SUMMARY

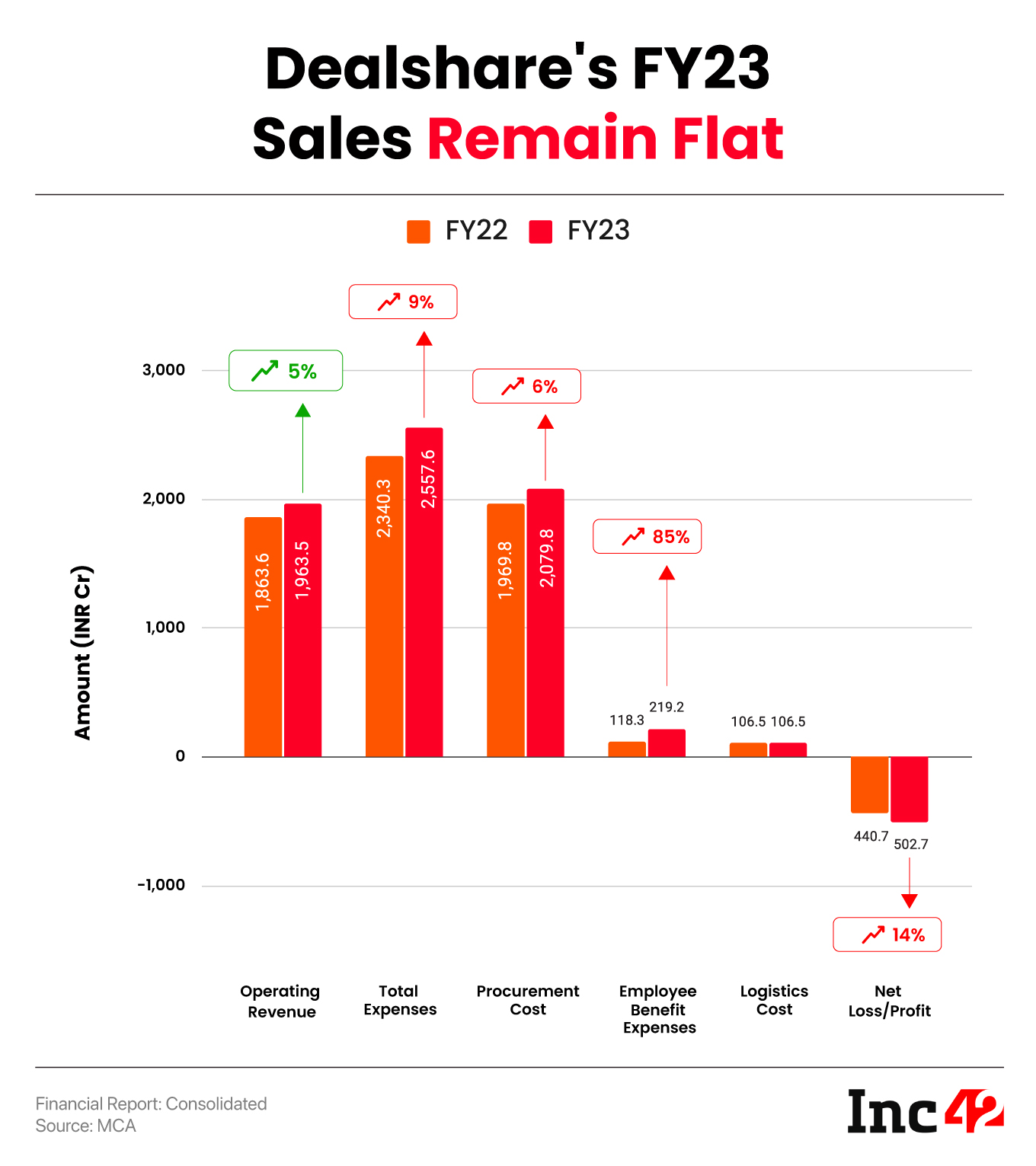

DealShare’s loss rose 14% to INR 502.7 Cr in FY23 from INR 440.7 Cr in the previous fiscal year

Operating revenue grew a marginal 5% to 1,963.5 Cr from INR 1,863.5 Cr in FY22

Led by a 85% surge in employee costs, the ecommerce startup’s total expenditure grew 9% YoY to INR 2,577.6 Cr

Alpha Wave-backed DealShare’s net loss crossed the INR 500 Cr mark in the financial year ended March 31, 2023. The B2C ecommerce startup’s loss rose 14% to INR 502.7 Cr in the financial year 2022-23 (FY23) from INR 440.7 Cr in the previous fiscal year.

Founded in 2018 by Sourjyendu Medda, Vineet Rao, Sankar Bora, and Rajat Shikhar, DealShare is a marketplace where users can buy groceries and vegetables. However, the startup has been facing a financial crunch for some time now (more on this later).

Its operating revenue grew a marginal 5% to 1,963.5 Cr in FY23 from INR 1,863.5 Cr in the previous fiscal year.

The startup primarily earns revenue by selling grocery products to customers after procuring it from wholesalers.

Including other income, DealShare’s total revenue grew to INR 2,054.9 Cr during the year under review from INR 1,899.5 Cr in FY22.

Where Did DealShare Spend?

The rise in DealShare’s expenditure outpaced the increase in its operating revenue in FY23. Total expenditure increased 9% to INR 2,577.6 Cr in FY23 from INR 2,340.3 Cr in the previous year.

Procurement Cost: Being a marketplace, the startup’s biggest expenditure was procurement of finished goods. Its procurement cost rose 6% to INR 2,079.8 Cr in FY23 from INR 1,969.8 Cr in the previous fiscal year.

Employee Benefit Expenditure: Employee expenses surged 85% to INR 219.2 Cr during the year under review. The startup had spent INR 118.3 Cr on employee benefit expenses in FY22. It is pertinent to note that the startup laid off around 100 employees, or 6% of its workforce, in FY23. Later, it laid off another 130 employees in September last year citing a shift in its business model.

Logistics Cost: DealShare spent INR 106.6 Cr on logistics and transportation cost in FY23, almost similar to what it spent in FY22.

DealShare’s Many Troubles

From layoffs to exit of cofounders, DealShare has been in the news for all the wrong reasons over the last year or so. The startup, which has raised $390 Mn till date and attained a valuation of $2.7 Bn, has been reeling under a capital crunch due to the ongoing funding winter and its high cash burn.

As a result, it has fired over 220 employees in two rounds of layoffs so far. Last year, the startup also shut operations in Maharashtra and in parts of Hyderabad.

The unicorn also shut its B2B business to focus only on the B2C vertical.

Amid all these, it also saw three of its cofounders – Sourjyendu Medda, Vineet Rao and Sankar Bora – step down from their individual roles. Now, Rajat Shikhar is the only cofounder associated with DealShare.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)