Was it wilful fraud or simply incompetence by the four founders and unintended outcomes thereof? That’s the question being asked in the case of Accel-backed Mooofarm, more than six months after controversy broke out at the startup.

As we reported exclusively in July 2023, the Delhi NCR-based agritech and dairy tech startup, which has to date raised more than $15 Mn from the likes of Accel, Aavishkaar and several other investors, filed a police complaint against its former finance head Vineet Bhati for allegedly embezzling INR 10 Cr for personal gains.

In the immediate aftermath, Bhati disputed the Mooofarm management’s claims and alleged that the founders — including then CEO Param Singh — were also complicit in the syphoning of funds. Sources close to the company said at the time that bank statements and transaction entries put Bhati at the centre of the alleged fraud.

Now more than six months later, many of these claims have been questioned by several former Mooofarm employees, which has further complicated the issue.

What’s more: Param Singh has been replaced as CEO by cofounder Abhijeet Mittal in what many employees are calling a response by investors to the corporate governance mess at Mooofarm. While Param Singh has denied that he was asked to step down, he confirmed handing over the executive decision-making to Mittal.

lockquote>

Param Singh has taken on the role of founding director in the company and told Inc42 that his focus is on fundraising to keep the company afloat.

But there is more. Former employees allege that not only were founders aware of the embezzlement as Bhati has claimed, but there is a deeper rot at Mooofarm, including its business model of cattle marketplace and supply platform on the back of which it has raised funds.

Indeed, when it comes to the business model, Mooofarm’s problems are similar to other startups in this segment, including Nexus Venture Partners and Omnivore-backed Animall, which has also pivoted in recent months.

The biggest allegation from employees is about gross misreporting of revenue, where Mooofarm’s founders and management are alleged to have employed tactics such as inventory rotation, fake vendors and fake customers to not just show higher-than-actual revenue but also embezzle funds further.

The company has vehemently denied these allegations, insisting that Bhati was singularly responsible for the alleged embezzlement of more than INR 10 Cr. The company’s complaint has been registered as an FIR by the Economic Offences Wing in Gurugram, though Inc42 was not given the current status of the probe by the EOW.

Bhati did not respond to Inc42’s requests on the company’s allegations in the FIR.

Mooofarm was founded in 2019 by Param Singh, Aashna Singh, Jitesh Arora and Abhijeet Mittal. Employees allege that the four founders didn’t just ignore widespread sales misreporting, but also used the company’s funds for personal travel, as well as spending on expensive gifts, artwork and luxury goods.

Some of these allegations are backed by statements for Mooofarm’s corporate credit card account, which Inc42 has reviewed. It’s unclear whether the company was reimbursed for this alleged personal spending by the founders, but in many cases, the company would also expense the corresponding amount to non-empanelled vendors, Inc42 has learnt from sources close to the finance team.

Employees Raise Red Flags At Mooofarm

The most vocal complaint from former employees is that Mooofarm has not paid them since August 2023. Many claimed Mooofarm already had lax payroll standards, but in this case, the company seems unwilling to even acknowledge the problems of those with emergency medical bills.

Former Mooofarm employees allege that only those close to the founders are being paid regularly. Besides overdue salaries, the company is alleged to have not deposited provident fund contributions and the tax deducted at source. Mooofarm did not deny these allegations but claimed to be working towards resolving the issue.

The company acknowledged that many employees have not been paid since September last year, but added that it’s offering all assistance to such employees, even though this has been disputed by our sources.

Current CEO Mittal told Inc42 that the financial situation of Mooofarm has been destabilised by the alleged embezzlement of funds and as a result, the company had to cut back on many fronts. The CEO added that the company has raised over INR 2 Cr to settle the overdue salaries.

And even though this money was raised — corroborated by MCA filings — employees have not reported being paid their salaries.

Employees who worked with the key decision makers in Mooofarm’s product and sales team claim that INR 2 Cr would not even cover half of the overdue salaries, and besides this the company is said to have unpaid vendor dues of close to INR 10 Cr.

