Incorporated in 2011, the NBFC has been profitable consecutively for the last nine years despite multiple industry-wide debacles, including the IL&FS crisis of 2018

So far, Kinara Capital has raised a total of $178 Mn from prominent investors like Sorenson Impact Foundation, Gaja Capital, responsAbility Investments, IndusInd Bank, etc.

The NBFC currently claims an NPA rate of 3-4%. By the end of FY24, its AUM stood at INR 3,142 Cr, up 26% YoY, and its capital adequacy ratio stood at 27.6%

In 2011, when Hardika Shah, now the founder and CEO of Kinara Capital, was contemplating setting up a non-banking finance company (NBFC), she had two options — either to join hands with larger enterprises to offer secured loans or support the country’s micro, small and medium enterprises (MSMEs) growth story with collateral-free offerings. Shah chose the latter — the road less taken.

While the move was bold (as it defied the trend back then), the idea was to flourish alongside the country’s MSME space, which has long been credited as the backbone of the Indian economy.

Notably, at the time (2011-12), the country fostered 26.1 Mn MSMEs, employing 59.5 Mn individuals, a far cry from an estimated 75 Mn such enterprises, employing a stonking 123 Mn individuals, which mushroomed by the end of the financial year 2022-23 (FY23).

Thirteen years on, Shah’s NBFC has been profitable consecutively for the last nine years despite multiple industry-wide debacles, including the IL&FS crisis of 2018.

lockquote>

What convinced us (Inc42) to engage in a tête-à-tête with the Bengaluru-based NBFC, which first turned full-year profitable in FY15 with a book size of INR 72 Cr, is the consistency with which it has been able to be in the black, all while locking horns with headwinds triggered by aberrations such as the GST impact, demonetisation and the Covid-19 pandemic.

Notably, over the past 12 years, the NBFC has expanded its loan offerings to meet the needs of MSMEs, helping them grow. It serves over 50 sectors, including food products, fashion, construction materials, textiles, provision stores, paints and varnishes, machine components, plastics, fabrication, and auto components.

Now, before we delve deeper into understanding how a management consultant with Accenture, Shah, cracked the profitability code in the country’s one of the most vulnerable spaces (lending), let’s quickly steal a glance at some of the company’s key metrics.

Kinara Capital

Stayed Profi

Kinara Capital’s Initial Journey

Speaking with Inc42, Shah said at the core of Kinara Capital’s vision has always been building a financially inclusive society where every entrepreneur has equal access to capital.

“At the time (in 2011-12), I believed that providing fast and flexible loans without property collateral to small business entrepreneurs in India can transform lives, livelihoods, and local economies,” said Shah.

lockquote>

As a result, she entered into the world of MSME lending. Although she had a basic understanding of how to run an NBFC, it was not enough. At first, she was faced with the uphill task of maintaining a stable revenue stream, which in the case of an NBFC is interest income.

Then, she needed to be sure of what her operating expenses and finance costs were going to be and how to control them. Finally, and one of the most critical of all, how to keep non-performing assets (NPAs) in check for sustainable growth.

After struggling for three years, the company tasted its first profitable financial year in FY15. However, the next big task was to sustain it.

For this, the NBFC expanded its loan product portfolio to satiate the diverse needs of MSMEs. It started by offering loans as small as INR 1 Lakh across categories and broadening its knowledge of its customers.

“With a thorough knowledge of our customers, we have maintained a high-tech and high-touch model. Our approach to staying the course coupled with addressing macro headwinds has helped us grow and led to investor interest,” she added.

lockquote>

Kinara Capital’s High-Stress Profitability Trail

While Shah has been managing the NBFC effectively, she said that there is little control over external factors. Over the last decade, she has faced several challenges that threatened the survival of NBFCs, causing many to fail.

First, there was the demonetisation in 2016, the impact of GST in 2017, the IL&FS crisis in 2018 and the Covid-19 pandemic in 2020.

