Jupiter, the neobank led by Jitendra Gupta, has secured a non-banking finance company (NBFC) licence from the Reserve Bank of India (RBI), allowing it to issue credit lines to customers. According to Gupta, Jupiter will now hire a professional CEO to run the NBFC, which will be housed under Amica Financial Technologies Limited, Jupiter’s parent company.

The NBFC will operate in parallel with Jupiter. So far, Jupiter has been offering lending solutions through its partner NBFCs, but the new licence will allow it to operate an in-house lending business. This development also comes after the RBI reportedly expressed concerns about giving NBFC licences to fintech startups, mainly due to ownership and capital flow issues.

Jupiter will invest INR 100 Cr into the NBFC and has recently raised the same amount in debt to fund its lending operations. The last time an Indian fintech startup received an NBFC licence was in November 2022, when ftcash was granted a licence by the central bank.

The NBFC licence will help Jupiter bolster its revenue stream and increase margins in lending, as it can now directly serve customers instead of working as a loan-service provider (LSP).

Jupiter’s current lending offerings include short-term, small-ticket loans with an average ticket size of INR 30,000 and six months in duration. The neobank had initially started with a UPI-based credit product, Bullet, which was discontinued in 2021. Since the relaunch last year, Jupiter is said to have a loan book of INR 100 Cr through its Early Salary product, allowing users to draw an early salary in the form of a payday loan.

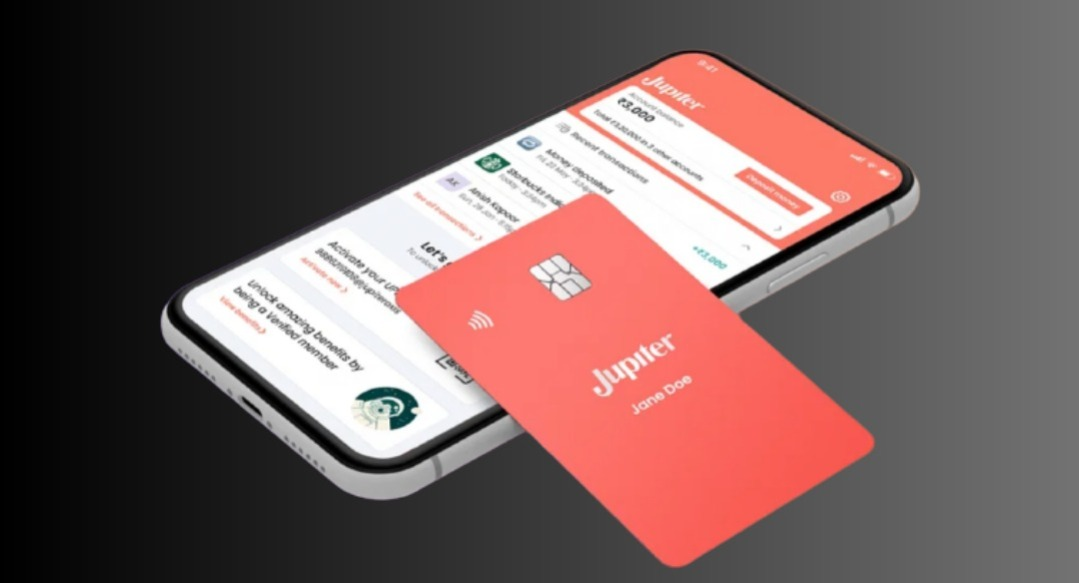

With the new licence, Jupiter has another revenue line beyond investments and mutual funds distribution, bringing in customers through new deposit openings and salary accounts in partnership with Federal Bank.