The bigger problem at Mooofarm is that its business model looked to organise a segment that has a reputation of being ‘unorganisable’. The company primarily earned revenue from connecting buyers and sellers of cattle.

While it started as a marketplace, Mooofarm is an inventory-led ecommerce platform today. But supply cattle across the country means dealing with middlemen, red tape, political hurdles, supply chain restraints and lack of monitoring.

As one investor in the agritech space told us, “No startup has been able to crack the model of cattle supply. Some businesses cannot be made better by tech or startups.”

lockquote>

In the grand scheme of the startup ecosystem, Mooofarm is not the largest startup by any measure. But it’s a story of how investors backed weak business models at the height of the zero interest rate policy (ZIRP) phenomenon in 2021 and 2022.

The Alleged ‘Fraud’ Mooofarm Acknowledges

Last July, the Accel-backed company filed a criminal complaint against former finance head Bhati for allegedly embezzling more than INR 10 Cr for potential personal gains. Bhati, an employee of the startup since day one, denied these allegations and shot back at the founders alleging that they were complicit in any fraud or embezzlement.

While the complaint filed in July was registered as an FIR in September by the Haryana Police and then passed on to the Economic Offences Wing — confirmed independently by Inc42 — the corporate governance disarray drew the attention of investors such as Accel and Aavishkaar Capital.

