Unlike the US, which is a credit-driven economy, Indians so far prefer to live their lives cheque-to-cheque to meet their daily expenses, including groceries. However, with the rise of the digital consumer lending ecosystem and an increase in the household income, much has started to take a sharp turn.

Consider this for starters: The RBI data for May 2023 shows that despite a mere 5.5% credit card penetration or 77 Mn Indians using the means, credit card spending hit a record high of INR 1.4 Lakh Cr.

Further, the Indian digital consumer lending sector is expected to touch $720 Bn by 2030, growing at a CAGR of 22% from 2023.

Amid this, it is also worth noting that the country’s growing consumer market, which is set to become the world’s third-largest by 2027, along with a rise in the number of middle- to high-income households, is expected to give a high-octane boost to the lending sector.

And this is not it. According to Inc42’s latest report, “State Of Indian Fintech Report Q3 2023”, the estimated number of digital payment users in India is expected to reach 1.08 Bn, surpassing the US, the UK and Germany with 320 Mn, 65 Mn and 70 Mn users, respectively, by 2027.

Meanwhile, a surge in the usage of UPI, integration of credit cards with UPI and ease of KYC under the India Stack are other factors that will play a key role in fuelling the growth of the digital consumer lending sector in India.

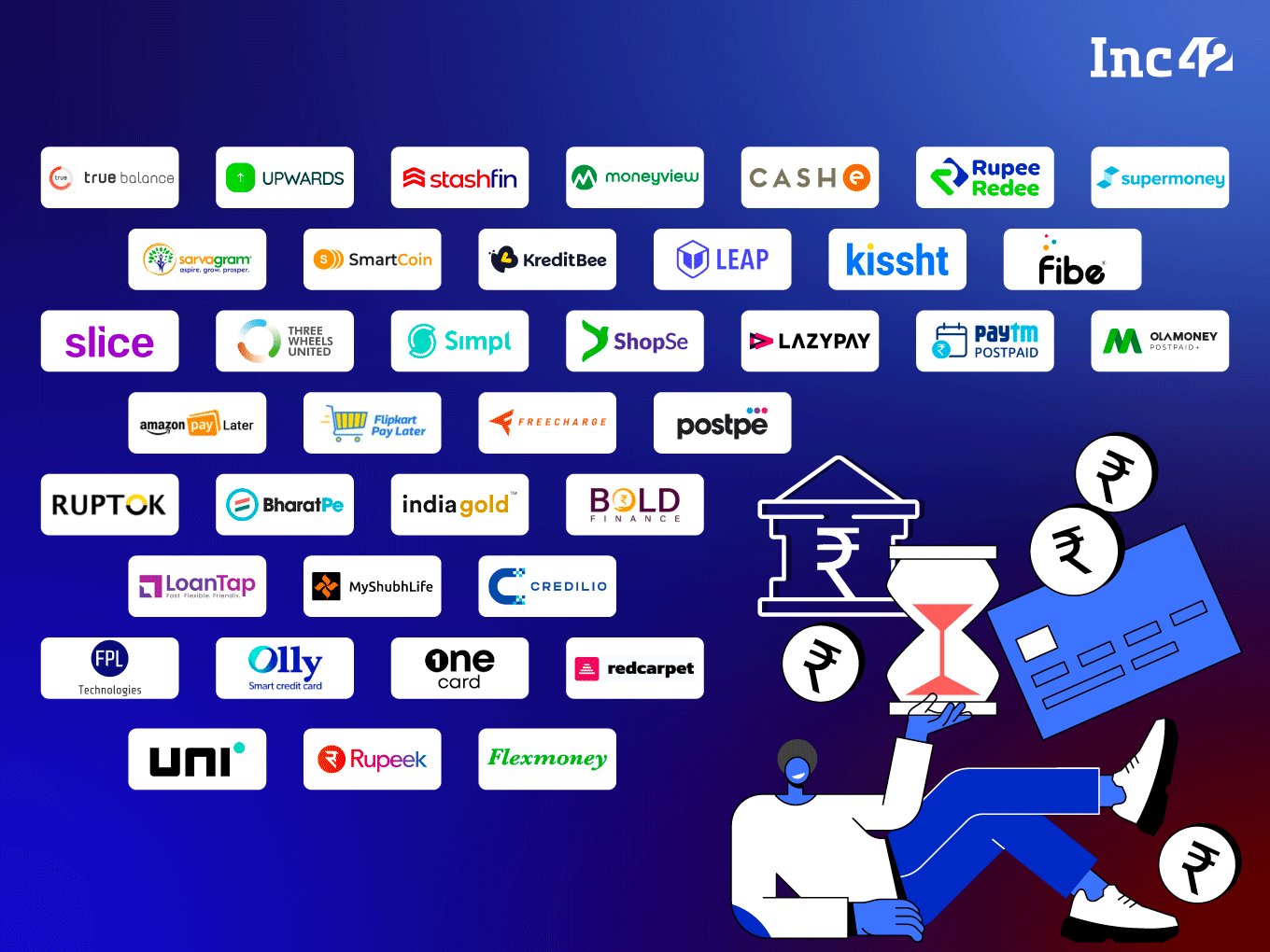

Swimming in the sea of opportunities offered by the sector are the Indian fintech startups. Currently, the country has more than 100 funded digital consumer lending startups spread across domains such as personal loans, retail cards, gold loans and buy now, pay later (BNPL).

According to an Inc42 analysis, startups operating in the personal loan segment raised a substantial 86.3% or more than $2.8 Bn of the total $3 Bn+ raised in the digital consumer lending space between 2014 and H1 2023. This is followed by retail cards at 8.8%, buy now, pay later (BNPL) at 4.8%, and gold loans at 0.2%.

While the numbers mentioned above paint a rosy picture of the country’s fintech ecosystem, elements that will play a key role in the success and failure of Indian fintech startups will be directly proportional to the consumer sentiment and the startups’ willingness to offer convenience and ease of transactions.

In our latest report, we have done a sentiment analysis of some of the most prominent Indian fintech startups that are engaged in the digital consumer lending business, and the revelations are quite intriguing.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-fintech-report-q3-2023-infocus-consumer-lending/” target=”_blank” rel=”noopener”>Download The Report

