When we caught up with Ixigo

And now 15 months later, Bajpai and ixigo are once again on the cusp of the IPO. This time around though there’s no hitting the brakes like in 2021.

The ixigo IPO opens tomorrow morning and with this one of the most unique startups in the Indian ecosystem will soon be jostling with listed competition in the stock market.

Unique because ixigo is often called a ‘cockroach startup’. “We have always been a very scrappy and frugal company,” Bajpai told us last year in reference to the cockroach startup moniker, when we dove into ixigo’s playbook for frugal and sustainable growth

lockquote>

And also unique because it is a major milestone in the 18-year journey of a venture funded startup. Not many venture-backed startups have displayed such resilience, survived multiple cycles of recessions and reached profitability like ixigo has done.

So the ixigo story is something different, and that’s the subject this Sunday. But only after a look at these top stories from our newsroom this week:

- The Startup Ecosystem’s Wishlist: Aarin Capital’s partner Mohandas Pai has called on the next Narendra Modi-led government to ease angel tax hurdles and set up an INR 50K Cr fund of funds for startups to take the Startup India vision forward

- Swiggy’s IPO Test: With Swiggy all set to bring in one of the largest IPOs in India for a tech startup, what is the grey market’s view on the valuation and what Swiggy needs to do to win over investors

- Zomato’s Rollercoaster: Despite the high potential for Blinkit, a profitable food delivery business and the ever-growing Hyperpure B2B vertical, Zomato seems to have lost some of its charm in the stock market. So what gives?

ixigo On The IPO Bandwagon

After three startups went for public listings in May, it’s now ixigo’s turn to keep the IPO momentum going in June. Come tomorrow, the ixigo IPO will open for subscription and once again test the appetite of public markets investors for new-age tech stocks.

