Indian startups cumulatively raised $86.4 Mn across 16 deals, a 80% decline from the $432.2 Mn raised across 24 deals last week

The week saw coworking space startup DevX file its DRHP with the SEBI

Seed funding dipped this week, with startups at this level only managing to raise $1.9 Mn as against $44.5 Mn raised last week

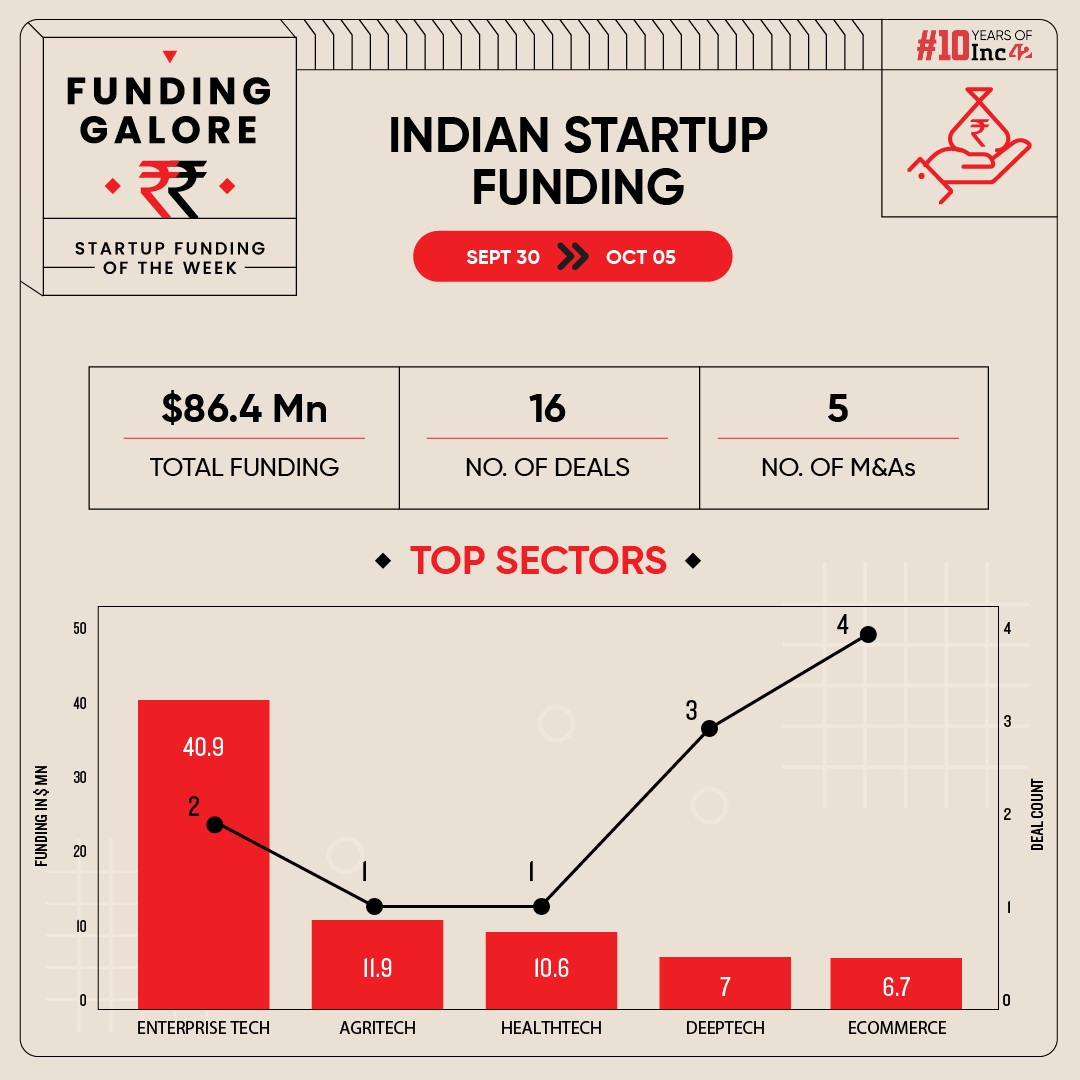

Investment activity across the Indian startup ecosystem saw a dip this week after bucking upward trends. In the week between September 30 and October 5, startups managed to raise $86.4 Mn via 16 deals, more than 80% drop from $432.2 Mn raised across 24 deals in the preceding week.

It is pertinent to note that the week was sans mega funding and further marks the beginning of festivity in India.

