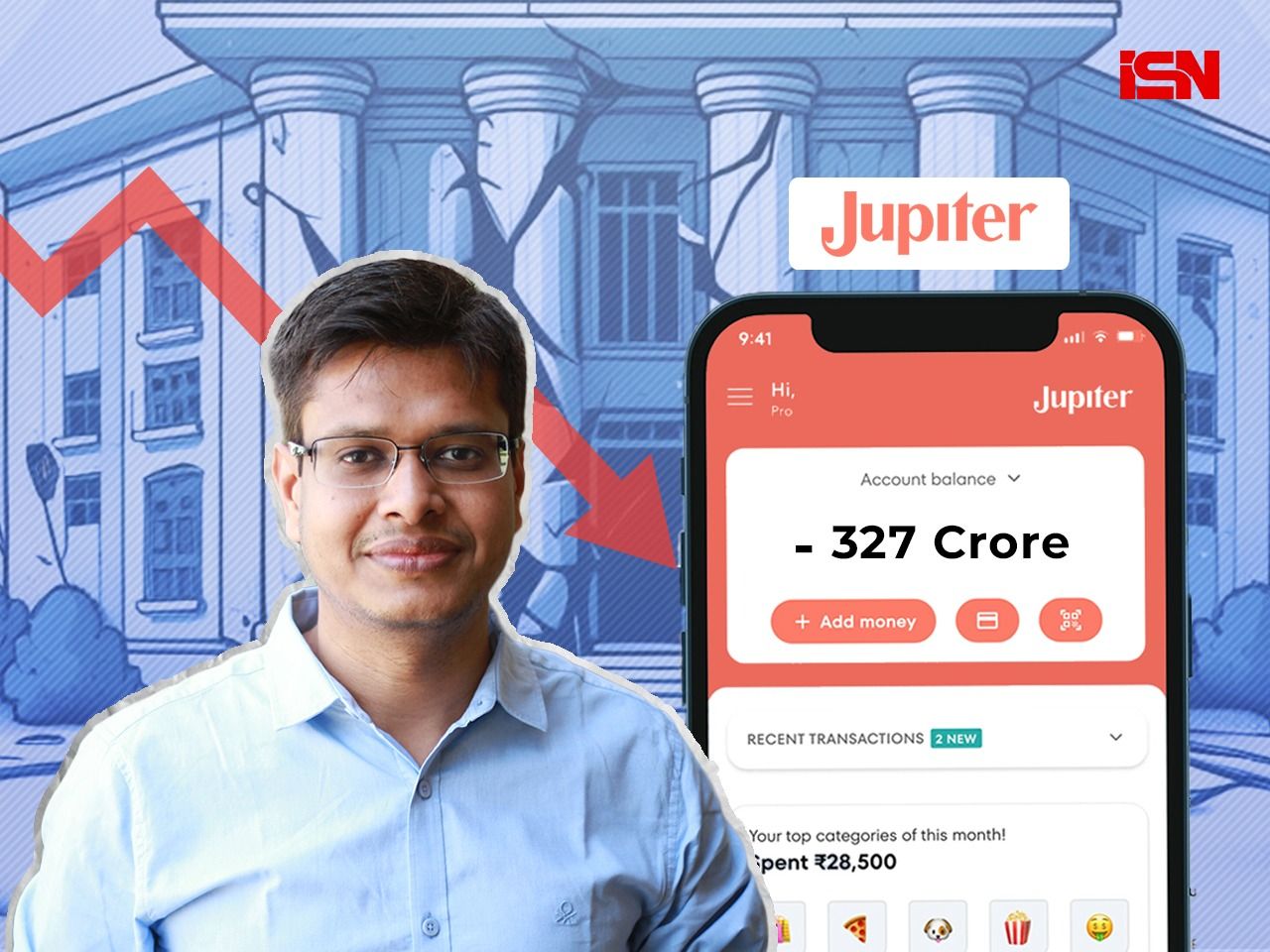

Neobanking platform Jupiter Money, in its third year of operation, reported a significant increase in its net losses for the financial year 2022-23 (FY23). The consolidated net loss more than doubled, rising from Rs 156.3 crore in the previous fiscal year to Rs 327 crore.

Despite this, the company saw a substantial jump in operating revenue, which increased over 1,500% to Rs 7.1 crore in FY23 from Rs 42 Lakh in FY22.

Revenue Streams and Growth

Jupiter, founded in 2019 by Jitendra Gupta, offers a variety of financial services including debit cards, SIPs, mutual funds, and UPI payments.

The majority of its revenue, Rs 5.3 crore, came from the sale of services. Other operating revenues, such as collaboration and subscription fees, contributed Rs 1.8 crore. Including interest income and other non-operating income, Jupiter’s total revenue stood at Rs 56 crore in FY23, a significant increase from Rs 22.1 crore in the previous fiscal year.

Escalating Expenses

The company’s total expenses surged by 114.6% to Rs 382.9 crore in FY23 from Rs 178.4 crore in the previous year. Employee benefit expenses were the largest contributor, jumping almost 150% to Rs 158.5 crore. Advertising and promotional expenses also rose by nearly 50% to Rs 74.5 crore. Other major costs included processing, software, and technology expenses, as well as after-sales service expenses.

Investments and Cash Flow

Jupiter generated a positive cash flow of Rs 318 crore from investing activities, a turnaround from a negative cash flow of Rs 873.7 crore last year. This was largely due to earnings from investments like interest on fixed deposits and gains on mutual funds, which almost doubled to Rs 49 crore. However, its cash flow from operating activities continued to be negative at Rs 381 crore.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)