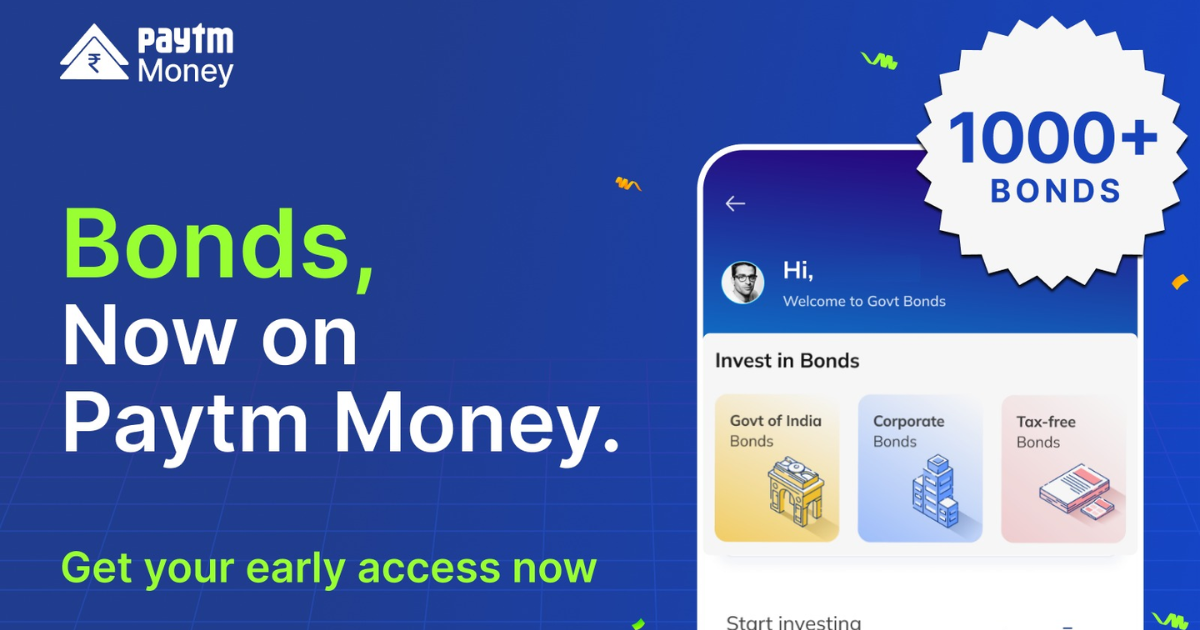

Paytm Money, the investment tech platform and subsidiary of One97 Communications Limited (OCL), announced on Monday the launch of a bonds platform aimed at helping retail investors explore the debt market. This new platform aims to simplify bond investments for retail investors, offering three types of bonds to invest in: government, corporate, and tax-free.

The bonds platform, available through the Paytm Money app, has been introduced with an early access waitlist program. It brings together all relevant information in one place and converts it into yield, enabling investors to analyze and understand the potential returns. Paytm Money believes that investing in the debt market is still relatively new in India and sees the country’s potential to have 100 million investors, with bonds serving as an excellent entry point into capital markets.

Varun Sridhar, CEO of Paytm Money, expressed the company’s vision, stating, “We believe bonds are the best way for first-time investors to enter capital markets and every Indian should have a diversified wealth portfolio with bonds being a core part of it.” Paytm Money aims to revolutionize the Indian capital markets, building on their success in the mobile payments sector.

In recent years, the Securities and Exchange Board of India (SEBI), the capital markets regulator, introduced a regulatory framework to facilitate retail investor participation in the bond market and streamline online bond platforms’ operations. This move has paved the way for platforms like Paytm Money to offer accessible bond investments to retail investors.

Paytm Money faces competition from other investment tech platforms like Zerodha and Groww. Groww, for example, recently completed the acquisition of the mutual fund business of Indiabulls Housing Finance, positioning itself to launch new mutual fund offerings. Zerodha, on the other hand, announced a joint venture with smallcase to enter the mutual fund business by launching its own asset management company (AMC) last month.

With the introduction of the bonds platform, Paytm Money aims to empower retail investors to diversify their investment portfolios and tap into the potential of the debt market in India, further expanding its reach in the investment tech sector.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)