Private labels have become a powerful vertical for retail giants looking to maximise profits and capture more users. From Future Group to Shoppers Stop and Aditya Birla Group to new-age companies such as Amazon, Flipkart, Myntra, and Nykaa — most scaled up players have jumped on the bandwagon. And now Reliance Retail-owned Tira is going for the same playbook.

By creating their own popular brands, these online retailers have tapped into a lucrative market, transforming private labels into a cornerstone of their business strategies.

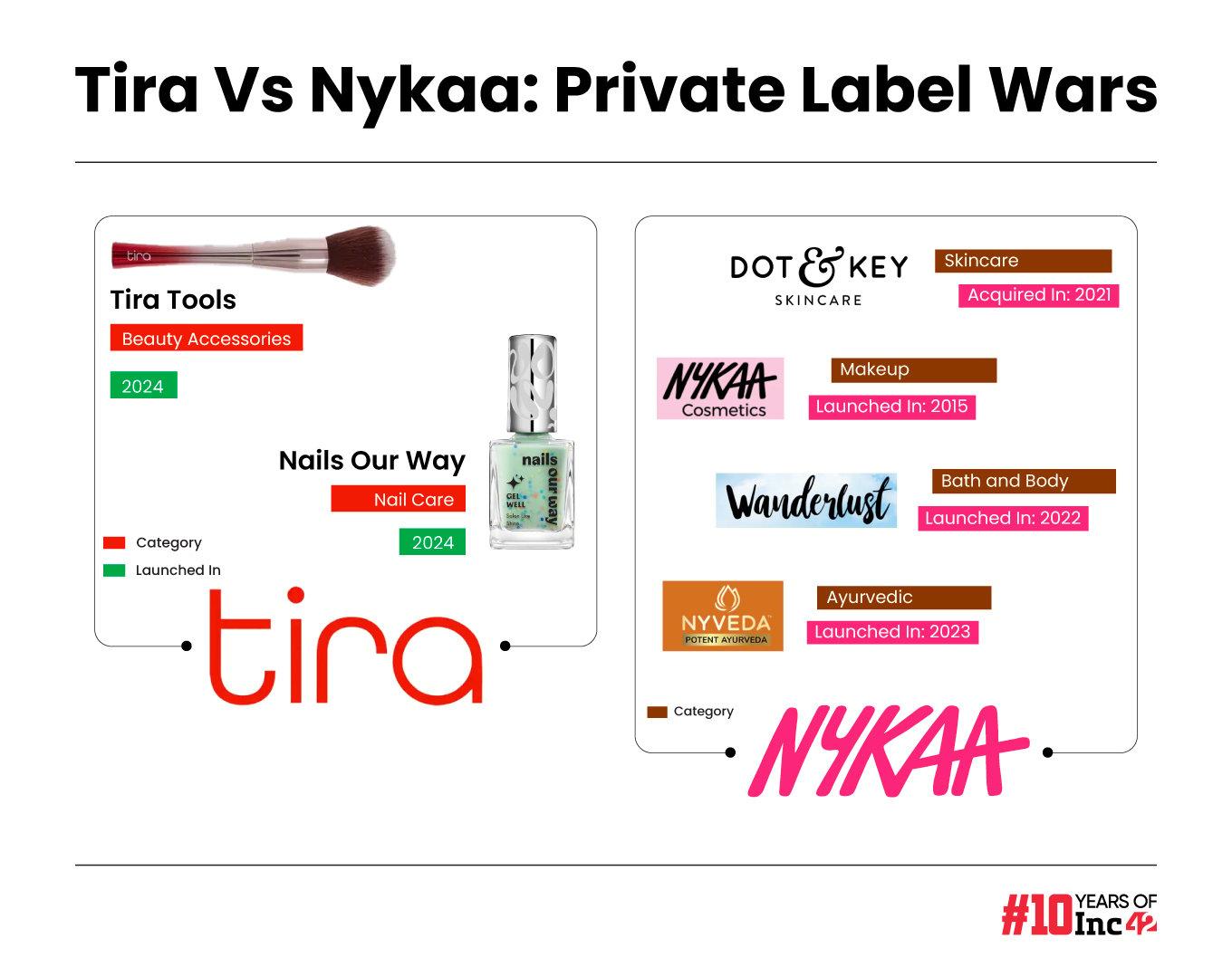

Tira, a direct rival to Nykaa, has announced the launch of two private labels in the past month. This move signals that the beauty and personal care marketplace is now focussing on scaling up, one year after its launch.

Last year, Reliance Retail entered the beauty and personal care (BPC) market with Tira, an omnichannel platform. Alongside launching the Tira app, the company also opened its flagship store in Mumbai. Since then, Reliance has expanded Tira’s offline presence to Delhi, Bengaluru, Hyderabad, Chennai, and Pune, bringing the total number of stores to ten across the country.

