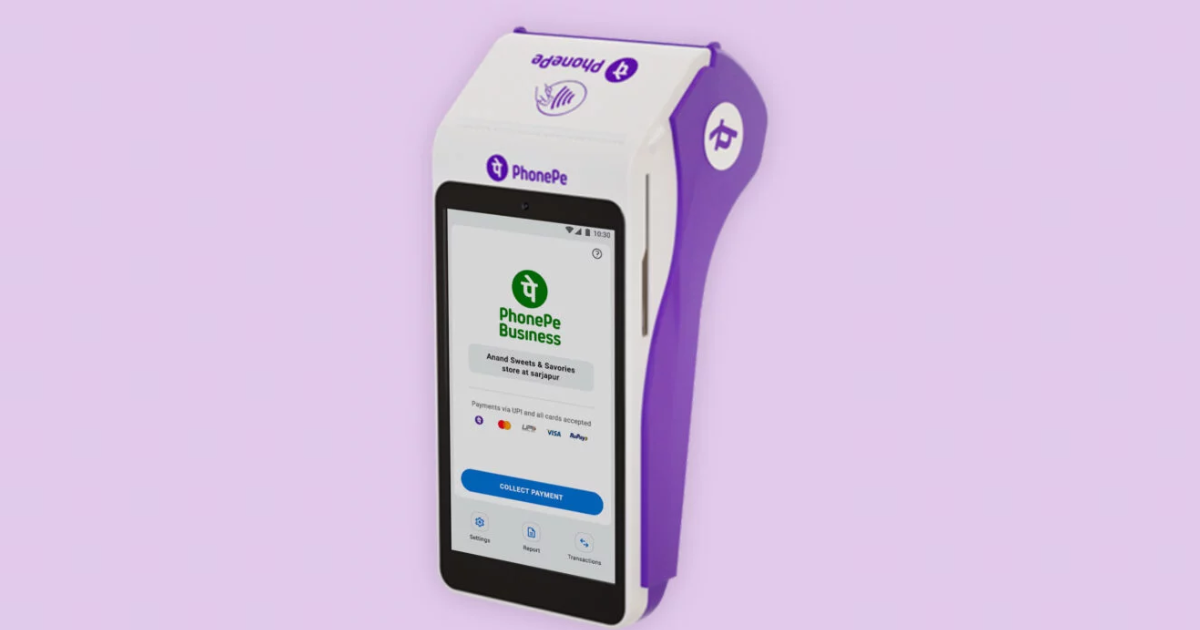

PhonePe has introduced its own point-of-sale (PoS) device, allowing merchants to accept payments via debit cards, credit cards, and UPI. Joining the ranks of Pine Labs, BharatPe, and Paytm, among others, PhonePe’s Android-based PoS device comes preloaded with the PhonePe PoS app and supports various transaction methods such as tap, swipe, dip, and interoperable dynamic QR codes.

The newly launched PoS device from PhonePe has received the PCI-PTS 6 certification, ensuring the security of both merchant and consumer data. With features like automatic batch closure and unified reconciliation, the device aims to provide a comprehensive solution for account settlement. Equipped with a touchscreen display, built-in printer for receipt printing, as well as WiFi and 4G connectivity via a SIM card, the PoS device offers convenience and seamless functionality.

PhonePe has also ventured into the payment device market with its PhonPe SmartSpeaker, capable of announcing transactions in 11 languages. Vivek Lohcheb, Head of Offline Business at PhonePe, highlighted that the new PoS device empowers merchant partners to enhance the purchasing experience for their customers, supporting various modes of payment.

PhonePe has set an ambitious target of deploying 150,000 PoS devices by the next year. Currently, the fintech giant claims to have a merchant base of 35 million across India. However, it faces tough competition in the PoS device market, with Pine Labs dominating the startup ecosystem. Paytm, PhonePe’s direct competitor, also offers similar products.

The launch of the PoS device follows PhonePe’s recent introduction of a payment gateway and a merchant lending marketplace. As the company expands its offerings, it aims to strengthen its position in the competitive fintech landscape in India.