Nigerian payment service provider Nomba raised $30 million in pre-Series B led by San Francisco-based Base 10 Partners where Partech and Khosla Ventures and existing investors also participated to support the delivery of bespoke payment solutions for African businesses.

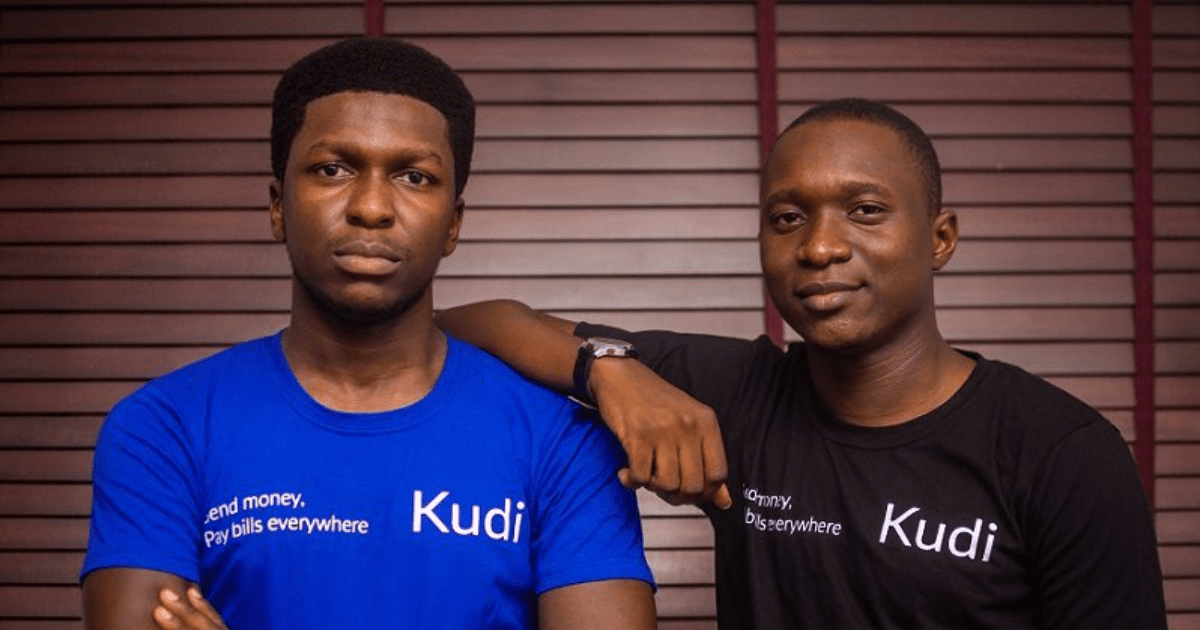

Nomba was rebranded from Kudi, which began in 2016 as a chatbot integration that replies to financial demands on social applications. It was an online solution that has since been adopted in bits by various fintechs but has struggled to achieve massive scale in an African country where 90% of informal economy transactions are cash-based and more than 60 million Nigerian adults are unbanked despite the proliferation of digital financial products.