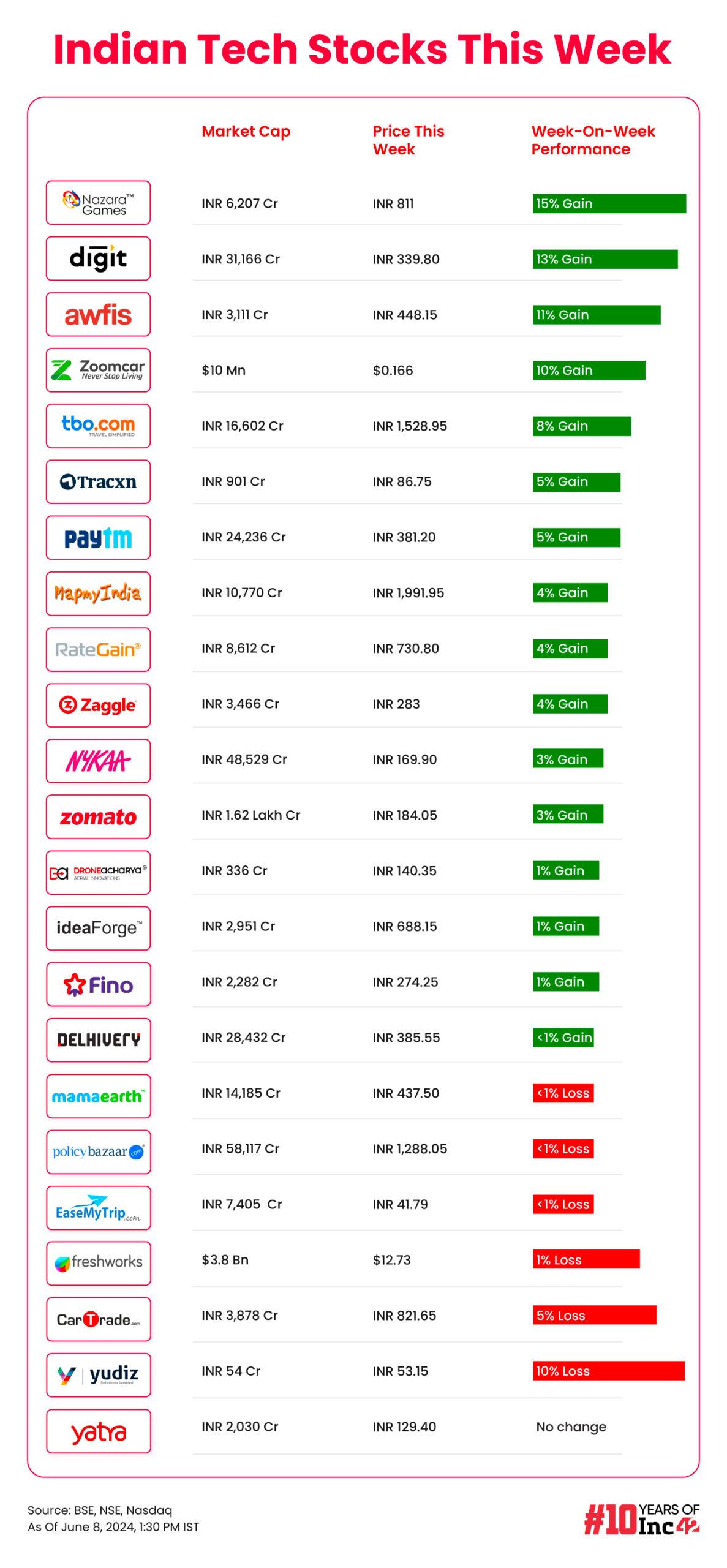

Given the recent experiences of TBO Tek, Go Digit and Awfis last month, the subscription for ixigo is expected to be healthy, the competition is steep in the travel tech segment. But ixigo’s profitability and its sustainable model are being counted as major advantages despite the competition.

The ixigo IPO comprises a fresh issue of shares worth INR 120 Cr and an offer for sale (OFS) component of 6.67 Cr shares worth INR 620 Cr. The startup has set a price band of INR 88-93 per equity share for its public issue.

At the upper end of the price band, ixigo is expected to raise a total of INR 740 Cr. Out of this, the company has raised over INR 333 Cr from 23 anchor investors at a price of INR 93 per equity share.

Most analysts believe that the competition will be iixgo’s biggest challenge given players such as EaseMyTrip, MakeMyTrip, Yatra, Flipkart-owned Cleartrip, as well as the likes of Paytm, Amazon, PhonePe and others that have travel ticketing verticals.

In fact, travel tech is one of the most competitive spaces in India and the market is still underpenetrated to a large extent given the use of ticketing agents and travel agencies in smaller towns and even large cities for corporate bookings.

This could be a cause for concern according to some analysts, because investors might not move to ixigo as soon as they see the IPO. Many investors have built a robust travel portfolio in the past two years, so this could be one potential hurdle for ixigo, but in all likelihood the IPO will see healthy oversubscription.

“The likes of EaseMyTrip, Yatra, TBO Tek and others might have tapped some of the liquidity of large investors in the past two years, and nobody wants too much exposure to travel given the present geopolitical situation around the world,” says one travel segment analyst with a Big Four firm.

lockquote>

The analyst added that ixigo has a strong moat in the railway ticketing business, which is an untapped market for investors after IRCTC.

Going Beyond The Comfort Zone

As we noted a few weeks ago, the competitive advantage in railway ticketing could become a double-edged sword for ixigo since IRCTC is the platform’s most important partner and also its biggest rival for direct train bookings. In its DRHP, the company highlighted that any variation or termination of its agreement with IRCTC might have an adverse impact on its business.

Train ticketing constitutes almost half of ixigo’s revenue. For the nine months ending December 2023, train ticketing revenue of INR 265 Cr contributed 45.3% to the total ticketing income of INR 585 Cr. ixigo posted a consolidated net profit of INR 65.7 Cr in the first nine months of FY24, up 3X from INR 23.4 Cr in the entire FY23.