Reliance Retail’s digital and ecommerce initiatives have continued to grow significantly, contributing about 18% of revenue during FY24, according to the company’s Q4 earnings call. However, Tira was not specifically mentioned in the results, likely because it is still in its early stages.

A Quick Look At Tira’s Private Labels Strategy

Given that Tira has achieved significant brand recall and acquired a substantial customer base, analysts believe this is a timely and practical move to aim for higher margins.

Last month, Tira launched its first private label Tira Tools, a line of beauty accessories including Pro Makeup Brushes, Facial Rollers, and Beauty Sponges. The company said the Pro Artistry Kits from Tira Tools collection are designed for professional makeup artists and beauty lovers.

Earlier this month, Tira Beauty rolled out its new private label brand, Nails Our Way, marking its expansion into beauty offerings. The new line features premium nail colour and care products. On top of single products, the line also offers a complete manicure solution and convenient kits, including ‘French ‘Em Up’ and ‘Nailed It’.

Interestingly, Tira has not expanded into typical beauty products, a market already saturated by numerous FMCG brands, D2C startups, private labels from offline retailers, and online marketplaces.

The primary reason any platform, marketplace, or multi-brand outlet launches a private label is to attain better margins, according to Ashish Dhir, EVP (consumer and retail), 1Lattice said. By introducing a company-owned brand, businesses can secure improved profit margins since they don’t have to part with the revenue as is typically the case with third-party brands.

Experts believe that marketplaces can harvest data from sales volumes, customer demographics, preferences, and buying behaviour from third-party brands and channel them into private label plays.

“Essentially, once you discern what customers desire in terms of product features and attributes, you can source those products from any manufacturer. Thus, what remains critical is the supply chain and sourcing capabilities, alongside offering competitive pricing,” Dhir added.

lockquote>

Fuelled by a surge in personal grooming awareness propelled by fashion trends, the pervasive influence of social media, urbanisation, and rising disposable incomes, nailcare and beauty accessories markets are also growing alongside typical beauty products.

Why Tira Needs Private Labels

The benefits of private labels extend beyond just higher margins. Tira can leverage years data to fill demand-supply gaps in their product portfolios, which will help them to tap into opportunities early in terms of product variety and price points.

According to Karan Taurani, SVP Research at Elara Capital, introducing a private label is a strategic move aimed at driving profitability, enhancing uptake, and improving efficiency. Especially when Tira has yet to capture a significant market share.

lockquote>

Therefore, it’s a pragmatic step for the Reliance Retail platform to carve out its niche and secure a larger market share. Furthermore, this approach can drive volume growth.

Moreover, Tira is trying to catch the consumer pulse as well. Both Tira Tools, Nails Our Way are marketed as having cruelty-free and vegan products.

“There is an increasing demand for organic and vegan products, as well as high demand for personalised items. Tira has recognised this trend and is aware of the need for versatile products. If Tira can cater to these trends by offering products that are organic, vegan, and technologically advanced, they will be well-positioned to ace the market,” 1Lattice’s Dhir said.

For private labels, Tira can also work with multiple vendors across various locations, which will eventually help the marketplace penetrate deeper into different market segments. Dhir and others believe that the approach will also benefit Tira’s offline strategy in the long run.

This move comes at a time when competitiveness in the beauty and personal care (BPC) segment has increased. Ecommerce majors such as Amazon and fashion marketplace Myntra are becoming increasingly bullish on their beauty portfolios. Offline retailers are also aggressively capitalising on direct-to-consumer (D2C) initiatives, Taurani mentioned.

lockquote>

How Is Tira Placed Overall?

Moreover, beauty is becoming a big category on quick commerce platforms. For instance, many well-known new-age and FMCG- beauty products are now available on Swiggy Instamart, Zepto and Blinkit, as these platforms diversify beyond groceries. Private labels could help Tira differentiate itself from the popular options on these platforms and target the consumer who is more willing to experiment with new brands.

While quick-commerce platforms can offer convenience, beauty marketplaces like Tira and Nykaa cannot. As a result, they are resorting to offering discounts. Tira has started deep-discounting too, similar to its peer Nykaa.

For many products, Tira is offering even higher discounts than Nykaa, as per Inc42’s analysis.

However, discounts are more effective for the low average order value (AoV) segment rather than the premium segment. Therefore, higher discounts may help attract some customers from Nykaa.

Interestingly, on the private label front, Nykaa announced a healthy uptick in its owned brands business, which have collectively grown 39% in FY24. Specifically, Dot & Key is claimed to have hit INR 600 Cr GMV run rate as of Q4 FY2024 on an annualised basis, scaling 10x since its acquisition.

To make this strategy work, Tira needs to instil confidence in customers about product genuineness and provide excellent customer service, as Nykaa has already well established its place among consumers.