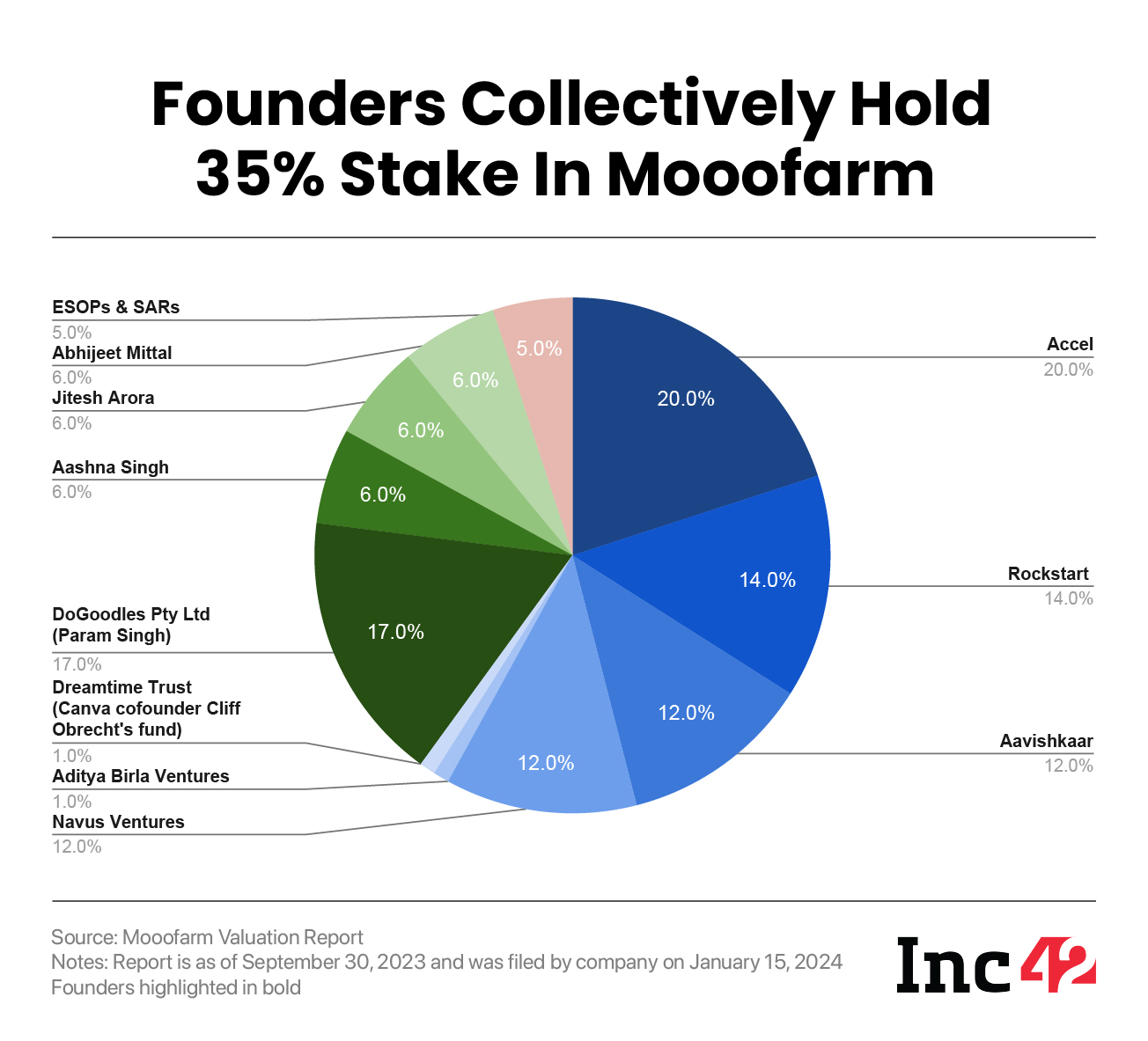

Accel, which holds a 20% equity in the company and is therefore the lead shareholder, is said to have initiated an internal audit. Employees who were with the company during this time said the auditor appointed by Accel found discrepancies in terms of fake employees drawing large salaries.

While Mooofarm acknowledged paying employees that never existed, it laid the blame at Bhati’s feet.

“On finding out about the fraud in July 2023, the company conducted a thorough internal investigation and identified 20 fictitious consultants meticulously orchestrated by ex finance head [Bhati], within the Company record. There is no record of any of these consultants in any Company data, such as offer letters, banking details, contact information etc. These salaries were never part of the payroll of the Company. Ex finance head transferred these fake booked salaries to his own accounts, making himself the beneficial recipient,” ex-CEO and Mooofarm cofounder Param Singh told Inc42 in response to a lengthy questionnaire about the allegations.

lockquote>

As per documents procured from sources that are privy to the company’s finances, Mooofarm paid over INR 2.64 Cr in salaries to 13 fictitious consultants from April 2021 to March 2023 (FY22 and FY23). The total amount paid could well be over INR 2.64 Cr since Inc42 was only able to source data for 13 fictitious consultants, and the company claims to have found 20 such individuals who have been paid without being formally employed.

The Alleged ‘Fraud’ Mooofarm Denies

Employees dispute the founders’ version of events claiming that the fictitious contractors were part of the payroll data sent to potential investors by the founders when raising the Series A round in December 2022.

“Founders claim to be unaware of Vineet Bhati’s actions till July 2023, but they had access to both the actual payroll data from Human Resources as well as how much salary was actually paid. Any discrepancy should have been clear when they submitted MIS to investors,” said one former employee who quit the company in August 2023 and is awaiting his final compensation.

