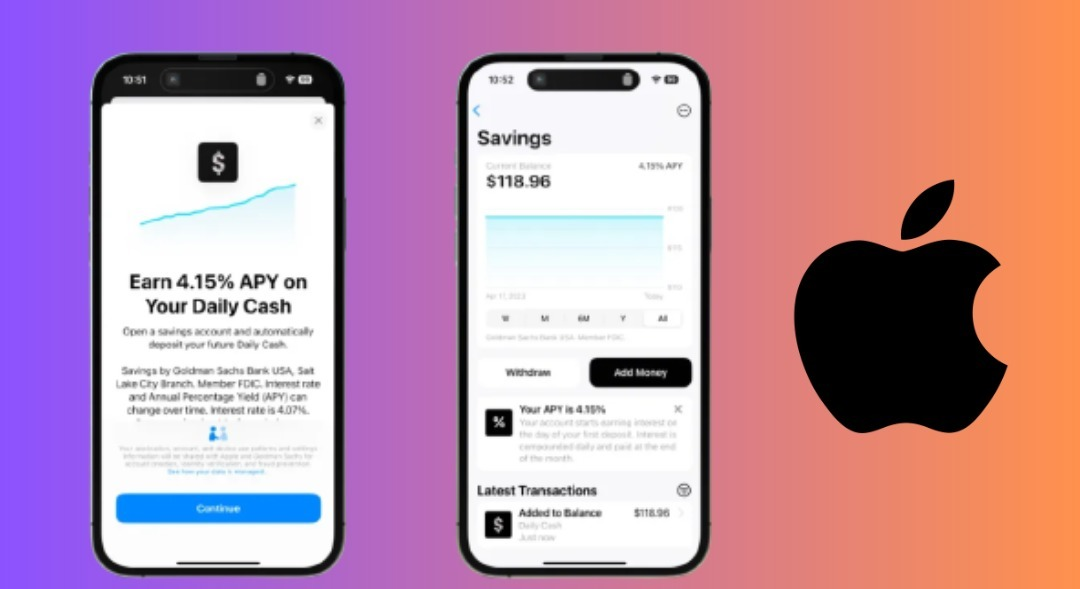

Apple Card customers in the U.S. can now open a savings account and earn interest on their balance, Apple announced on Monday. The feature was first announced in October of last year, but at the time Apple did not reveal what interest rate would be paid out on these accounts.

As of today, the Apple Card savings account will offer an annual percentage yield (APY) of 4.15%. This puts it in a competitive position with other savings accounts on the market, which currently offer an APY of between 3.5% and 4.75%, according to data from Bankrate.

Apple has partnered with Goldman Sachs to offer the banking feature, and the savings accounts are technically managed by the bank, meaning that balances are covered by the Federal Deposit Insurance Corporation (FDIC).

The high-yield savings account is available exclusively to Apple Card customers, who earn cash back on all purchases made with their card. By default, customers receive 1% cash rewards on all purchases, and 2% for all purchases made using Apple Pay. Purchases with select merchants can unlock rewards of up to 3%.

Customers can now choose to deposit their daily rewards into their savings account, allowing them to save money without having to think too much about it. The savings account can be accessed from the Wallet app, where users can see their current balance, interest rate, and recent transactions. They can also manually add or withdraw money, and transfer the balance to Apple Cash or a regular bank account.

While the interest rate being offered by Apple is subject to change, the introduction of the savings account is a welcome addition to the Apple Card’s suite of features. With the potential to earn a high rate of interest on their savings, Apple Card customers may find it easier to reach their financial goals.