Food waste is a major problem.

In the U.S. alone, roughly 30% to 40% of the supply ends up in landfills. A United Nations report estimated that around one-third of the world’s food is wasted every year, adding up to 1.3 billion tons — worth almost $1 trillion.

Given the scale — and societal implications — of food waste, it’s not surprising that there’s an entire cohort of startups attempting to tackle the challenge from various angles.

Yume’s platform helps manufacturers turn potential food waste into cash. Divert aims to tackle grocery store waste algorithmically. Ida is applying AI to attempt to prevent surplus in supermarkets. And Choco is fostering a more sustainable food system for restaurants and suppliers.

Another among the food waste-fighting ventures is Los Angeles-based ProducePay, whose stated mission is to give fresh produce growers and buyers greater transparency — and flexibility — in the grocery supply chain.

“ProducePay is on a mission to eliminate the economic and food waste caused by the volatile and fragmented nature of today’s global fresh produce supply chain,” CEO Pat McCullough told TechCrunch in an email interview “Our [platform] is giving growers and buyers greater control of their business by providing unprecedented access to capital, a global trading network, insights and supply chain visibility.”

Pablo Borquez Schwarzbeck founded ProducePay in 2015, shortly after graduating from Cornell with his MBA.

Schwarzbeck’s first exposure to produce supply issues was on his family’s asparagus and grape farms in Mexico. As a young adult, Schwarzbeck, who’s now ProducePay’s executive director, went on to work for the Giumarra Companies, a fruits and vegetables grower, where he says he came to truly grasp the magnitude of the disadvantages growers face.

“A single shipment of produce typically travels 1,600 miles, and will be handled by four to eight intermediaries,” Schwarzbeck said. “Along the way, factors such as unpredictable weather, fluctuating markets, crop disease and pests create a constant state of instability that wreaks havoc across the supply chain. This volatility and unpredictability, coupled with the fragmented, speculative nature of the supply chain, results in enormous inefficiencies and wasteful practices.”