Additionally, geopolitical tensions in Europe strained the Indian economy in FY23, disrupting the global supply chain and setting off inflation. These issues made it difficult for businesses to repay loans, leading to high NPAs and delayed collections for NBFCs.

Shah said that during these times, they had to be careful with new loans and needed to understand their customers’ pressures. For example, when GST was implemented, the NBFC anticipated delayed collections from their borrowers (60% of whom were manufacturers).

“We knew that it was a temporary phase and the GST situation would get normalised soon, putting collection cycles back on track. So, we extended the payment cycle from 90 days to 180 days to help businesses adjust,” Shah said.

Similar was the case during demonetisation and the pandemic. The startup’s anticipation playbook, among other factors, has helped it keep its NPAs at bay, we were told.

Kinara Capital’s Tech-Driven Approach

One of the key pillars of the company, which helped them demonstrate scalability and profitability consecutively is their “High Touch-High Tech” MSME lending model. This is essentially a blended tech model wherein the NBFC touches upon all consumer points of contact online as well as offline. This has helped in increased consumer engagement, and also in lowering the cost of acquisition over the years.

Almost 90% of the Bengaluru-headquartered NBFC’s customers originate from its 125 physical branches across 100+ cities in India. These branches are spread across six states – Tamil Nadu, Karnataka, Maharashtra, Andhra Pradesh, Telangana and Gujarat. These regions account for approximately 70% of India’s manufacturing output.