The startups have been gauged on all vital metrics ranging from the user experience of their respective platforms to the level of benefits they provide to their users. Further, we have also endeavoured to pinpoint key trouble areas that could potentially hamper the credit sentiment of users, thereby making many digital lenders lose their potential and existing userbase.

In our analysis, we have found that digital consumers engaged with fintechs today look for an impeccable app experience, transparency of transactions, including app charges and other fees, well-oiled customer support, and easy access to credit, among other things.

Without further ado, let’s delve into Inc42’s latest findings. But before that, let’s steal a glance at some of the key players competing in the Indian digital consumer lending arena.

App Functionality Top Priority For BNPL Users

According to the sentiment analysis conducted by Inc42, app functionality serves as the key satisfying criteria for BNPL users. Ease of process, loan details, offers and discounts are the other crucial elements consumers look for when choosing a BNPL platform.

Of the 10 players operating in the BNPL segment, Simpl scored the highest and was termed the best app by users in terms of experience, according to Inc42’s sentiment analysis of 92K+ users on App Store, Play Store and Trust Pilot.

Launched in 2015 by Nitya Sharma, Simpl is a Bengaluru-based checkout network. Since its inception, the startup has raised over $110 Mn, including $40 Mn in Series B funding led by Valar Ventures, PayPal cofounder & CEO Peter Thiel’s VC fund, and existing investor IA Ventures. It has also attracted the interest of investors such as LFH Ventures, Greenvisor Capital, Recruit Strategic Partners, and FJ Labs.

One-tap payments, seamless integration with other apps, continuous increase in spending limit as per usage, easy-to-understand transaction activity, billbox to pay bills and autopay option are some of the features which make Simpl quite popular among users.

On the popularity and app experience indices, Simpl is followed by Lazypay, Paytm Postpaid and Ola Money Postpaid.

Users Demand Transparency In Fee Charges, A Well-Oiled Customer Support

Our analysis shows that BNPL users need transparency in terms of charges, along with swift and user-friendly customer support to seek assistance.

Paytm Postpaid has been a laggard on this front, with the least satisfied users. One can also find several complaints regarding this on the Indian Consumer Complaints Forum. Topping the list of grievances is the startup’s inaccessible customer care support.