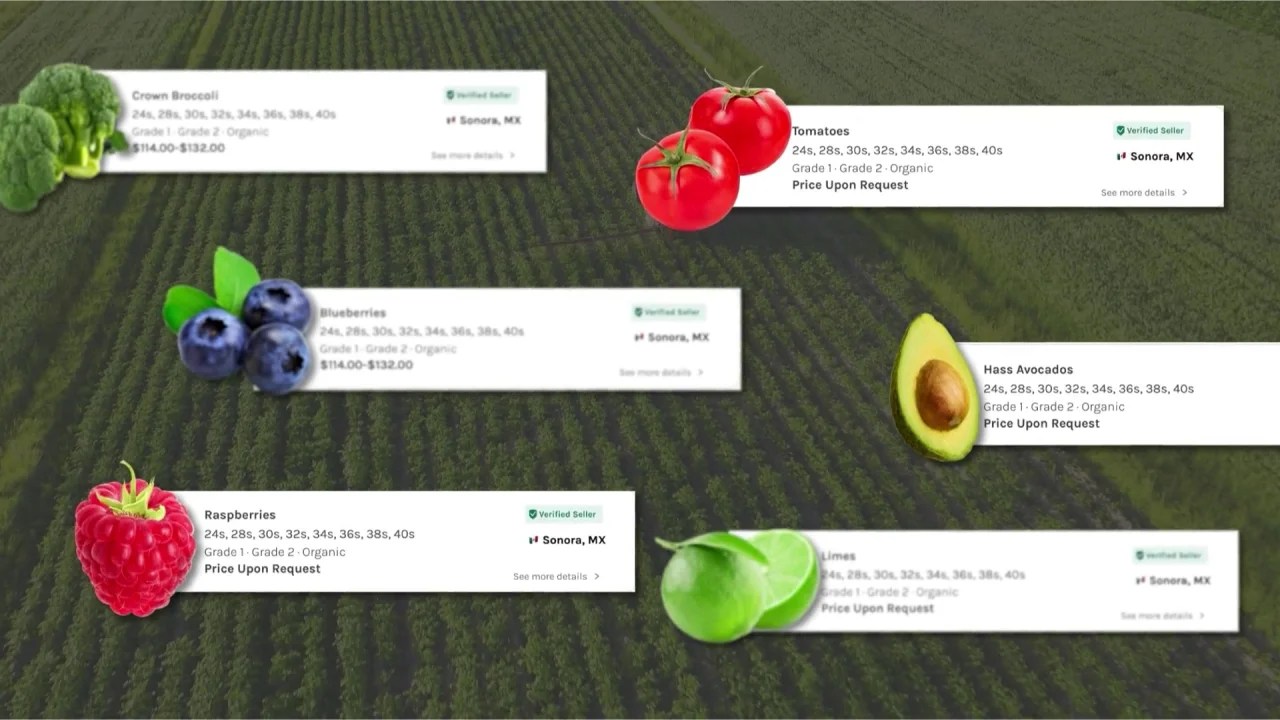

ProducePay’s platform helps connect — and fund — fresh produce growers and buyers.

As Schwarzbeck alluded to, growers face a number of pressures — but one of the most acute is steep competition for buyer contracts. In a report from the environmental organization Feedback investigating international food supply chains, six out of ten farmers admitted to overproducing to avoid losing contracts — resulting in supply exceeding demand and, by extension, food waste.

ProducePay’s solution is two-pronged: supply chain monitoring and financing products for food growers and suppliers.

ProducePay supplies working capital to help growers and distributors pay for things like operating expenditures, tech upgrades and land acquisitions. In addition, ProducePay extends liquidity to growers and distributors post-harvest, enabling growers to reach ostensibly stronger cash positions for their next growing cycle — and distributors to attract sought-after growers by offering them faster, larger payouts.

Are the loan terms favorable? Some customers think they are — McCullough claims that ProducePay is now working with over 60 commodities across 20 countries, having funded more than $4.5 billion in harvests so far.

“This success is built entirely on trust,” he added. “Growers trust that we are there to help them grow. And we’ve built a robust network of growers and buyers who we know can deliver on their commitments.”

Beyond standalone services, ProducePay bundles its financial products with supply chain visibility tools to create what McCullough calls “predictable commerce programs.” The programs have retailers commit to fixed pricing and volume before the growing season starts in exchange for produce from vetted growers. ProducePay’s team of agronomists monitor and communicate order quality from the field throughout each program, through transportation and upon final arrival.

One customer for which ProducePay built a program, Four Star Fruit, is leveraging it to connect to growers, advertisers and retailers in ProducePay’s ~1,000-client network while bypassing “non-value-added intermediaries,” McCullough says. “We’re addressing volatility with capital, technology and our team of agronomists to more efficiently capture all of the value that’s lost to these intermediaries and other inefficiencies,” he continued.

ProducePay’s business — taking a cut of every transaction through its platform — has proven to be quite lucrative, with revenue increasing 76% last year compared to 2022. Trade volume on the platform is up by almost 3x, according to McCullough, while transaction volume is track on track to reach $2 billion by late 2023.

Evidently pleased with the figures, investors are pouring more money into Schwarzbeck’s venture.

Today, ProducePay announced that it raised $38 million in a Series D round led by Syngenta Group Ventures with participation from Commonfund and Highgate Private Equity, G2 Venture Partners, Anterra Capital, Astanor Ventures, Endeavor8, Avenue Venture Opportunities, Avenue Sustainable Solutions and Red Bear Angels. The new capital, which brings ProducePay’s total raised to $136 million, will be put toward supporting the company’s expansion into Europe, Asia, Africa and Australia and growing ProducePay’s team of ~300 full-time employees.

“Even though many industries have presented a slowdown, fresh produce will always be indispensable and continues to grow as consumers demand healthier food choices,” McCullough said. “We saw it through the pandemic and continue to see that upgoing trend.”

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)