At the same time, this is also a moat for ixigo, since its revenue base is higher than EMT or Yatra.

Analysts believe that it might be a good opportunity for investors to subscribe to the IPO from a long-term perspective, and the profitability track record is also very encouraging. But for long-term value creation, ixigo has to compete with majors such as EaseMyTrip, Yatra, MakeMyTrip, Cleartrip and others that focus primarily on flights and hotels.

This will help reduce the company’s high dependence on IRCTC as a partner, which is pretty much the biggest risk for investors, according to analysts.

So while ixigo has largely relied on its railway ticketing business to grow and increase its user base, the same energy has to be brought to the air ticketing, hotels and packages businesses as well.

Given that ixigo’s core target customer in Tier 2 or Tier 3 India is price-sensitive, the company has to spend significantly on customer acquisition. Advertising and sales promotion expenses made up 24% of total revenue as of December 2023, and this is much higher than the 18.6% in FY23

Other risks such as its limited experience of operating as an online ticketing agent also come into play, since ixigo transitioned to ticketing in 2019-20 from being a travel aggregator. It has also expanded into hotel bookings only as recently as 2024, so here too it has limited operating experience.

Will ixigo Go For Acquisitions?

But these risks apply equally to players who are looking to grab market share from ixigo in the train bookings space. At the end of the day, all travel tech players will have to push the accelerator on all key verticals in travel.

For example, ixigo recently launched an AI-powered travel planning and recommendations tool called “ixigo PLAN” for personalised itineraries and destination suggestions, which the company is hoping will target customers in metros and Tier 1 cities.

The company is also building its hotels business from the ground up since late 2023 and launched this recently. So there are some areas where ixigo will clearly need to invest from the proceeds of the IPO. And there could be more acquisitions on the cards as well.

After narrowing down on train and bus bookings as a core business, ixigo acquired Confirmtkt and AbhiBus in 2021. Other players have also gone for inorganic expansion to enter new verticals.

For instance, EaseMyTrip acquired ETrav Tech in April this year to focus on the corporate bookings space as the company looks to diversify its portfolio in the non-air segments.

In 2023, EMT acquired Guideline Travels, TripShope Travel Technologies and Dook Travels, as well as hotel booking marketplace cheQin. This after acquiring Spree Hotels & Real Estate for INR 18.25 Cr in 2021.

It must be noted that EMT was a bootstrapped company when it went public and as a result, it is doing what the likes of ixigo did with VC money in their growth stages.

But it’s also fair to say that ixigo’s competition is also new to some of the key lines of business in travel, and it’s definitely a large enough market for multiple players.

The Cockroach Mentality

India’s travel tech ecosystem is witnessing promising growth and is expected to receive a further boost with the advent of AI-led tools and products. Unlike the ecommerce sector, where there is a duopoly of Amazon and Flipkart, the travel tech segment has plenty of players with high brand visibility and the numbers to back it. At the moment, the market is far from saturated, and this means ixigo and others can grow and thrive without cut-throat competition.

A report by Allied Market Research estimates the global travel tech market to reach $21 Bn by 2032, growing at a CAGR of 8.6% between 2023 and 2032.

The analyst quoted above said there is no shortage of capital in the Indian public markets, and all manner of investors are ready to invest in companies with unique stories and attractive valuations. In both these regards, ixigo scores highly.

The valuation itself has sobered down from the 2021 expectations significantly with the IPO size cut almost in half from three years ago.

But most importantly, ixigo’s story continues to be unique among Indian startups for its steady run of profitability and the clues it leaves behind for startups to solve the growth vs profits dilemma. It’s showing that even cockroaches can get to the stock markets.