lockquote>

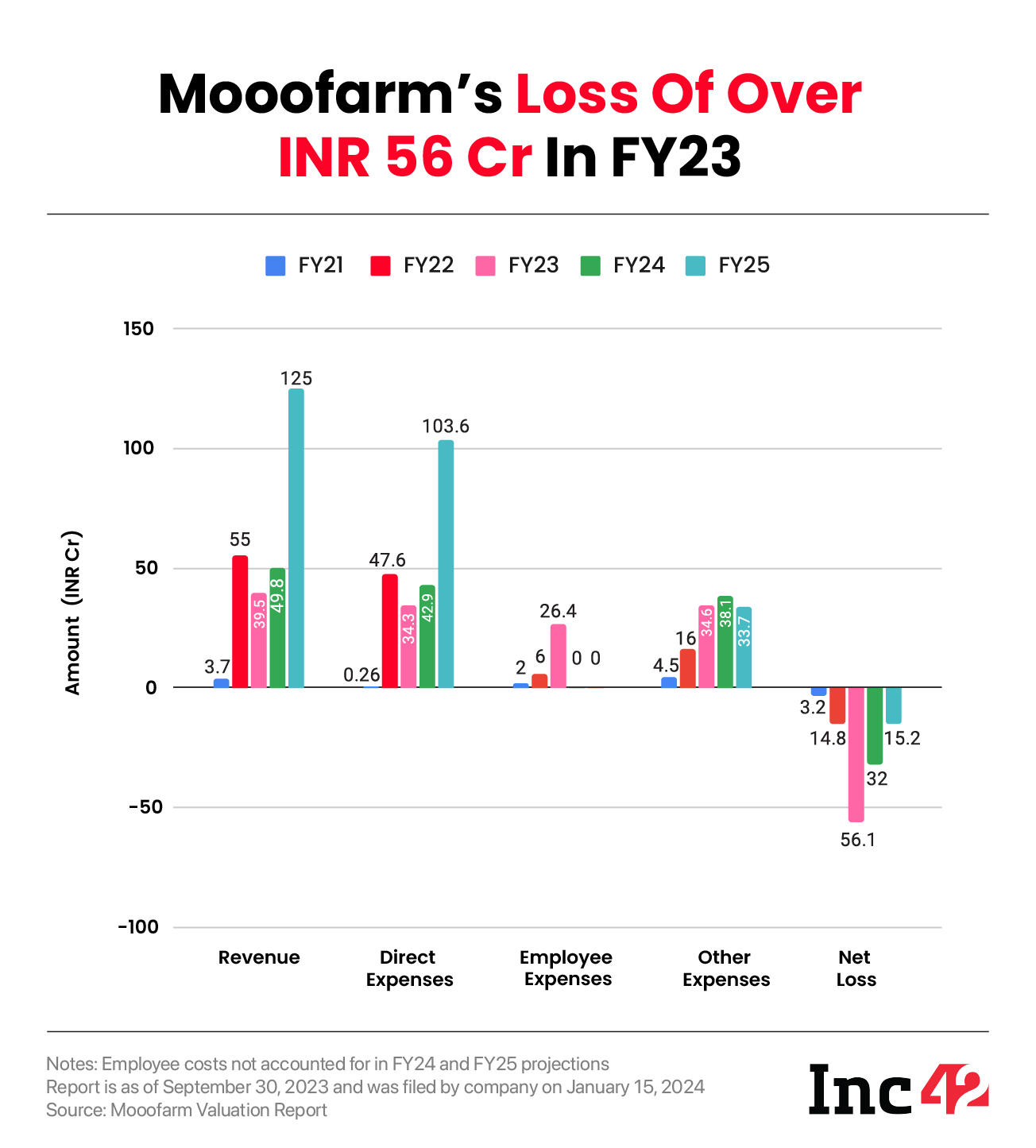

Further, employees allege that Mooofarm was not able to prove its marketplace model and any growth shown to investors was based on fabricated revenue. “The founders pitched revenue of INR 120 Cr for 2023 when raising funds in 2022, but the numbers for FY23 are just around INR 20 Cr.”

CEO Mittal confirmed that Mooofarm’s total revenue (marketplace+inventory) for FY23 was INR 19.6 Cr, and employees say that founders are at the very least responsible for this revenue inflation even if they claim to have not known about the salaries to fake employees.

But former employees in the product, design and business teams at Mooofarm claim the startup has done even worse in FY24, which led to layoffs and forced resignations, unpaid salaries and vendor dues.

Besides fake employees, the management is alleged to misreported revenue in a bid to show higher top line or gross merchandise value (GMV) and secure funds on the basis of GMV growth.

