In H1 2023, the Proptech investments in India surpassed the $4 billion mark

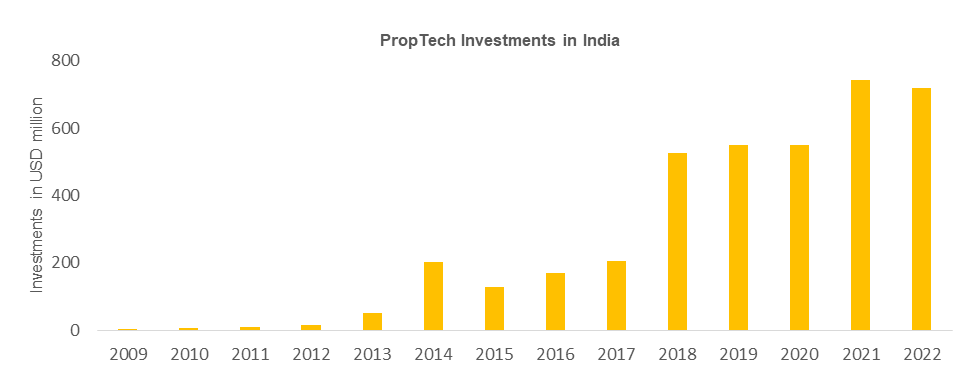

Despite global economic uncertainties, funding in PropTech firms experienced a slight dip in 2022, reaching USD 719 million, according to a comprehensive report by Housing.com. However, the PropTech sector has demonstrated resilience, with a cumulative investment of nearly USD 4 billion between 2009 and 2022, boasting a remarkable compounded annual growth rate (CAGR) of 49 per cent.

Source: Venture Intelligence, Housing.com Research

Mr. Dhruv Agarwala

Mr. Dhruv Agarwala, Group CEO of Housing.com, PropTiger.com & Makaan.com, commented on the sector’s performance, saying, “Investments in the PropTech space remained stable throughout 2022, even amidst global turmoil. Over the past decade, the real estate sector has made significant strides in adopting innovative technologies, particularly in the last three years. The COVID-19 pandemic and subsequent lockdowns served as catalysts, accelerating the adoption of technology across the industry.”

While funding in PropTech firms marginally declined from USD 742 million in the previous year, certain segments within the industry drew substantial investor interest. Notably, shared economy platforms such as co-living and co-working secured the majority share, accounting for 64 per cent of the total fund inflow. This surge of investor confidence can be attributed to the perceived growth potential in these segments.

PropTech Players

Additionally, PropTech players offering construction technology solutions received 15 per cent of the total funding in 2022. This trend reflects the real estate developers’ growing emphasis on reducing construction times while maintaining high-quality standards. In countries like India, where extended construction cycles inflate project costs, PropTech solutions are increasingly being leveraged for effective project management.

Mr. Agarwala pointed out “the coworking segment has witnessed rapid expansion in the last three years, driven by the escalating demand for flexible workspace solutions from corporates.”

Despite facing challenges during the COVID-19 pandemic due to the temporary closure of schools and colleges, the co-living segment made a remarkable recovery with the reopening of educational institutes and offices. Co-living operators that weathered the pandemic storm experienced a V-shaped recovery, with substantial demand for superior quality rental accommodations.

Between 2009 and mid-2023, Proptech investments in India witnessed the Shared Economy Sector as the frontrunner, comprising 40 per cent of total investments, followed by Sales & Marketing with a 24 per cent share.

Proptech investments in India have grown at a CAGR of 49% since 2010 with segment such as shared Economy and Sales & Marketing seeing significant investments in value terms.

In H1 2023, the cumulative Proptech investments in India surpassed the $4 billion mark (Since 2009), backed by tech adoption in real estate especially in the last few years.

Ms. Ankita Sood, Head of Research

Commenting on the report, Ms. Ankita Sood, Head of Research, Housing.com, PropTiger.com & Makaan.com said, “India’s PropTech sector is thriving. Despite global headwinds, investments in 2022 reached USD 719 million, just shy of its historic peak. Demand-side tech adoption is clear, with investments coming in sales, marketing, and the shared economy. Supply-side tech is also accelerating, with construction technology receiving USD 109 million, or 15% of total investments in this period.”

Ms. Sood further added, “The last half decade or so has seen tremendous growth in investments, indicating that India’s PropTech sector is a bright spot in the global market. Today Tech is being used across all stages of the real estate lifecycle, from finding a property to closing the deal. This is also cutting time and pricing, making processes for all stakeholders more efficient and streamlined.”

| Year | Investments (USD million) | YoY % change | Number of Deals | YoY % change |

| 2009 | 0.2 | 1 | ||

| 2010 | 6.1 | 2673% | 1 | 0% |

| 2011 | 9 | 50% | 4 | 300% |

| 2012 | 15 | 65% | 3 | -25% |

| 2013 | 51 | 236% | 10 | 233% |

| 2014 | 203 | 301% | 12 | 20% |

| 2015 | 127 | -38% | 30 | 150% |

| 2016 | 168 | 32% | 30 | 0% |

| 2017 | 206 | 23% | 28 | -7% |

| 2018 | 527 | 156% | 34 | 21% |

| 2019 | 549 | 4% | 43 | 26% |

| 2020 | 551 | 0% | 29 | -33% |

| 2021 | 742 | 35% | 23 | -21% |

| 2022 | 719 | -3% | 38 | 65% |

Note:

Deals include Debt , PIPE (Private Investment in Public Entity), PE investments in Special Purpose Vehicle (SPV), Projectlevel investments, Pre IPO PV deals, Buyouts from January 2009 – June 2023.We exclude deals with undisclosed amounts.

Source: Venture Intelligence, Housing Research

The report encompassed various investment deals, including Debt, PIPE (Private Investment in Public Entity), PE investments in Special Purpose Vehicles (SPV), Project-level investments, Pre-IPO PV deals, and buyouts. However, deals with undisclosed amounts excludes from the analysis to maintain transparency.

In summary, while the PropTech sector experienced a marginal dip in funding during 2022, its overall growth trajectory remains positive. The robust investment in shared economy platforms and construction technology solutions underscores the industry’s commitment to leveraging technology for sustainable progress and development.