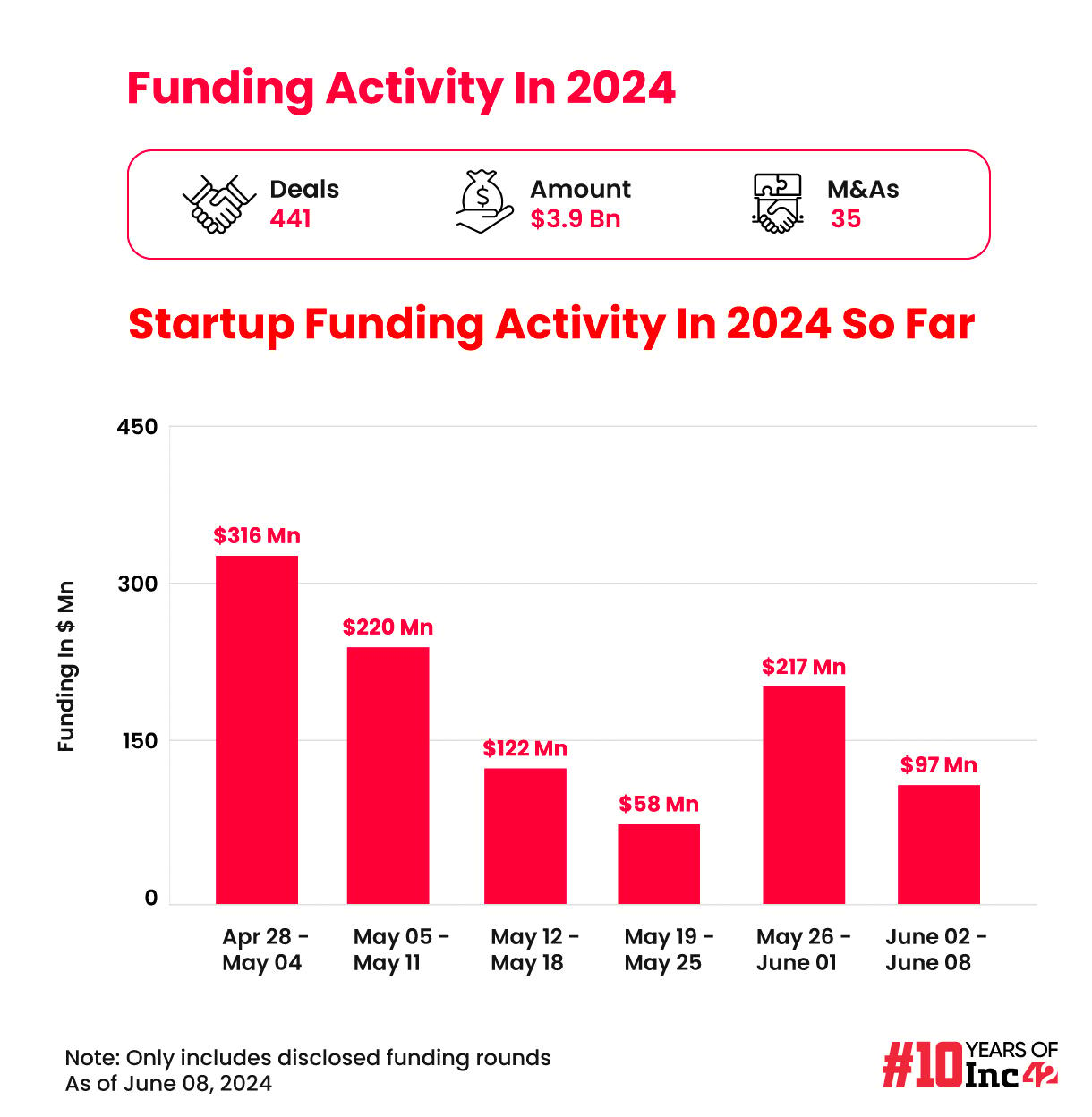

Sunday Roundup: Tech Stocks, Startup Funding & More

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)