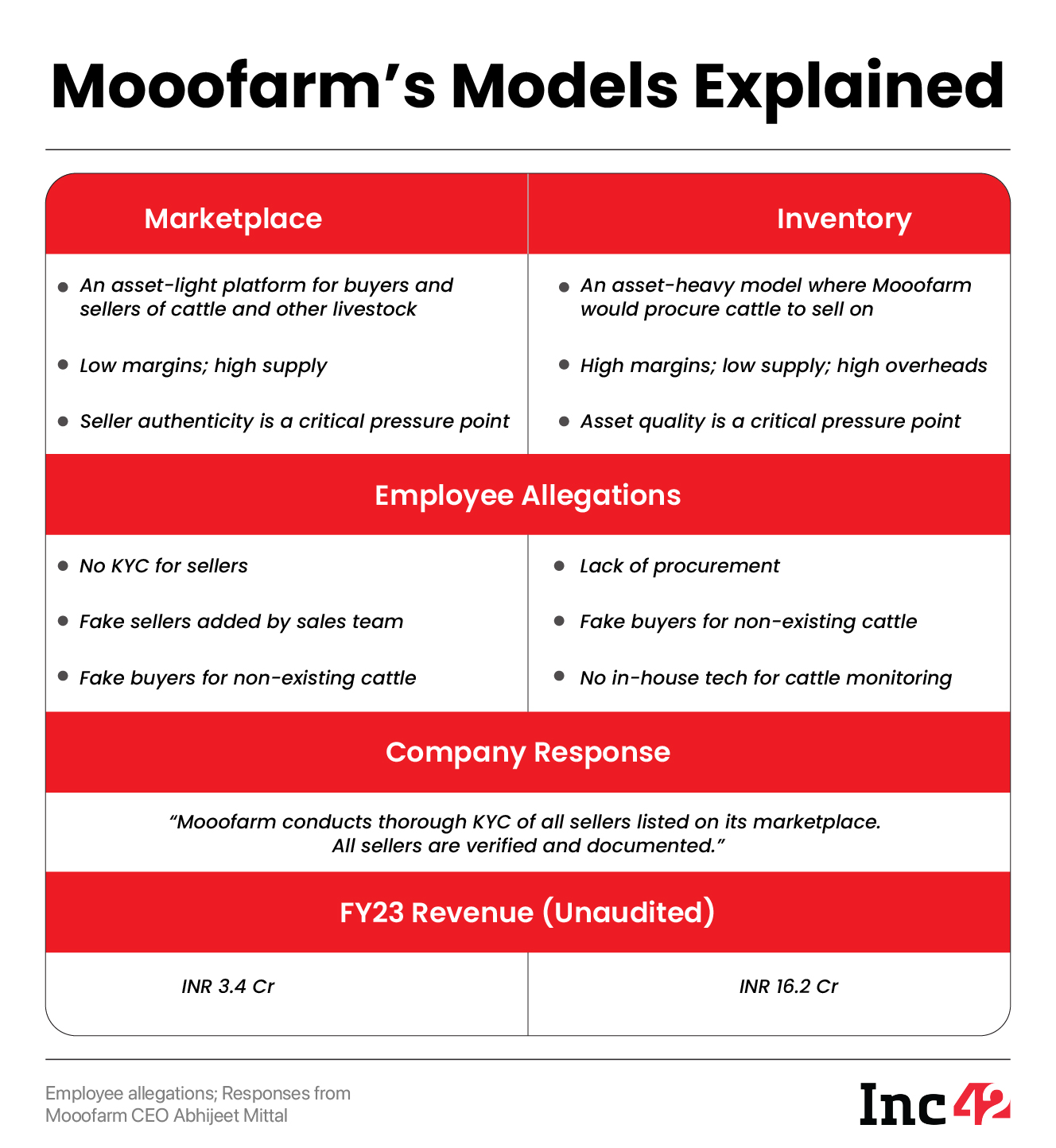

To be clear, in the ecommerce sector, GMV is a legitimate metric that is used to gauge the scale of any marketplace or platform. But in the case of Mooofarm, the GMV metric was hollow because of the holes in the business model. So to understand the fraud, we need to understand Mooofarm’s business model, where there were two pillars — a marketplace model and an inventory model.

