SUMMARY

Overall, Indian startups raised $10 Bn+ in 2023, according to Inc42’s Indian Tech Startup Funding Report 2023. However, only two new unicorns – Zepto and InCred – were seen in the past year, marking the lowest number of unicorns in a calendar year after 2017

Bhavish Agarwal’s AI startup Krutrim becoming the first unicorn of 2024 to join the club, but these are still early days for the new year. Krutrim is something of an anomaly given the huge promise it holds in the future, so we don’t expect too much similar frenzy around high valuations and unicorns in 2024

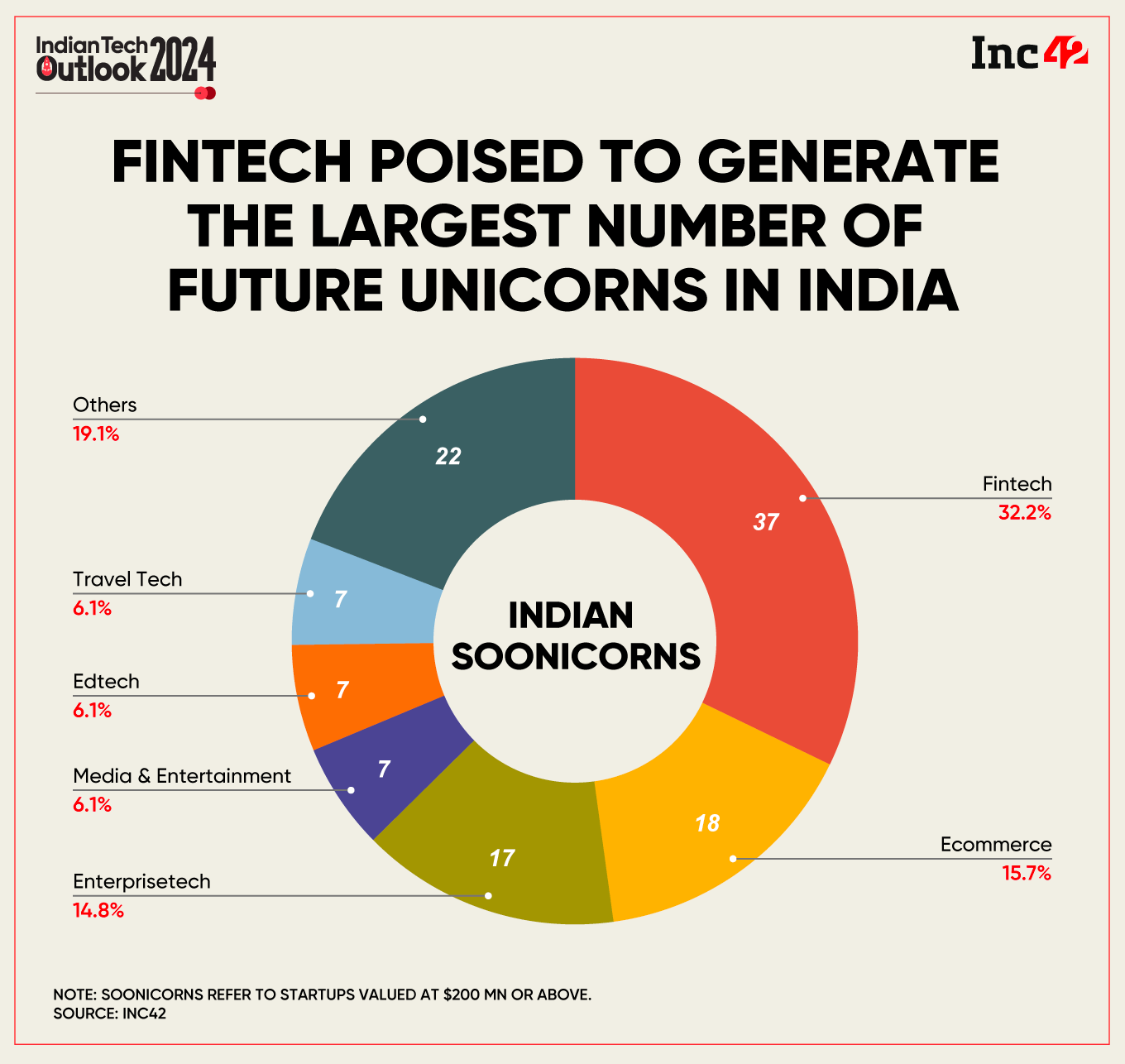

Most new unicorns will likely emerge from the fintech sector, closely followed by ecommerce and enterprise tech, especially the SaaS segment, per Inc42’s Indian Tech Startup Funding Report 2023

The year 2023 came and went without good tidings for the startup ecosystem. After the FOMO-driven funding frenzy during the pandemic, the splurge became a drip due to global headwinds and investors becoming ultra-cautious about backing profitable businesses, investing at high valuations and returns and exits.

The result: A big drop in mega-rounds, cutbacks at startups across sectors and just a couple of new unicorns.

India is now home to 113 unicorns with a combined valuation of more than $350 Bn, but many of these are feeling the pressure of living up to their paper valuations. The likes of BYJU’S, Pharmeasy, Meesho, Pine Labs and several other startups saw corrections in their valuation based on adjustments from investors.

Overall, Indian startups raised $10 Bn+ in 2023, according to Inc42’s Indian Tech Startup Funding Report 2023. However, only two new unicorns – Zepto and InCred – were seen in the past year, marking the lowest number of unicorns in a calendar year after 2017.

Bhavish Agarwal’s AI startup Krutrim became the first unicorn of 2024 to join the club, but these are still early days for the new year. Krutrim is something of an anomaly, given the huge promise it holds in the future, so we don’t expect too much similar frenzy around high valuations and unicorns in 2024.

Instead, the focus will turn to startups growing into their valuations by improving unit economics, cutting their losses and showing a clear path to profitability.