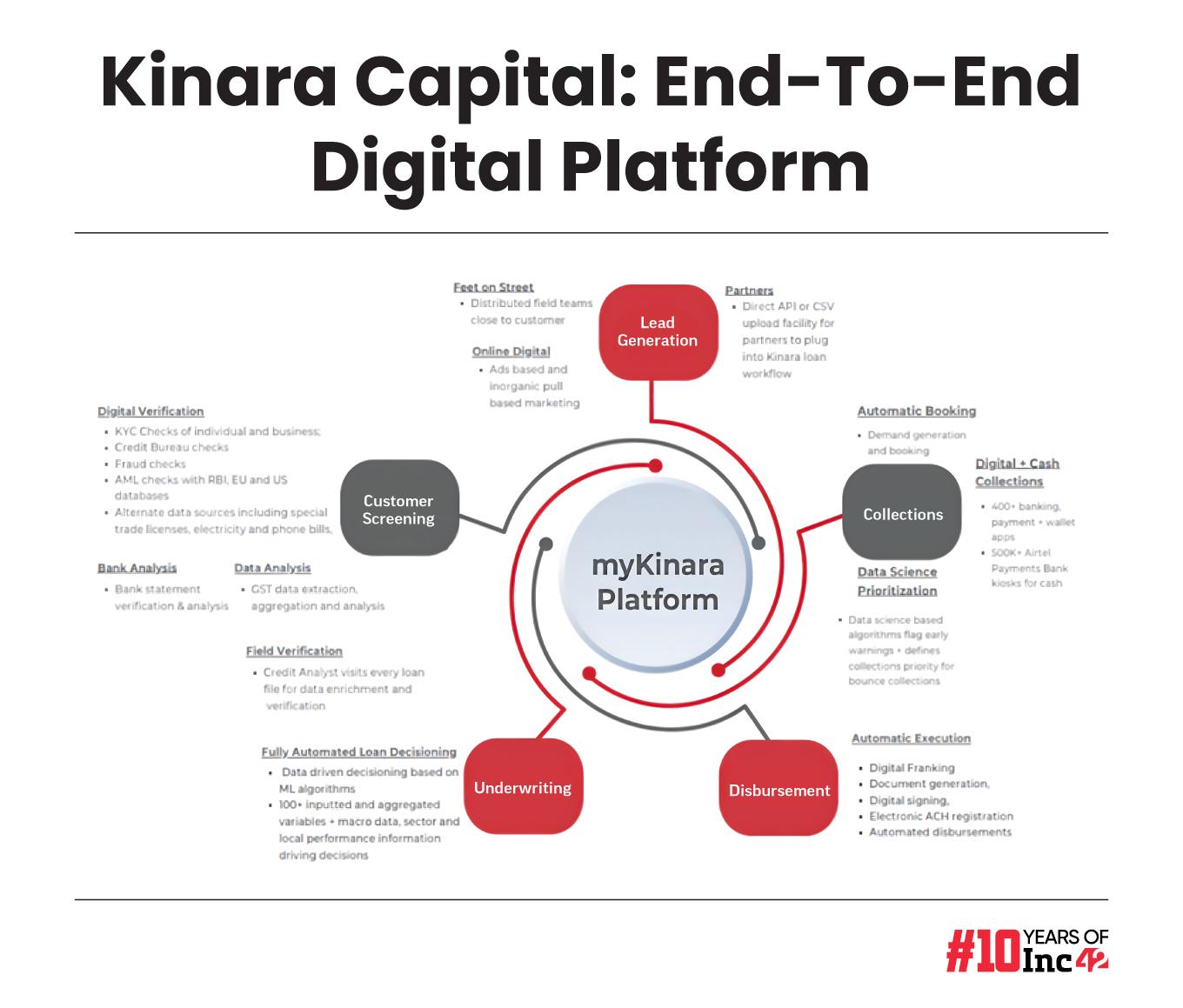

The remaining 10% comes from its end-to-end digital platform, which is capable of handling functions, including lead generation, customer screening, underwriting, disbursement, and collections.

Here’s how the NBFC uses tech for maximum impact:

- The NBFC runs video and static ads on Facebook and YouTube in local languages for lead generation. In FY24, the company disbursed INR 160 Cr to digitally sourced leads, up 10.3% from INR 146 Cr in FY23.

- It uses an automated loan decision system to determine loan approval, amount, tenure, and risk-adjusted interest rates.

- Automated reminders via calls, SMS, and WhatsApp in local languages, along with automated ACH clearance, have reduced EMI bounce rates.

- Kinara Capital combines digital collections with in-person efforts. Various payment options like UPI, deposits at Airtel Payment Banks, and payments through their website support their collections strategy.

What’s On The Horizon For Kinara Capital

So far, Kinara Capital has raised a total of $178 Mn from prominent investors like Sorenson Impact Foundation, Gaja Capital, responsAbility Investments, IndusInd Bank, Impact Investment Exchange, British International Investment, Nuveen Investments, and BlueOrchard Finance, among others.