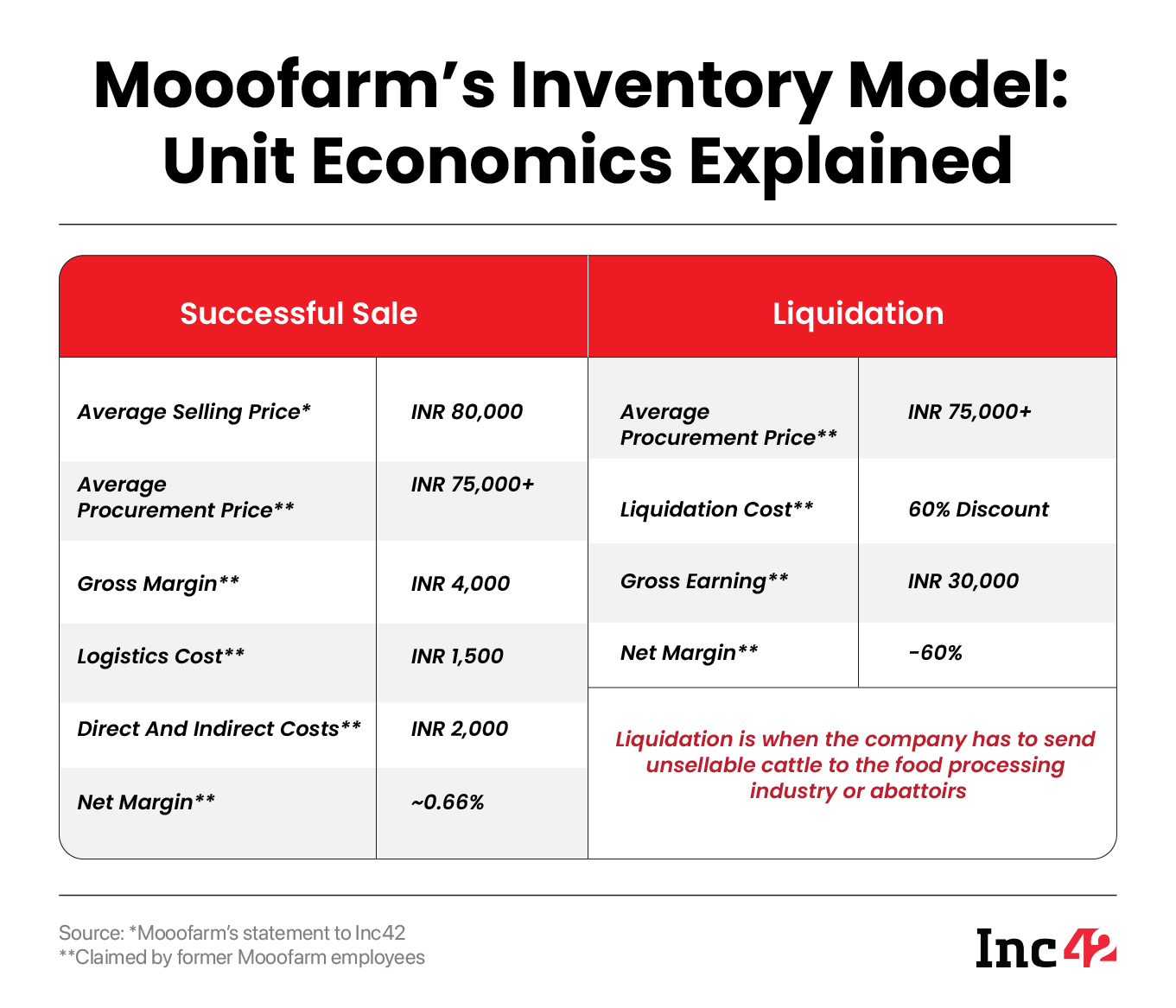

To be clear, the inventory model is better for unit economics, since Mooofarm could ensure higher quality for the cattle and get the best margins between procurement and sales. On the marketplace, owners selling cattle could set their own prices and platforms have to bear the discount costs, but under the inventory model, Mooofarm can look to extract higher margins.