Funding Galore: Indian Startup Funding Of The Week [ Sep 30 – Oct 5 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 3 Oct 2024 | Mstack | Enterprisetech | Enterprise Services | B2B | $40 Mn | Series A | Lightspeed, Alphawave, HSBC Innovation Banking | Lightspeed, Alphawave |

| 1 Oct 2024 | Waycool | Agritech | Market Linkage | B2B-B2C | $11.9 Mn | Debt | Grand Anicut | Grand Anicut |

| 30 Sep 2024 | BASIC Home Loan | Fintech | Lendingtech | B2C | $10.6 Mn | Series B | BII, CE-Ventures, Gruhas, LetsVenture, 100 Unicorns, Venture Catalysts, Ashish Kacholia | BII |

| 3 Oct 2024 | Str8bat | Deeptech | IoT & Hardware | B2C | $3.5 Mn | Series A | Exfinity Venture Partners, RTL, Eternal Capital, VCats Group, Techstars, SucSEED Indovation Fund | Exfinity Venture Partners |

| 3 Oct 2024 | Furnishka | Ecommerce | D2C | B2C | $3.3 Mn | pre-Series A | IndiaQuotient, Sparrow Capital, Sujeet Kumar, Ramakant Sharma | IndiaQuotient |

| 30 Sep 2024 | LISSUN | Healthtech | Fitness & Wellness | B2C | $2.5 Mn | pre-Series A | RPSG Capital Ventures, Multiply Ventures, Atrium Angels, IvyCap Ventures, Sucseed Ventures, Rainmatter | RPSG Capital Ventures |

| 30 Sep 2024 | FermionIC Design | Deeptech | IoT & Hardware | B2B | $2.5 Mn | – | – | – |

| 4 Oct 2024 | True Balance | Lendingtech | Consumer Lending | B2C | $2.3 Mn | Debt | VentureSoul Partners | VentureSoul Partners |

| 3 Oct 2024 | ZEVO | Cleantech | Electric Vehicle | B2B-B2C | $2 Mn | pre-Series A | Pegasus India Fund, BizDateUp, JIIF | – |

| 1 Oct 2024 | ClayCo | Ecommerce | D2C | B2C | $2 Mn | Series A | Unilever Ventures | Unilever Ventures |

| 3 Oct 2024 | AI Health Highway | Healthtech | MedTech | B2B | $1.5 Mn | pre-Series A | Turbostart, Rainmatter, Chennai Angels, BITS BioCyTiH Foundation | – |

| 30 Sep 2024 | Conscious Chemist | Ecommerce | D2C | B2C | $1.4 Mn | – | Atomic Capital | Atomic Capital |

| 3 Oct 2024 | Oncare | Healthtech | Telemedicine | B2C | $1 Mn | Seed | Huddle Ventures, TRTL Ventures, Cloud Capital, DeVC | Huddle Ventures |

| 1 Oct 2024 | IG Drones | Deeptech | Dronetech | B2B | $1 Mn | – | India Accelerator | India Accelerator |

| 30 Sep 2024 | Zintlr | Enterprisetech | Horizontal SaaS | B2B | $0.9 Mn | Seed | Om Jain, JIIF, Motilal Oswal, Vimal Shah, Sparsh Jain, Vinod Dugar, Ramesh Jain, Prabhakar | Om Jain |

| 3 Oct 2024 | Secret Alchemist | Ecommerce | D2C | B2C | – | – | Samantha Prabhu | Samantha Prabhu |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- On the back of the week’s top funding round, which saw Mstack raising $40 Mn, entrerprisetech retained its top spot as the most funded sector.

- Ecommerce witnessed the most number of deals materialise this week. Startups in the sector raised $6.7 Mn via 4 deals.

- Seed funding dipped this week, with startups at this level only managing to raise $1.9 Mn as against $44.5 Mn raised last week.

Startup Fund Launches Of This Week

- Angel investment network ThinKuvate marked the first close of its maiden India fund, ThinKuvate India Fund – I, at INR 25 Cr. The firm is targeting a total corpus of INR 100 Cr for the fund.

- Early-stage focused venture capital firm Trillion Dollar Ventures (TDV) floated its second fund with a target corpus of NR 50 Cr ($5.9 Mn). The fund will back 10-12 pre-seed and seed stage startups annually with an average ticket size of INR 1-2 Cr.

Updates On Indian Startup IPOs

- Enroute to its initial public offering (IPO), foodtech major Swiggy received approval from its shareholders to increase the size of the fresh issue in its IPO to INR 5,000 Cr from INR 3,750 Cr earlier.

- Ahmedabad-based coworking space provider DevX filed its draft red herring prospectus (DRHP) with market regulator Securities and Exchanges Board of India (SEBI) this week. Its proposed IPO will consist solely of a fresh issue of 2.47 Cr equity shares.

- CarDekho is in advanced talks with bankers for a $500 Mn IPO, which it plans to file by March 2025.

Mergers and Acquisitions This Week

Other Developments Of The Week

- Angel investment firm BizDateup’s cofounders Jeet Chandan and Meet Jain picked up an undisclosed stake in Swiggy.

- Peak XV Partners pared the size of its $2.85 Bn fund by 16% or $465 Mn more than a year after it split from Silicon Valley-based Sequoia Capital.

- Ratan Tata partially exited broking platform Upstox with 10X returns after the startup concluded a buyback of 5% of Tata’s stake in it.

- Fabless semiconductor startup FermionIC Design is looking to raise $6 Mn in a funding round led by Lucky Investment Managers’ Ashish Kacholia and his associates. The startup has already raked in $2.5 Mn as part of the investment round.

- Belgium-based VC firm Verlinvest is looking to double its annual investment in India in three years. Its managing director and head of Asia Arjun Anand has invested over $110.3 Mn annually in India over the last few years and aims to double this in the next two-three years.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)