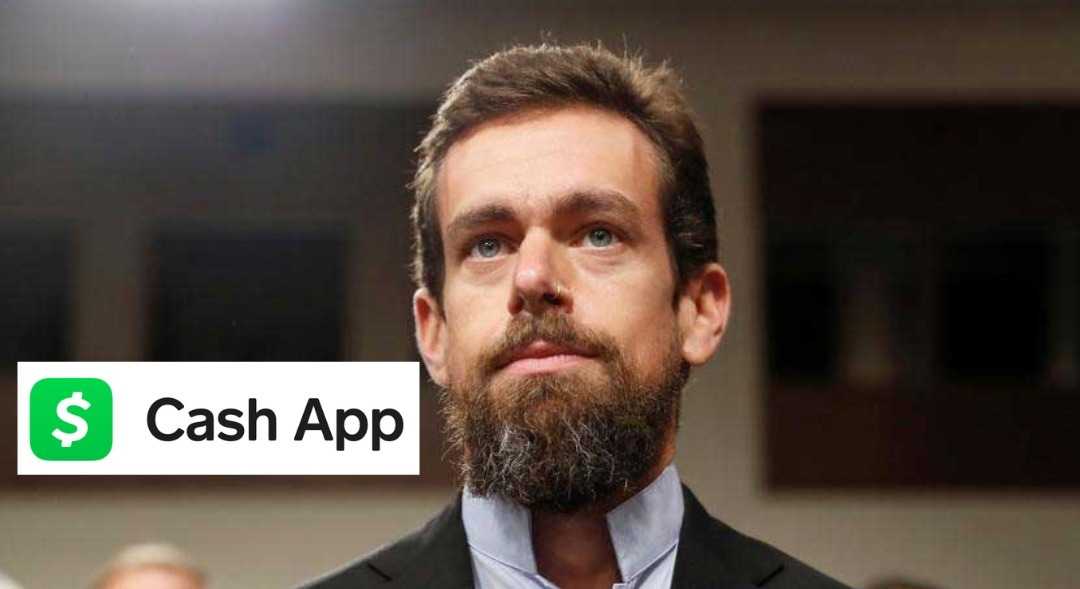

Jack Dorsey’s Cash App, a popular mobile payment service, has been hit with accusations of fraud in a new report by activist short seller Hindenburg Research. The report, released on Wednesday, alleges that the company has engaged in fraudulent practices to inflate its financial metrics and mislead investors.

According to the report, Cash App has been manipulating its Bitcoin trading volumes to artificially inflate its revenue figures. The report states that Cash App has been using a “synthetic” Bitcoin trading platform, which allows it to report higher trading volumes without actually executing any trades. The report claims that this has allowed Cash App to overstate its Bitcoin revenue by as much as 10 times its actual revenue.

The report also alleges that Cash App has been engaging in predatory lending practices, targeting low-income and financially vulnerable users with high-interest loans that they are unable to repay. The report states that Cash App has been extending loans to users with no income or credit history, and then charging them interest rates as high as 200%.

Hindenburg Research claims to have spoken with several former employees of Cash App who confirmed the company’s fraudulent practices. The report also cites public records and other evidence to support its claims.

Cash App, which is owned by Dorsey’s financial technology company Square, has denied the allegations, calling them “false and misleading.” In a statement, the company said that it “will vigorously defend itself against these baseless allegations.”

Dorsey, who is also the CEO of Twitter, has not commented on the allegations. However, the news has sent shockwaves through the financial technology industry, with many investors questioning the integrity of Cash App’s financial reporting.

This is not the first time that Hindenburg Research has targeted a high-profile tech company. Last year, the company released a report accusing electric truck maker Nikola of fraud, which led to a sharp drop in the company’s stock price.

The allegations against Cash App come at a time of increased scrutiny of the financial technology industry, which has seen explosive growth in recent years. Regulators are increasingly concerned about the potential for fraud and other abuses in the industry, and are stepping up their oversight of companies like Cash App.

Investors will be watching closely to see how the allegations against Cash App play out. If the allegations are proven to be true, it could have significant consequences for both Cash App and Square, as well as for the broader financial technology industry.