“The thin margin is barely enough to break even and when there is a liquidation of assets (cattle), it basically eats into the margin of all breakeven transactions,” said one of the sources that we spoke to.

lockquote>

Liquidation essentially means the company has to send the cattle to the food processing industry or abattoirs. This would net the company around 40% of the procurement cost, so each liquidated asset is a 60% negative margin.

It’s no surprise that the marketplace model has been discontinued by Mooofarm since Q4 FY23.

The company denied any misreporting of revenue in its responses to Inc42. “All the company’s recorded revenue is substantiated with proper documentation. There are very low trade receivables and the business runs on negative working capital. There is no misrepresentation or falsification of revenue bookings. Furthermore, the company is on track to achieve EBITDA positivity by October 2024,” Param Singh said.

In response to our questions, Mooofarm’s current CEO Mittal told Inc42, the company earned INR 3.24 Cr from the marketplace model in FY23, and INR 16.4 Cr from the inventory model for a total of INR 19.6 Cr in operating revenue from sale of goods. He did not comment on the losses in FY23.

However, the company’s valuation report as of September 2023 shows a total revenue of INR 39.5 Cr in FY23 with losses of INR 56 Cr.

Amid these losses, the founders are being accused by employees of spending on luxury goods and gifts from the company’s credit card. Inc42 has seen credit card statements that show payments of nearly INR 8 Lakh to a bronze sculptor based in the US, along with purchases worth nearly INR 3 Lakh from international and Indian online gifting stores.

In the past, Mooofarm had claimed it offered a dairy-as-a-service full-stack platform where farmers could not only buy cattle, but also access telehealth and veterinary services that are said to increase milk yield, and also get financing aid to manage operations and buy dairy inputs.

Mittal told Inc42, “Our topline is increasing month on month and we have already become operationally profitable in both the businesses and CM3 profitable in the Animal Nutrition business.”

lockquote>

Can Accel-Backed Mooofarm Survive?

For Mooofarm, the last major round of infusion came in December 2022. In December 2023, the company received board approval to raise a bridge round. So far it has raised INR 2.1 Cr in the bridge round from existing investors Navus Ventures, Rockstart and new investor Thrive Wealth.

Interestingly, the pre-placement offer for this bridge round which is expected to raise INR 8 Cr+ or $1 Mn was sent to a number of investors but Mooofarm’s majority investors Accel, Aavishkaar Capital were not offered a chance to invest

We asked Accel and Aavishkaar about investing in Mooofarm, but neither responded to Inc42’s questions on the company, the alleged corporate governance lapses, or allegations against the founders and the management.

Vanity metrics like GMV have been used as a revenue analogue for as long as retail has existed. But in the case of startups that need to ‘show’ growth to secure VC funds, GMV has become something of a cuss word, especially in 2024 and at the growth stage.

Mooofarm is firmly in the growth stage of its lifecycle and as a growing company, it desperately needs VC money to scale up. Without external funds, the growth of new-age ecommerce verticals such as cattle or agritech inputs is highly arduous to scale up. VC funds bring in the money needed for marketing, creating technology moats, high-quality software products and hiring the right talent.

It’s interesting that Mooofarm is raising such a low amount, especially given that based on the company claims, this would only offer a short runway. For instance, Mittal said that the company has brought down its EBITDA burn to around INR 1 Cr per month since October 2023, but it’s not clear whether this accounts for the outstanding dues.

“Following recent initiatives to lower fixed costs, we anticipate that by March 2024, our EBITDA [burn] will be reduced to below 50 lakhs. This trend is expected to continue, bolstered by a growing topline and consistently improving margins month-over-month and hence the profitability in Oct-24,” he added.

lockquote>

Even at this EBITDA burn, the company only has a few months of runway given that it has only raised INR 2 Cr from investors thus far in what it calls a ‘bridge’ round.

