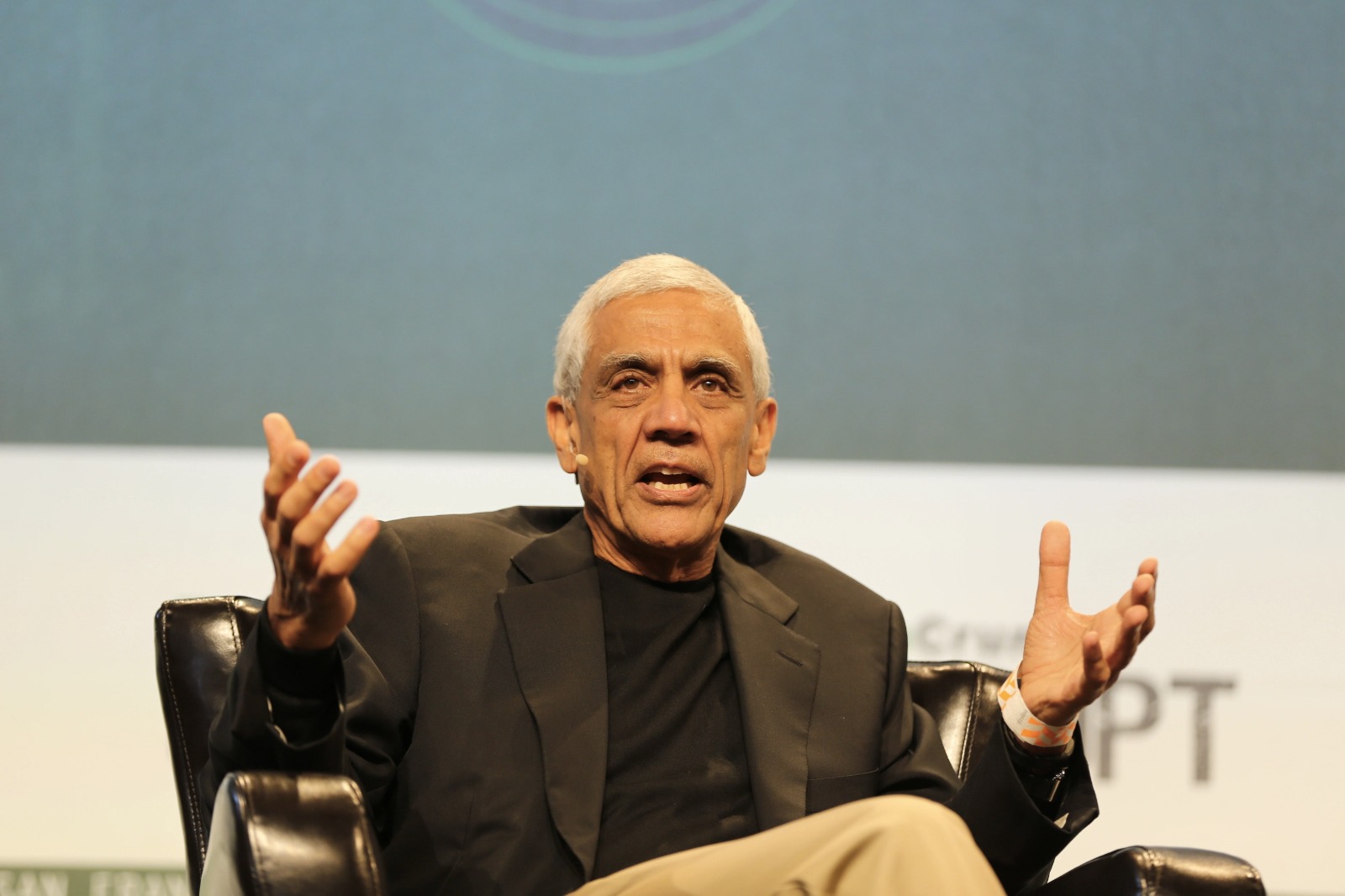

Serial entrepreneur and seasoned investor Vinod Khosla has some strong, contrarian advice for the venture capital industry: don’t sit on your founders’ boards. Khosla, who spoke onstage at the Upfront Summit in Los Angeles this week, spoke about the culture of capital.

“I’m not a big fan of governance; I think if you engage as a team member with a founder, you have much more influence than if you’re sitting on a board and voting,” he said. “Other VCs accuse us of being very active and very engaged — but the flip side of it is they vote on boards. We don’t — no matter how important an issue.”

lockquote>

It’s a non-consensus take in a world where VCs are being asked hard questions about their due diligence, but Khosla added that “it isn’t the VC’s job to sit on a board and vote…there’s a hard line you don’t cross, which is don’t make founders or management do things they don’t want to do by voting.” Khosla says that by avoiding six-hour board meetings, he spends “more time doing decks for presentations for our founders than almost anybody I know.”

The reality, added Khosla, is that “most board members today in startups have not earned the right to advise” because many have not themselves built startups. Khosla has a history of criticizing some of the mainstream wisdom by VCs. Onstage, he pointed to a TechCrunch piece he wrote in 2013, titled: “70-80% Of VCs Add Negative Value To Startups.”

Other investors similarly spoke about the need for investors to rethink how to interact with founders. 01 Advisors, built by Dick Costolo, Twitter’s former CEO, and Adam Bain, Twitter’s former COO, said onstage that their biggest misses as a firm have been around backing the wrong people. The firm spoke about a questionnaire that helps them better vet a founder’s potential strengths and weaknesses (they say they use this to make investment decisions). Echoing Khosla comments, the duo also spoke to the importance of not taking a board seat so they can instead be a founder’s first call.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)