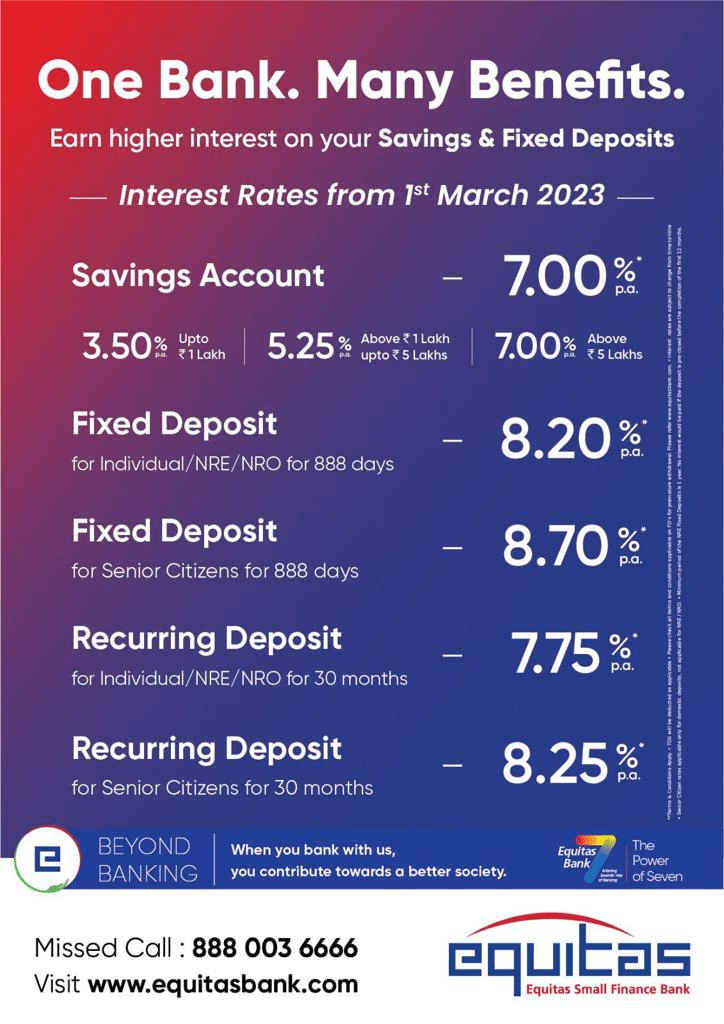

Equitas Small Finance Bank Limited, one of the leading SFBs, has announced the revised interest rates for Fixed Deposits as well as Recurring Deposits in Domestic and NRE/ NRO Interest Rates Accounts. The hike in interest rates will be effective from 01st March, 2023.

The hike will allow FD customers to earn 8.20% interest on investing less than INR 2 crore for a tenure of 888 days. The bank is also increasing interest rates on investments for tenures ranging from 12 months to 24 months. This is applicable to both domestic accounts and NRE/ NRO accounts. Furthermore, domestic senior citizens will receive 0.50% extra on the FD and RD rates. The interest payouts will continue to be quarterly across all account types.

Murali Vaidyanathan, Senior President and Country Head, Equitas Small Finance Bank, said, “We are happy to announce that customers of Equitas Small Finance Bank will earn better interest on Fixed Deposit and Recurring Deposit. This meets the key agenda of the bank to encourage the customers’ habit of saving and maximize their benefits through a hike in interest rates and help people’s money grow. As a matter of fact, locking money for a determined period through lump-sum Or recurring deposits also ensures meeting certain goals in life. Besides, to boost the saving drive amongst senior citizens in India, Equitas offers an additional 0.5% on their Fixed Deposit and Recurring Deposit which enhances capital creation and suits their requirement of investment at the same time. We look forward to our customers joining the transformational journey of our Beyond Banking philosophy for achieving better growth of the society together.”

Fixed Deposit Rate for Domestic, NRE / NRO (for INR) with effect from: 1st March 2023

| Tenure | Interest rates for amount less than Rs. 2 crore w.e.f 1st March 2023 | Annualised Yield |

| 7 – 14 days | 3.50% | 3.50% |

| 15 – 29 days | 3.50% | 3.50% |

| 30 – 45 days | 4.00% | 4.00% |

| 46 – 62 days | 4.25% | 4.25% |

| 63 – 90 days | 4.25% | 4.25% |

| 91 – 120 days | 5.00% | 5.00% |

| 121 – 180 days | 5.00% | 5.00% |

| 181 – 210 days | 6.00% | 6.09% |

| 211 – 270 days | 6.00% | 6.09% |

| 271 – 364 days | 6.00% | 6.09% |

| 1 year to 18 months | 7.70% | 7.93% |

| 18 months 1 day to 2 years | 7.50% | 7.71% |

| 2 years 1 day 887 days | 7.75% | 7.98% |

| 888 days | 8.20% | 8.46% |

| 889 day to 3 years | 7.75% | 7.98% |

| 3 years 1 day to 4 years | 7.25% | 7.45% |

| 4 years 1 day to 5 years | 7.00% | 7.19% |

| 5 years 1 day to 10 years | 7.00% | 7.19% |

Recurring Deposit for Domestic, NRE / NRO (in INR) Rate for different tenure with effect from:

1st March 2023

| Tenure | Interest rates for amount less than Rs. 2 crore w.e.f 1st March 2023 |

| 12 Months | 7.70% |

| 15 Months | 7.70% |

| 18 Months | 7.70% |

| 21 Months | 7.50% |

| 24 Months | 7.50% |

| 30 Months | 7.75% |

| 36 Months | 7.75% |

| 48 Months | 7.25% |

| 60 Months | 7.00% |

| 90 Months | 7.00% |

| 120 Months | 7.00% |

For further information or any questions, please contact equitaspr@adfactorspr.com;

About Equitas Small Finance Bank Limited [ESFB]

Equitas Small Finance Bank is one of the largest small finance banks in India. As a new-age bank, we offer a bouquet of products and services tailored to meet the needs of our customers – individuals with limited access to formal financing channels, as well as affluent and mass-affluent, Small & Medium Enterprises (SMEs) and corporates. Our firmly-entrenched strategy focuses on providing credit to the unbanked and underbanked micro and small entrepreneurs, developing products to address the growing aspirations at the ‘bottom of the pyramid’, fueled by granular deposits and ‘value for money’,