Mittal’s claims about EBITDA burn do not align with the stock purchase capital requirements in the inventory model and the high liquidation rate for low-quality cattle. The company’s move to an inventory-first model means it has to procure cattle to sell to prospective buyers.

Former employees in the tech and product team claim the company has not developed any technology for cattle monitoring. Even the marketplace business was being run through unsophisticated Google Forms.

But Mooofarm’s CEO Mittal is bullish despite these long-term issues. “Our top line is increasing month on month and we have already become operationally profitable in both the businesses and CM3 profitable in the Animal Nutrition business.”

lockquote>

It’s interesting that Mittal namedrops the nutrition business, which does not feature in the company’s financials for FY22 or the valuation report for FY23 and FY24. The revenue structure for the nutrition business was also not explained by Mittal.

Dairy Tech Promise Sours

Other companies in spaces parallel to Mooofarm have learnt the ground reality the hard way. Sources told us that Animall, for instance, is looking to move on from a full-stack dairy play i.e. holding inventory to a marketplace model because it’s hard to take ownership of an asset like cattle.

Bengaluru-based Animall reported revenue of INR 7.4 Cr in FY22, with a net loss of over INR 44 Cr.

Another major dairy tech startup Stellapps, which is close to raising a fresh round, is relying on hardware and IoT for dairy monitoring and other supply chain solutions for dairy farmers. It has also expanded into milk supply with MooMark.

To be clear, several startups have made the most of the milk supply and delivery opportunity but this space has long-tail competition and plenty of conglomerate-backed players such as Tata’s BigBasket, Reliance’s Milk Basket and scaled up startups such as Country Delight with revenue over INR 500 Cr.

Mooofarm’s and Animall’s respective revenue base pales in comparison.

“No agritech startup has been able to crack the full-stack model for cattle, inputs and services. The biggest problem is the cattle supply. The unorganised market has problems related to logistics costs, social and political hurdles, revenue leakage and the reliance on cash, and unfortunately, there are some areas that you cannot improve with tech,” added another early-stage investor who is said to have reviewed Mooofarm’s model during due diligence.

lockquote>

Which brings us to why noted investors such as Accel, Aavishkaar and others missed the potential red flags in the dairy business.

It’s interesting to note that Mooofarm raised funds at the tail end of the ZIRP season. The zero interest rate policies or ZIRP meant that investors were more than happy taking risky bets, and perhaps even a bit casual on the due diligence side. The valuation bubble from this time resulted in what many are calling ‘ZIRPicorn startups’.

The realisation is fast-setting that banking on GMV or top-line growth alone — as Mooofarm is in its responses— is just not tenable in 2024, unless it is supported by massive scale.

Mooofarm does not have the scale, it has burnt investors’ funds at an alarmingly fast pace and the governance mess (whoever might eventually be responsible for the alleged fraud) is a major red flag. Investors are taking a fine tooth comb to every claim made by founders and projected financials. And often the ghost of misreported revenue comes back to haunt startups and founders in times of cash crunch.

We saw this in the case of GoMechanic, where the fudging of books came to the surface when the company wanted to raise funds. Or in the case of Zilingo before that, or Mojocare after that. While startups could have manipulated GMV to secure funding in the past, these corporate governance lapses have perked up the ears of even the most easy-going VC.

Former employees claim founders have passed on the buck to the former finance head Bhati without acknowledging their role or responsibility. “In fact, Vineet [Bhati] has been close to Param [Singh] for nearly 15 years. It’s not possible that the founders were unaware of anything he was doing. It’s either fraud or incompetence,” said one former employee.

lockquote>

Mooofarm is learning the hard way that shortcuts to growth have long-term consequences. Now, employees are caught in the middle and the startup also owes crores in loan repayments and vendor dues.

Will the hundreds of employees who have waited for months finally get relief or will Mooofarm struggle to get enough funds to pay off all these dues and become another startup that fell by the wayside due to a cash crunch that uncovered its revenue and governance mess?

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)