Mubadala-backed buy now, pay later platform Tabby has secured $700 million in debt financing in the form of receivables securitisation from JP Morgan, boosting its balance sheet and efforts to support the growing economic impact of the region’s BNPL market.

At the same time, the Riyadh-based start-up extended its series D funding round by securing $250 million from Saudi Arabia’s Hassana Investment Company, US firm Soros Capital Management and Saudi Venture Capital, Tabby said on Thursday.

“A vibrant and growing consumer lending sector is vital for the local economy and we are pleased to work with Tabby on this strategic initiative to support retail credit throughout the Middle East,” said George Deves, co-head of Northern European asset-backed securities at JP Morgan.

This is in addition to the $200 million it raised last month, which helped Tabby join an elite group of unicorns, or billion-dollar start-ups, in the Mena region, ahead of its planned initial public offering in Saudi Arabia.

The other regional unicorns are the UAE’s Careem, Kitopi, Swvl and Emerging Markets Property Group, Egypt’s Fawry, and Saudi Arabia’s STC Pay and Tamara, which gained unicorn status last week after raising $340 million in a series C funding round.

“Securitisation is a major milestone … it mirrors the rapid growth and evolution of the FinTech landscape in our markets,” said Hosam Arab, chief executive and co-founder of Tabby.

The new fundings are poised to support Tabby in amplifying its reach and impact and will help “reshape the future of financial services in Saudi Arabia and the wider Mena region”, said Ahmed Al Qahtani, chief investment officer for regional markets at Hassana.

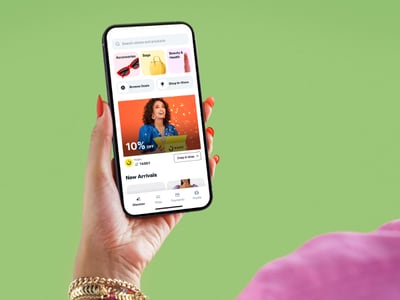

The BNPL business model, which allows consumers to make online purchases instantly and spread their payments out over interest-free instalments, has boomed since the onset of the Covid-19 pandemic, driven by the millennial and Generation Z cohorts.

The global BNPL market is projected to hit $565.8 billion in 2026, from an estimated $309.2 billion in 2023, growing at a compound annual rate of 25.5 per cent, the latest insight from GlobalData shows.

More than 45 start-ups are expected to emerge as unicorns from the region by the end of the decade, led by Saudi Arabia, a previous report from STV had shown.

The UAE unveiled its updated Entrepreneurial Nation 2.0 initiative that has a goal of creating 20 unicorns by 2031.

“Tabby is poised for accelerated growth, further market penetration and continued innovation … maintaining its commitment to transparency, affordability and responsible lending practices,” Mr Al Qahtani said.

The company has been actively attracting more funding to boost its operations. In January, it raised $58 million in a series C round that valued it at $660 million.

That made the company one of the most valuable start-ups in Mena and the first in the GCC to receive funding from the venture capital arm of PayPal.

It secured $150 million in debt financing from US-based Atalaya Capital Management and Partners for Growth in August 2022, in one of the largest credit lines secured by a FinTech start-up in the GCC.

In March of the same year, it raised $54 million from Sequoia Capital India and STV.