“The usual strategy of Reliance companies involves leveraging their financial strength to offer deep discounts and gain market share. By providing these discounts, they gradually diminish the competitive advantage of their rivals. This approach is sustainable for Reliance, as they can endure losses for an extended period,” an ecommerce analyst said.

lockquote>

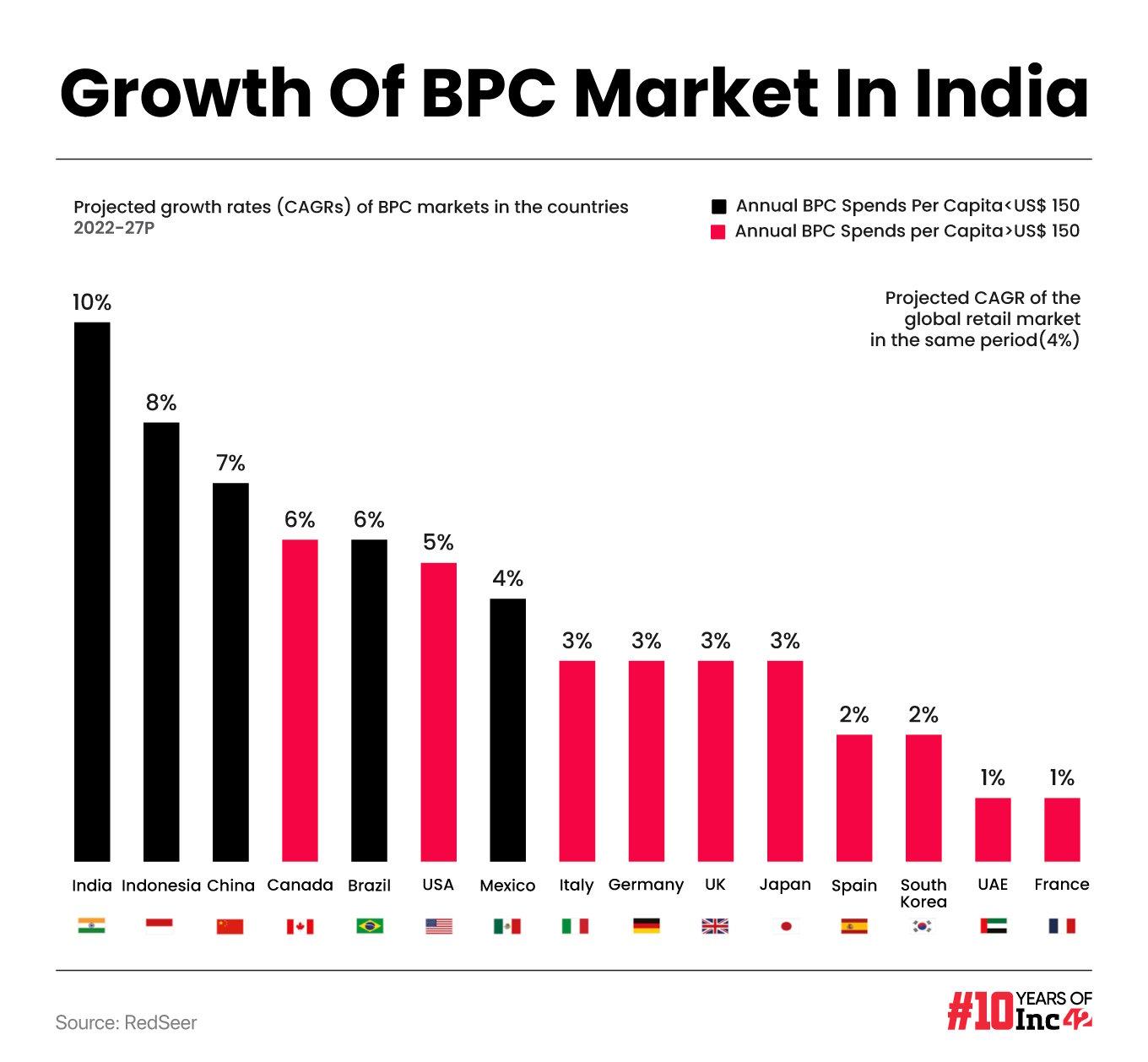

The Indian BPC market is set to grow rapidly, reaching a total GMV of $30 Bn by 2027, which will make up about 5% of the global BPC market. With an annual growth rate of approximately 10%, it’s the fastest-growing BPC market among large economies.

Tira’s entry into private labels is a strategic move to capitalise on India’s fast-growing beauty and personal care market. By launching brands focused on cruelty-free and vegan products, Tira aligns with consumer trends, aiming for higher margins and market differentiation.

Backed by Reliance Retail’s financial strength, Tira can offer competitive pricing and deep discounts to attract customers. As competition intensifies, Tira’s ability to offer unique value propositions through its private labels will be crucial in capturing the loyalty of India’s beauty-conscious consumers.

[Edited by Nikhil Subramaniam]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)