Inc42 spoke to several investors in the past month and a half and found a mixed bag of opinions — while many had an optimistic outlook, others were quick to point out caveats.

One thing is clear: Startups aiming to raise funds today must exhibit robust fundamentals, ensuring their valuations align well with the value they bring. Only those unicorns with transparent financials, strong corporate governance, great teams and good company culture may loosen the purse strings.

What’s Next For India’s Unicorn Club?

As we enter 2024, buckling the current trend and restoring investor confidence in India’s startup ecosystem would be critical. It should not be difficult at the macroeconomic level as India is expected to register better-than-expected GDP growth in the current financial year. In fact, GDP grew at 7.6% in Q2 FY24 (July-September 2023), surpassing the RBI projection of 6.5%. The central bank’s economic activity index now estimates the Q3 growth of at least 7%.

Backing this growth expectation, VCs are readying up their dry powder (capital raised between 2021 and 2023) to make a run at startups looking at public listings. Instead of creating unicorns, the idea in 2024 is to back startups that are closest to offering the best exit opportunities.

As per these expectations and based on data compiled by Inc42, at least a dozen startups are likely to join the unicorn club in 2024.

Most new unicorns will likely emerge from the fintech sector, closely followed by ecommerce and enterprise tech, especially the SaaS segment, per Inc42’s Inc42 analysis.

Unicorns Eyeing Public Listing, Return To India

As private market investors have grown cautious, startups are turning to public markets for funds. Five new-age tech startups got listed in 2023 and three in the previous year.

However, at least 14 tech startups are expected to list in 2024 – a much-needed step to ensure fundraising if an immediate inflow of the dry powder under question proves elusive.

V Jayasankar, managing director at Kotak Investment Banking (KIB), believes that the funding winter may end in 2024 and expects 15-20 unicorns to go public in the next one or two years.