“There is no proper customer care number, for any postpaid related queries on call, they are sending SMS link, which is redirecting to Paytm App help&Support section. This help&Support is very work one, it is a CHATBOT which display only predefined options, there is no option for the customer to enter their query,” wrote a user in a September 8, 2023, post.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-fintech-report-q3-2023-infocus-consumer-lending/” target=”_blank” rel=”noopener”>Download The Report

At the same time, Ola Money Postpaid is the least preferred platform due to its terms of fee. From excessive bills, shaky customer support, and refund issues to harassing users for recoveries, Ola Postpaid repels its customers quite successfully.

Both Paytm Postpaid and Ola Postpaid services were launched in 2019.

Rupeek Ranks Highest In Terms Of App Experience And Ease Of Loan Access

Digital gold loan provider Rupeek has been touted as the best player in terms of giving easy access to gold loans and app functionality. Close on the heels are Muthoot Finance, LoanTap and BharatPe.

Founded by Sumit Maniyar and Ashwin Soni in 2015, Rupeek provides instant gold loans. The startup is currently operational in more than 60 Indian cities across 5,000 locations. It offers loans within 30 minutes at the doorstep, or the customer can avail the same by visiting its branch.

Since its inception, it has raised over $170 Mn in multiple funding rounds. Rupeek is backed by investors such as Lightbox, GGV Capital, Bertelsmann, Accel India, and Sequoia Capital India (now PeakXV).

Ease Of Process: Zenda, Upwards Fintech Services Take On Conventional Players

Inc42’s user sentiment analysis suggests that startups providing personal loans receive a more favourable sentiment, indicating higher levels of satisfaction when compared to traditional industry participants.

In terms of ease of process and customer care service, personal loan lending startup Zenda has topped the charts in terms of interest rates, speed and loan approvals. Meanwhile, Upwards Fintech has bagged the second spot.

Key Challenges Ahead

Digital consumer lending presents a vast opportunity, but the path to success is fraught with its own hurdles. Anubhav Jain, the cofounder of a B2B payments startup Rupifi and personal loans startup Qbera, highlights the critical early stages of tackling issues related to data, credit risk, customer segmentation, and operational workflows, given the intense competition in this space.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-fintech-report-q3-2023-infocus-consumer-lending/” target=”_blank” rel=”noopener”>Download The Report

Similarly, Gurjot Singh, cofounder of fintech startup Collekto, points out that while the growing internet penetration and increased digital proficiency have made things easier, one of the primary challenges is to evaluate the creditworthiness of loan applicants.

To overcome this, an increasing number of digital lenders are today harnessing the power of AI and data analytics to significantly reduce the risk of loan defaults.

Onboarding customers is another challenge for digital lenders, as it can lead to problems with identity verification and fraud prevention.

Inaccurate information in the hands of lenders complicates the task of tracking borrowers in case of delinquencies, resulting in difficulties for collection service providers.

Furthermore, the lack of seamless and accurate information flow between the lender and the collection service often results in disrupted communication, ultimately leading to a poor borrower experience.

According to Axio’s CFO Akshay Sharma, in the process of winning consumers’ trust and sentiment, consumer lending fintech firms should remain laser-focussed on not losing their focus on enhancing risk monitoring and improving collection strategies to prevent customers from becoming over-leveraged in the market.

What’s Next?

Today, many merchants are taking the digital route to meet the evolving needs of millions of consumers throughout the country. A report on India’s e-retail market by Bain & Company estimates that the market’s size will increase to $150 to $170 Bn with an annual growth rate of 25%-30%, and a doubling of market penetration to 9 to 10% by 2027.

In September, UPI transactions exceeded 1,056 Cr. The number of transactions grew over 3% month-on-month (MoM), while the transacted amount increased by a little over 4%.

The growth of ecommerce, coupled with the rise in digital payments and increased regulatory oversight, has provided a substantial boost to Indian digital consumer lending startups. It’s expected that by 2030, digital lending may overshadow traditional lending channels.

Overall, customers expect a seamless experience when borrowing and during the collection process. Traditional collection practices are often viewed as aggressive and detrimental to borrowers, so developing products that enhance the end-to-end consumer experience, from loan application to repayment, is paramount for Indian fintechs.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-fintech-report-q3-2023-infocus-consumer-lending/” target=”_blank” rel=”noopener”>Download The Report

The post title=”India’s Digital Credit Wars: Who’s Thriving & Who’s Strifing?” href=”https://inc42.com/features/indias-digital-credit-wars-whos-thriving-whos-strifing/”>India’s Digital Credit Wars: Who’s Thriving & Who’s Strifing? appeared first on Inc42 Media.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)