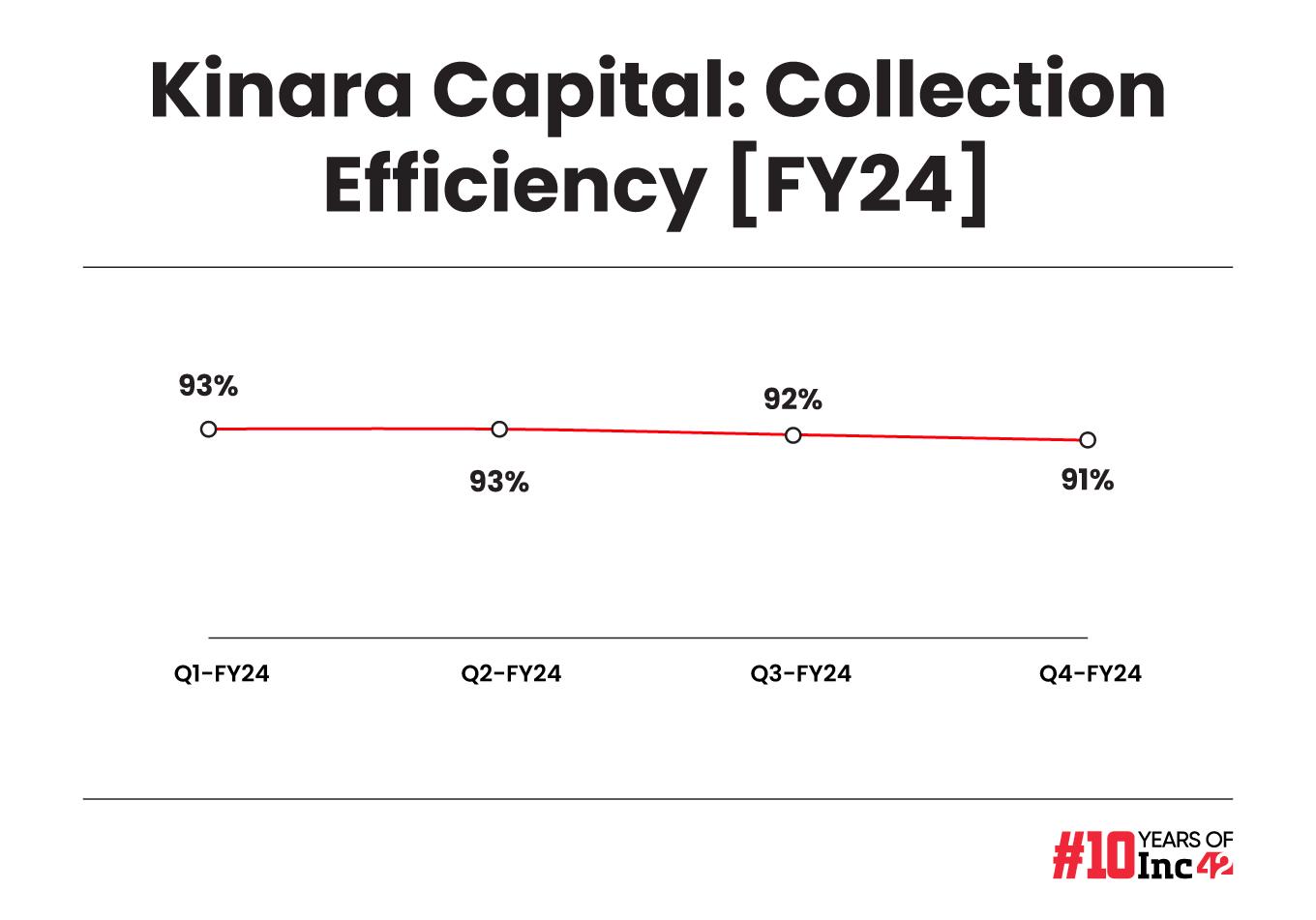

The NBFC currently claims an NPA rate of 3-4%. By the end of FY24, the company’s assets under management (AUM) stood at INR 3,142 Cr, up 26% YoY. Further, its capital adequacy ratio stood at 27.6%, higher than the minimum requirement of 15%. For the uninitiated, the purpose of the capital adequacy ratio is to ascertain whether a bank or an NBFC has enough capital on reserve to handle a crisis.

Meanwhile, when asked if the company has any plans to go beyond MSME lending and service new-age startups, Shah said that would deter the company from its mission of empowering MSMEs.

For FY25, Shah is targeting $100 Mn (INR 832.6 Cr) in revenue and is heading towards doubling the current AUM by FY26. The growth plans will be anchored on Kinara penetrating further into existing geographies via its branch-led model.

In the larger lending tech space, Kinara Capital competes with the likes of Lendingkart, Finova Capital, Kissht, and Navi Finserv, just to name a few.

Notably, the Shah-led NBFC operates in the burgeoning Indian lending tech space, which has seen the emergence of multiple new-age tech startups in the past few years.

These startups are looking to quench the growing capital thirst of small businesses enduring liquidity crunch. Additionally, banks are cautious while dishing out loans to these unorganised businesses as they lack assets to offer as collateral. It is this whitespace that Shah aims to fill in the Indian lending tech space expected to become a $1.3 Tn market opportunity by 2030.

[Edited by Shishir Parasher]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)