As many as six unicorns – Ola Electric, MobiKwik, Swiggy, Digit Insurance, FirstCry and OYO – have plans to go public in the year. Except Swiggy, the others have also filed draft red herring prospectus (DRHP) for IPOs.

The Reverse Flipping Wave

This year, another prominent trend among unicorns could be reverse flipping or redomiciling Indian startups after their headquarters were shifted overseas. This is intrinsically linked to the growing reliance on public markets to raise funds.

Several unicorns, including Razorpay, Eruditus, Meesho, Groww, and LivSpace, Zepto, plan to relocate their headquarters back to India in 2024. Many of these are eyeing IPOs in the near future on the basis of the positive noises coming from the Indian stock exchanges for 2024.

Sameer Nigam, the cofounder and CEO of PhonePe, which redomiciled to India in October 2022, said as many as 20 Indian unicorns were open to returning to India if regulatory conditions were eased.

The Indian government aims to speed up reverse flipping through various incentives including easing restrictions in relation to the GIFT IFSC in Gujarat.

GIFT City enables investors and startups to manage their financials in USD, provides a slew of tax benefits and fintech schemes, and helps tie up with global financial centres.

Vaibhav Gupta, partner at the tax regulatory firm Dhruva Advisors, told Inc42 earlier, “With the withdrawal of treaty benefits in Mauritius and Singapore and availability of a 10-year tax holiday and other regulatory advantages, GIFT IFSC has become an attractive destination for setting up PE/VC funds. The finance minister has also announced a single-window clearance system. When implemented, it will go a long way.”

Is The Unicorn Label A Fast-Fading Fad?

In 2015, India was home to just 10 unicorns, but this number grew more than 11x in less than a decade.

Although the market underwent a course correction in the past two years, slowing the pace of unicorn creation, we cannot overlook that a startup today may achieve the status within a few months compared to the earlier timeframe of seven to eight years.

Earlier, the assessment criteria for unicorns and soonicorns was around scale, user growth and revenue projections, but today these vanity metrics are being eschewed.

Interestingly, the shift in focus among startup investors has sparked a debate surrounding the hype that comes with the unicorn label. Is it waning fast, and a new set of startup achievers will emerge based solely on their performances and the strength to stay afloat through thick and thin — aka cockroach startups?

But some believe that unicorn startups need not feel overly concerned even if the sentiment in the ecosystem is changing. Talking to Inc42, a prominent investor, requesting anonymity, said that Indian startups would no longer require large late stage rounds that have characterised past unicorns.

“In the past, companies spent considerable time scaling up and building profitable businesses, necessitating funds for survival. But this is no longer the case. If your idea is robust, funding is readily available. At the growth stage, companies can secure another funding round to stabilise revenues, strengthen fundamentals and even opt for an IPO at a valuation as low as INR 250 Cr ($30 Mn),” he added.

Another investor told us that entrepreneurs today do not aspire to create unicorns as they fear being too much in the spotlight and the intense scrutiny it triggers.

In fact, a few startups have avoided getting the unicorn tag for fear of hype, including B2B marketplace Bizongo, which raised $50 Mn at a valuation of $980 Mn. Similarly, insurtech platform Turtlemint was valued at around $950 Mn during its $120 Mn Series E round.

Industry experts also argue it is time to abandon fancy labels and refocus on the basics. Global headwinds will always be there. Be it geopolitical conflicts like the Russia-Ukraine war, market volatility affecting the INR-US dollar exchange rate or textbook cases of mismanagement like the Silicon Valley Bank shutdown, political, economic and regulatory crises will continue to impact businesses. But unlike the incumbents or legacy companies, startups will be more vulnerable to these challenges.

Indian unicorns need to justify their value and valuations as soon as possible, not only to disrupt but also to ensure sustainability. As they say, 2023 was like no other year and nothing went according to plans. Therefore, in 2024, the success mantra will lie in adaptability and staying prepared for the unexpected.

[Edited by Sanghamitra Mandal]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)